Farewell TradeMe

On Wednesday, New Zealand online goods trading and classifieds platform TradeMe will hold an extraordinary general meeting so that shareholders can vote on the proposed acquisition of the company by one of the private equity funds of Apax Partners for NZ$6.45 per share.

Assuming shareholders vote in favour of the proposal, trading in the company’s shares is expected to cease on 2 May with shareholders expected to receive the proceeds from the sale of their shares on 8 May.

TradeMe is a high-quality company that we at Montgomery have believed was fundamentally undervalued for some time. While its legacy goods trading platform was likely to continue to struggle in the face of growing competition from global competitors, the potential market opportunity for its classifieds businesses, and property in particular, was largely unrealised. Drawing parallels with the share of transaction costs generated by similar classifieds operations in other countries like Australia indicated that there remains enormous headroom to lift revenue in the medium to longer term.

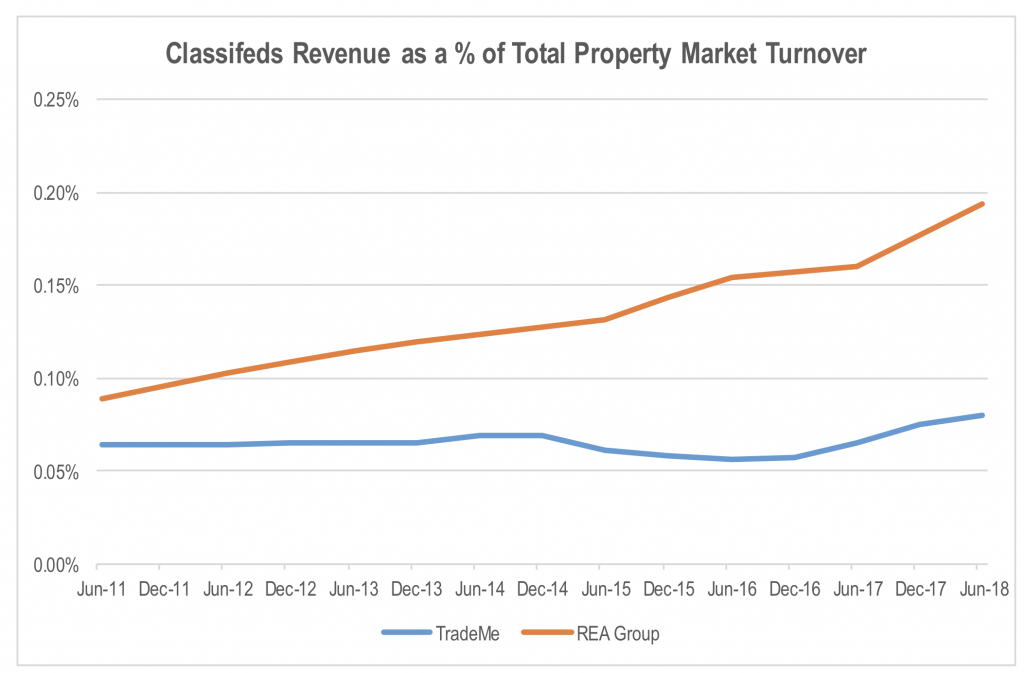

Looking at the property classifieds market in particular, the revenue capture of REA Group (ASX:REA) in the Australian market as a percentage of the value of property sold in the overall Australian market has more than doubled over the last 7 years to just under 0.2 per cent. In contrast, TradeMe’s property classifieds revenue as a percentage of the total value of New Zealand property transacted in a given year has remained relatively flat, and currently sits at just a 40 per cent of that of REA.

Source: Companies, ABS, Credit Suisse

This indicates revenue per listing upside of around 150 per cent from current levels for TradeMe if it were to merely match REA’s current level of monetisation. While there are some differences in the way real estate is sold in New Zealand relative to Australia, this does not explain the size of the gap in classified monetisation.

The difficulty for TradeMe has been in managing the short to medium term earnings expectations of the market while continuing to step up investment to the level required to realise the long-term potential of the company’s classifieds franchises. The share price has reacted poorly in the past when management has announced a step up in investment to enhance the product, despite the obvious long-term upside. We believe that while a more aggressive reinvestment cycle that would entrench the company’s market leadership position in property and motor classifieds, but it was likely to be impossible in a listed environment.

As such it is not surprising to see private equity fund interest emerge for the company. A private equity owner will be able to sacrifice short or even medium-term earnings in order to invest for the future and realise the full potential of the platform.

It is also interesting to note the number of private equity firms that have acquired similar businesses in other parts of the world over the last year. In May 2018, Silver Lake acquired UK property portal ZPG for £2.4 billion and in February this year, Hellman & Friedman and Blackstone raised their bid for European property and motor classifieds business Scout24 to €5.7 billion. This is on top of a number of other online classified businesses that are already owned by private equity funds. We also note that Oakley Capital Private Equity bought REA Group’s European classifieds businesses in 2016.

The Independent Expert’s report valued TradeMe at between NZ$5.93 and NZ$6.39 per share. However, this valuation range was determined using earnings multiples relative to comparable companies. As such it did not reflect the opportunity to significantly improve the monetisation of TradeMe’s classifieds franchises to bring it more in line with classifieds businesses in other countries.

But as mentioned before, to realise this upside opportunity, TradeMe would have needed another material step up in investment, something that would have proved difficult while listed.

As a result, while the bid by Apax does not fully reflect the true long-term potential value of TradeMe, it provides shareholders with some of this upside upfront. And with that we are likely to bid farewell to TradeMe as a listed investment opportunity.

The Montgomery Funds own shares in TradeMe Group and the Montgomery Global Funds own shares in REA Group. This article was prepared 01 April with the information we have today, and our view may change. It does not constitute formal advice or professional investment advice. If you wish to trade these companies you should seek financial advice.

This post was contributed by a representative of Montgomery Investment Management Pty Limited (AFSL No. 354564). The principal purpose of this post is to provide factual information and not provide financial product advice. Additionally, the information provided is not intended to provide any recommendation or opinion about any financial product. Any commentary and statements of opinion however may contain general advice only that is prepared without taking into account your personal objectives, financial circumstances or needs. Because of this, before acting on any of the information provided, you should always consider its appropriateness in light of your personal objectives, financial circumstances and needs and should consider seeking independent advice from a financial advisor if necessary before making any decisions. This post specifically excludes personal advice.

INVEST WITH MONTGOMERY