Fat tails indicate that the S&P 500 is unexpectedly strong

It hasn’t been widely reported (which could, of course, mean I am about to repeat the common mistake of reading too much into a central banker’s utterances), but earlier in March, Federal Reserve Chairman, Jerome Powell, dropped a subtle remark that may shed light on the central bank’s mindset. As the Federal Reserve heads into its meeting this week, Powell’s words may also carry weight for the unpredictable economic road ahead.

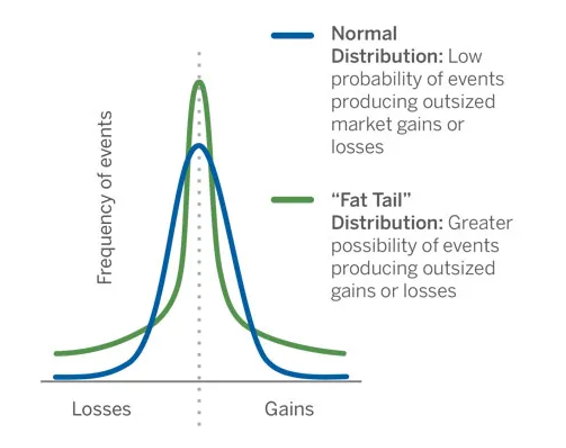

Powell’s observation came in the context of the pandemic-disrupted economy, though it resonates equally with the emerging landscape of the Trump 2.0 era. He said, “However fat you think the tails are, they’re fatter than you think”, alluding to the far reaches of a probability curve. In simpler terms, he’s warning the chances of wild, seemingly far-fetched outcomes are more significant than most of us realise and, therefore priced into market and asset valuations. With trade, fiscal, immigration, and regulatory policies in upheaval (leading to the U.S. constitution itself is being challenged and undermined), and the judiciary on notice, the range of potential economic futures is unusually broad. Add to those, the potential for armed conflict with China, Russia, North Korea and Iran, and the tails are even fatter.

Figure 1. Normal versus fat tail probability distribution

Source: Brown Advisory

At this week’s meeting, Federal Reserve officials will sketch out forecasts for growth, inflation, unemployment, and interest rates – projections that will be unveiled tomorrow afternoon in the U.S. Predicting the economy’s path over the next few years feels like a coin toss, especially with so many variables in flux. Expect their estimates to reflect an even wider spread than usual, a nod to the chaotic backdrop they’re working against.

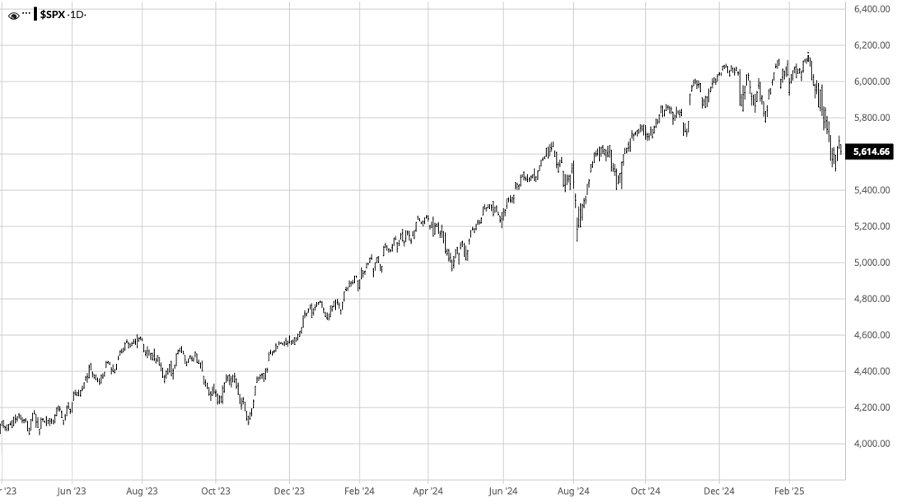

Figure 2. S&P 500

Source: Barchart

As is usual, the U.S. central bank appears reluctant to rely too heavily on recent fluctuations in the financial markets or the unstable nature of survey data that have dominated the past two months. When these figures do come into play, they further cloud the issue. Take the University of Michigan’s March sentiment survey: it indicated rising long-term inflation expectations – suggesting a need to keep rates steady or increase them – while also presenting more pessimistic views on the job market, which could support arguments for rate cuts instead. Conflicting signals like these makes the Federal Reserve’s job more complicated and makes investor predictions meaningless – not that the latter should ever be relied upon.

Several analysts anticipate the Federal Open Market Committee (FOMC) will underscore the unpredictability of policy shifts and their ripples on economic activity and prices. For what it’s worth, the economy still looks robust, suggesting that the Federal Reserve will sit pat until any consequences of Trump’s executive orders emerge. Expect inaction from federal policy rather than urgency.

Powell’s news conference this week will include quarterly projections. These are a shaky guide in regular times, and today’s fluid nature of U.S. politics and policy suggests those projections deserve extra scepticism now. The sheer scope of unknowns and the scale of uncertainty leave me surprised the market has held up as well as it has.

Indeed, a 10 per cent retracement, such as the S&P 500 has recently experienced, seems positively ordered and mild when considering the multiple crises the U.S. is confronting within and beyond its borders.

Those “fat tails” Powell mentioned suggest extreme outcomes – whether soaring growth or runaway inflation – are more plausible than we’d like to admit. And with risks looming large on both sides of the Federal Reserve’s dual mandate (price stability and full employment), the argument for a cautious approach does not seem overly conservative.