Coca-Cola Amatil on strict diet

In the past twelve months the Coca-Cola Amatil share price has declined by 40 per cent, from an all-time high of $15.10 to the current share price of $9.10.

It seems to us the duopoly that makes up Australia’s grocery retail landscape has put Coca-Cola Amatil on a strict diet of shrinking volumes, values and loss of market share to Schweppes and more particularly, the category known as “Private Label” soft drinks.

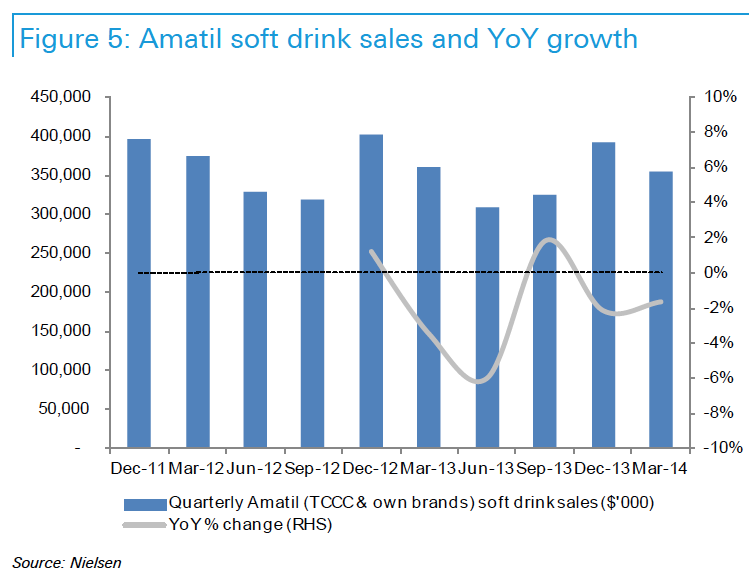

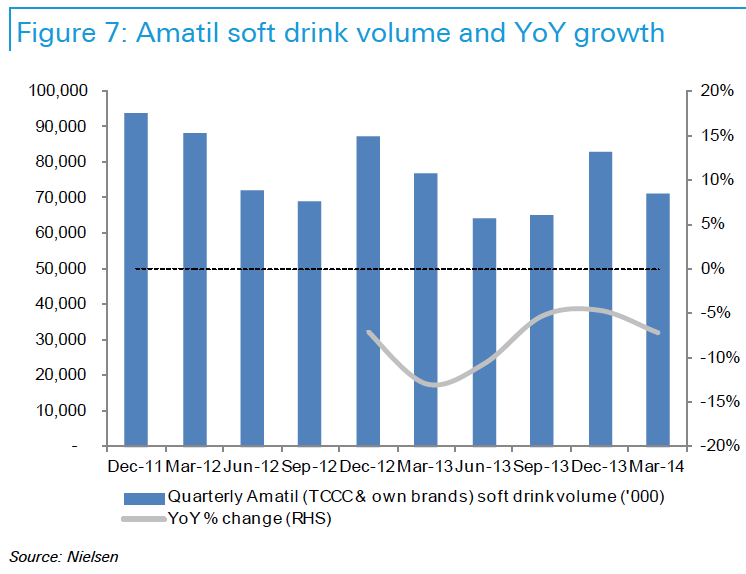

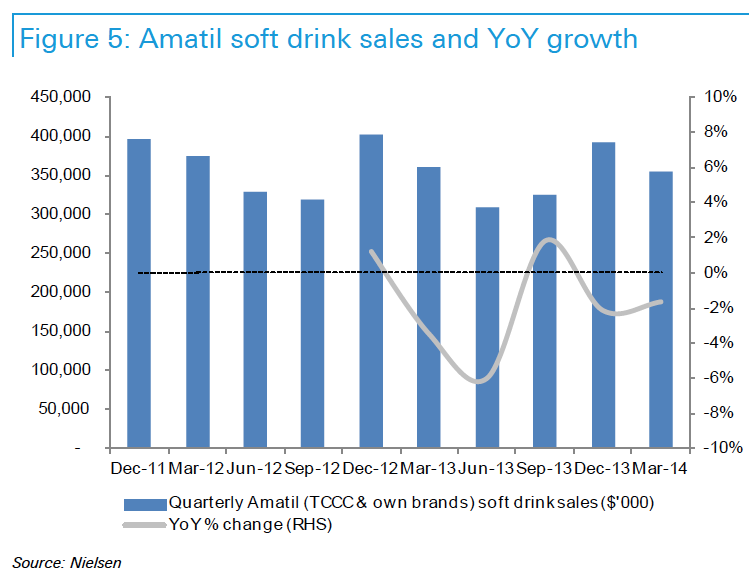

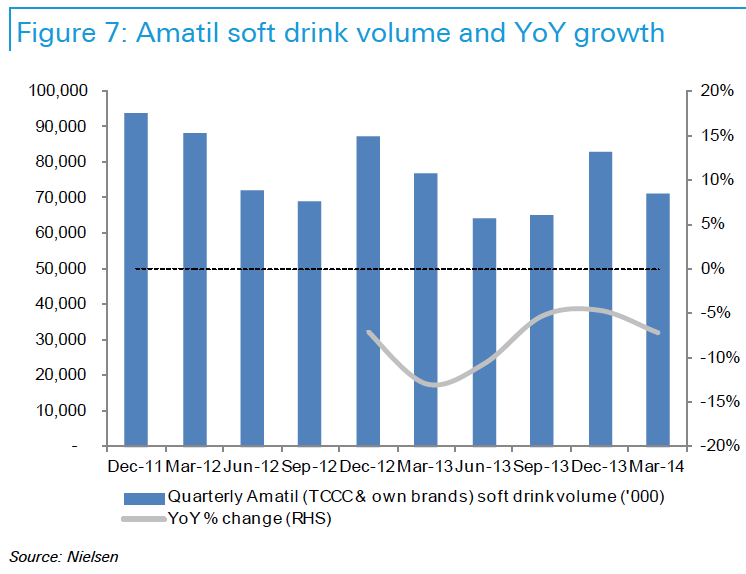

The graphs below illustrate Coca-Cola’s soft drink sales and volumes. In four of the past six quarters (to March 2014), year-on-year sales were down, while in all of the past six quarters, year-on-year volumes were down.

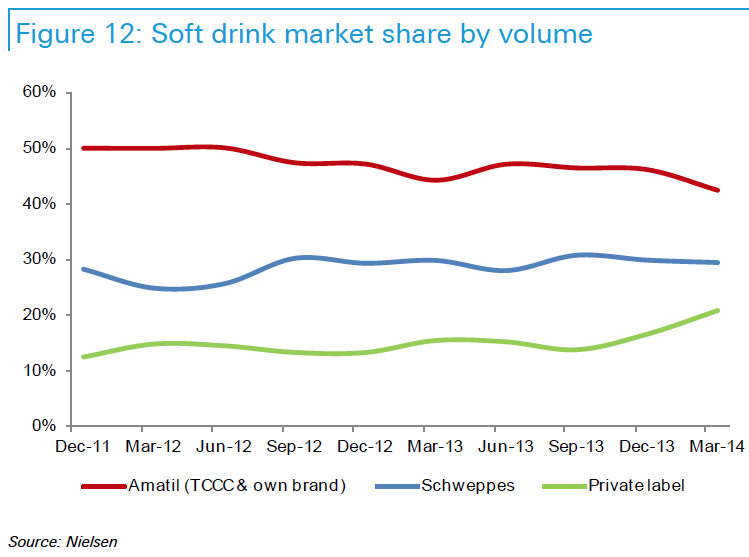

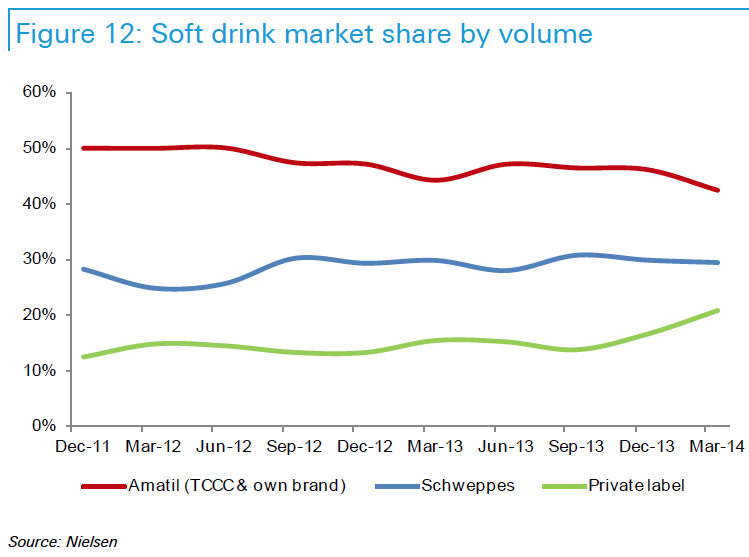

Coca-Cola’s loss of volume in recent years – from 50 per cent to 42 per cent of the Australian soft drink market – has been taken by the Private Label category, whose volumes have grown from 13 per cent to 21 per cent over this period.

And this reflects the far cheaper products offered by Australia’s major grocery retailers. Which begs the question: are Woolworths, Coles and Aldi significant distributors of Coca-Cola Amatil’s products, significant competitors, or both?

MORE BY DavidINVEST WITH MONTGOMERY

Chief Executive Officer of Montgomery Investment Management, David Buckland has over 40 years of industry experience.

David is a deeply knowledgeable and highly experienced financial services executive. Prior to joining Montgomery in 2012, David was CEO and Executive Director of Hunter Hall for 11 years, as well as a Director at JP Morgan in Sydney and London for eight years.

This post was contributed by a representative of Montgomery Investment Management Pty Limited (AFSL No. 354564). The principal purpose of this post is to provide factual information and not provide financial product advice. Additionally, the information provided is not intended to provide any recommendation or opinion about any financial product. Any commentary and statements of opinion however may contain general advice only that is prepared without taking into account your personal objectives, financial circumstances or needs. Because of this, before acting on any of the information provided, you should always consider its appropriateness in light of your personal objectives, financial circumstances and needs and should consider seeking independent advice from a financial advisor if necessary before making any decisions. This post specifically excludes personal advice.

Coca Cola Amatil in Australia is in my opinion run by overly paid incompetents. They undermine their own interest with a slash and burn approach to servicing customers, marketing and refrigeration equipment maintenance teams. They are so short sighted and think that a sugar fix of redundancies and sackings of key personnel will makes the company gain market share. Confident but wrong! This is no real long term solution. A temporary resulting spike in the share price to gain kudos and bonuses is no business model to follow. Hope you read this Alison Watkins.

Hi Roger,

I’m just reading over a few of your recent articles the last few days and you have cross-referenced this article. Apologies for posting a question on a relatively old post.

I own CCL but I have lost a lot of faith in the business, management and their business model.

Nowadays, when I think of CCL I think of them in a similar vein to how you think of mining companies:

– They can’t control their selling price (Woolies and Coles have got them here)

– The volume that they are able to sell is being dictated by the actions of others (Coles and Woolies using their house brand products and stealing market share from CCL brands, deliberately)

I can’t really see how CCL management can reverse these two major issues. “Strategic Reviews” by the current CEO won’t help too much.

I’m back and forth on buying ccl at the current price. On the one hand you’ve got the strength of the brand name with the competitive strength of all those fridges in corner stores and bakery’s all around Australia and the proven track record to be able to grow profits and raise prices above inflation. On the other hand you have the seemingly very high debt levels and strange non core business purchase of SPC. Difficult to ignore the current price drop but by my estimates it seems to have gone from crazy expensive to just fairly priceed…on the watch list for sure though

Most private label products by woolies or coles (even aldi) are produced by the same big name retailers, great example is SPC is the provider for Woolies Select brand.

Any idea who is making the private label soft drinks? My feelings are that it’ll either by CCL or Schweppes who have the size and capabilities.

An interesting stock to debate, in the blue corner you have Warren Buffett who loves this stock, and in the red corner you have the distributors and consumers.

The distributors are doing their level best to replace coke products with house brands [along with all other fast moving high GP items], and the consumer 1) know’s these products are not good for us probably in any measure, 2) is being squeezed harder & harder and is rapidly loosing buying power

That said a 40% drop is too hard to ignore, definitely on my SMSF shopping list!

Keep in mind that Coke in Australia is a bottler. The uS company Coke is the owner of the licence, the formula and the syrup.