Crunch Time for Medibank’s Direct Sales Strategy

APRA released December quarter data on the health insurance industry last month. This shows that private health insurance penetration fell for the first time in 10 years. While the percentage of Australian residents that had private hospital insurance only fell 0.1 per cent to 47.2 per cent, this will be of great concern to the Government given that falling coverage rates inevitably sees the healthcare burden fall back onto the public system.

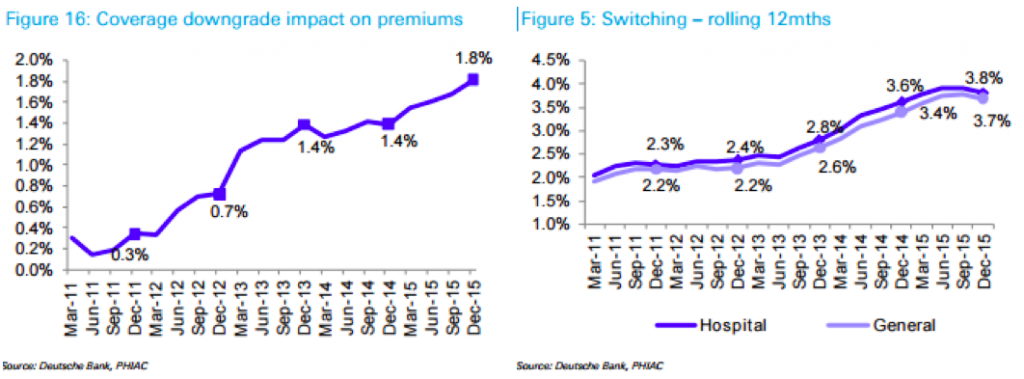

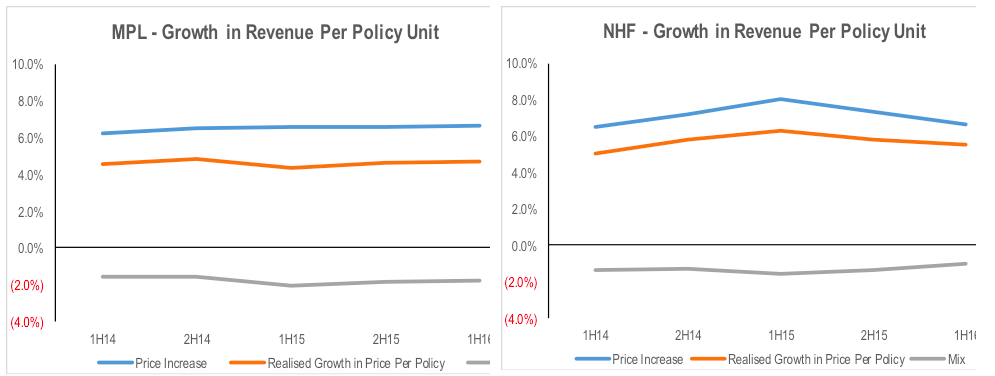

Government comments have focused on the need to improve affordability for consumers. The signs that affordability is a key issue driving the reduced growth in consumer demand are clearly evident in the APRA statistics, with the rate of downgrading to lower priced policies and the lapse rate driven by switching between providers accelerating. Medibank Private (ASX: MPL) and Nib Holdings Limited (ASX: NHF) recently released their result for the 6 months to December 2015. If we look at the rate of downgrading in the results, as determined by the difference between the average premium increase and the realised change in premium revenue per average policy, this indicates a slowing for MPL. NHF’s results showed a slowing of net mix drag on revenue growth.

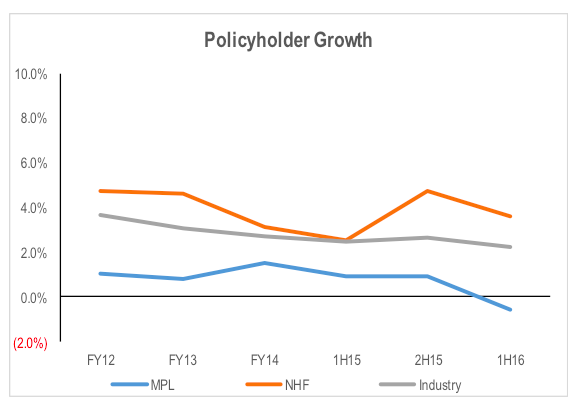

Medibank Private (ASX: MPL) and Nib Holdings Limited (ASX: NHF) recently released their result for the 6 months to December 2015. If we look at the rate of downgrading in the results, as determined by the difference between the average premium increase and the realised change in premium revenue per average policy, this indicates a slowing for MPL. NHF’s results showed a slowing of net mix drag on revenue growth.

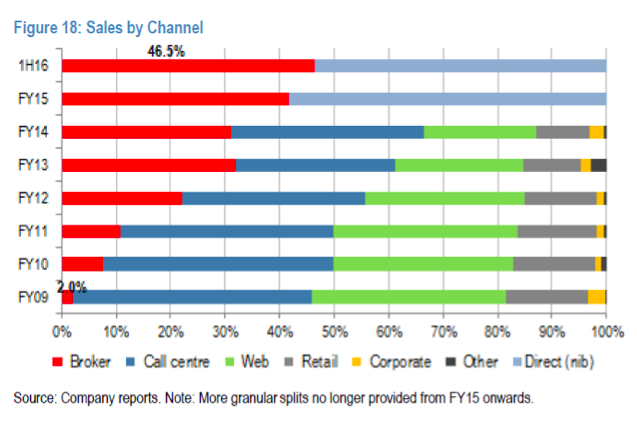

The results fly in the face of the average pricing growth put through by the respective companies with MPL’s average price increase has been around 1ppt lower than NHF’s over the last couple of years. Despite this, NHF has grown its policyholder numbers at above market rates, and well above MPL. This suggests that pricing is not necessarily the problem for MPL. NHF has more aggressively pursued volume growth through the comparison site channels. This has seen the proportion of its new policy additions coming from brokers increase from 2 per cent in FY09 to 46.5 per cent in 1H16.

NHF has more aggressively pursued volume growth through the comparison site channels. This has seen the proportion of its new policy additions coming from brokers increase from 2 per cent in FY09 to 46.5 per cent in 1H16.

By contrast, MPL only offers its ahm Heal Insurance brand through this channel. Additionally, ahm was removed from the iSelect product suite during 1H16, which was part of the reason for the weakness in MPL’s addition rate during the period.

By contrast, MPL only offers its ahm Heal Insurance brand through this channel. Additionally, ahm was removed from the iSelect product suite during 1H16, which was part of the reason for the weakness in MPL’s addition rate during the period.

While the growing broker channel offers a means of growing new policyholder numbers, it come at a higher cost per new policy. It also arguably results in increased churn in the market, increasing lapse rates. Given an existing policy is far more profitable than a new policy, increased churn negatively impacts industry profitability. This comes through on a deferred basis given the commission paid is initially capitalised and then amortised over the expected period the policyholder is expected to stay with the insurer.

The flipside issue is that underperformance on revenue growth due to restricting your access to third party channels has a negative impact on both the company’s ability to leverage its management expenses, as well as reduced benefits from the cash inflow from a growing negative working capital base.

Despite the Minister for Health asking private health insurers to recut their 2016 premium increases, the average premium increase for the industry will be around 5.6 per cent from 1 April. This means the net premium paid by consumer after their applicable Federal Government rebate will increase between 5.6 per cent and 7.7 per cent. While it is lower than the 6.2-9 per cent net increases in 2015, it remains well above CPI growth rates. Therefore, consumers will continue to look for ways to save money.

MPL has been resisting the need to refocus its new customer access on expensive third party channels. In 2H16 it will again attempt to use increased marketing spend to try to improve its new customer acquisition rate (and reduce lapse rates) through its direct to consumer channel. If this is not successful, the position of the comparison sites could be strengthened until MPL can create a more commercially obvious gap between its pricing and that of competitors as it shares the benefits of cost reductions with shareholders and customers over time.

Stuart Jackson is a Senior Analyst with Montgomery Investment Management. To invest with Montgomery domestically and globally, find out more.

This post was contributed by a representative of Montgomery Investment Management Pty Limited (AFSL No. 354564). The principal purpose of this post is to provide factual information and not provide financial product advice. Additionally, the information provided is not intended to provide any recommendation or opinion about any financial product. Any commentary and statements of opinion however may contain general advice only that is prepared without taking into account your personal objectives, financial circumstances or needs. Because of this, before acting on any of the information provided, you should always consider its appropriateness in light of your personal objectives, financial circumstances and needs and should consider seeking independent advice from a financial advisor if necessary before making any decisions. This post specifically excludes personal advice.

INVEST WITH MONTGOMERY

A week ago I received a notice from MPL saying my premium was going up by 11.5% from the 1st of April !!!

Hi Mike, The price increase you receive from Medibank is net of the change in the Federal Government rebate. The rebate originally was a straight 30% of the premium. A few years ago, the government changed it such that it increase in an absolute sense in line with inflation. As a result, if the health insurance companies raise premiums by more the inflation, the percentage of the premium covered by the rebate reduces. As a result, the net increase in the premium is even higher than the gross premium change charged by the insurer. Additionally, the figures reported by the government are the average premium increase. Premiums for some policies will increase by more and some will increase by less than the average rate.

Health insurance is complex and comparison sites spend a lot of money on marketing. Although they don’t offer a comparison of all available funds, they might be as far as many people go in their research.

Also, compounding suggests that a continuation of increase at historic rates will eventually make health insurance a luxury good. The government can threaten with all the sticks it likes, but it will simply become unaffordable and modestly high income earners will cop the Medicare levy and rely on the public system. I am hearing much talk along these lines from people in this situation. They are hanging on for now, but the compounding gap between inflation and health fund increases is killing them.

It seems the problem goes much deeper than the funds themselves into the overarching medical system which has become expensive at almost every level. This tends to happen with life’s necessities. Meanwhile we keep getting told inflation is low because the cheap imported discretionary goods on offer have come down in price. A case of inflation life’s needs and deflation in the wants.

Something’s got to give.

Hi Wayne,

I agree that something needs to change, but the industry and the government are fighting a losing battle against demographic shift. An analysis of the growth in claims costs shows that the need to raise premiums is more due to volume growth than the rising cost of procedures relative to CPI growth. A range of Government reviews are taking place at present, designed to take inefficiencies out of the overall health system. This might curtail the rate of premium growth for a while but the aging population is the core problem. Rising premium rates then increase the likelihood of younger people opting out of private health insurance, which puts more pressure on the system given that younger people cross subsidise older people due to the community rating system. The alternative is to incentivise younger people through lower premiums. The lifetime surcharge does this to some extent, but it probably needs to go further.

When people drop out and revert to the public system, then the cost to the Government (ie the taxpayer) increases as well. So I would expect that as healthcare costs rise of a percentage of GDP in Australia due to the aging population, the Government will inevitably be forced to increase the size of the stick used to keep people in the private system. This is likely to mean increasing penalties for opting out.

Its a very difficult issue, but given the importance of an adequately funded and efficient healthcare system, it is an issue that needs an improved response.