Collapse in household financial conditions laid bare

Here’s a bit of a depressing picture for the retail sector for the September 2023 quarter. New data from the Australian Bureau of Statistics (ABS) paints a bleak outlook for retailers this Christmas and into early 2024.

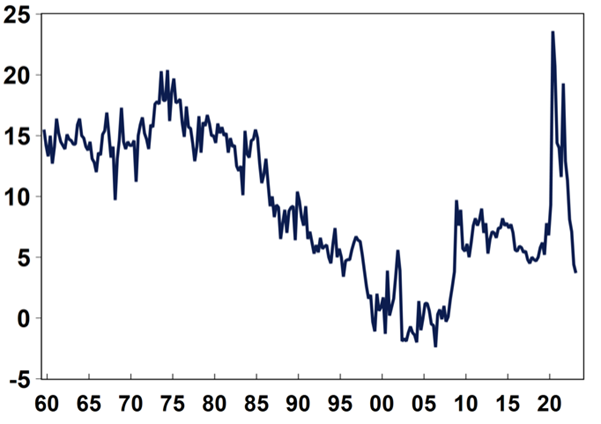

The “savings rate” measures household savings (household disposable income less consumer spending) as a percentage of household disposable income. Since September 1959, the savings rate in Australia has averaged 9.4 per cent (Figure 1.).

Figure 1. Australian households saving ratio (September 1959 – August 2023)

Source: AMP

Source: AMP

Recently, however, the ABS September 2023 quarter national accounts revealed a material deterioration in financial conditions for consumers and households. Households have seen their savings ratio plunge to just 1.1 per cent. This is the lowest level since just before the great financial crisis (GFC) in December 2007.

The plunge in savings has helped support spending but its extreme low suggests there are now much less savings available to support spending in the current December quarter and the March 2024 quarter.

And consumption hasn’t been that great to begin with. For the year to September 2023, the nation’s real per capita household consumption fell almost two per cent (-1.9 per cent).

Without relief from tax or interest rate cuts, or perhaps a little deflation, the savings plunge suggests consumption will only worsen in coming quarters.

And that’s also because disposable income is now tracking at roughly the same level as December 2011 – a time when we were still recovering from the effects of the GFC and receiving help from the Rudd government’s school building program, amongst other programs.

Last week, the ABS reported a record collapse in real household disposable income per capita of 5.8 per cent for the year to September. As an aside, the decline brings the average disposable income growth for the current decade down to just 0.62 per cent, worse than last decade’s 0.96 per cent, which was previously the worst decade on record.

The plunge in disposable income and household consumption, coinciding with low levels of savings, suggests retailers will need to pull out every promotional trick in the book to get volumes up before, and especially after, Christmas.

After the COVID-related fiscally stimulated years of 2021 and 2022, annual retail sales growth to October 2023 fell to a rate of just 1.2 per cent. This was despite five per cent inflation and 2.5 per cent population growth. Without inflation and population growth, retail sales growth would be deeply negative. Consumption is now at similar levels to those seen during the GFC. But that should not be a reason to promote unsustainable migration Gerry (Harvey)!