Demographic shifts over the balance of this decade

In this week’s video insight, I want to discuss two intriguing findings from Deutsche Bank’s report on global demographic shifts. Firstly, we’ll explore the substantial population growth in less developed regions and its potential implications. Secondly, we’ll delve into the aging population in developed markets, their dependence on government pensions, and the resulting consequences. Many commodities, both construction-related and agricultural, as well as healthcare should benefit from the aggressive shift in demographics.

Transcript:

Hi, I’m David Buckland and welcome to this week’s video insight.

Deutsche Bank Research have released a report on global demographics over the balance of this decade; and I believe two of the more pertinent conclusions follow:

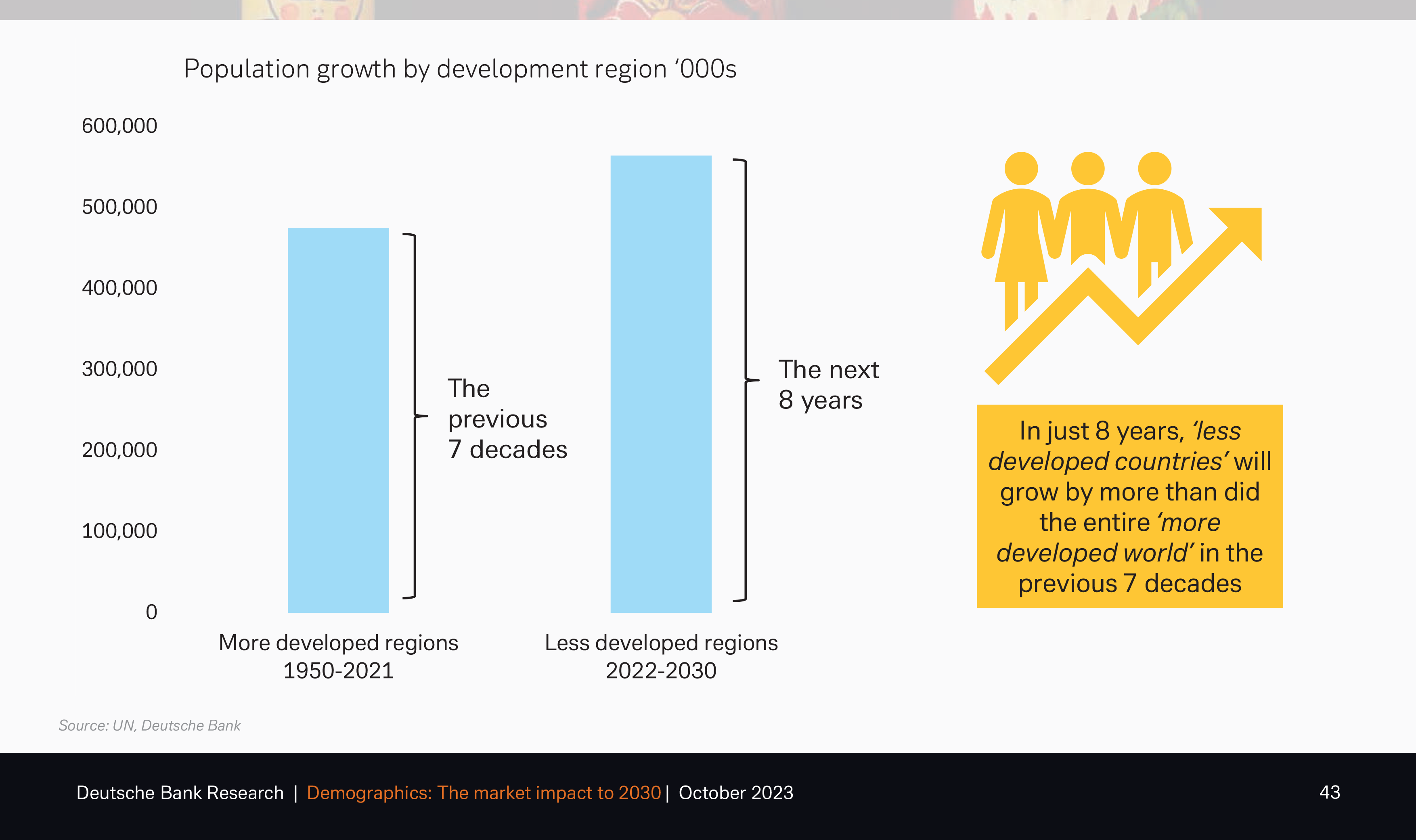

Number 1, In the 71-year period between 1950 and 2021, the population growth of the more developed regions of the world was around 480 million people. For context, the world population in 1950 was 2.5 billion people. However, over the 8-year period 2022-2030, the population growth of the less developed regions of the world is forecast to increase by 575 million people. For context, the world population in 2030 is forecast to be 8.5 billion people.

Growth in less developed regions will catalyse unprecedented demand for raw materials

The strong Emerging Market population growth will drive huge urbanisation, construction, energy and electricity demand, infrastructure, and of course education. Australia should benefit as a significant exporter of commodities, including Coal, Iron-ore, Wheat, Beef, Copper, and Aluminium – where we rank first, second, third or fourth in the world of exports. And;

Number 2, people in developed markets are aging and generally lack pension savings. However growing lifespans from “better health” means people are generally working longer, through either choice or necessity. Amongst the OECD (Organization for Economic Co-operation and Development) countries, the retirement age has gently been trending up to the current 63.5 years of age.

That said, reliance on governments to provide for retirees is a risk to bigger budget deficits, and potentially bond yields. People want governments to fund pensions, and the concentration of voting power in older generations will keep the pressure up on those governments.

Pension spending in advanced economies is trending up to an estimated 9.25 per cent of GDP (gross domestic product) by 2030, it was sub 5 per cent in 1970, and this is often financed by people in work. The working age population as a percentage of the total population is trending down for many developed economies and that forecast ratio of around 55 per cent by 2030 stands out, particularly places like France, Germany, Italy, and the UK.

Labour force projections for this decade are grim for many major economies

Of the 36 OECD economies, total healthcare expenditure is expected to grow by 1.8 per cent of GDP between 2015 and 2030 to around 10 per cent of GDP. In the US, for example, this figure is growing by 3.4 per cent to 20 per cent of GDP over the 15 years to 2030.

In summary, many commodities, both construction-related and agricultural, as well as healthcare should benefit from the aggressive shift in demographics particularly in developing economies over the balance of this decade.