Farewell 2014, Hello 2015

With 2014 behind us, let’s take a look at the year that was, and consider what could be in store for 2015.

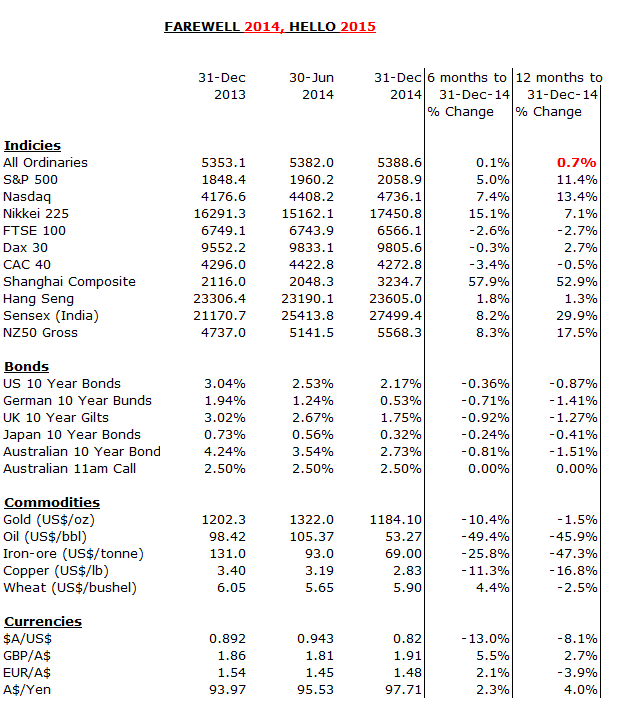

The Australian market, excluding reinvestment of dividends, rose 0.7 per cent in the year to 31 December 2014 from 5,353.1 to 5,388.6.

Other major share markets which did not deliver acceptable returns over 2014 included the FTSE 100, the Dax 30, the CAC 40 and the Hang Seng. The Shanghai Composite Index lead the way, up 52.9 per cent as the Chinese Central Bank instituted monetary easing on the back of slower economic growth.

Returns from the Sensex (+29.9 per cent) and the NZ50 Gross (+17.5 per cent) were impressive while the Nasdaq (+13.4 per cent) and the S&P 500 (+11.4 per cent) were solid.

The yield on ten year bonds continued their strong downtrend. German ten year bunds rallied from 1.94 per cent to 0.53 per cent, for example.

Japanese ten year bonds (0.32 per cent), UK ten year gilts (1.75 per cent), US ten year bonds (2.17 per cent) and Australian ten year bonds (2.73 cent) are indicating deflation is a significant risk for the global economy, while inflationary expectations continues to be downgraded in many major economies.

This thesis has support when we consider the crash in certain commodities. Examples include oil, down 49 per cent to US$53.27/bbl in the six months to 31 December 2014; iron-ore, down 47 per cent to US$69/tonne over the year; and even copper, down 17 per cent to US$2.83/lb.

Many “commodity currencies” are now under pressure and the 13 per cent decline in the A$/US$ exchange rate to US$0.8166 in the past six months was well overdue.

Several emerging economies with large external debt to GDP ratios will likely hit the headlines in 2015. The strong US Dollar will not assist matters.

Issues associated with hyper-inflation in Venezuela and debt default in Argentina will likely extend to several peripheral eastern European economies.

The fragmented electoral landscape in Greece will see increased fear of an exit from the Euro, which could place pressure on several European Banks.

Maybe Quantitative Easing will be around for longer than many anticipate!

Thanks Roger, the table is a very good summary of what

‘s happening in the world.