Earnings announcements provide some fuel for the optimists

Right now, we’re seeing a tug-o-war between investors who think the worst is behind us and those who feel there is more coronavirus induced pain to come. A look at recent corporate earnings announcements gives a slightly clearer picture of the road ahead.

As investors, it is important to form your own view of the future prospects of a company and not to rely on statements from the management of said company as they are in general very optimistic. This optimism is not bad or surprising, as it would be challenging to run a business that you do not fully believe has a bright future, but it means that statements from company management should be taken with a grain of salt!

Saying this, in the shorter term, company management and boards have much better insight into what is going on inside a business than people outside so it is worth taking notice when companies give guidance updates.

At the moment, we are in an unprecedented situation where visibility on what will happen to various sectors of the world economy (and overall society) is probably less than at any point since the outbreak of World War II. It is even more interesting to look at guidance updates, not necessarily for what they say, but to look at the number of companies that do have some kind of visibility into the future and compare to how many have not.

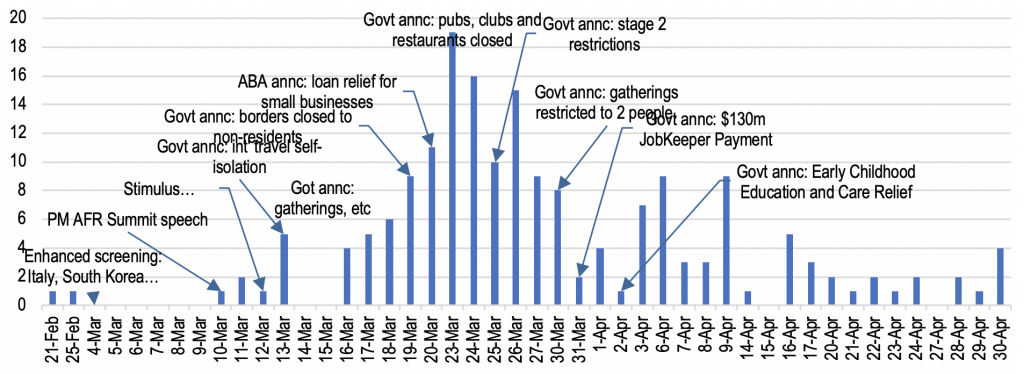

To this extent, I found it interesting to look at the corporate announcements from 20 February when the Australian market reached its peak.

Since then until 30 April, there have been 185 announcements from companies containing statements about their outlook for the rest of the year. From the chart below, we can see that the frequency of statements reached a peak in late March when the government announced a number of tighter lockdown restrictions as well as stimulus packages.

Source: JP Morgan/MIM

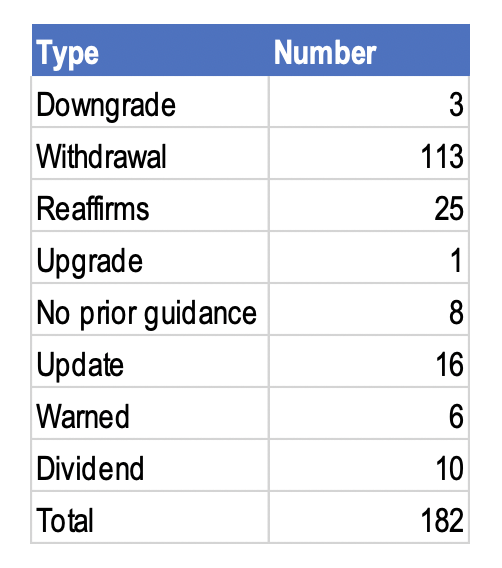

What is even more interesting to me is to look at the nature of the statements and, to that extent, I have in the chart below classified them in the following categories:

- Downgrade – Where a company has said that they are seeing an impact on the business and have tried to quantify how big this impact is

- Withdrawal – Where a company has decided that they believe that the current situation is just too uncertain for them to continue to provide any sort of guidance

- Reaffirms – Where a company reaffirms the previously given guidance

- No prior guidance given – Where a company has not given any previous guidance but where they have felt the need to update the market

- Update – Where a company gives an additional update on trading conditions

- Warned – Where a company has warned that they will not meet the previous guidance, but they have not tried to quantify it

- Dividend – Where a company has either lowered or fully withdrawn or cancelled the dividends for the current period but not said anything about guidance

In total, 182 of the 185 announcements can be categorised into the above categories with the majority being withdrawals of guidance but with 25 companies reaffirming guidance and one company (Fisher & Paykel, which manufactures ventilators) upgrading guidance.

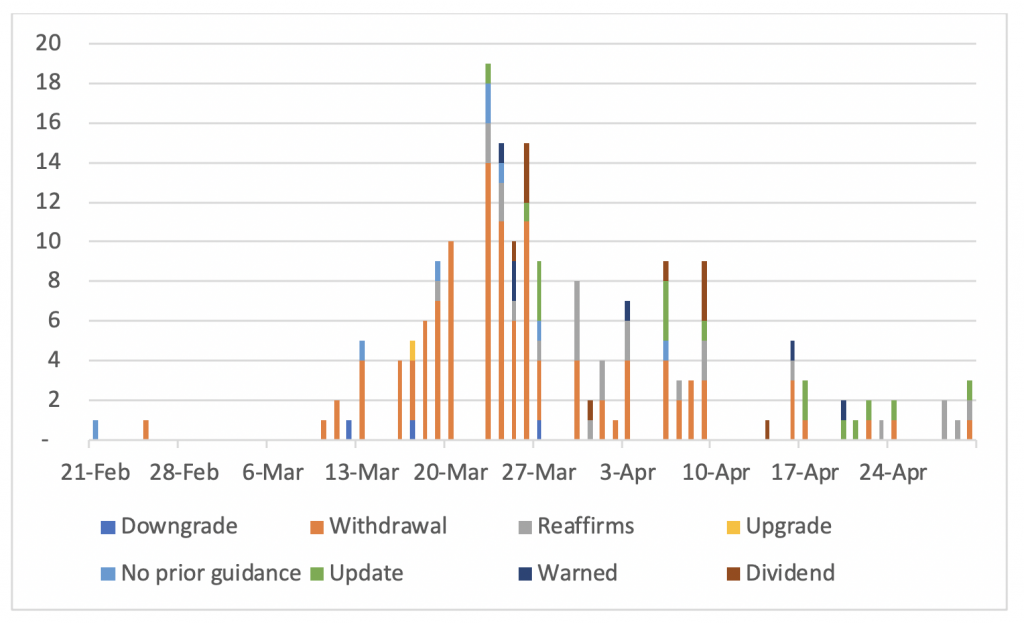

If we look at the distribution of the type of statements over time, we can see that we are recently seeing a shift from companies withdrawing guidance and cutting dividends to either giving updates or to reaffirming previous guidance.

Source: JP Morgan/MIM

What conclusions do we draw from this?

Given the uncertain situation, it is of course very hard to draw any definite conclusions but it is somewhat positive to see that we are not seeing companies giving incremental negative updates as the recent statements are generally of the type “we still do not know” or “not getting incrementally worse.” We are still early in the evolution of the crisis and although the health risks are now becoming better understood, I am not so sure that the market has fully understood the earnings impact from the lockdowns and the reduced economic activity that has resulted. One thing is certain, most of the companies themselves seem to not know!

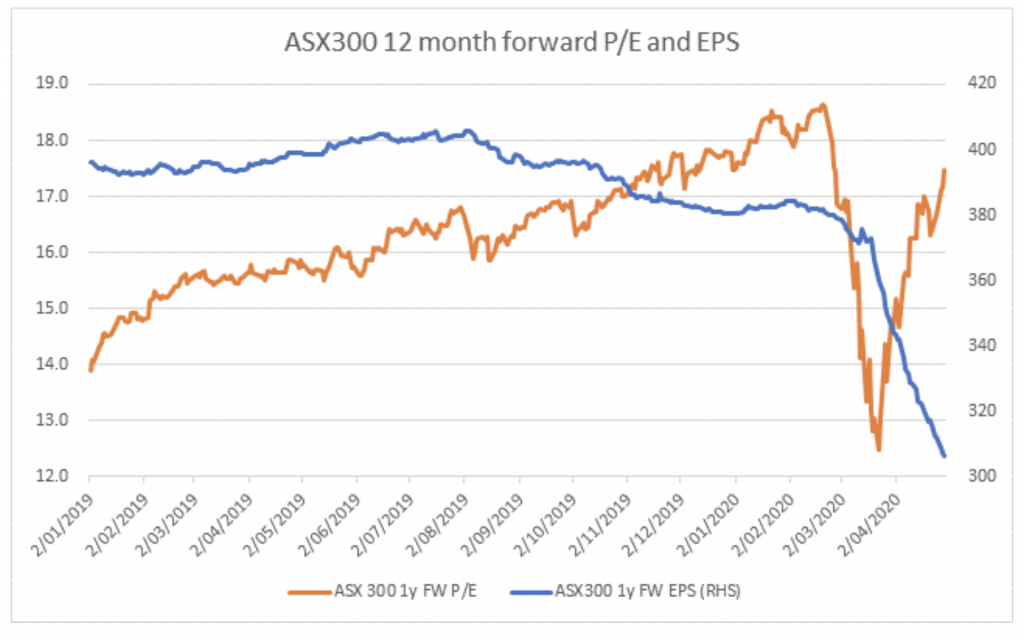

No matter what the future directions of corporate earnings will take from here, it is clear that the market is now prepared to pay about the same P/E multiple as before the fall based on the current consensus earnings forecasts as the chart below shows.

This post was contributed by a representative of Montgomery Investment Management Pty Limited (AFSL No. 354564). The principal purpose of this post is to provide factual information and not provide financial product advice. Additionally, the information provided is not intended to provide any recommendation or opinion about any financial product. Any commentary and statements of opinion however may contain general advice only that is prepared without taking into account your personal objectives, financial circumstances or needs. Because of this, before acting on any of the information provided, you should always consider its appropriateness in light of your personal objectives, financial circumstances and needs and should consider seeking independent advice from a financial advisor if necessary before making any decisions. This post specifically excludes personal advice.

INVEST WITH MONTGOMERY