Chasing Viewers…..

Given its relatively undemanding market price, we decided to take a cursory glance at Nine Entertainment Co. Holdings Limited (ASX: NEC). While the shares might look attractively price however, there’s a good reason we believe they aren’t.

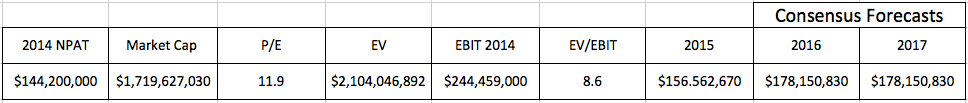

With an historical price/earnings of 11.9x, an Enterprise Value/Earnings Before Interest Tax Depreciation and Amortization (EBITDA) of 8.6x and the recent company guidance for pro-forma Financial Year (FY) 2015 earnings to grow circa $160m (implying an even lower price/earnings), Nine Entertainment’s shares started to look cheap.

Source: MIM analysis, company filings

Source: MIM analysis, company filings

Consensus estimates for Nine Entertainment suggest net earnings will grow from $144.2m to $193.8m over the next few years, which makes the valuation case compelling. But it is far better to buy an extraordinary business at a fare price than a fare business at an extraordinary price. While these valuation metrics are attractive, we believe they might be deserved.

Nine Entertainment has three divisions; Television network, live events and online media.

- Nine Networks – national free-to-air TV network.

- Nine Events – Ticketek, Allphones Arena and Nine Live. The live events industry is heavily fragmented, however Ticketek is somewhat of an aggregator providing ticketing services to more than 135 venues from which it collects commissions.

- Nine Digital – Mi9, smaller investments and joint venture’s (including Stan).

We do like the quality and potential of the events and digital assets, however Nine Networks, we believe might suffer from ‘dismediation’.

TV is struggling and TV advertising is in trouble

Nine Entertainment have provided guidance for first half Net Profit After Tax (NPAT) for FY2015 to be down -5 to -11 per cent due to negative advertising growth in the metro TV market of two per cent – this is important. Nine Entertainment derives the majority of its revenue (and hence EBITDA and Earnings) from free-to-air advertising. For every one per cent contraction in the TV ad market, Nine Entertainment’s earnings fall five per cent.

The $160m guidance, implies a second-half reversal of the decline experienced in the first half, and a 1-2 per cent rebound from the current contraction. This could eventuate, but we note that the longer-term growth in this core market is severely challenged. Perhaps more importantly, Nine’s expectations contrast with Seven West Media’s commentsl; in their half-year report released recently, “Management guidance for the 2015 financial year television advertising market is for a slight decline from prior year.”

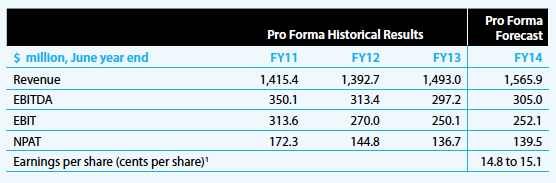

When Nine Entertainment listed in December 2013, the company provided the following set of historical financials. These clearly show a declining business in FY 2011/2012, prior to the acquisition and listing of TV stations in Perth and Adelaide, which perhaps explains the bounce in FY 2013/2014.

Source: Nine Entertainment Prospectus

Source: Nine Entertainment Prospectus

Despite several acquisitions, EBITDA in FY 2014 is still lower than FY 2011, so is EBIT and NPAT, offering some insight into the headwinds faced by the free-to-air advertising market.

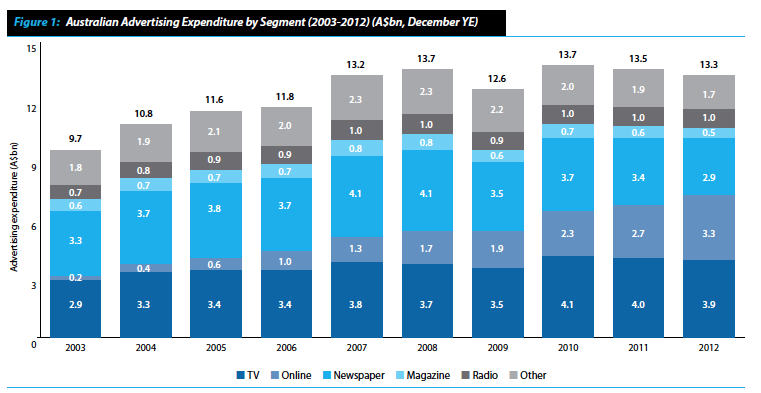

Intense competition exists between the networks, including Seven and Ten, (you will have observed the increasing amounts paid by the networks for the rights to distribute coverage of football, rugby and cricket) as well as the ABC and SBS (which are government owned). And fierce competition in a mature advertising markets (total dollars spent has been flat since since 2007/2008 at circa $13.4b) provides an unattractive combination of investment merits.

Source: Nine Entertainment Prospectus

Source: Nine Entertainment Prospectus

Looking at the overall market, all categories of advertising appear to be flat to declining, with the exception of online. The price paid for online advertising however is lower and consequently, the growth in online’s share is not enough to offset completely the declines experienced elsewhere. With TV’s market share relatively stable between 2005 and 2012, market share losses been experienced by paper and radio.

Since 2012 however, the growth in ‘online’s’ share of advertising spend has also eroded TV’s share. The latest numbers we found show that to June 2014, TV ad dollars have declined from $3.9b in 2012 to $3.5b which backs up both Nine Entertainment and Seven West Media’s comments of a contracting market.

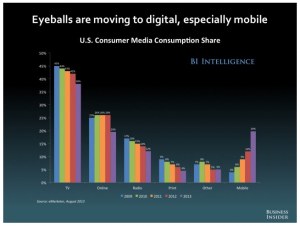

One possible explanation for this is that viewers are simply splitting their viewing time between free-to-air and online (streaming, tablets and mobile devices). Naturally, advertisers are likely to follow suit as they chase eyeballs.

Interestingly, the quote speaks volumes; programs “that used to be considered successful at 2 million viewers are now considered successful if they hit 1 million.”

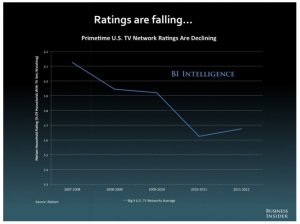

The trend is clear; less time is spent watching TV and advertisers will follow the eyeballs, to the detriment of Nine Entertainment and its peers. And if the latest trends in the US are experienced locally, a further loss of market share for free-to-air providers will follow.

In an expensive market overall, an apparently attractive market price for Nine Entertainment is tempting, but the longer-term prospects do not appear bright and for that reason the Montgomery funds will take a pass on this investment ‘opportunity’.

Russell Muldoon is the Portfolio Manager of The Montgomery [Private] Fund. To invest with Montgomery, find out more.

This post was contributed by a representative of Montgomery Investment Management Pty Limited (AFSL No. 354564). The principal purpose of this post is to provide factual information and not provide financial product advice. Additionally, the information provided is not intended to provide any recommendation or opinion about any financial product. Any commentary and statements of opinion however may contain general advice only that is prepared without taking into account your personal objectives, financial circumstances or needs. Because of this, before acting on any of the information provided, you should always consider its appropriateness in light of your personal objectives, financial circumstances and needs and should consider seeking independent advice from a financial advisor if necessary before making any decisions. This post specifically excludes personal advice.

INVEST WITH MONTGOMERY

SXL, NEC and SWM have a combined market cap in excess of $4b. I dont think the earnings power of this asset base looking 5-10 years out justifies such a valuation. Just my opinion.

Great article, I’ve been hearing this sort of thing for a while now, just look at the younger generation – the future is mobile! :) (Also the reason I’m shorting SWM and SKT.)

Also very relevant:

http://fortune.com/2015/02/18/millennials-are-abandoning-their-tv-sets-faster-than-ever/

and:

http://www.businessinsider.com.au/nielsen-q4-total-audience-data-2015-3

Thanks for those links John.

Great post Russell, I totally agree. I recently took a look at Southern Cross Media and the situation there looks even more dire, but for many of the same reasons. If I shorted, SXM would definitely be my pick.