Forty consecutive quarters of growth

It’s a rare feat indeed for businesses to grow consecutively year-on-year for a decade, and just a handful of companies will ever achieve such a milestone. So when you own a company that has just notched up its fortieth consecutive quarter of growth, you know you have something special.

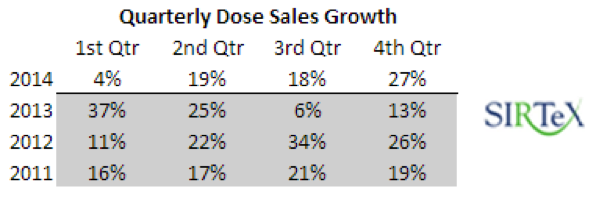

Sirtex (ASX: SRX) have just released their quarterly dose sales to round out FY2014, and we have updated the table below accordingly:

As you can see, dose sales for SIR-Spheres – Sirtex’s targeted radiation therapy for liver cancer – grew in the June 2014 quarter by 27 per cent year-on-year. We expect this to translate to at least 8,500 dose sales in FY2014, up from 7,299 in FY2013.

This is an excellent result by the company, and testament to the quality of the liver cancer treatment and delivery mechanisms SRX has developed over the past decade.

With particular interest, we note that despite achieving 11.5 per cent growth in the December 2013 half-year, dose sales growth has averaged 23 per cent in the June 2014 half-year. This is further evidence that oncologists and radiologists around the world are becoming more aware of the treatment, and seeing results in patients. This is driving stronger adoption, giving us increased confidence that business growth is accelerating.

As per our last post, SRX’s pivotal Phase 111 SIRFLOX trial results are due out early next year. It’s at this time we believe there’s potential for SIR-Spheres to be elevated to a first line of treatment, in which case the business could experience a material step-change in revenue and earnings over the remainder of this decade.

Both The Montgomery [Private] Fund and The Montgomery Fund own shares in Sirtex Medical Limited.

Below: David Boshell, interventional radiologist at Sydney’s St Vincent’s Hospital.

This post was contributed by a representative of Montgomery Investment Management Pty Limited (AFSL No. 354564). The principal purpose of this post is to provide factual information and not provide financial product advice. Additionally, the information provided is not intended to provide any recommendation or opinion about any financial product. Any commentary and statements of opinion however may contain general advice only that is prepared without taking into account your personal objectives, financial circumstances or needs. Because of this, before acting on any of the information provided, you should always consider its appropriateness in light of your personal objectives, financial circumstances and needs and should consider seeking independent advice from a financial advisor if necessary before making any decisions. This post specifically excludes personal advice.

INVEST WITH MONTGOMERY

Roger – what do you make of the statement to not post 1/4 dose sales any more?

We have some fluffy words about 2020. GW has often stated that the day to day gyrations of the stock is of no concern to him, as the senior managements job is to create profits and growth.

This is a reduction in data that retail investors will have access to in the future, and I can see no logical reason for this.

I’d sincerely be interested in your take on this from a fund managers point of view.

Cheers

A subject of ongoing internal discussions…