David Jones: Non retailers distracted by a takeover?

This week David Jones announced their 2012 results and reported a 40% decline in profit. The only positive was that 4th quarter sales fell by just 1% on pcp whereas 1st quarter sales had fallen 11% on pcp. Actually there was another positive; the 35% decline in earnings per share was inline with expectations.

Separately the company also provided an update to its property strategy. Investors should understand that anything DJS does with its properties is simply a takeover defence against private equity (or Premier Investments perhaps) pulling off the same stunt that was done on Myer. That is; launch a takeover, succeed, sell off the property portfolio and get the business cheaper. if DJS shows it is proactive in this area it becomes much harder from Private Equity to argue that they are “adding value”.

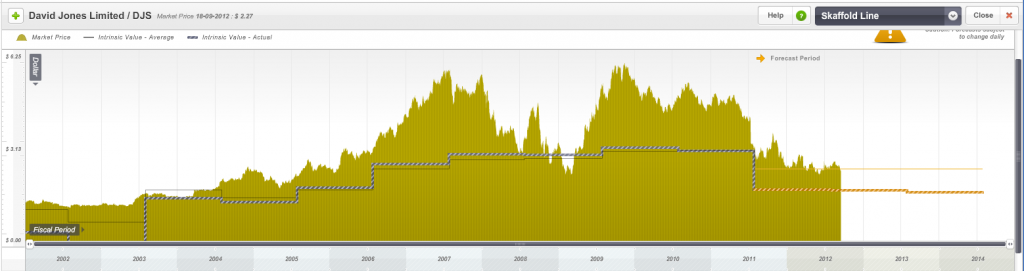

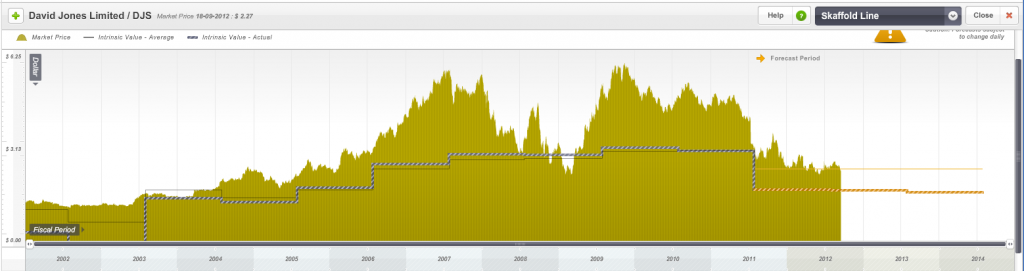

DJS intrinsic value (see Fig. 1) has now not increased since 2004 and according to Skaffold.com DJS’s intrinsic value is not expected to rise at all over the next two years.

Figure 1

Finally, Fig 2 is the last slide in today’s DJS analyst presentation slide deck. There is no financial information on this slide. It simply says “END”

Figure 2

My question is are these guys really retailers? A real retailer would put the “omnichannel” (anyone sick of that word already? Gerry Harvey is!) URL on the last slide or mention a sale or a list of specials available through the “omnichannel” (there’s that word again).

You need merchants running retailers to get the best out of them. The last slide of DJ’s results presentation is telling.

MORE BY RogerINVEST WITH MONTGOMERY

Roger Montgomery is the Founder and Chairman of Montgomery Investment Management. Roger has over three decades of experience in funds management and related activities, including equities analysis, equity and derivatives strategy, trading and stockbroking. Prior to establishing Montgomery, Roger held positions at Ord Minnett Jardine Fleming, BT (Australia) Limited and Merrill Lynch.

He is also author of best-selling investment guide-book for the stock market, Value.able – how to value the best stocks and buy them for less than they are worth.

Roger appears regularly on television and radio, and in the press, including ABC radio and TV, The Australian and Ausbiz. View upcoming media appearances.

This post was contributed by a representative of Montgomery Investment Management Pty Limited (AFSL No. 354564). The principal purpose of this post is to provide factual information and not provide financial product advice. Additionally, the information provided is not intended to provide any recommendation or opinion about any financial product. Any commentary and statements of opinion however may contain general advice only that is prepared without taking into account your personal objectives, financial circumstances or needs. Because of this, before acting on any of the information provided, you should always consider its appropriateness in light of your personal objectives, financial circumstances and needs and should consider seeking independent advice from a financial advisor if necessary before making any decisions. This post specifically excludes personal advice.

I think David Jones and other retailers will only do better when the australian dollar depreciates, perhaps, back to 70-80cents. For instance Macys, a shop similar to DJ in USA sells pretty much everything and more than David Jones sells here in Australia but a lot cheaper. Macys is just one of many shops. Also Macys is not the cheapest online place to get things from. So I think retailers will go back to surplus only when the AUD goes back to 75 cents or they come up with a better strategy. As long as the currency continues at parity or above parity Australians will continue buying items from USA, Hong Kong and other places.

Another good set of thoughts as usual Roger.

I was a fan of this company and even tipped them to beat their online rivals as i could see some advantages of an “omnichannel” (i luckily know the word to descibe it now) operator but they just took so long. It appears they got distracted and somehow this whole online thing grew without them realising it was a force and for that their shareholders deserve an honest explanation as to what happened. You could not argue that they just woke up one day and the retailing landscape changed. It has been changing for a while.

The whole announcement on property values was obviously in response to takeover rumours and to prevent them from having a myer done to them.

We really do seem to have a lot of prehistoric retailers going on at the moment. It makes Oroton seem like visionarys. If DJ’s, Myer and HVN etc don’t pick up their game the final slide might indeed be a bit prophetic.

I think currently our big department stores and some other retailers are showing that they are maybe not in touch with their particular target market and that is worrisome for investors as it means they don’t have their fingers on the pulse of their industry and how it is or could potentially change.

The sshareholders should be asking some very tough questions to management. I think the first one should be “what did you expect would happen?” and “What have you been doing for the last 5 years?”