Cash-strapped borrowers are hammering the housing sector

Rising interest rates are already having a major impact on the Australian housing sector. Dwelling approvals are down, an increasing number of off-the-plan buyers are trying to exit their purchases, and furniture and appliance sales are declining. If you’re looking to invest in companies exposed to housing, I’d suggest it’s a case of buyer beware.

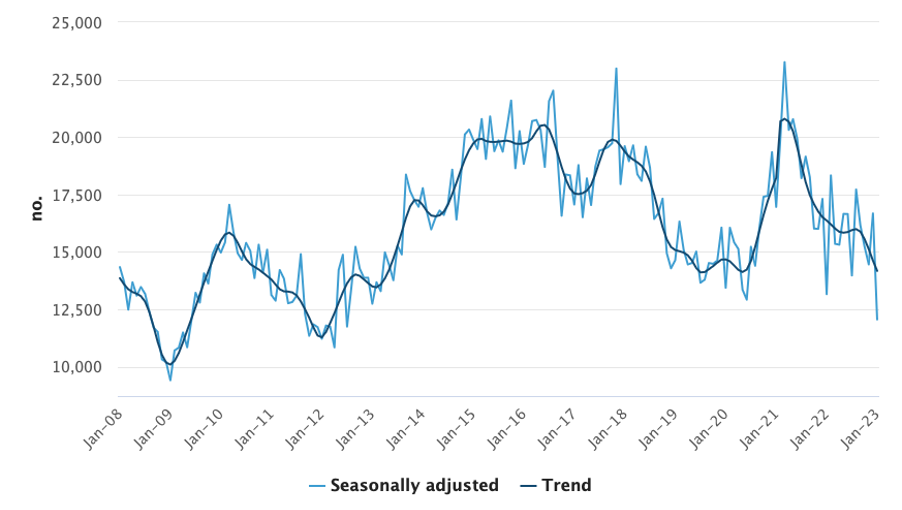

According to the Australian Bureau of Statistics, Australian dwelling approvals declined a seasonally adjusted 27.6 per cent in January from the month before to be down 8.4 per cent year-on-year.

Private sector house approvals fell 13.8 per cent, while private sector dwellings excluding houses fell 40.8 per cent. The value of total building fell 18.6 per cent, while the value of non-residential building fell 25.6 per cent.

As Figure 1. shows, approvals are now back to levels last seen in 2012.

Figure 1. Dwelling unit approvals (number of units)

Meanwhile, off-the-plan buyers are trying to exit their purchases in increasing numbers amid higher interest rates, and in some cases, lower equity.

According to the Australian Financial Review; “Qi Chen, founder of OpenLot.com.au, a listings site for new housing developments said the number of buyers enquiring about selling or nominating another buyer to take over an unconditional off-the-plan contract had surged over the past 12 months.” According to Qi, “We saw a large jump in the number of seller requests in 2022, which had more than doubled compared to 2021.” Qi added the trend continued in January.

According to Qi, in 2021 only 22 per cent of the seller requests on the site were unsettled off-the-plan properties. In 2022 that rose to 47 per cent. From the AFR; “Based on this, we’re anticipating developers could be facing up to 5 per cent of their off-the-plan contracts failing at settlement due to buyers not being able to get finance.”

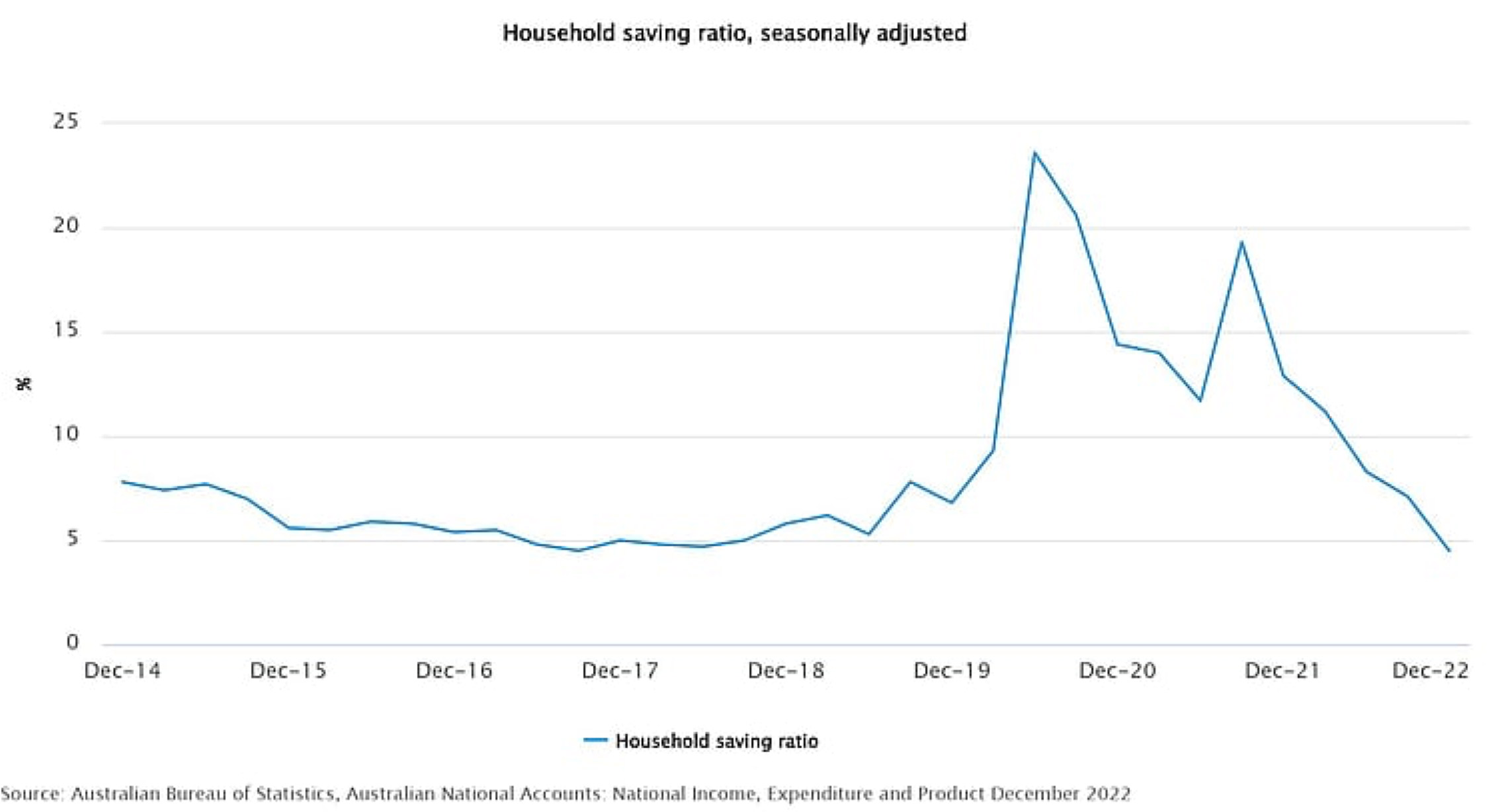

Meanwhile it seems consumers have spent their savings. These are the savings the RBA had previously pointed to as the reason why, along with mortgage prepayments, Australia would likely withstand the substantial increase in rates.

Figure 2. Seasonally adjusted household savings

Australia’s household savings rate dropped for the fifth-consecutive quarter, from 7.1 to 4.5 per cent and now sits at the lowest levels since 2017.

With wages falling amid inflation, and borrowers forced to make higher repayments on mortgages, it would appear households are spending their savings. The question for investors should be, how much longer can plunging household savings continue to support consumption?

The first-order effects of the above snapshot will be felt by residential construction players and their suppliers. Second-order effects will be suppliers of furniture and appliances – the stuff people kit out their new homes with. The third-order effects are then spread in a non-linear fashion based on the remaining consumption priorities of various consumer cohorts.