Dairy, Dairy Me

As set out in the Montgomery [Private] Fund prospectus, there are 3 core attributes we look for when selecting stocks for inclusion in the portfolio. These are:

1. The company is an extraordinary business

2. Management is shareholder oriented, and

3. It is trading at an attractive purchase price.

A lot of the articles we post discuss the first and third attributes above, but a shareholder oriented management and board are also very important in ensuring that shareholders are rewarded for the risk capital invested in the business.

Management being shareholder oriented refers to the way they are remunerated as well as their focus on reinvesting capital, either organically or through acquisitions, to add shareholder value.

The market recently experienced the impact of when the interests of those that control the company conflict with minority shareholders.

Murray Goulburn announced that weak export commodity prices meant that its expectations for the FY16 Southern Region Farmgate Milk Price (FMP) from A$5.60 per kilogram of milk solids (kgms) to between A$4.75 and A$5.00 per kgms.

The profit warning itself was not the concern. The business produces a large amount of commodity product for sale both domestically and for export.

The issue is that the company decided to implement a Milk Supply Support Package to boost the payments supplying dairies receive for their milk. This will see supplying dairies receive A$5.47/kgms for their product instead of the A$4.75-A$5.00 that is justified by the profitability of the company. This boosts supplier payments by between A$95m and A$165m relative to what they would have received under the terms of the Profit Sharing Mechanism set out in the IPO document last May.

Management stated that the extra payments will be recovered from suppliers between FY17 and FY19 by reducing the unit price paid to farmers relative to the average FMP generated by the company. The Milk Supply Support Package is being introduced because of the impact on farmers, with the extra payments assisting suppliers through this transition, providing additional cash flows for the balance of the financial year.

The problem from a unitholder perspective is that it completely changes the risk/return proposition of their investment. The IPO document set out how profit would be split between supplier famers and share and unit holders in Murray Goulburn.

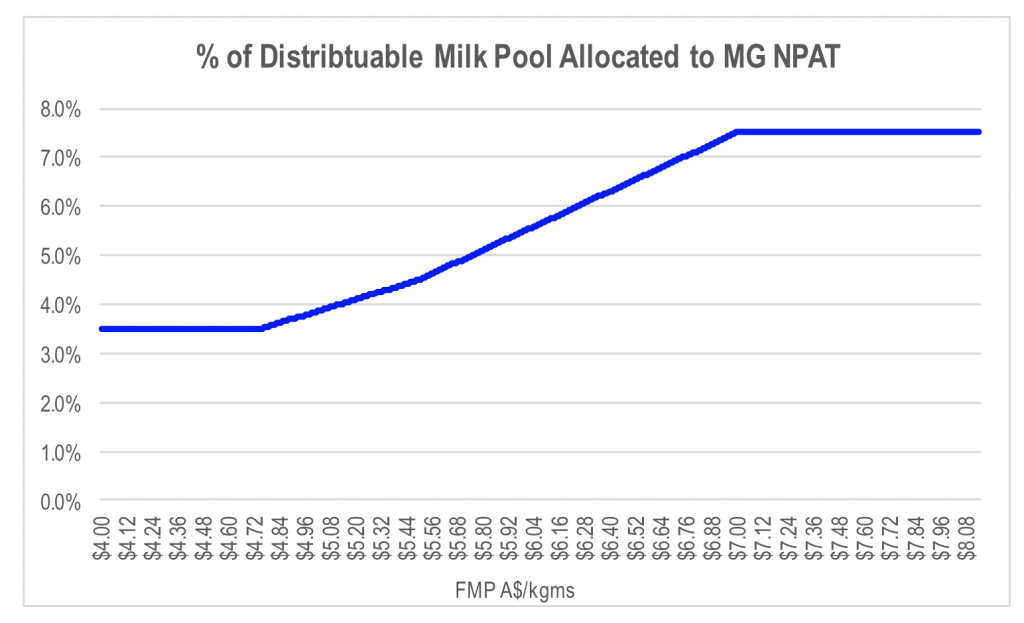

The distributable milk pool is determined by deducting the costs, interest and tax payable by the company from the revenue generated. The percentage of the distributable milk pool that was allocated to share and unit holders as net profit was a function of the FMP. The higher the FMP, the higher the share of the distributable milk pool goes to share and unit holders. This results in a model in which both unitholders and farmer suppliers share in the impact of higher and lower commodity prices on MG’s profit margins. This structure created a problem for us. Murray Goulburn plans to invest around A$500m over 3 years to expand capacity of more value added products and reduce operating costs. The returns generated from this investment will lead to a higher unit revenue and increased profit per tonne of milk intake. However, under the Profit Sharing Mechanism, the uplift in profitability is shared between share/unit holders and suppliers through higher raw milk supply payments.

This structure created a problem for us. Murray Goulburn plans to invest around A$500m over 3 years to expand capacity of more value added products and reduce operating costs. The returns generated from this investment will lead to a higher unit revenue and increased profit per tonne of milk intake. However, under the Profit Sharing Mechanism, the uplift in profitability is shared between share/unit holders and suppliers through higher raw milk supply payments.

While share and unit holders are supplying all of the risk capital, the return generated on the investment is shared with the suppliers through higher raw milk supply prices. Therefore, share and unit holders only receive a portion of the return generated by their capital investment.

To balance out this asymmetric sharing of risk and return between supplier farmers and unitholders, there is supposed to be a minimum percentage of the distributable milk pool that goes to the company’s net profit of 3.5 per cent. If the FMP falls below A$4.75/kgms, the impact on profit is reduced. This reduces share and unit holder exposure to commodity price downside.

However, the announcement last week sets a precedent that the sharing of the downside risk may not apply in any or all circumstances. This changes the risk characteristics of investing in the trust, with suppliers likely to continue to take a share of any upside, but not necessarily sharing in the downside risk.

Management would argue that the Milk Supply Support Package funds will be repaid by suppliers. However, given that the repayment will come out of future supplier payments, there is nothing stopping a supplier from taking the additional payments this year, then deciding to supply another dairy processor in future years to avoid repaying the money to MG. This means that the receivable MG will carry on its balance sheet at the end of FY16, which reflects the value of the Milk Supply Support Package paid to farmers during the year, is likely to be at least partially written off in future periods.

The board of Murray Goulburn is made up of 12 directors, of which 8 are dairy farmers according to the company’s website. However, unitholders have no voting rights. Therefore, all directors are appointed by dairy farmers.

Similarly, heavy investment in capacity and equipment generates a more significant return on capital for suppliers than unitholders. With the company’s strategic direction and decision making determined by those representing suppliers, there is a risk that investments are made that benefit suppliers but do not generate a sufficient return for unitholders.

With the offsetting sharing of risk in times of weak commodity prices now in question, the goal posts have been moved for unitholders.

Stuart Jackson is a Senior Analyst with Montgomery Investment Management. To invest with Montgomery domestically and globally, find out more.

This post was contributed by a representative of Montgomery Investment Management Pty Limited (AFSL No. 354564). The principal purpose of this post is to provide factual information and not provide financial product advice. Additionally, the information provided is not intended to provide any recommendation or opinion about any financial product. Any commentary and statements of opinion however may contain general advice only that is prepared without taking into account your personal objectives, financial circumstances or needs. Because of this, before acting on any of the information provided, you should always consider its appropriateness in light of your personal objectives, financial circumstances and needs and should consider seeking independent advice from a financial advisor if necessary before making any decisions. This post specifically excludes personal advice.

INVEST WITH MONTGOMERY

Such is agriculture so investors should be aware before investing in ag companies