Floating the OzForex boat

RogerMontgomery.com subscribers can read our in-depth analysis of OzForex in this month’s exclusive white paper later this week.

Despite the buoyancy in the stock market over the past 12 months, we have been surprised to see so few new businesses apply for listing on the Australian Securities Exchange.

Rising markets, maturing term deposits and low cash rates are a good recipe for companies with IPO plans. Investors, who are likely to be more open about putting their hard-earned savings to work rather than reinvesting them in low yielding term deposits, may be keen to take on a little more by investing in companies that are angling to take the IPO plunge.

On the other side of the fence sit the investment managers. Having watched a rising market lift all the “boats” in their portfolios, they are now finding it much more difficult to generate new ideas, and they would certainly be receptive to new opportunities.

Despite this, few IPOs have measured up to what we consider quality, of decent size, have bright future prospects, and are being offered at a discount to our estimate of their intrinsic value. The exception to this is Virtus Health Limited (ASX: VRT), the only recent float we have participated in.

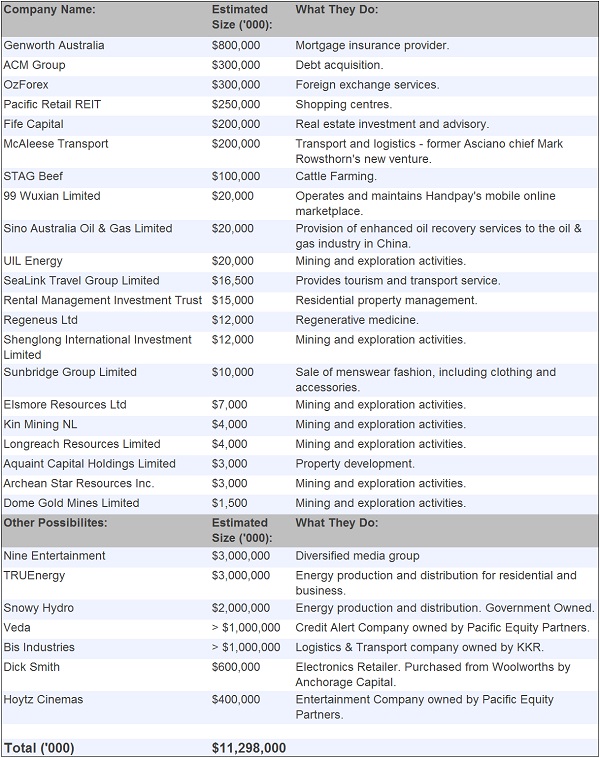

This lack of attractive new IPOs may be about to shift. Over the past few weeks, we have been told to prepare for a number of new floats – with an estimated combined value of $11b. Many are set to arrive by the end of 2013, and these are summarised below.

For context, so far this calendar year, new floats have totalled approximately ~$1.1b. In 2012, that figure was just ~$900m. The last time the market saw an excess of $6b in value was just prior to the GFC.

We are actively looking for any opportunities in this list of 28 names. To answer this, let’s start with some speculation.

Hi Roger.

On rereading this article, I note that you have not made any further reference to Fife Capital, having initially included it in your initial “short list” of 6 possibilities for consideration. You rule out Genworth, Pacific Retail and McAleese transport but then comment only on ACM and OzForex. What’s your view on Fife Capital?

PS I’ve followed your blog for sometime now but this is my first post. I have made some great investment decisions by adopting your principles.

Hi Helen,

I am delighted to hear the philosophy is working so well. WIth respect to individual stocks please understand any list that appears is never intended to be exhaustive. We will always leave a few things out – it doesn’t necessarily mean we like or dislike it.

Great white paper once again Roger.

Good luck re getting an allocation Jason. Having had to deal with foreign exchange in my work I’m aware of the charges via the bank(s). Its very profitable business on the buy or sell! As well when you travel, their buy rates are pricey. (It can be better to go to Asia with AUD and change in country as the rates can be less that end). I tried to get an allocation via my full service broker who in turn tried to get some for me via their Macquarie connections but they didn’t have any to spare. I thought about it some more and it concerns me that a couple of the original owners are selling down a significant proportion of their holdings. There will be other opportunities.

Yes – this one is for the in crowd with no public offer

If you really want to save on currency transfers use currency fair – fee 3 euros

Anybody been able to come up with a valuation

Keep an eye out for this week’s Whitepaper, which will be sent to RogerMontgomery.com subscribers. Its an assessment of the quality and valuation of OZforex

Hi Roger,

Is it possible to participate in this IPO, or is it only clients of certain brokers?

Generally, a mutually profitable relationship with a full service broker gives you a better chance of securing an allocation. With the very large floats, there is often an allocation offered to the ‘public’ – especially where brand is important – and you may simply need to be a client of Etrade or Commsec to secure some shares.