Can US house price falls happen here?

We have all been reading and listening to the debate about Australian property prices and whether they are going to crash. It’s hard to ignore when august journals like The Sydney Morning Herald report,

“The Australian real estate market is in the grip of the biggest housing bubble in the nation’s history and Melbourne will be at the epicentre of an historic ‘bloodbath’ when it bursts, according to two housing economists.”

More level heads suggest that for prices to crash either interest rates need to jump dramatically, or unemployment-inducing economic conditions need to transpire.

Hoping for a bargain

Perhaps because I love a bargain and I am an optimist (a value-investing optimist hopes for lower prices), I have until now been broadly in agreement with those expecting a correction of some magnitude. I was in Malaysia in the 1990’s when the skyline was filled with cranes and I was in New York and Florida in 2007. In both cases, overbuilding was followed by a collapse.

Today, I am not sure whether we are due for a significant correction, despite the construction boom in Brisbane, Melbourne and Sydney.

The reason for my more sanguine view is the result of some simple calculations, using ABS data, into the demand and supply picture for Australian property. The weakness in my thesis is that I am looking at aggregate data rather than city-specific, but aggregate data was all that was needed for some to predict housing price collapses elsewhere in the world.

Factors affecting house prices

Employment, inflation expectations, interest rates, debt-to-income ratios, house-prices-to-income, financial stress measures and the like all influence short-term property prices, but basic demand and supply seem to be the most important influences over the medium term. And given very few people buy property to ‘flip’ over the short term, it is the medium term we should focus on.

There is merit in looking at household formation as a proxy for demand and construction as our indicator of supply. With the exception of the circa 80 per cent falls in property prices in mining towns in Australia, the most notable real estate price collapse that occurred recently was in the US.

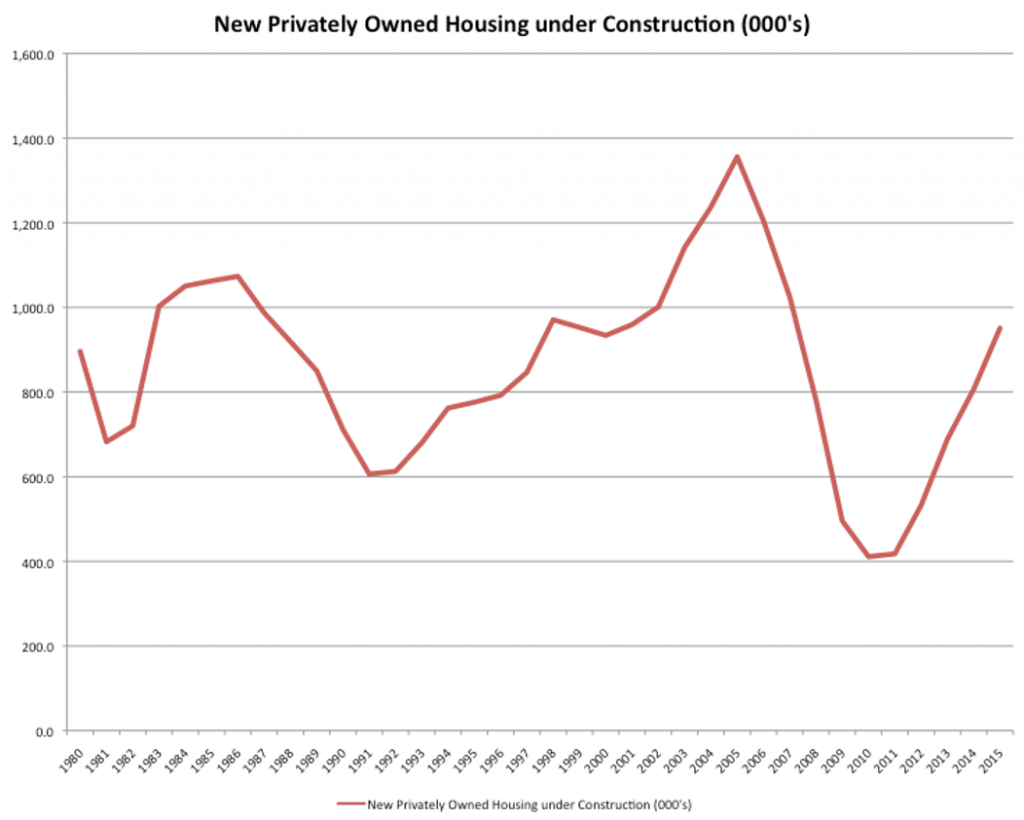

Figure 1 illustrates one of the conditions that preceded the collapse: a sharp jump in the level of construction. According to the US Census Bureau, in the years prior to the GFC, the number of dwellings under construction had risen from 993,000 annually in 2000 to 1.1 million in 2003, 1.2 million in 2004, 1.4 million in 2005 and 1.2 million in 2006.

Figure 1. US private housing construction, 1980-2015

Source: US Census Bureau

Meanwhile, according to the US Census Bureau’s Current Population Report entitled Projections of the Number of Households and Families in the United States: 1995 to 2010, household formation was increasing at about a million per year. In other words, the US was oversupplying dwellings for seven years, and by 2007, possibly a million excess dwellings needed to be soaked up.

Houses were simply being built faster than they could be occupied. In 2012, Warren Buffett observed as much when he said, “In normal times, we need about one million or more homes to keep up with household formation.”

And we know what happened next.

How many residential dwellings are needed in Australia?

In Australia today, dwellings are being constructed at a rate faster than they can be occupied by newly-formed households.

According to the Australian Bureau of Statistics (ABS) March 2015 report Household and Family Projections, Australia, 2011 to 2036, “The number of households in Australia is projected to increase from 8.4 million in 2011 to between 12.6 and 12.7 million in 2036.”

In other words, household formation is increasing at about 1.6 per cent annually and in 2017 that equates to about 150,000 new dwellings required.

The ABS also reports dwelling units commenced and the construction industry is currently building about 56,000 dwellings per quarter. That’s 228,000 per year, a lot more than seem to be needed. More importantly, this has been growing since 2011 when 35,000 dwellings were being constructed per quarter, which was about the same number as the number of new households being formed. It roughly balanced.

So if we assume an average of 47,000 dwellings were constructed per quarter in the years 2012 to the first quarter of 2016, and we add the 18,000 or 19,000 monthly approvals occurring now and project this number for eight months until the end of 2016, we arrive at a supply of 923,000 dwellings. During this period, the number of dwellings required, as estimated by household formation, is 716,249. That suggests an oversupply of about 200,000 dwellings.

At the current rate of household formation, that oversupply could be soaked up in about 18 months, provided construction of new dwellings ceased completely. But of course construction will continue and the oversupply will take longer to be absorbed.

It looks like Australia has a greater oversupply problem than the US did in 2007. The estimated 18 months is more than the 12 months oversupply the US had and after their property market collapse, it took five years before property prices began recovering.

What about sub-prime in the US?

But before we jump to the conclusion that we are due for a crash, keep in mind that our banks have not been extending $700,000 subprime mortgages to Mexican strawberry pickers earning $14,000 per year.

It’s reasonable to expect property prices will not rise by much in the next few years and it is certainly possible they could fall. But the falls experienced elsewhere in the world seem unlikely, which means my hopes of a bargain in the next few years may be just that: hope.

However, I am reminded of the inflationary effect on global asset prices from quantitative easing. Cheap and plentiful money injected into the financial system triggered the purchase of assets by institutions migrating away from the safety of cash into (apparently) higher-yielding assets. But the easy money is over, particularly in the US, where the Fed ceased its third quantitative easing programme in October 2014. Since then the amount of money in the system – the US balance sheet – having reached about $US4 trillion (up from $800 billion in 2008), has stopped rising.

Unsurprisingly, the world economy is now slowing. If quantitative easing was responsible for inflating asset prices, the end of QE must surely have the opposite effect. And sure enough, it has.

Since 2014, commodity prices have collapsed. Oil has fallen from $115 per barrel to $40 per barrel and commodities from wheat and corn to copper and cattle have collapsed. Other assets aren’t doing too well either, with the US, UK and Australian stock markets about where they were in 2014.

So why are property prices persistently high? One factor is that they aren’t traded on an exchange. They’re a clunky asset and re-pricing is less efficient as they can take weeks or months to sell and even longer to settle.

And there’s a generation of students, and twenty-something-year-old, low-to-middle income earners with multi-million dollar mortgages over property investment portfolios that don’t even know what an interest rate is. They aren’t strawberry pickers on $14,000 but what will they do if and when rates rise?

Don’t worry about rushing into residential property

One thing I’m confident about: the probability of a bargain is higher than the probability of prices running away. There’s no need to rush and it may pay to have some cash around rather than a lot of debt.

Roger Montgomery is the founder and Chief Investment Officer of Montgomery Investment Management. To invest with Montgomery domestically and globally, find out more.

Tim

:

Hi Roger,

Thanks for interesting analysis. However there’s one aspect I don’t get which is the link between apartment oversupply and overall property prices. How does an oversupply of apartments lead to the devaluing of a suburban house?

Roger Montgomery

:

Hi Tim,

Properties are priced relatively (features, size and geography). If apartments were to decline in price by a meaningful amount, it would attract potential buyers away from similarly featured houses. Fewer people at the auction of a house, means the vendor who wishes tons ell, needs to meet a market with fewer buyers. There is nothing new in this. Any analysis of past cycles will reveal a similar pattern.

Mark Oughton

:

Roger, as i understand it there has been a lot of baby boomers invest in property over a long period of time. More recently this has increased through SMSF’s borrowing money to buy investment property. Dividend yield from this strategy is not great. These people are investing for income in their retirement. If i am correct i would think the impact on property would be negative. my question is would it be a significant impact/ Mark

Andrew Wright

:

I was in Melbourne looking at properties about three months ago and, my word, they seem to be building like there is no tomorrow. Much of the new construction, it seemed to me, was in the non-residential sector, which suggests business is expanding and that can’t be a bad thing.The stats show that Melbourne’s population is also growing significantly faster than Sydney’s is. My take is that there will be an oversupply of residential units (essentially a hole in the sky) in and near the city and we should see significant price softening in this sector over the next twelve months, but houses (built on their own block of land) should retain value, because it is the land itself that retains value.

Roger Montgomery

:

Thanks Andrew. This might be interesting reading too: http://rogermontgomery.com/wp-content/uploads/2016/03/Australian_20160319_035_0.pdf

Ron Smart

:

Over here in Perth, much of our new home construction has been showing up as apartment blocks. The story is that many have been sold to overseas investors of which a portion now just sit empty without tenants.

Would be interesting to know, if, and to what extent this might also be the case in Sydney, Melbourne etc.

Lucas Hainsworth

:

The only comment I would add is that my household was formed ~8 years ago, and now that we have a 4 year old, only then were we able to get the money together to build our house. So there may be some pent up demand in the system. And the reason why I am building over buying established is because of what kind of square metres you can get for what I consider is a responsible mortgage amount.