Guest Post: What’s the real BHP share price?

Portfolio Point: BHP Billiton is well known to every Australian investor, but what you may not be aware of is the unique opportunity the corporate structure offers the trader and investor.

Portfolio Point: BHP Billiton is well known to every Australian investor, but what you may not be aware of is the unique opportunity the corporate structure offers the trader and investor.

BHP Billiton was formed when BHP and Billiton merged in June 2001; following the merger the companies maintained their separate stock exchange listings. Australian investor know BHP Billiton Limited (ASX:BHP) traded on the Australian Stock Exchange, the other major listing is on the London Stock Exchange (LSE:BLT) BHP Billiton Plc. A share bought on either exchange has equal economic and voting rights, meaning you receive the same dividend payment and have equal claim to the company’s assets.

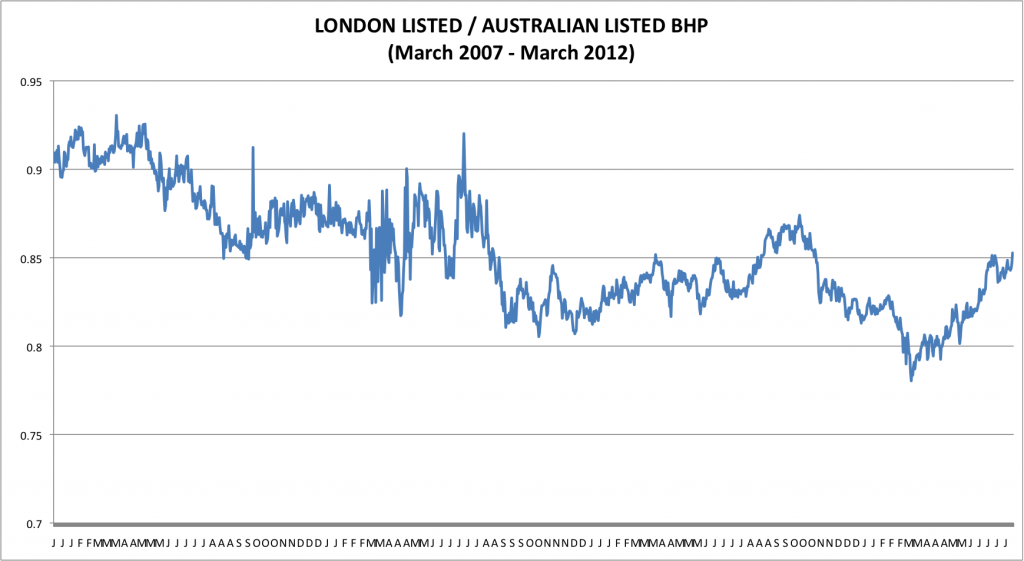

A logical person would assume that adjusted for the exchange rate a share of BHP Billiton Limited would trade very closely to BHP Billiton Plc, surprisingly this assumption is not correct. BHP Billiton Plc has traded at a discount every day for the last five years compared to the Australian listed BHP. If the shares were interchangeable between the exchanges the law of one price would remove the price difference, but in this case it is not possible to transfer a London listed BHP share to the Australian Stock Exchange, so there is not an arbitrage trade opportunity.

On the other hand, as the discount does not remain constant under all market conditions there is an opportunity to profit in the movement of the spread. To trade the spread a person buys one BHP and sells the other listed BHP, the trader is in a hedged position and is not concerned by the price movement of BHP they are just concerned by the movement of the discount/premium between the two shares.

As the shares are traded on different stock exchanges in different currencies, the exchange rate and the movement of the exchange rate needs to be considered if a trader is going to take a spread position. Fortunately in this case both are also traded on the New York Stock Exchange (NYSE) in US dollars through the use of American Deposit Receipts (ADR) an ADR traded on the NYSE represents shares in a foreign company. The ADR shares are interchangeable with the company it represents, so the law of one price keeps the price of the ADR adjusted for the exchange rate in line with the share it represents.

During the last five years the London listed BHP ADR (NYSE:BBL) has traded between 78% and 96% of the price of an Australian listed BHP ADR (NYSE:BHP), with an average of 86%.

An excellent risk/return ratio is obtained if the trader can buy the spread near it historic low and sell when the spread moves up to its average and the timing to perform this trade is when the price of BHP is collapsing. In November 2008 when ASX:BHP hit the low of $20.10 the above spread moved 8% in 9 days, 8% might not sound like a great return but as the trade is a hedged position leverage is safely utilised to increase the return on invested capital.

On the other hand, if you are an Australian value investor who wants to buy BHP shares at a discount to their intrinsic value there is a greater margin of safety in buying the London listed BHP for a 15% discount compared to buying the Australian listed BHP. If you follow Roger’s advice and only invest in the highly rated companies on Skaffold then BHP is not going to be a buy for you today at any price, but as the financial situation of every company is constantly changing one day in the future BHP may be rated A1 on Skaffold and at that time it might be worth you considering the London listed BHP.

Author: David Smith 13 March 2012

Great timing for a post on BHP David, I was trying to figure out how the listings on multiple stock exchanges worked. Unfortunately, I’m still a bit confused on how to put it all together. If I search for BHP in Google Finance, I get around 5 results as of 29/03/12:

BHP Billiton Limited – market cap of 182.34 billion, 5.32 billion shares

BHP Billiton Limited (ADR) – market cap of 113.65 billion, 1.61 billion shares

BHP Billiton plc – market cap of 100.35 billion, 5.32 billion shares

BHP Billiton plc (ADR) on the NYSE – market cap of 63.44 billion, 1.06 billion shares

BHP Billiton plc (ADR) on the PINK exchange? – market cap of 193.40 billion, 6.40 billion shares

Just to add to my confusion, CommSec has a market cap for BHP Billiton Limited of 111.16 billion and dividing this by the share price of $34.25 gives 3.25 billion shares.

So why are there are 6 different market caps and which one should we be looking at? Are some differences due to exchange rates? Secondly, if we are looking for figures on a per share basis to buy BHP on the ASX, what should the denominator be? Finally, could someone explain how ADRs work and why BHP has used them?

Thanks in advance,

Chris

Hi Chris,

In regards to the different listings below is some information off BHP website:

”

BHP Billiton is a Dual Listed Company (DLC) comprising BHP Billiton Limited and BHP Billiton Plc. BHP Billiton was created through the DLC merger of BHP Limited (now BHP Billiton Limited) and Billiton Plc (now BHP Billiton Plc), which was concluded on 29 June 2001.

The headquarters of BHP Billiton Limited, and the global headquarters of the combined BHP Billiton Group, are located in Melbourne, Australia. BHP Billiton Plc is located in London, United Kingdom. Both companies have identical Boards of Directors and are run by a single management team. Shareholders in each company have equivalent economic and voting rights in both companies.

BHP Billiton Limited has a primary listing on the Australian Securities Exchange and BHP Billiton Plc has a premium listing on the London Stock Exchange, with a secondary listing on the Johannesburg Stock Exchange. In addition BHP Billiton has two American Depositary Receipt listings on the New York Stock Exchange.

”

The reason to compare the two ADR is that they are both traded in US dollars so removes exchange rates from the comparison between the two shares.

ADR make it easier for Americans to invest in foreign companies as the ADR is traded on an American exchange.

According to BHP 2011 Annual report (under shareholder ownership), BHP Biliton Limited had 3,211,691,105 shares and BHP Biliton Plc had 2,136,185,454 shares as of 30 June 2011.

Ok thanks David, so going by your last paragraph, if you buy one share in BHP on the ASX you’ll get 1/5,347,876,559th interest in the company (as of 30 June 2011). Therefore, the market cap of the whole company in Australian dollars is equal to $34.61*5.3 billion shares = roughly 183 billion dollars. However in GBP, the market cap would be 19.08*5.3 billion shares = 101 billion pounds. Converting the Australian market cap and British market cap into American dollars gives 190 billion and 162 billion respectively. This is the discount that you were referring to in your post. Please correct me if I’m wrong here.