What does fewer migrants mean for property?

The latest economic update from the Federal Treasurer includes an assumption that net overseas migration will plummet as a result of COVID-19 related travel restrictions. Given that overseas migration is a major driver of property prices and construction activity, this will put a dampener on prices and have a major impact on employment.

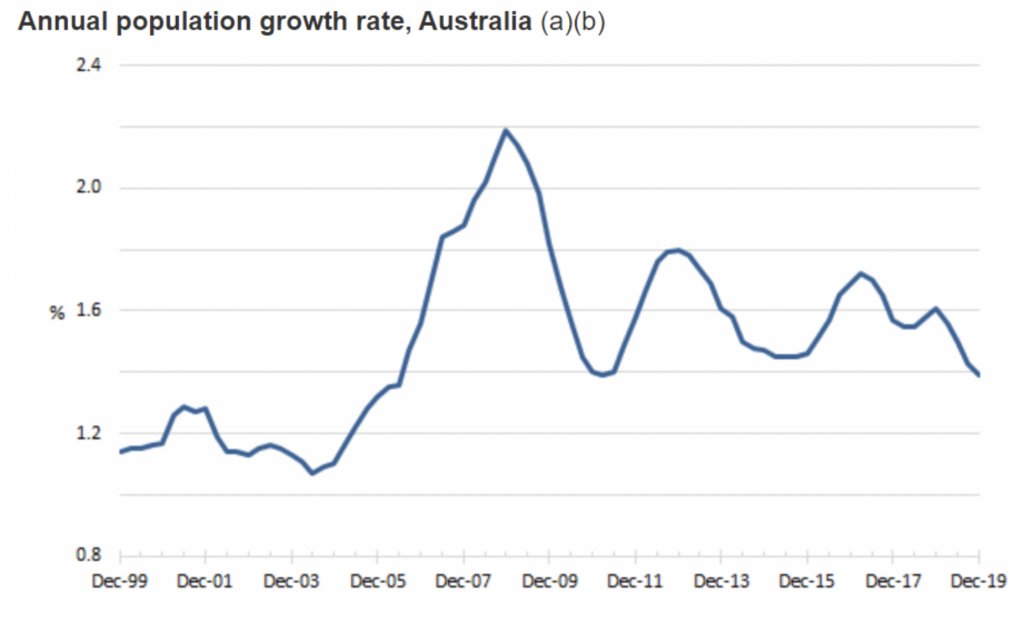

One of the major drivers of Australia’s boom in property markets has been the strong population growth which since 2007 has been running at around 1.6 per cent per year as the chart below shows.

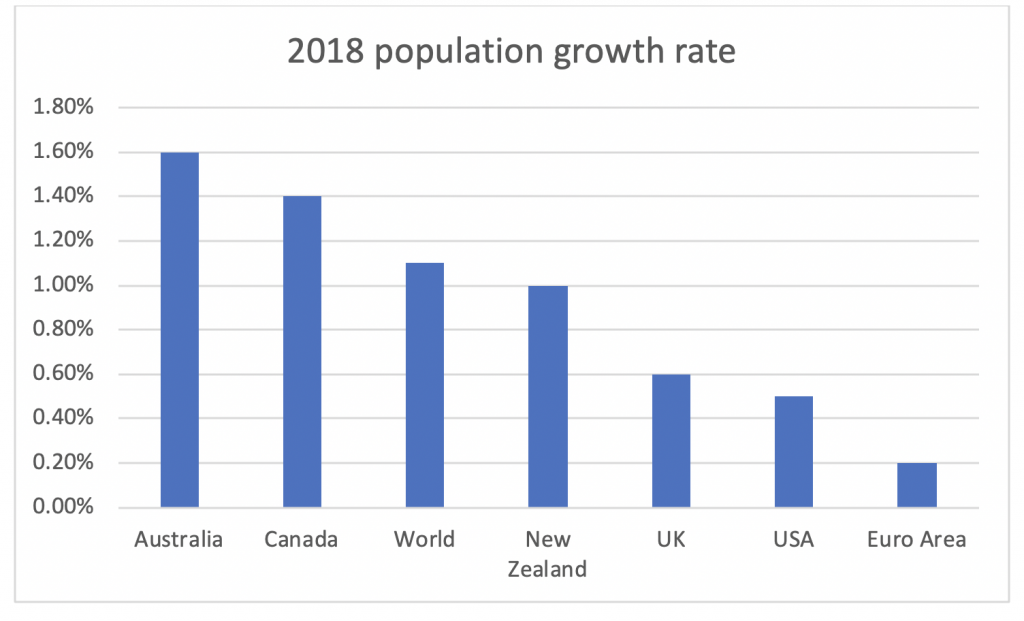

As readers are probably aware, this is one of the highest in the developed world and also well above the world average of 1.1 per cent:

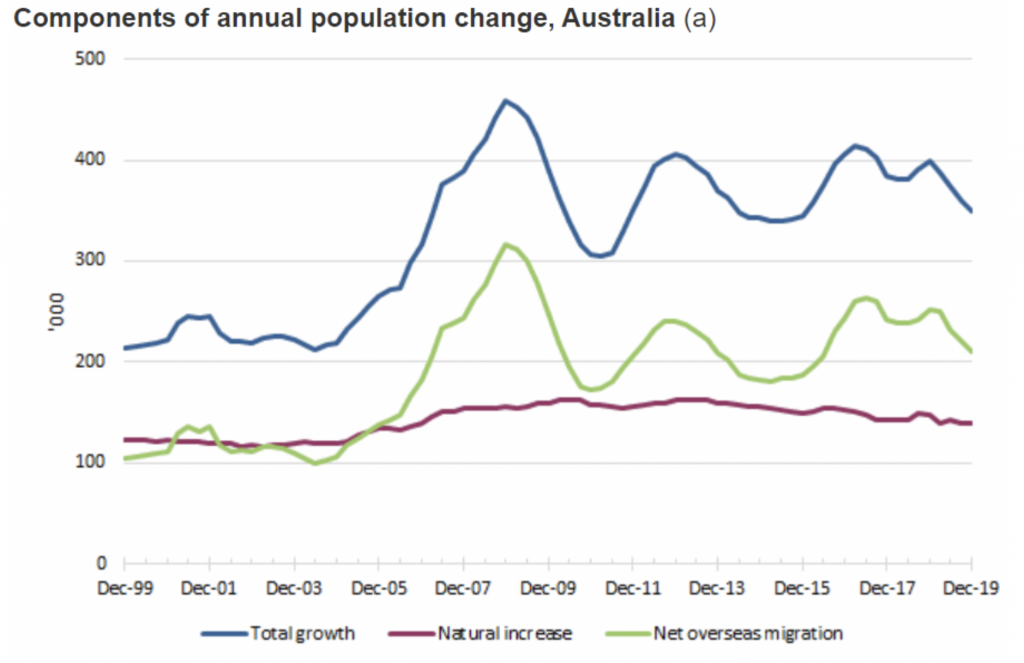

Now, Australian families are not having significantly more babies than the rest of the world and as we can see from this chart, about 2/3 of the total growth rate comes from net overseas migration while about 1/3 is from natural increase (the natural increase is indeed looking like it is coming down):

From this chart, we can also see the massive increase in net overseas migration that started around 2007 with the Big Australia policy introduced by the Kevin Rudd government where the yearly amount was increased from around 100k per year to on average about 250k per year.

With an average of around 3 people per household, this means that net overseas migration drives a demand for about 80,000 new properties per year. About 85 per cent of new arrivals in Australia settle in Sydney or Melbourne and it is therefore no surprise that these two cities have seen skyrocketing property prices (of course combined with other drivers like falling interest rates and perverse tax incentives).

The economic update from the Federal Treasurer on 23 July is therefore interesting to read in that the assumption for net overseas migration will fall to just 31,000 as a result of COVID-19 related travel restrictions.

Property prices are, as any other asset, driven by a supply/demand balance and taking away a significant portion of incremental demand will undoubtedly have significant impact on this balance, especially as around 170,000 dwellings are due to be completed in calendar year 2020.

We have probably not yet seen a pick-up in unemployment for people involved in construction as it has been deemed an essential industry so it was exempt from lockdowns and the lead time it takes to complete houses and apartments but it could have some serious effects on overall employment when we consider that:

- About 140,000 people are directly employed in building domestic properties

- Including the multiplier effects, it is estimated that up to 1 million jobs are supported in total by domestic property construction

It is therefore in the government’s interest to get immigration restarted as soon as possible but at least I struggle to see that happening quickly given that:

- The virus outbreak in Victoria came from overseas travelers and politically it will be very hard to open up international travel before an effective vaccine is widely available.

- With steeply rising unemployment, there will be increased political pressure not to increase immigration until unemployment comes down again.

- A large portion of the net overseas migration is from foreign students that stay after completing their studies. As I have written previously, I see a high risk that we will see a downturn in the number of overseas students over time which should naturally reduce the numbers.

This post was contributed by a representative of Montgomery Investment Management Pty Limited (AFSL No. 354564). The principal purpose of this post is to provide factual information and not provide financial product advice. Additionally, the information provided is not intended to provide any recommendation or opinion about any financial product. Any commentary and statements of opinion however may contain general advice only that is prepared without taking into account your personal objectives, financial circumstances or needs. Because of this, before acting on any of the information provided, you should always consider its appropriateness in light of your personal objectives, financial circumstances and needs and should consider seeking independent advice from a financial advisor if necessary before making any decisions. This post specifically excludes personal advice.

INVEST WITH MONTGOMERY

Also, one wonders if the government will begin building social housing/public housing as a stimulus measure and as a means of housing the increasing unemployed and low income and to overcome the problems with apartments blocks (poorly built, fire traps, and now public health hazards.

No doubt this would have a substantial impact on demand for private housing market especially apartments.