Caterpillar machine sales cratering outside North America

Caterpillar Inc’s March 2013 quarterly net income was down 45 per cent to $0.88 billion, on a 17.5 per cent reduction in revenue to $13.2b (click here to read our original post on the reduction).

At the time, management had cut the company’s 2013 revenue forecast by 8 per cent to $59b. The final figure was somewhat worse, at $55.7b.

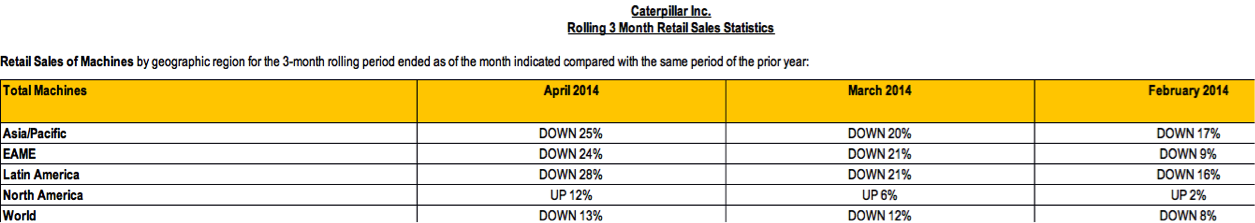

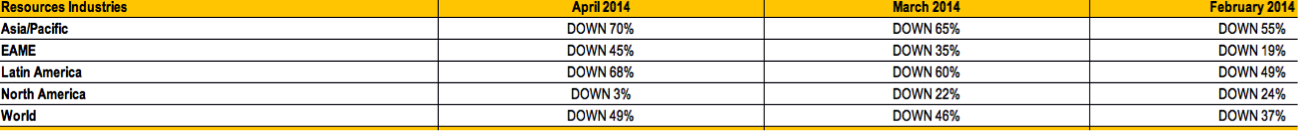

Over recent months Caterpillar’s machine sales – outside of North America – have cratered.

For example, the months of February, March and April 2014 have seen Caterpillar’s Asia/Pacific machine sales record a year-on-year decline of 17 per cent, 20 per cent and 25 per cent, respectively.

This downturn is attributable to the resources industries, and the year-on-year declines, by region, for February, March and April 2014 are detailed below.

Consensus forecasts for Caterpillar’s June 2014 quarterly earnings per share (EPS) has halved in the past couple of years, from over $3.00 to the current $1.50.

Given the severity of the decline in machinery sales outside North America, it would not surprise if further earnings downgrades were forthcoming.

MORE BY DavidINVEST WITH MONTGOMERY

Chief Executive Officer of Montgomery Investment Management, David Buckland has over 40 years of industry experience.

David is a deeply knowledgeable and highly experienced financial services executive. Prior to joining Montgomery in 2012, David was CEO and Executive Director of Hunter Hall for 11 years, as well as a Director at JP Morgan in Sydney and London for eight years.

This post was contributed by a representative of Montgomery Investment Management Pty Limited (AFSL No. 354564). The principal purpose of this post is to provide factual information and not provide financial product advice. Additionally, the information provided is not intended to provide any recommendation or opinion about any financial product. Any commentary and statements of opinion however may contain general advice only that is prepared without taking into account your personal objectives, financial circumstances or needs. Because of this, before acting on any of the information provided, you should always consider its appropriateness in light of your personal objectives, financial circumstances and needs and should consider seeking independent advice from a financial advisor if necessary before making any decisions. This post specifically excludes personal advice.