Get set for weaker employment data

Australia is currently enjoying the most buoyant labour market conditions since the 1970s. But how long can the low unemployment rate persist? As the saying goes, if something can’t go on forever, sooner or later it must stop. And with consumer and business sentiment both waning, surely it is just a matter of time.

With the cost of living rising at an accelerating pace, and the Reserve Bank tightening monetary policy in response, the outlook for economic growth is deteriorating as reflected in falling consumer and business sentiment indicators. The one area of strength in the economy has been employment, with the unemployment rate sitting below 4 per cent, and the level of underemployment having declined materially over the last year.

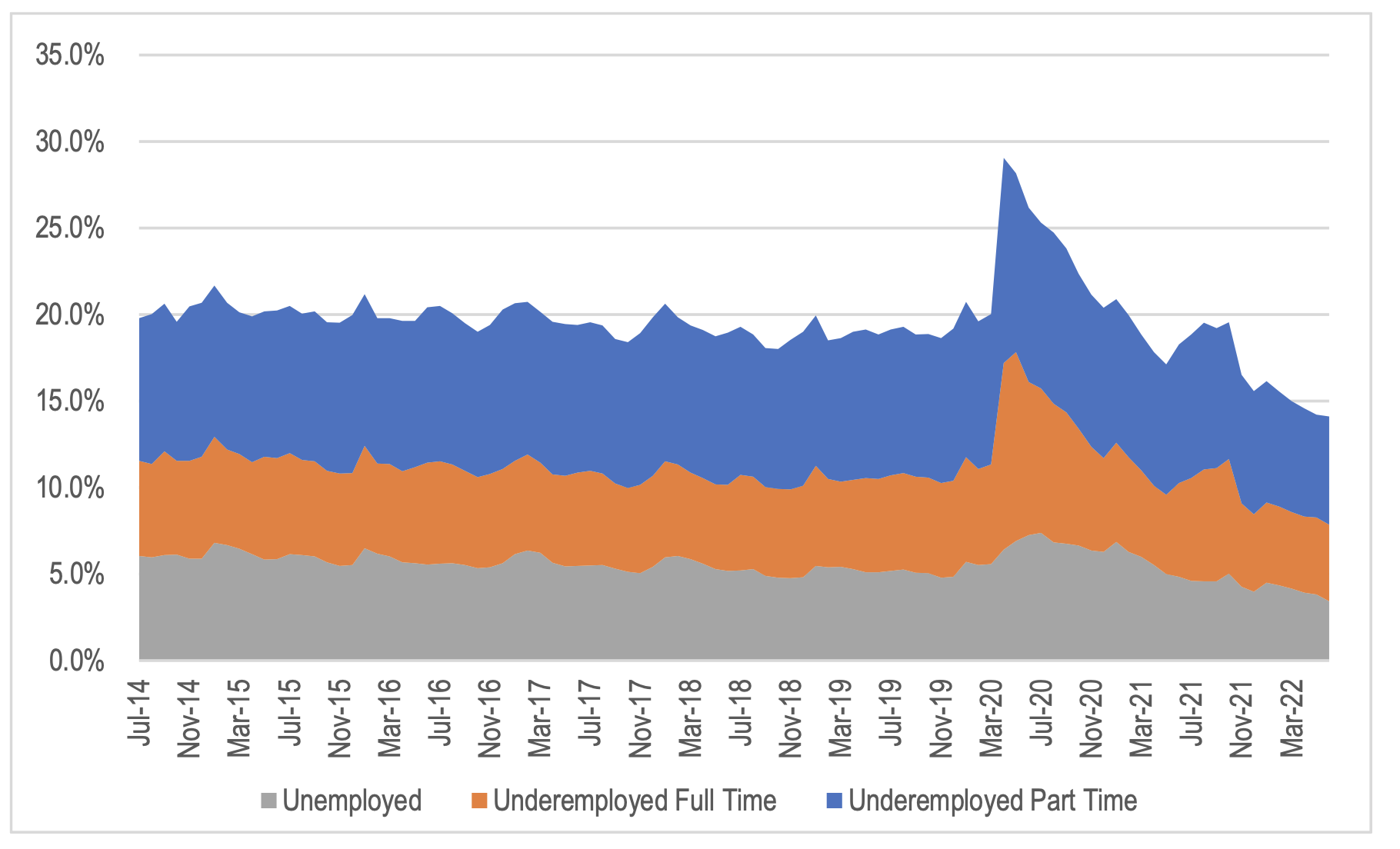

If we combine the unemployed with those that are underemployed (i.e., want to work more hours than they currently are able to) as a percentage of the overall workforce, this gives us an indication of the amount of available labour capacity that remains in the economy. This is shown in the chart below.

Figure 1: Australian unemployed and underemployed as a percentage of the total workforce

Source: ABS

The chart shows that the total unemployed and underemployed as a percentage of the overall workforce has fallen from more normal levels of around 20 per cent to 14 per cent at present. This is indicative of a very tight labour market. Labour market tightness is leading to upward pressure on wages and increased industrial activity. While accelerating wage increases provide households with a short term offset to the rising cost of living, it does nothing to fix the inflationary problem of supply constraints in the economy. It must be remembered that inflation is just the price mechanism doing what it is supposed to do: allocate supply constrained goods and services to the highest bidder and thereby ration demand.

More money in the hands of households and no offsetting increase in the supply of goods and services increases the risk that higher wages just devalues money further (i.e. leads to ongoing inflation).

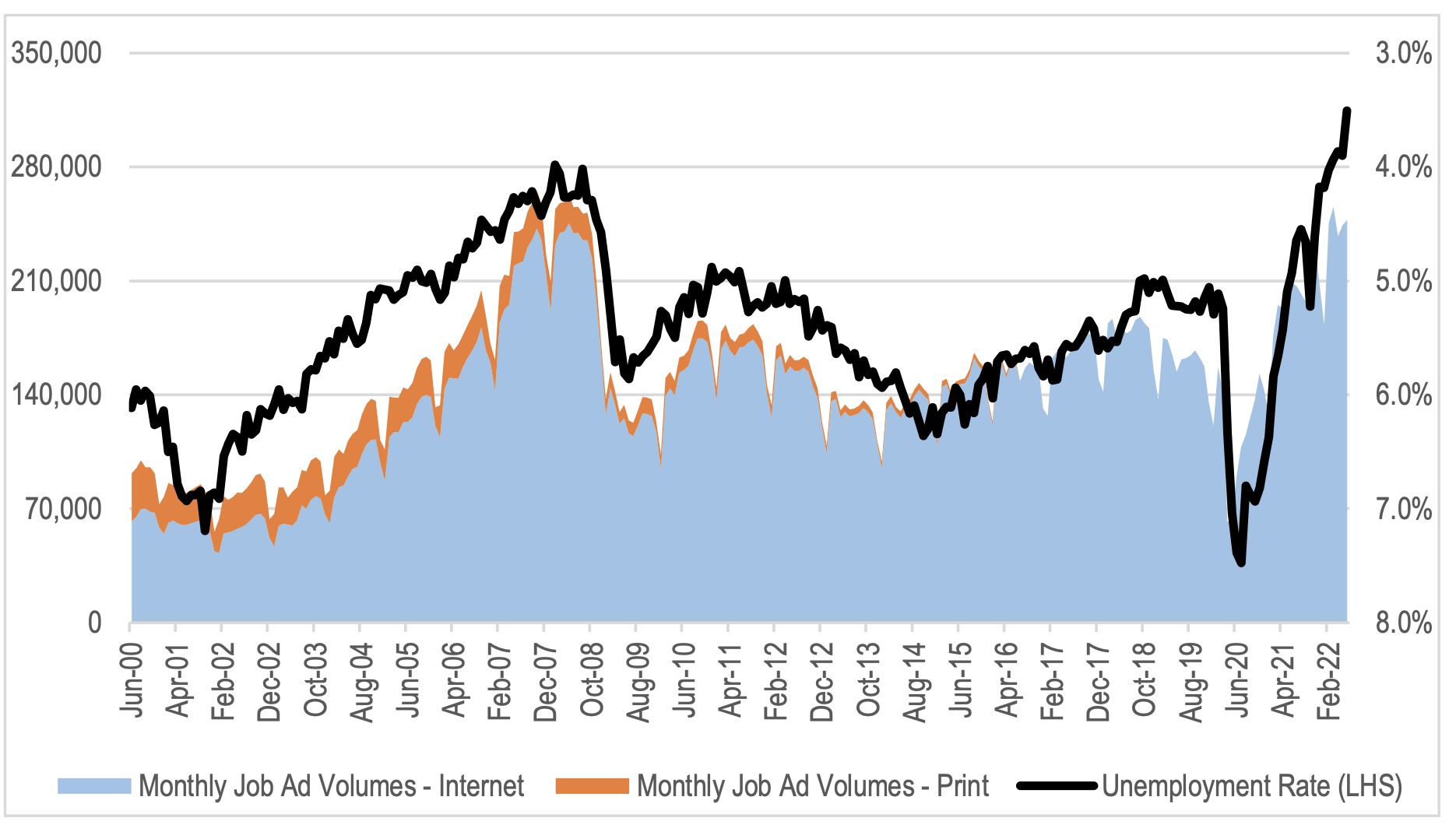

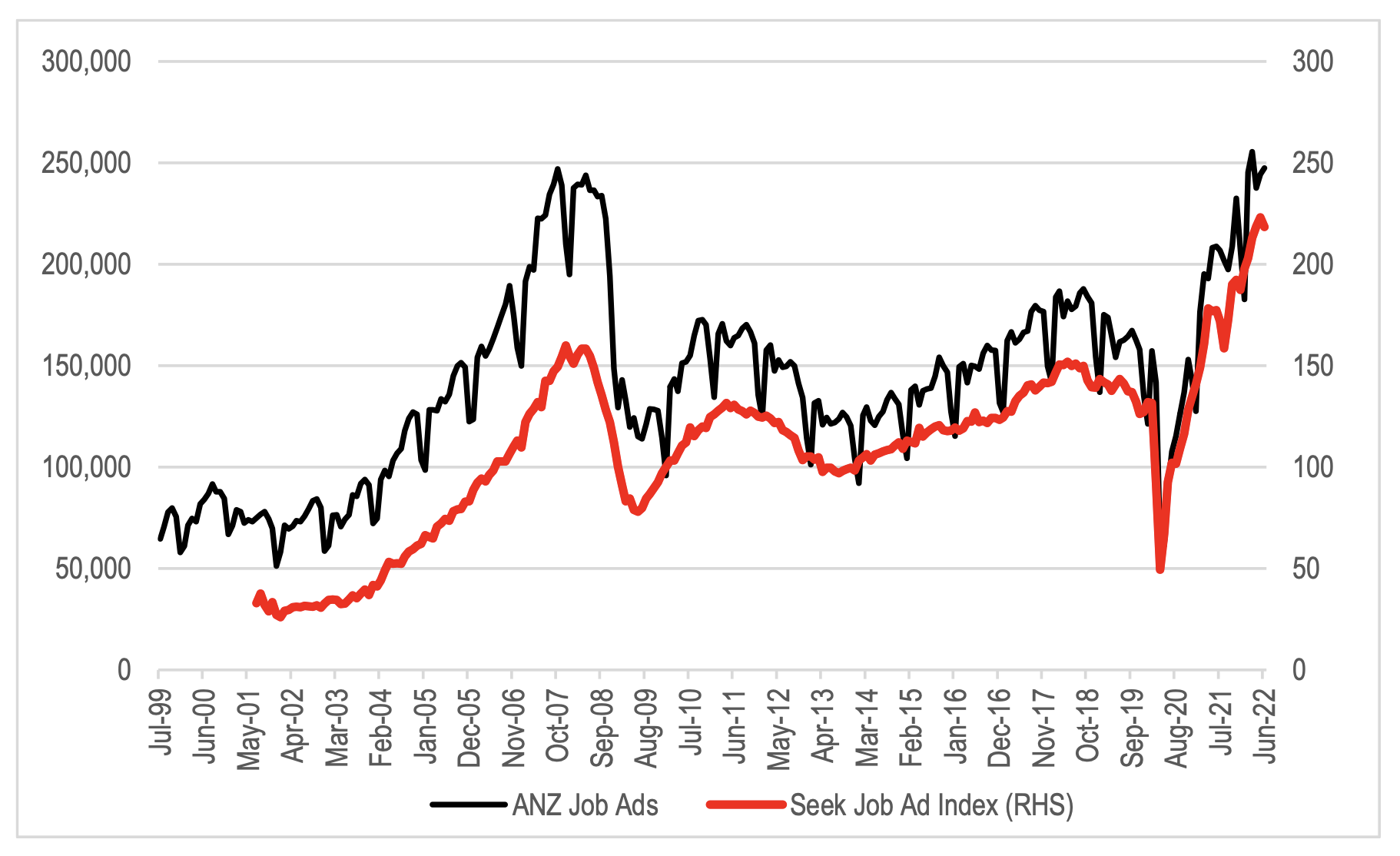

While the labour data is undeniably strong, it is a bit of a backward-looking indicator. The ANZ and Seek job ad series provide a slightly more current indicator of labour demand. Job vacancies have increased strongly over the last 12 to 15 months as the economy reopened. However, the data is now starting to peak with seasonally adjusted monthly volumes relatively flat since February.

Figure 2: Monthly ANZ job advertisement data vs Australian unemployment rate

Source: ABS

Figure 3: Monthly ANZ job advertisement data vs Seek job advertisement data

Source: ABS, Seek

While employment is strong, the household balance sheet and budget are likely to remain supported for the average household, buffering the impact of rising living costs. For those that remain unemployed, pressures will continue to mount. However, the tightening of monetary policy is designed to reduce demand relative to supply in order to take the pressure off prices. The risk is that this flows through to businesses and, in turn, their demand for labour, removing the last pillar of support for the economy.

The risk on the other side of the coin is that if demand is not reduced enough and the labour market remains extremely tight, this will inevitably flow through into wage growth, risking further increases in inflation unless the supply constraints in the economy can be reduced.

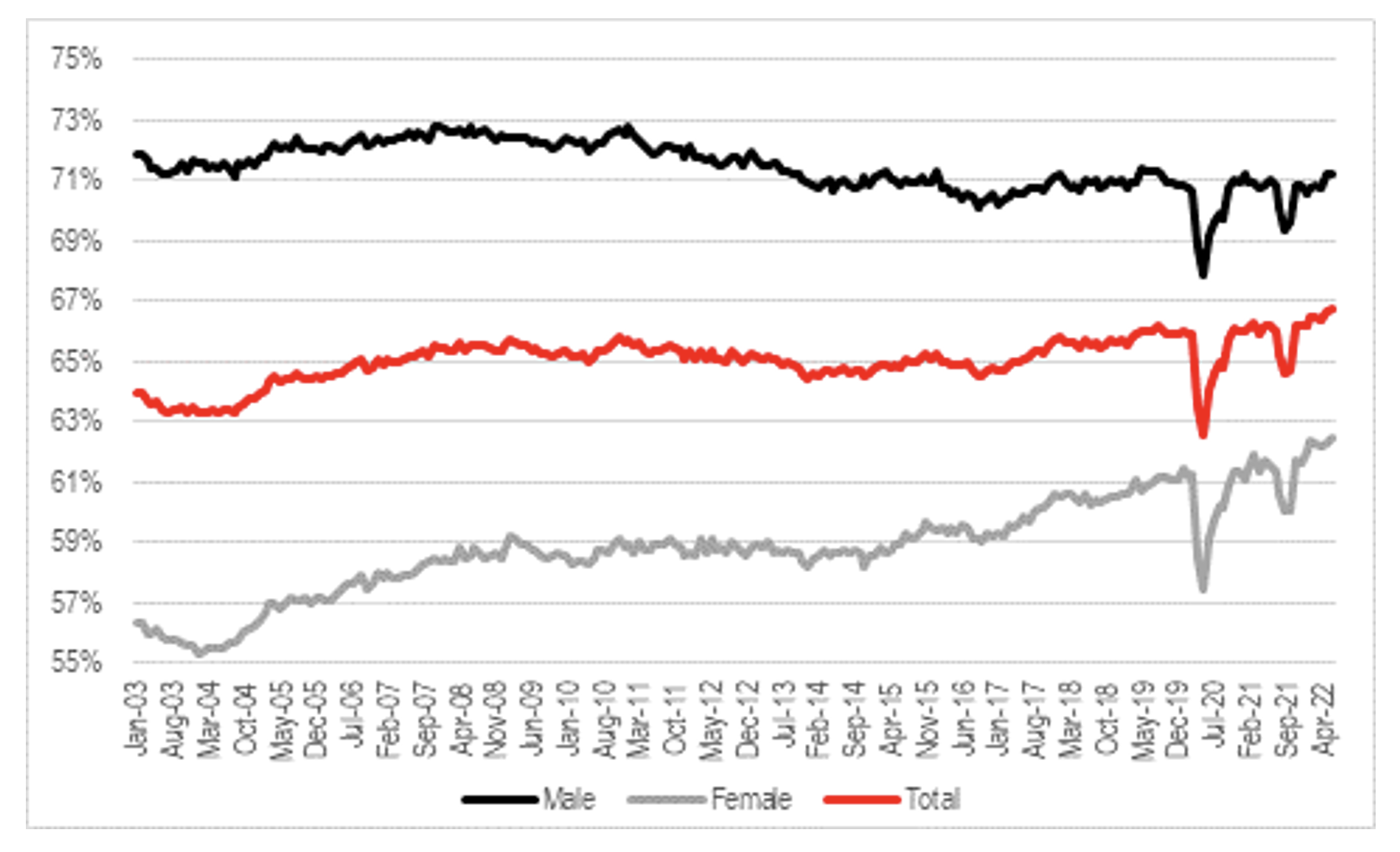

The glass half full argument is that higher wages encourage more people into the workforce. This is supported by the rising trend in participation rates over the last six months. Most of this improvement has come from women joining the workforce.

Figure 4: Australian labour force participation rates

Source: ABS, Seek

As workforce participation rises, the economic capacity of the Australian economy also improves, reducing some of the supply constraints. Of course, increased labour supply will do little to alleviate the supply pressures driving up energy and import prices, but it will help in services industries.

With the Reserve Bank raising rates to cool the economy, consumer and business sentiment falling, and participation rates rising, the current imbalances in the economy that are driving price inflation are starting to be addressed. For the moment, labour demand is proving resilient, but the question is how long this can persist in the face of waning consumer and business sentiment.

This post was contributed by a representative of Montgomery Investment Management Pty Limited (AFSL No. 354564). The principal purpose of this post is to provide factual information and not provide financial product advice. Additionally, the information provided is not intended to provide any recommendation or opinion about any financial product. Any commentary and statements of opinion however may contain general advice only that is prepared without taking into account your personal objectives, financial circumstances or needs. Because of this, before acting on any of the information provided, you should always consider its appropriateness in light of your personal objectives, financial circumstances and needs and should consider seeking independent advice from a financial advisor if necessary before making any decisions. This post specifically excludes personal advice.

INVEST WITH MONTGOMERY