Do people who open a SMSF actually get higher returns?

Recent figures from APRA show that there are over 565,000 self-managed super funds in operation as at December 2015 and that represent 29.1 per cent of all superannuation assets in Australia. There is no doubt that the growth of SMSFs has been phenomenal considering they are, at their essence, just a structure and are not product sold or promoted by a particular company, such as an iPhone or a pair of Nike shoes.

Many people cite control, flexibility, choice and potential for better returns compared to retail super funds as the main reason for opening an SMSF. But do people who open an SMSF actually get higher returns?

Much of the marketing by cut-price SMSF providers insinuates that people who open an SMSF will achieve better returns, however, it is worth considering whether or not SMSFs actually outperform other public offer funds.

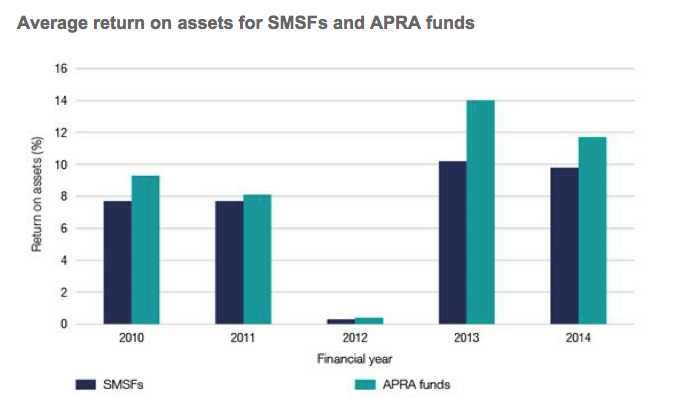

The ATO report ‘Self-managed super funds: A statistical overview 2013-14’ makes for interesting reading. Note, this is the most recent report from the ATO which has data that is approximately 18 months old. It shows that overall, SMSFs do not outperform average APRA funds (these are generally public offer funds with four or more members).

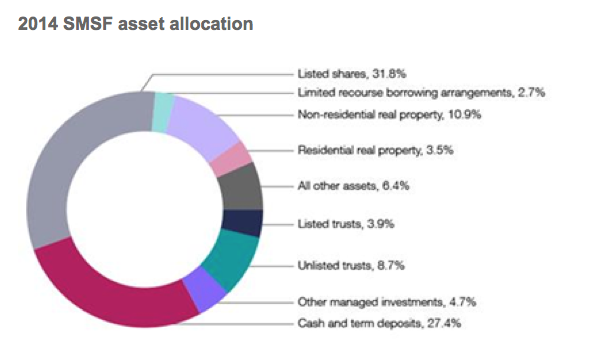

Looking at the overall diversification of SMSFs, the reasons why their returns may be less than stellar become more clear.

Investment Trends’ Self-Managed Super Fund Survey released in May 2015, highlights that the average SMSF has only 18 holdings and 51 per cent of the fund is invested in banks and resource stocks. This split largely represents the ASX market index as a whole, which from a capital gain perspective has been basically flat over a 10-year time frame. Long term readers of the blog will know Montgomery’s view on the resources stocks.

One way that SMSF investors can diversify their holdings away from the standard index mix is to increase exposure to smaller, less well known names in the technology, healthcare or industrial sectors. Doing this independently takes a lot of time, research and monitoring and there is no guarantee of success.

Another way is it to allocate a portion of their SMSF to an equity trust, that has the flexibility to move money into stocks that show more promise than the standard ‘blue chips’. Generally, equity trusts (sometimes called managed funds), have a team of analysts and experienced fund managers who are focused on finding the best opportunities in the market.

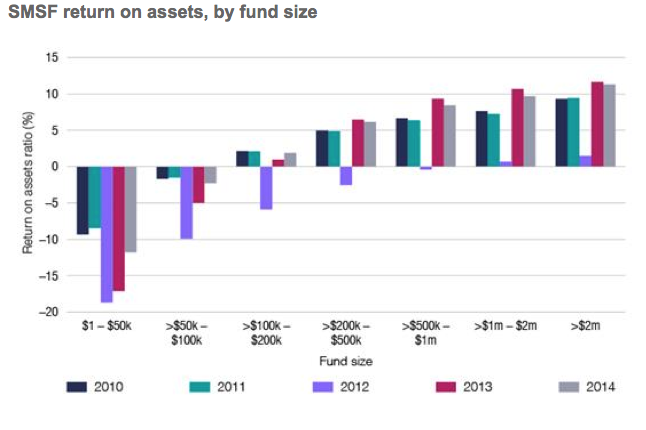

Another interesting finding by the ATO is performance of SMSFs based on the size of the fund. It indicates that the larger the fund, the better the rate of return, to the extent that a person with an excess of $2million in their SMSF is likely to receive twice the returns than someone with $500,000.

There are many competing thoughts as to why this is the case, some argue it is because high net worth individuals see the value in professional management and have benefited from their expertise – they are happy to outsource or rely on experts rather than trying to navigate the markets themselves outsourcing the management of some or all of their investment portfolio to share-based managed funds who they feel have a better chance to outperform than themselves. Source: ATO

Source: ATO

In selecting an investment manager, it is important to look past recent performance and carefully consider their investment philosophy, their investment universe (i.e. the sectors/markets they will focus on) to make sure you are comfortable with the way they will manage your money, and whether it is a good fit for the overall super strategy. We offer multiple funds here at Montgomery that may help you diversify your super investments.

You can invest your super into Montgomery funds with, or without an SMSF. No matter what your current superannuation structure is, we can help you to find a suitable option to diversify your super investment portfolio.

Scott Phillips is the Head of Distribution of Montgomery Investment Management. To invest with Montgomery domestically and globally, click here to find out more.

Considering how we did for years following the advice of financial planners, we couldn’t be happier with our SMSF, we love that we control and manage our own money, no one cares about your money more than you do.

Hopefully, things will change after the royal commission but I think many financial planners only care about maximising their returns. Most of our colleagues and friends have now moved to SMSFs to get away from poorly performing portfolios put together by financial planners, most lost capital but are now heading in the right direction.

We’ve lost trust in the financial planning industry, I’m sure there are great financial planners out there, but we didn’t find one over 30 years and we looked and looked…

The trailing commissions meant we got a Christmas card, that stopped when we cashed out, pretty expensive card!

I

It doesn’t surprise me that SMSFs have not done as well as they may have. They have swapped poor diversification from their normal super fund, to (probably) an even greater concentration on the same businesses, whilst paying their accountant and auditor more to do so.

I don’t suppose the Mont funds will ever be offered in industry funds will they? (Eg Australian Super and the like).

Tristan

Tristan we would be delighted to have industry funds offer any of the Montgomery Funds on their investment menus, but as you are probably aware the decision rests with the provider of those offerings and not us.

My SMSF which has done very well I’m pleased to say. One of the main reasons is that it forces me to be very patient with my investing. Yes I’d read Ban Graham and Warren Buffet and understood the principals, but didn’t really live them, especially when markets were tanking! Now with a SMSF I have to be patient and am happy to sit on a portfolio of great companies (including Vocus, Challenger, CSL, Sirtex, REA, Altium, etc) and watch them grow over the next 20 years or so until I retire.

Good morning Scott

I found your comments on SMSF underperforming public offer funds interesting but no surprise.

Running a SMSF can be costly as far as fees are concerned and this goes some way to explain why SMSF underperform public offer funds. There are costs for running the SMSF itself and there are also costs if the SMSF then invests in managed funds which have fees of their own.

In a low growth low return environment the overall level of fees can have a significant impact on SMSF returns and should be a major consideration when establishing a SMSF.

Has the team at Montgomery ever considered establishing a public offer super fund which is internally managed whereby the additional costs of going through a SMSF or through Netwealth to invest in your Funds is eliminated or reduced?

Hi Max – thanks for your comments but no we will not be offering a publicly offered super fund ourselves.

I’m very much looking forward to the Global fund and Montaka making their way onto Netwealth. Any update on when that might be?

We’re working on it Carlos

Hi Carlos, we are waiting on an external ratings houses to review our global offerings before netwealth will add the funds to their menu. Hopefully this should happen later this year.