Could reporting season unearth some bargains?

As many readers are probably aware, 1 August is the kick-off for reporting season. A recent report by JP Morgan confirms what we’ve been thinking for some time – the Australian market looks very expensive. With reporting season set to start, we’re about to get a really good picture or whether or not we’re right.

During the coming month, most Australian companies will report their full year results and we will get a good read on the state of the economy and corporate profitability. We should expect some significant share price movements and, hopefully, The Montgomery Fund will have more positive than negative surprises.

As people are probably aware, we are defensively positioned in the fund with a cash position of close to 24 per cent and a general tilt towards companies that we perceive as defensive.

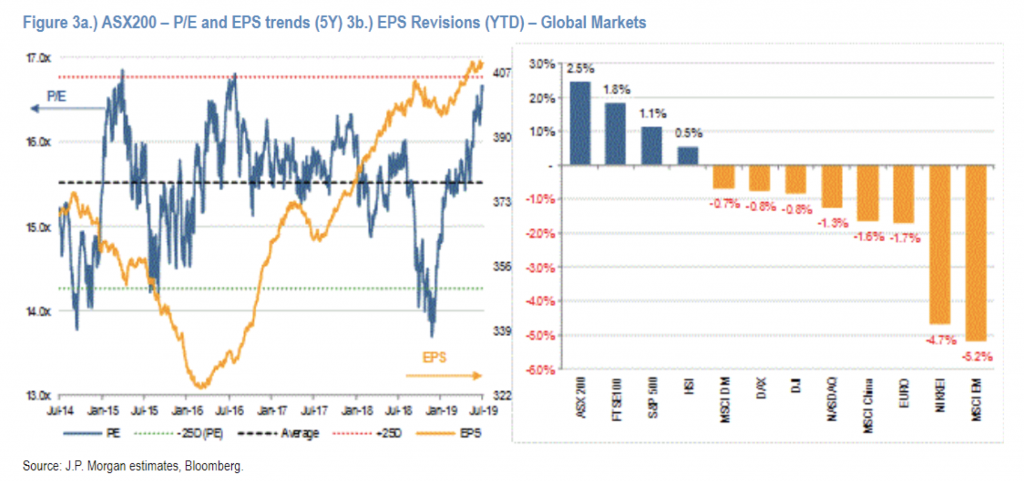

We read with interest a report from JP Morgan looking at where we are in terms of valuations and earnings revisions. From the left chart below, we can see that the ASX200 is trading at around 2 standard deviations above the 5-year average which is at the very high end of the last 5 years trading range. We can also see that the earnings per share (EPS) revisions have turned positive in the last 6 months and increased by around 2.5 per cent which puts Australia at the top of the international leader board.

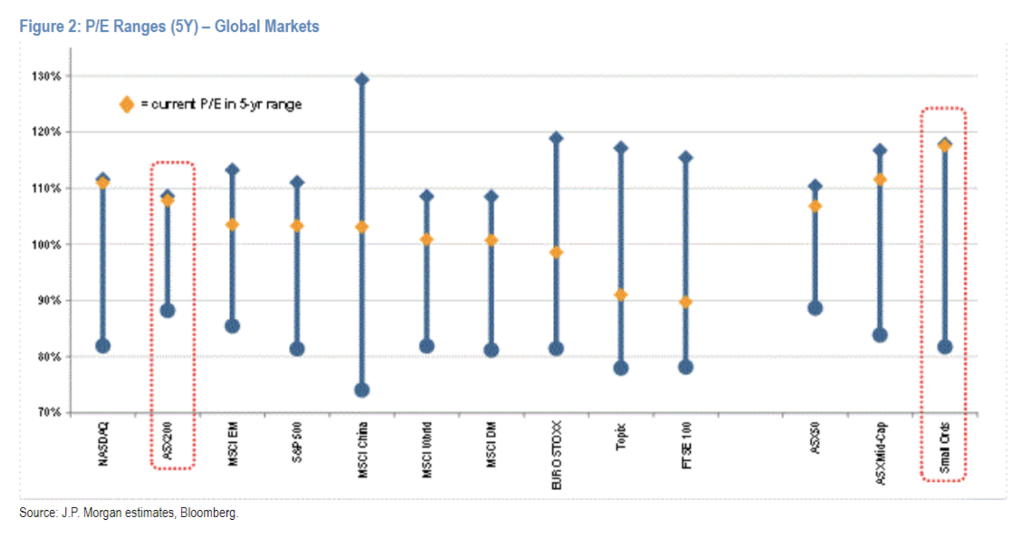

If we compare the relative P/E compared to the last 5 years, both the ASX200 and the Small Ordinaries indices are, together with NASDAQ, at the very top in an international comparison:

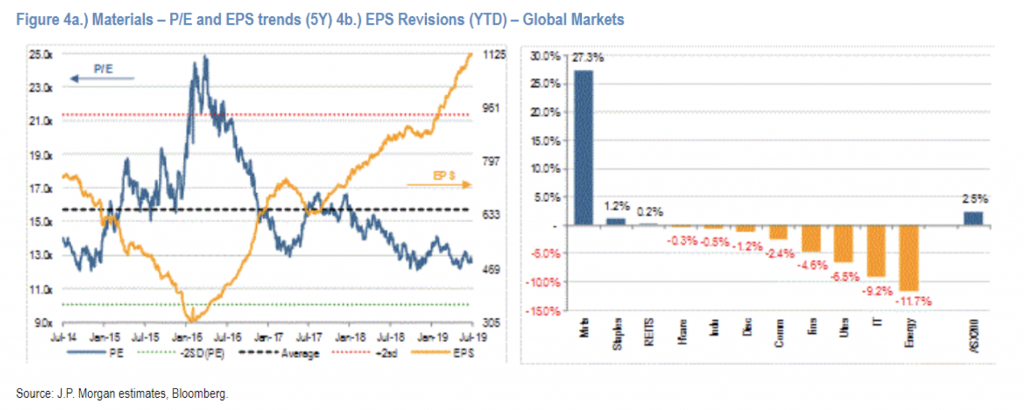

If we delve into the details, it is clear that the earnings picture for most of Australia is not as rosy as the first picture indicates. We should remember that Australia has a very large portion of companies active in the Materials sector and these companies tend to trade at lower P/E multiples than the market when things are going well for them. If we are getting upgrades to earnings projections in Materials, we are therefore likely to see both the overall P/E being suppressed and the overall EPS growth being inflated.

This is indeed the case which we can see if we look at the following charts which shows the P/E and earnings revisions for the Australian Materials sector where we can see that earnings projections have gone through the roof while the P/E multiple has come down. We can also see that the Materials sector accounts for virtually all the overall market’s earnings upgrades with most sectors having seen negative revisions.

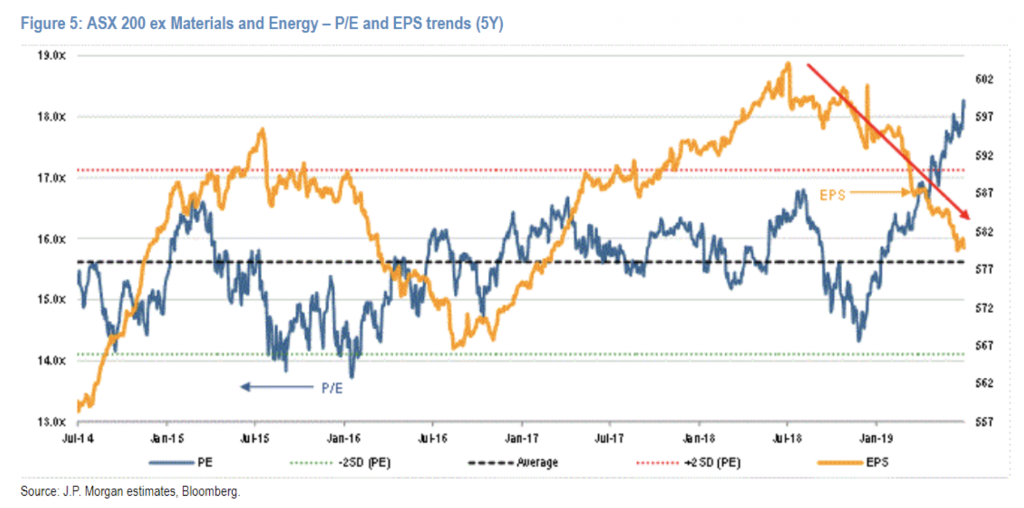

If we strip out the Materials sector from the ASX200, the valuation and earnings revision picture does indeed look even more stretched than for the overall market with a P/E of 18.7x which is more than 3 standard deviations above the 5-year average and with earnings that have been revised down by approximately 5 per cent in the last 6 months:

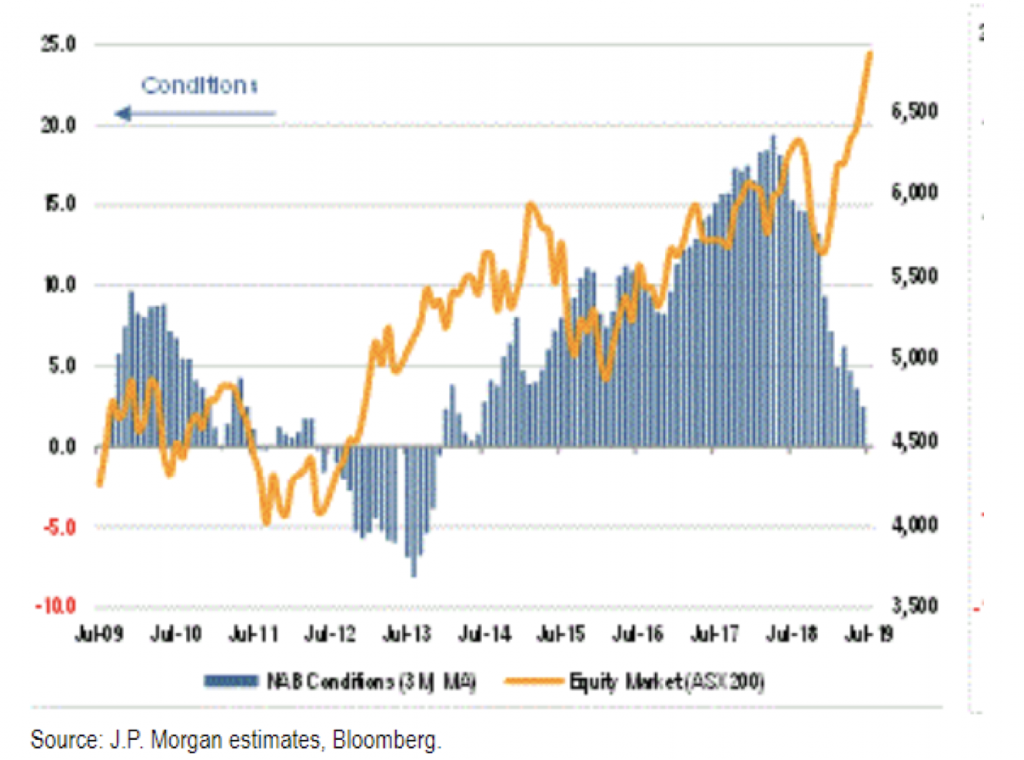

Finally, we can also compare the performance of the ASX200 with the trend in the NAB Business Conditions survey which gives an indication of the overall “health” of the Australian corporates as reported by themselves. Historically, there has been a non-trivial positive correlation but recently, we have seen a sharp divergence with share prices surging higher while the sentiment has dropped sharply:

JP Morgan’s report in many ways confirms what we are seeing from a bottom up perspective, the Australian market is very expensive while fundamentals are deteriorating outside the Materials sector. Given our positioning in the fund, we hope that results and share price movements during the reporting season will present us with opportunities to deploy our cash balance.

This post was contributed by a representative of Montgomery Investment Management Pty Limited (AFSL No. 354564). The principal purpose of this post is to provide factual information and not provide financial product advice. Additionally, the information provided is not intended to provide any recommendation or opinion about any financial product. Any commentary and statements of opinion however may contain general advice only that is prepared without taking into account your personal objectives, financial circumstances or needs. Because of this, before acting on any of the information provided, you should always consider its appropriateness in light of your personal objectives, financial circumstances and needs and should consider seeking independent advice from a financial advisor if necessary before making any decisions. This post specifically excludes personal advice.

INVEST WITH MONTGOMERY