Growth stocks could rebound if inflation turns out to be “transitory” after all

Since bravely declaring that inflation would be “transitory” the Chair of the U.S. Federal Reserve, Jerome Powell, has been ridiculed for being so wrong. After all, we’ve since seen inflation exceed initial estimates and be more persistent than anticipated. But now it seems inflation could be transitory after all. And that augers well for quality growth stocks.

Indeed, commentators and investors appear to be convinced that Powell’s original assessment of inflation being “transitory” may prove prescient.

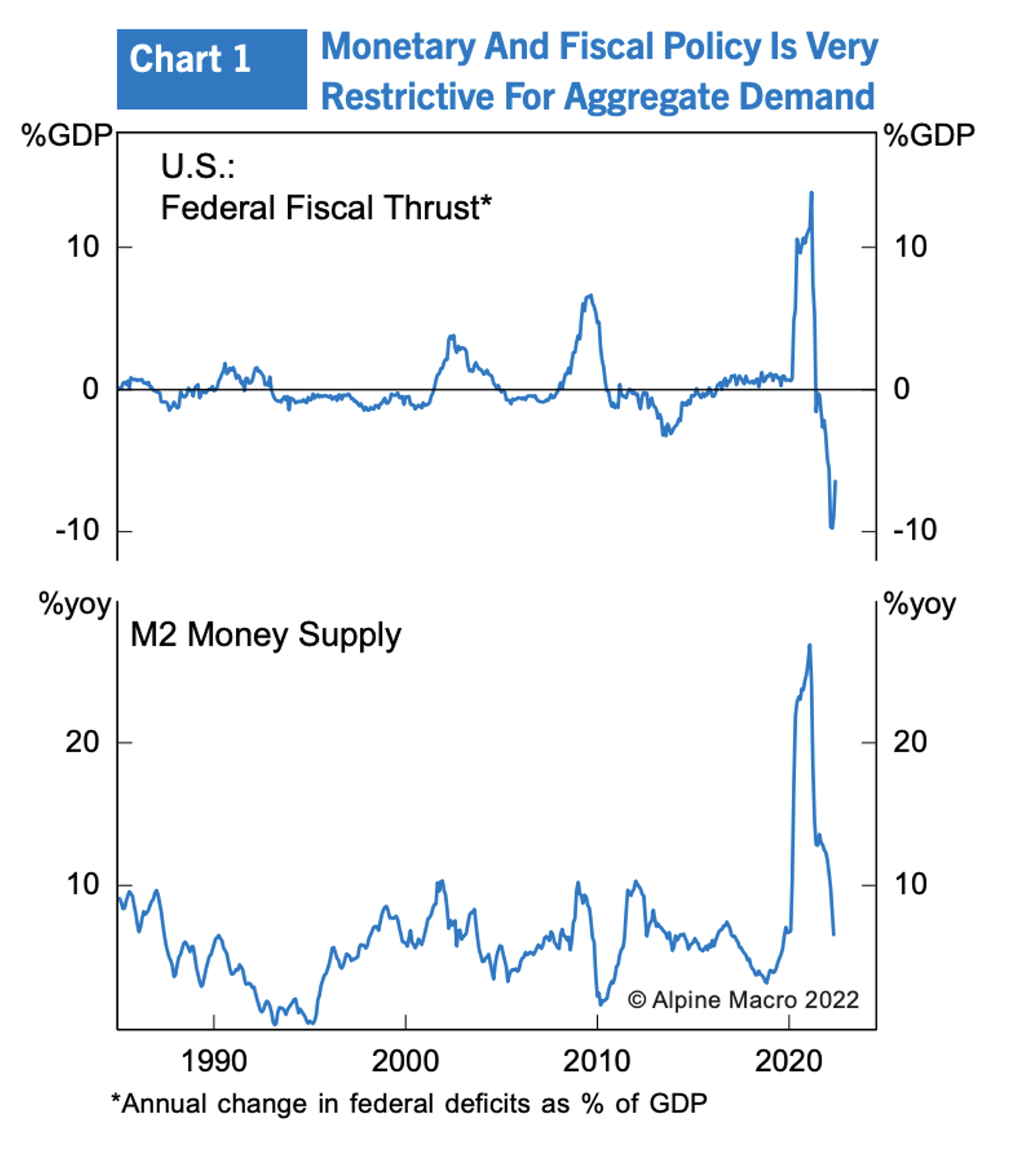

Figure 1. Restrictive money supply and fiscal policy

Source: AlpineMacro

As Figure 1., reveals, fiscal and monetary largesse has given way to restraint. This should dampen aggregate demand and indeed, according to Bloomberg and the U.S. Conference Board, U.S. consumer sentiment has fallen to its lowest level since February 2021 and is now at levels last seen in 2017. Meanwhile consumer expectations are the lowest since 2016. With U.S. real incomes going backwards, consumer spending should soon follow. And if that happens the Fed may pause on its path of rate rises, especially given it is now near the famed ‘neutral’ rate.

The market is already pricing in a slowing in the pace of US rate increases. Already the 5y/5y forward inflation breakeven rate has fallen below 2 per cent. As an aside, the five-year TIPS/Treasury Breakeven Rate is the difference between the five-year treasury rate and the five-year treasury inflation-indexed security rate. The value of the difference represents an average of what market participants believe expected inflation should be in the next five years.

The sharp fall at the short end of the curve suggests investors now believe the inflation spike is transitory. (Jerome Powell was right after all!). Lower long term inflation expectations indicate expectations of a reversion to a low inflation/deflationary environment.

We wrote about this a year ago. Back on December 1, 2021, I wrote:

“At the beginning of 2021, when Inflation Scare 1.0 hit market sentiment, we focused more on technological innovation, automation, the materially lower level of unionised labour and the economy’s reduced reliance on oil as continuing to drive the inflation declines that were evident prior to COVID-19.

“Now the market is in a FUD, or Fear, Uncertainty and Doubt. FUD relating to inflation is the concern du jour, but I believe investors have little to worry about.”

A pause in the Fed’s and the RBA’s tightening cycle next year may very well be reasonable to expect. Indeed, provided P/E ratios don’t reflect too much popularity in stocks in the interim, we may find share prices much higher next year.

Of course, there is every chance that current expectations of rate cuts next year take hold, driving share prices significantly higher prematurely and then a sell-off occurs when expectations of cuts meet with the reality of merely a pause to higher rates.

We may get the rate decisions right but that doesn’t mean accuracy will be translated to share prices. This is because we don’t know what set-up will be in place ahead of the macro-economic developments.

The conditions for material gains in innovative growth stocks

Nevertheless, if, in the longer-term economic environment, inheres is a combination of modest to low economic growth and ‘disinflation’ – the latter being successively lower rates of inflation – the conditions are excellent for material gains in innovative growth stocks.

If your question is whether high P/E stocks, which have led the decline, are likely to lead a recovery, the answer may be, yes. And the case is stronger if subdued interest rates, inflation and economic growth exist. As we have previously noted, research from the 1970s by Gavekal shows growth stocks should outperform.

As you well know I added to my investment in the Polen Capital Global Small and Mid Cap Fund a month or so ago. I added to the fund again last week.

There is always the risk of markets sliding amid a resumption of fear about the outlook. But even in that environment, P/Es have to fall a long way before long-term investors do poorly investing in high quality companies that are growing.

If the recent spike in inflation is the beginning of a secular shift, then the bear market in stocks is not over. However, if the current inflation problem turns out to be “transitory”, then the bear market will prove to be very late, if not over.

Great summary Roger. If we continue to look 5 and 10 years out there are still some great opportunities. The big one I am still trying to get my head around is how world markets will respond to a Chinese invasion of Taiwan. I think the impact will be much more than Russia into Ukraine.

I agree stuart. Its the fattest tail-risk of all.