China watch

We believe China’s steel production is growing at the rate of 2-3 per cent per annum. Longer term, this – combined with the inevitably slowing economy and the increasing Australian supplies – is an obvious negative influence on the price of iron ore. And it’s something we’ve been warning investors about here on the blog for several years.

In the short run, there are seasonal influences that can affect the price of the commodity as well as short-term supply and demand imbalances.

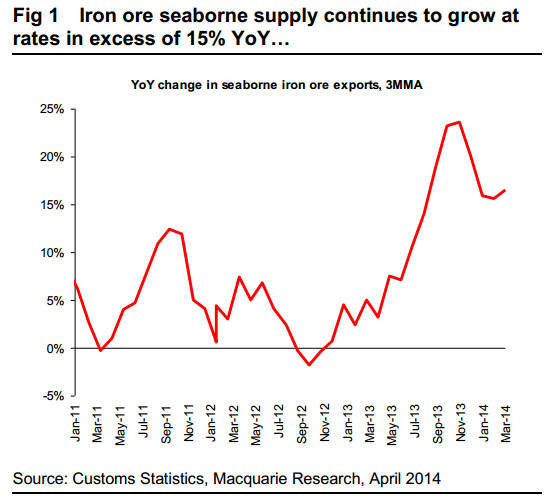

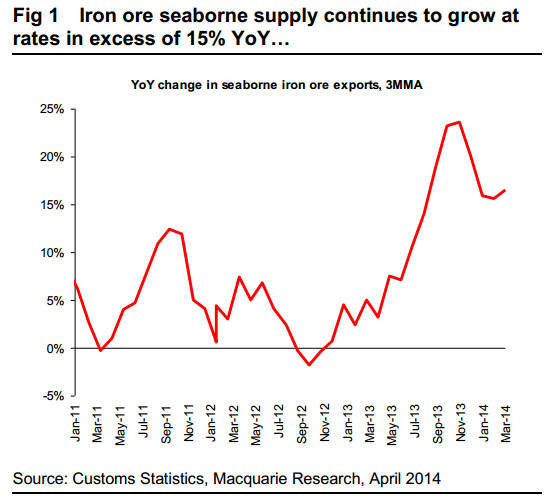

Seaborne iron ore supply changes is one of the indicators of shorter-term imbalances, and seaborne supply is growing.

One should also remember that Q2 represents seasonally strong steel consumption months in China, before the summer heat reduces construction activity.

Based on Macquarie’s analysis, over the coming months – as Chinese demand slows – this strong supply should result in lower iron ore prices, which we believe will be negative for Australian iron ore producers.

MORE BY RogerINVEST WITH MONTGOMERY

Roger Montgomery is the Founder and Chairman of Montgomery Investment Management. Roger has over three decades of experience in funds management and related activities, including equities analysis, equity and derivatives strategy, trading and stockbroking. Prior to establishing Montgomery, Roger held positions at Ord Minnett Jardine Fleming, BT (Australia) Limited and Merrill Lynch.

He is also author of best-selling investment guide-book for the stock market, Value.able – how to value the best stocks and buy them for less than they are worth.

Roger appears regularly on television and radio, and in the press, including ABC radio and TV, The Australian and Ausbiz. View upcoming media appearances.

This post was contributed by a representative of Montgomery Investment Management Pty Limited (AFSL No. 354564). The principal purpose of this post is to provide factual information and not provide financial product advice. Additionally, the information provided is not intended to provide any recommendation or opinion about any financial product. Any commentary and statements of opinion however may contain general advice only that is prepared without taking into account your personal objectives, financial circumstances or needs. Because of this, before acting on any of the information provided, you should always consider its appropriateness in light of your personal objectives, financial circumstances and needs and should consider seeking independent advice from a financial advisor if necessary before making any decisions. This post specifically excludes personal advice.

Hi Roger,

Hmm, what do they do with all that coal then, some for heating and power but about the rest of it, steel production? Oh well, China will slow down hopefully India will pick up.

Regards,

Sergey

Thanks Sergey, Here’s the article you referred to from my good friends at Thomson Reuters:

SYDNEY, April 30 (Reuters) – Hastings Funds Management and China Merchants Group have won a state government auction for a 98-year lease on Australia’s Port of Newcastle, the world’s biggest coal export terminal, paying a higher-than-expected A$1.75 billion ($1.6 billion).

An initial New South Wales state budget plan had valued the lease on the port terminal at A$700 million, but fierce competition for Australian infrastructure assets coming on to market has seen a steady rise in multiples paid.

The winning bid for Newcastle port came in at 27 times earnings, matching the 27 times earnings Transurban Group, Australia’s biggest toll road owner, paid last week for a Queensland state toll road firm.

That compares with multiples of 25 times earnings in a A$5.07 billion deal for 99-year leases for Port Botany and Port Kembla that was won by Industry Funds Management last year.

Local media have reported that other bidders for Newcastle port included Hong Kong-listed Cheung Kong Infrastructure , a consortium of New York-based Global Infrastructure Partners and Deutsche Asset & Wealth management, Macquarie and its partner China Construction, as well as a one from ATEC Rail Group and fund manager TIAA-CREFF.

“It was an incredibly competitive field,” State premier Mike Baird told a news conference.

Hastings, an Australian firm with A$7.4 billion in funds under management, and state-backed China Merchants were equal partners in the bid, according to a statement from the Premier’s office.

Hastings has a portfolio of utilities, airports, toll roads and ports in Australia, Britain, Europe and the United States. It was a partner in winning bids for a Sydney desalination plant last year and Cairns and Mackay Airports in 2008.

China Merchants, which owns a wide range of transportation, finance and property assets, had A$819 billion assets under management as of end-December.

A record 142.64 million tonnes of coal was exported in 2012/13 from Port of Newcastle, up 17 percent from a year earlier, according to its annual report.

At end-June 2013, the port had a net profit of nearly A$23 million and net cash flow from operating activities of A$27 million.

Infrastructure assets such as toll roads, power stations and ports are in hot demand from investors for their stable, long-run returns and tough barriers to competition.

Australia’s state governments, once hesitant to give up tax revenue by selling infrastructure, have had a change of heart since New South Wales sold its desalination plant for $2.3 billion in 2012.

The federal government said last month it would pay states to sell assets as treasurers across jurisdictions agreed to do more to lure local and overseas investors to take a slice of an estimated A$100 billion in infrastructure.

The proceeds from the sale of Newcastle port will be invested to build infrastructure in the state with 30 percent directed towards projects in rural and regional areas. ($1=1.0789 Australian Dollars) (Additional reporting by Jane Wardell; Editing by Edwina Gibbs)

This may well change further to the negative given that the authorities in China are cracking down on using iron ore as a means of loan collateral.