Guest Post: Who’s on the Phone?

Harley takes his pen to My Net Fone and impresses even the company’s management with his results.

Harley takes his pen to My Net Fone and impresses even the company’s management with his results.

Take a look at any of the financial media channels or websites and you will likely notice the prevalence of brokers, advisors and commentators claiming that Australian stocks are currently cheap when viewed on a P/E basis. There is no denying that at the present time investors in the Australian stock market are willing to pay considerably less for the earnings of a company than they were just a few years ago. There are a number of possible explanations for this from the risk of external shocks to the increased demand for fixed income securities but there is no doubt that one of the main drivers of the lower market multiple is that investors are pricing in an expectation of lower growth rates in the majority of industries. The earnings of companies in retail, mining, property and construction just to name a few are all expected to experience low to moderate growth, if not stagnation, in the foreseeable future.

In an environment where opportunities for growth are sparse, when a true opportunity presents itself investors have demonstrated their willingness to pay up. There is no better example of this than the substantially higher industry average P/E in the telecommunications sector, where internet growth and new technological developments are driving rates of growth unrivaled elsewhere in the market. As a result investors have their eyes set on discovering the next rising star in the telecommunications world. My Net Fone Ltd may be about to have its turn in the limelight.

My Net Fone (ASX:MNF)

In the words of the company:

“My Net Fone Limited, (ASX:MNF) is Australia’s leading provider of hosted voice and data communications services for residential, business and enterprise users. My Net Fone was first founded in 2004, was listed on the ASX in mid 2006, has 52.5 million shares on issue, has operated profitably since 2009 and has paid dividends to its shareholders every six months since September 2010.

The company has a reputation for quality, value and innovation, having won numerous awards including the Deloitte Technology Fast 50 (2008, 2009, and 2010), PC User Product of the Year (2005), Money Magazine Product of the Year (2007) and many others.

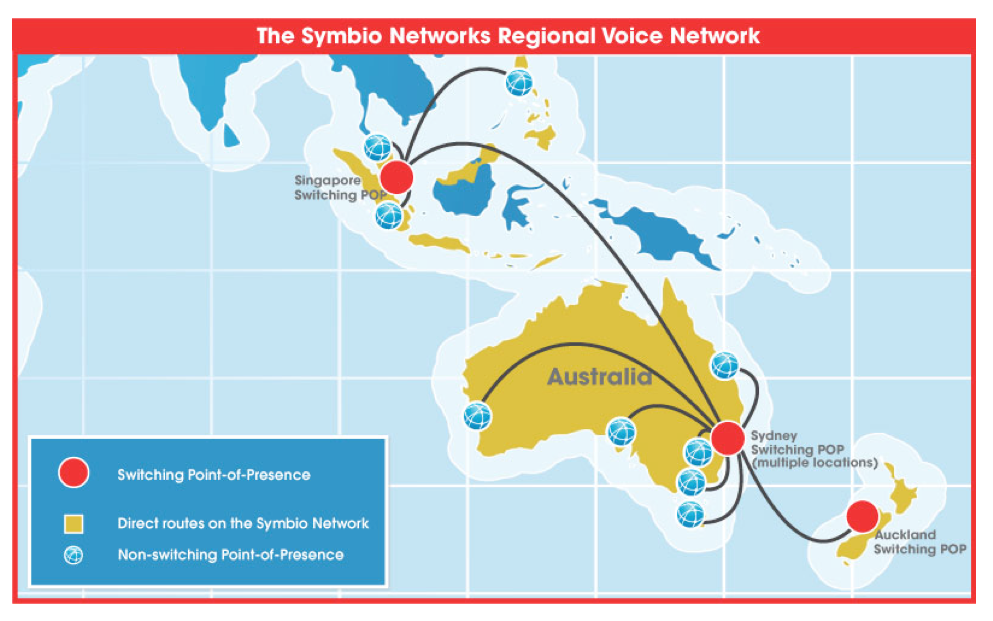

My Net Fone’s wholly owned subsidiary, Symbio, owns and operates Australia’s largest VoIP network, providing wholesale carrier services to the Australian industry, including number porting, cloud‐based hosted PBX services, call termination, call origination and many other infrastructure enabled services. The Symbio network carries over 1.5 Billion minutes of voice per annum.”

What is VoIP? A Look At The Industry

Before looking closer at MNF, it is helpful to have a sound understanding of the industry in which the company operates. Indeed one should first gain a complete and comprehensive understanding of the injdustry and the competitive landscape.

VoIP, or Voice Over Internet Protocol, in its simplest form refers to the group of services that use the internet as a means for communication rather than the standard phone line. A phone call via VoIP involves the call conversation being split into data packets, transmitted over the internet and then reassembled at the other end. The primary benefit as a result is that there is no need for line rental, which provides significant savings to consumers and businesses alike. While cost reduction is generally seen as the most attractive feature of VoIP services the benefits are not limited solely to reduced expenses with a range of other products and services offered by MNF including Virtual PBX, number porting, SIP trunking and hosted services. While their terms may sound complicated they all fit under the catch all term of ‘VoIP.’

The VoIP market is highly competitive and the battle is generally fought over price. For a retail customer, the main reason you would choose VoIP over your traditional provider would of course be the cost savings that occur as a result. But for small and medium businesses, while cost is also of primary importance, other factors come into consideration including product offering, service quality and the ability of the provider to continually innovate and develop new products and services.

VoIP is not new nor is it only just now gaining popularity. If you have ever used Skype or a similar service, you have used VoIP (in fact Skype is a client of MNF’s wholesale division). But there are different VoIP service types and the kind you use when you Skype your family while away on holiday is very different to the kind you would install in your small to medium sized business of 50 full time employees. The two do not directly compete with each other. Sure, businesses may use Skype for video conferencing, but they will still need a communications system, multiple phone numbers, 1300 numbers, fax over IP, remote access to their VoIP number and a host of other services provided by MNF and their competitors. Customers of MNF have reported cost savings on phone bills of up to 50% and in the current business environment it seems likely that businesses will continue to look at ways to reduce costs while still maintaining or even increasing productivity. VoIP services have much to offer small to medium businesses in this regard.

In the early years of VoIP the main restriction was (and at times still is) the issue of low quality broadband. If the broadband connection was weak then the quality of the VoIP service would follow suit, thus making the adoption of VoIP unworthy of the investment for anyone without the highest quality broadband connection. It is no surprise then that in the case of Europe those countries with a high rate of strong broadband connection to homes and businesses (eg France) saw a higher uptake of VoIP than European countries with lower rates of high quality broadband access.

As broadband speeds improve, so too will the quality and available range of VoIP services in Australia. The roll out of the NBN will provide significant opportunities for MNF across all divisions of their business. As more people have access to fast, high quality broadband the potential market for MNF will grow. In the transition period there is likely to be a strong push for new customer acquisition by service providers as retail and business customers alike consider changing from their service type and/or service provider (See MNF’s current marketing program offering significant savings for customers to sign up prior to the roll out of the NBN). While this could result in greater competition in the business and retail markets, as we will see the wholesale division is well positioned to benefit from more service providers setting up shop creating higher demand for wholesale services.

Historic Performance – A Demonstrated Track Record Of Growth

Many investors require a demonstrated track record, which is seen as a way to further reduce the risk one takes in any given investment. As a result there are those who will take one look at the financial reports of MNF, notice the accumulated losses and be frightened away, preferring to wait until MNF has had a few years of strong returns, improving margins and profit growth under its belt. For some, turnaround stories are no go zones.

There is nothing wrong with this method of investing, in fact it can be incredibly successful (witness one W.E. Buffett) but in the case of MNF it is important to understand why the company experienced losses in its early years and why the profits are about to start rolling in.

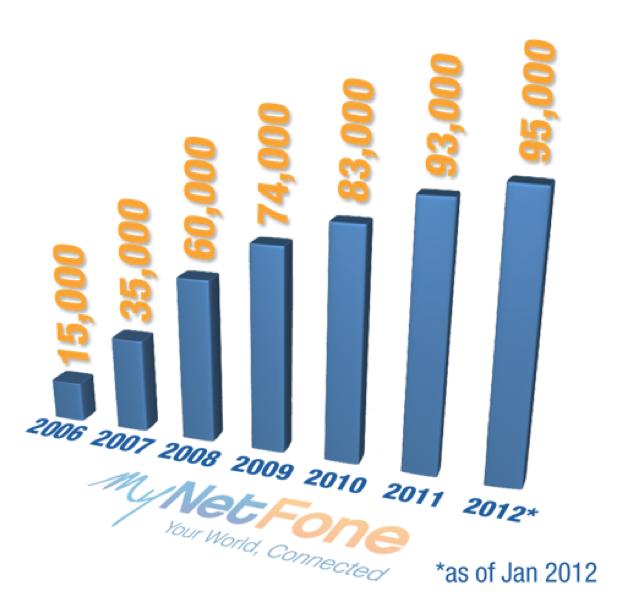

First of all, MNF does possess a proven track record in regards to consistent revenue growth. MNF was started from scratch and has since grown to become a company that currently has 95000 subscribers. Any business owner will know that in the early years of operation profits can take time to come to fruition and a period of investment and cash outflows inevitably precedes growth in scale and subsequent cash inflows. In the case of MNF the company was operating in a brand new industry where the majority of individuals and businesses were still becoming aware of the potential for VoIP services, not to mention the fact that only the tech savvy had the necessary high speed broadband connection to make VoIP worthy of investment in the first place. In 2006, a year that VoIP uptake experienced rapid growth, 19 percent of small to medium businesses in Australia used VoIP services. But of those that didn’t, 35% were completely unaware it existed and another 7% did not understand how it could be implemented into their business.

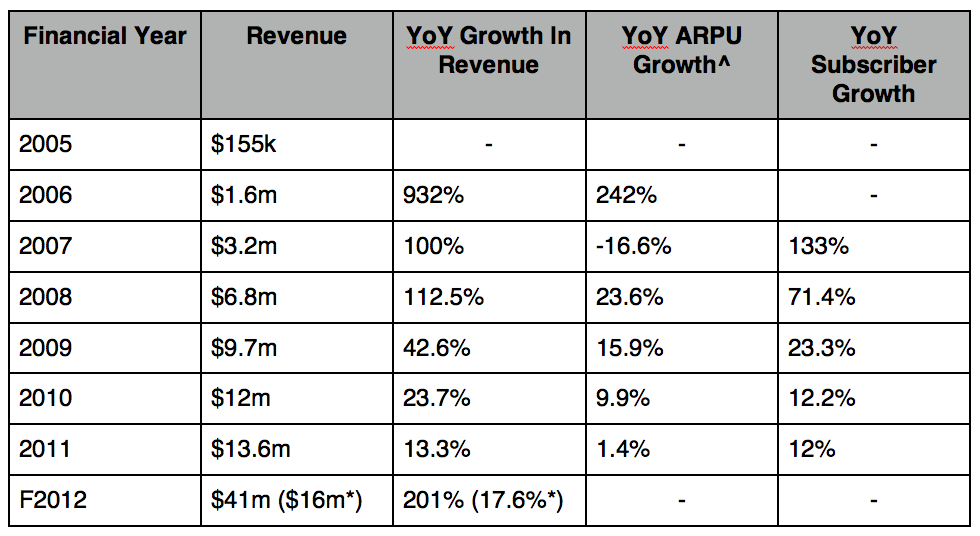

Having said that the growth in revenues (shown in the table below) since MNF listed as a public company is very impressive.

^Provides general summary; figures are not broken down into individual or small to medium business customers

*Minus the contribution of the newly acquired Symbio Networks

Similarly impressive is the year on year growth in MNF’s total customer base, as shown both in the table above and below in a graphic from the company’s website.

Today consumer awareness regarding VoIP is strong and growing. The uptake amongst small and medium businesses is gaining considerable traction due to the significant cost savings and continually developing services on offer. While MNF’s subscriber growth rate is declining from its dizzying heights the company now has access to the potentially lucrative wholesale market through their acquisition of Symbio Networks. And to top things off the government is about to gift MNF with a once in a lifetime opportunity.

NBN – Opportunities Abound For MNF

As previously mentioned, in the past one of the restrictions holding back individuals and businesses from subscribing to VoIP based services was the lack of access to high quality broadband. While broadband penetration in Australia is not particularly low (we were ranked 21st out of OECD countries for fixed broadband penetration and 8th for wireless broadband penetration as at 30 June 2011) the roll out of the National Broadband Network (NBN) will only serve to increase the equality of access to high speed broadband across Australia. What this means is that MNF’s potential market will grow as the NBN roll out progresses.

The capability of MNF’s services are enhanced by any increase in computer power, software/hardware development or internet speeds. Furthermore since product innovation is a demonstrated strength of the company, as technology progresses the range of potential product and service offerings that MNF can deliver to their market will increase. Product and service innovation is a vital differentiating factor in any highly competitive market.

The NBN, in the company’s own words is “a once in a lifetime opportunity” for new customer acquisition as their is a mass transition from the current copper fibre network to the NBN. If the NBN achieves its objectives 93% of Australian households, schools and businesses will have access to broadband services. This will increase the up take potential for residential and SMB VoIP services significantly, and while MNF will likely have to deal with the arrival of many, many new competitors as a result of the expanding market, their wholesale division is likely to benefit from general growth of the VoIP market regardless of which service providers win market share.

(on the flip side, note the higher costs to all competitors/participants after the NBN rolls out and consider the implications of the NBN possibly becoming fibre to the node if Labour loses the next election)

The Importance Of Scale and Differentiation

As an investor it is certainly advantageous to focus on industries experiencing rapid growth. As they say, ‘A rising tide lifts all boats’ and to an extent this will be seen in the performance of internet and VoIP service providers for years to come as the tremendous growth rates are forecast to continue into the foreseeable future. But a market experiencing rapid growth breeds intense competition and if a company cannot differentiate itself from the pack it will be left to fight solely on the basis of being the lowest cost provider, which very rarely ends well for those involved.

There are two things that can separate a company from the pack and ensure it achieves financial performance above the industry average. The first is the presence of scale. MNF’s margins have historically been quite tight, but as revenue grows the margins will naturally improve. The VoIP service industry, while intensely competitive, is such that those who are able to achieve economies of scale have the potential to experience strong margin expansion as each incremental dollar of revenue generates a higher proportion of value to the bottom line. Symbio Networks, the wholesale division of MNF, currently operates at 50% utilisation leaving significant room for margins to be increased at little incremental cost to the company. So while revenue growth will likely taper off to more sustainable growth rates it is highly likely that NPAT growth will outpace revenue growth over the next few years.

In order to reach and sustain a level where economies of scale begin to benefit the bottom line, a company like MNF needs to be able to differentiate itself from competitors. There needs to be a reason why individuals and businesses will choose MNF over other VoIP providers if we, as investors, can be confident that the current high rates of return being generated by the company can be sustained.

The first differentiating factor relates to the vision of MNF management and their focus since the founding of the company. Unlike some of their larger competitors who are being forced to make the transition from older technologies and offer VoIP in addition to their current services, MNF is coming off a lower cost base and with sole focus on New Generation Networks and innovation within the VoIP market. Since the founding of MNF the goal has been “to be the leading VoIP provider in Australia.” The acquisition of the owner of the largest supplier of VoIP wholesale and managed services in Australia also helps separate MNF from the pack.

A quick read through MNF’s past annual reports will give you an idea of the demonstrated ability of the company to come up with new and innovative product offerings. In the past this has no doubt served to enhance the ability of MNF to grab market share, and is reflected in their many industry awards for exceptional products and services. As an investor your job is to determine whether or not MNF will be able to sustain the current high rates of return well in to the future. Start by researching the company’s product offering, read testimonials and compare it with those of MNF’s competitors. Sometimes the best way to form a view over the future of a company is not to approach things as an investor, but to view the business from the perspective of a potential customer.

Perhaps the most attractive feature of MNF’s business model and that which most effectively differentiates MNF from its competitors is the fact that the company is not simply a reseller of VoIP services. A large proportion of VoIP providers are in the business of buying from a wholesaler and reselling the product to the end consumer. Prior to the acquisition of Symbio, this is what it appeared as though MNF was doing when Symbio Networks was external but in actual fact the company was creating these voice services using Symbio’s VoIP technology, adding value through internally developed software and delivering a unique product offering to their customers. The company places a great deal of importance on the development of software and intellectual property to ensure they add value to the services they sell to customers. In the words of the CEO, Rene Sugo, “Today our advantage is largely technical – in terms of scalability, quality, reliability and innovative intellectual property. That is what has driven our growth, and will continue to do so in the medium term.”

Ultimately there is no negating the fact that for a company like MNF (where product development and technological advancement happens faster than most of us can fathom) we are heavily reliant on the competence of management.

The Founders – Interests aligned with shareholders

The two founders, Andy Fung and Rene Sugo, own just over 50% of the company between them. In the first quarter of this year Andy Fung retired from his position as CEO and Rene Sugo took his place. Fung is staying on as a non-executive director and retains his significant holding in the company. Both have strong backgrounds in the telecommunications industry, as well as experience and in depth knowledge in the area of Next Generation Networks. In the ever developing industry of VoIP service providers, experienced and business savvy management is integral to a company’s success.

There is more than just their significant shareholdings in the company that indicates management’s strong desire for MNF to succeed. In the early stages the directors performed services for the company at no or low cost and salaries were kept artificially low as the company dealt with the low capital base nature of a start up business. Similarly, the company was “supported by the low cost provision of services, technology and business support from Symbio Networks Pty Ltd during the start up and early growth phase of the business.” Andy Fung and Rene Sugo were the founders of Symbio Networks, and the company is now wholly owned by My Net Fone after the (related party?) acquisition was finalised earlier this year.

When MNF listed in 2006 they raised $2.5m. Unlike so many of the companies that list on the ASX these funds were not used to repay loans to related parties or to line the pockets of directors, but to fund an expanded marketing program and increase sales and support staff, which was no doubt a raging success evidenced by the growth in total customer numbers of those early years.

Management have also shown their ability to innovate and stay one step ahead of the market. They were the first to remove the pay-for-time model of pricing on international calls and pioneered the move to the now prevalent flat charge for international VoIP calls. The development of ‘On-the-Go’ services which allowed customers to access VoIP services on their mobile in 2007, ‘Meet-Me Conferencing’ in 2010 and the regularly introduced new service plans available to customers are all examples of MNF’s commitment to continually innovating their product offering.

In the process of conducting your research on MNF, do as Roger has suggested frequently here and read each financial report from the prospectus through to the most recent half yearly report. No doubt you will notice the trend of management promising something one year and delivering the next. This is, I believe, exactly what you should be looking for in the management of companies you choose to invest in. In the announcements regarding the Symbio acquisition, and in related articles, the CEO of MNF regularly described the increase in growth that he believed the company was about to experience. On the 23rd of April the company delivered yet again with a profit upgrade that they attributed to the “outstanding performance across the group,” particularly in the March quarter.

The interests of management appear strongly aligned with those of shareholders and as investors our money seems in more than capable hands. Do take the time to read the past annual reports of MNF. Not only will you better understand the growth path that management have in mind for the company but you will most certainly notice the way in which management come across as genuinely interested in the future of the company, its customers and its shareholders, something which is unfortunately rare in many ASX listed companies.

Symbio Networks – A Game Changer For My Net Fone

In September of last year MNF announced they were acquiring Symbio Networks for a maximum consideration of $6m. Symbio Networks is Australia’s largest supplier of VoIP wholesale and managed services. The company was founded by Andy Fung and Rene Sugo, the same founders of My Net Fone. The acquisition of Symbio significantly changes the dynamics of MNF as it means the company is now positioned to benefit from the entry of more VoIP providers.

Management plans to run Symbio as a wholly owned subsidiary, separate to the day to day business of My Net Fone. This is important as some of Symbio’s customers are direct competitors with the retail and business division of MNF. Symbio is actually larger than My Net Fone when comparing on the basis of revenues, with $25m of MNF’s FY12 revenue expected to come from Symbio.

The wholesale operations Symbio brings with it is a game changer for MNF. It means that the company is effectively diversified from the inevitable increase in competition that is sure to arise if and when VoIP uptake continues to grow. While the business and retail division benefits only if customers choose MNF over its competitors, Symbio, as the owner and operator of Australia’s largest VoIP network, is positioned to benefit from any overall increase in competition.

Because Symbio has clients across the Asia Pacific the company will not only benefit from the NBN in Australia, but are also positioned to do well from any further increase in broadband penetration or VoIP uptake in Singapore, New Zealand and Malaysia. As such the growth potential for Symbio, and thus MNF, is not limited solely to the Australian market.

The story of both Symbio Networks and My Net Fone are evidence of in my opinion, the visionary skills of the founders of both companies, Andy Fung and Rene Sugo. What we are seeing in the market today with increased uptake of VoIP, new VoIP related products and services being developed and the beginnings of the transition of VoIP to mobile applications, were all envisioned by Fung and Sugo as early as 2002. Today, Rene Sugo is the CEO of the merged entity and Andy Fung will remain as an advisor, consultant and significant shareholder. If their current views on the potential growth in the wholesale, retail and business divisions of their company is half as accurate as their views from ten years ago then it appears MNF is well positioned for the future.

Key Risks (may not be exhaustive)

While the prospects for MNF appear very attractive, like any investment there are risks one needs to consider:

- The NBN: While the NBN is expected to be a fantastic opportunity for MNF there are risks that surround its ultimate effect on the company. These risks include potential increases in costs that favour the larger ISPs, the possibility of substantial changes to the NBN between now and final rollout and of course the fact that the opposition intends to scrap the plan altogether. The first of these risks is reduced by the merger of My Net Fone and Symbio and the fact that MNF’s customer base, while not among the largest, is substantial at around 100,000 customers. The risk of any changes to the details of the NBN that may negatively impact MNF is negated somewhat by management’s active and ongoing correspondence with government and the fact that as the largest VoIP network operator in Australia MNF does indeed have some say in negotiations. And finally if the NBN were to be scrapped, business would go on as usual and if the recent past is anything to go by MNF will continue to grow both revenues and subscribers.

- With the acquisition of Symbio, MNF is liable to pay up to $6m depending on the performance of the now wholly owned subsidiary. The risk here is that if cash flows are impaired for whatever reason the company may need to reduce its dividend payment to fulfill its obligations. With current strong operating cash flows, growing profits and no debt this risk appears minimal.

- External shocks. While MNF is not immune to financial crises occurring in Europe, China or even here in Australia, to some degree their business is defensive in nature. The worse the economic environment becomes the more likely businesses and consumers will decide to cut costs. MNF’s services offer cost reductions in conjunction with improved efficiency and so will benefit from more Australian businesses looking to reduce their overheads.

- VoIP failing to grow and/or the introduction of a new disruptive technology. VoIP itself is a disruptive technology and one that old generation service providers are now finding themselves forced to deal with. But that does not mean a new, more efficient technology won’t come along and steal some of VoIP’s market share, so this risk is certainly one to keep in mind.

- Some other risks may be covered by watching for director’s selling of stock

The Financials

As outlined earlier MNF have grown revenues consistently since listing on the ASX. This year they are forecast to generate $41m in revenue, with $25m coming from the recently acquired Symbio Networks. In their recent earnings upgrade management forecast FY12 NPAT to come in between $2.75m and $3m, with FY13 NPAT guidance for $4m (Note: as a result of past losses the company has tax assets of $930k). If we assume the lower end of guidance then on a fully diluted basis MNF will earn around 5c per share in FY12. In the past the company has paid a dividend around half of the total earnings and with operating cash flows remaining strong there seems no reason why that will stop any time soon. Under these assumptions the company is currently trading on a PE of 7.5 and is paying a respectable dividend. What multiple should the market attribute to a company undergoing strong growth in earnings, paying a healthy dividend and operating in the rapidly expanding internet industry? That is anyone’s guess but there are numerous examples of similar companies currently trading on the ASX that the market has priced on a P/E multiple in the mid-teens, and there is no reason why MNF will not or should not be priced accordingly.

While the company appears to be cheap on a P/E multiple basis the most attractive feature of MNF’s financial performance for me, is its ability to continue to generate fantastic returns on incremental capital for many years to come. The current returns on equity are unsustainably stratospheric – a result of the accumulated losses on the balanced sheet. But even if we calculate return on equity with total contributed capital from shareholders, ignoring the reduction in equity that has resulted from accumulated losses, the company will still generate a return on equity in excess of 50% for FY12 and FY13. The nature of this business is such that provided success continues, high returns on equity can be sustained.

I believe the market is yet to factor in that MNF is now a significant player in the wholesale VoIP market and while its business and retail division will continue to face growing competition, the company has demonstrated its ability to differentiate itself from its competitors. With what seems like highly competent management, bright industry prospects and the ability to sustain current high rates of return My Net Fone currently appears to tick all of my value investing boxes.

Let Harley know what you think of his work and share your own insights. Please note the views of the author are his own and may not represent those of the publisher. It is a must that you conduct your own research and seek and take personal professional advice before undertaking any security transactions. The sources of data Harley relied upon to produce this post may or may not be accurate so readers must investigate and satisfy themselves that are are completely aware of and accept all risks before undertaking any securities transactions they conduct after they have sought advice from a licence adviser familiar with their needs and circumstances.

Authored by Harley and posted by Roger Montgomery, Value.able author, SkaffoldChairman and Fund Manager, 29 April 2012

A bit late to the discussion.

I am a MNF customer (spent around $10 a month). And used to worked as an engineer for a VOIP Service provider company.

There are several head winds I see in the VOIP business

– The ARPU is very low. Average about $150 p/y per customer. This is likely to go lower in the future. There are already providers that are offering $10 all you can call plan (national call) if bundled with broadband.

– Competition from Mobile. Many mobile service providers are already offering $40 all you can call (both landline + mobile). This set the ceiling for the VOIP revenue per customer.

– Over the top (OTT) providers like Skype/Google/Facebook are getting popular. As more and more people are using smart phones which has all their contacts in one place, it is very easy to make voice call using these OTT services.

– Once NBN comes, many service providers will offer bundled services with all you can call voice services. Other bigger broadband service providers have better advantages than MNF.

– Many of the current MNF customers are earlier technology adaptors, and these are the ones who would be more willing to move if there are better offering elsewhere. There is no stickiness in MNF’s offering. (This also shown in MNF’s subscriber growth).

This is my observation of the overall VOIP business only, whether MNF can/will survive and /or thrive will depend on how they manage in this environment.

Hello,

Great article thanks. Working in IT and familiar with the telco industry, really appreciated the article.

Will do some more research.

As an aside, interesting to note that the share price shot up the weekend after this article was published ;)

Correlation?

I haven’t ever studied the VOIP industry. Your article Harley is a terrific in-depth analysis.

If this industry shows signs of acceleration, the big Telcos may come into it creating a cut throat commodity pricing environment that has existed for years in the internet/mobile phone sectors of the industry.

Thanks for your efforts with producing this article and I wish you good fortunes with My Net Phone.

Btw, I love the photo of the old phone. On a humorous note, I wonder if Buffet still uses that type of phone in his office considering he is not one for fast moving technology.

Regards

Ron

Thanks for the detailed analysis Harley. I first installed MNF VOIP for my father’s home who cut his phone bill significantly and have since also installed them in my own home. Pleased with the service I’ve also looked into the company financials due to them having one of the highest ROEs in the ASX last year. But ended up deferring investing due to the uncertainty of other competitors coming into the rapidly changing communications/technology sector.

Great scuttlebutt Sterling. Thanks.

A great piece Harley. You have provided an excellent summary and allowed me to go away and do my own research.

Great insights Harley! I will have to do my research, but some very interesting things to look at.

Very good summation Harley – an interesting company I notice the net assets of $1.3mln which included deferred revenue liability of $1.07mln reported in the half year accounts which they have rightly not booked to profit.

A good article, but I have some issues with MNF’s performance.

Growth has slowed in the last 3 years with 2009 the peak of revenues, ARPU and subscribers. Since then all of the above have been growing at slower rates. If would be interesting to know why growth has slowed since 2009 and what forecast growth is.

Given the increased use of broadband and wider knowledge of what it is and how SMEs could use it, you would think (at least I do), that growth should still be rising, or at least growing at faster rates than reported in the table above (e.g. just look at Vocus Communications growth in last few years)

It has occurred to me that the purchase of Symbio could be a fillup to mask the fall in MNF’s core businesses in future years, but happy to be persuaded otherwise.

Some risks that have not been identified:-

Competitor risk – no mention of MNF’s major competitors. I imagine that Telstra and the other major ISPs/Telcos could become a major threat to MNF’s business, should any of them choose to do so.

Liquidity risk – its only $24m in market cap (and that’s after rising 17% today). With only 55m shares on issue and director’s holding half of that, there’s not much stock available.

Cheers

Mike

I saw that too, both the charts seem to indicate a maturing of the market which isn’t a surprise as my thoughts are tech style companies can have a rather short life cycle and this can be seen by the declining growth figures and a forecast growth in customer base of around 2% and the fact that they are now going down an M&A route.

I can see why such technology would be attractive to businesses however as i am very short on the future of fixed line telephones i can’t really see much use for the retail kind of customer. Does this technology have any impact on the mobile phone market? Sorry i am very much a novice on this type of customer but found this very informative and greatly educational.

If i understand it right, the NBN does appear to be something that could provide a bit of a change in the environment and i guess could restart a new stage of growth as more people get access to a quality broadband network which seems vital for this technology and there for this becomes more attractive. I am happy to sit on the sidelines with this but thought i would pose the above thoughts for comment as i love learning about industries that i do not quite understand well.

It will be all about content. Keep an eye on who buys the foxtel stake.

Hi Andrew,

Yes I agree the market is maturing for the business and retail divisions, but in my view this is due to the fact that most people with the necessary infrastructure to install and take full advantage of VoIP has already done so. This is where the NBN plays a role in kick starting growth again.

The move to VoIP on mobile devices will be part of the next transition for this industry, in my opinion. This is where we rely on management and their ability to anticipate and be the first into the market.

For your research, some reasons why retail customers would continue to use a landline rather than rely on mobile phone:

– need to make or receive overseas calls

– At home businesses. This has been a strongly growing market in recent years. With VoIP you can have multiple phone numbers, so customers may decide to have one for personal contact, and one for business. Having a business phone number often appears more professional than providing your mobile phone number.

– Check out the prices of VoIP for a retail customer. The prices are very low and to an extent there will be many customers who decide that the minimal cost of maintaining a landline using VoIP is beneficial to relying entirely on your mobile phone.

My main business is printing and as we download lots of files, VOIP came to us naturally.

We investigated (as well as we could at the time) the various offerings.

MNF won us over and we have never looked back.3 years now of innovating and suggestions.

The old , big guys, just are not in the same league, with service and style.

Obviously i am biased now, but I know service when i see it, and can remember the old guys, don’t care attitude.

Now they have some billions coming in from the previous governments call at selling things they probably shouldn’t have, watch them try and buy back or keep market share.

I have MNF shares, ( 2 years holding now) and no TLS or SGT.

I firmly believe if their pockets were not so deep they wouldn’t be here anymore such has the market moved from under them.

MNF is tiny but so far the have not done much wrong by customers and if this is the reason for being in business it should come to pass they stay here for a while yet.

regards,

Nebo

WOnderful information (aka Scuttlebutt) thank you Eddie.

I have to agee with you Eddie. I have been a customer for 3 years and a shareholder for 1 year. Service is great and improving all the time. I went to the last AGM and wrote about it on this blog. It was a great day and I went home fairly confident of their future for the next few years. Their recent profit upgrade was a lovely surprise. The terms of the symbio purchase incentivise Rene and Andy to keep things moving on up.

I agree that NBN roll out will definitely benefit VOIP industry. I also agree that customer base is on its exponential expansion. I sort of disagree VOIP is a competitive industry, the reason is that the number of telecommunication companies is dramatically smaller than the number of retailing companies, so from my perspective, it still has room to grow. What I am not sure of, is the ratio of the profit to price carried out from each sale, this to me is crucial as it has immediate impact on the financial earnings. I personally like this industry as it has recurrence revenue and we all know internet will be the leader for the next decade, so VOIP will also be catching up as a runner up.