Can Things Go Better With Coke?

Coca Cola Amatil (ASX: CCL) reported its half year results during the week. The company has been under pressure for some time. The consensus view is that a combination of the growing market power of the major supermarkets, combined with a consumer shift away from soft drinks, has resulted in a downward spiral in volumes and earnings over the last 3 to 4 years.

While both of these issues have been a factor for the company, it’s not as though these issues are new. The soft market has been underperforming the broader beverages category for over a decade, and the market dominance of the two major supermarkets was arguably greater 5 years ago than it is today due to the emergence of Aldi and to a lesser extent Costco.

So why did Amatil go from market darling, and a core part of most fund manager’s portfolios in 2012 to an unloved structural decline story by 2014?

The first thing to understand about Amatil is that it is not really a brand owner, but a manufacturer and distributor. Its greatest asset is its distribution scale and reach outside of the supermarket channel. This enables it to put products in front of customers across a range of consumption occasions. Of greatest value is its fleet of refrigerators in smaller outlets that create a visible presence for their products that can trigger consumption demand. However, Amatil needs the support of its brand owner TCCC (The Coca Cola Company) to not only build brand equity, but to deliver products that meet the changing preferences of consumers.

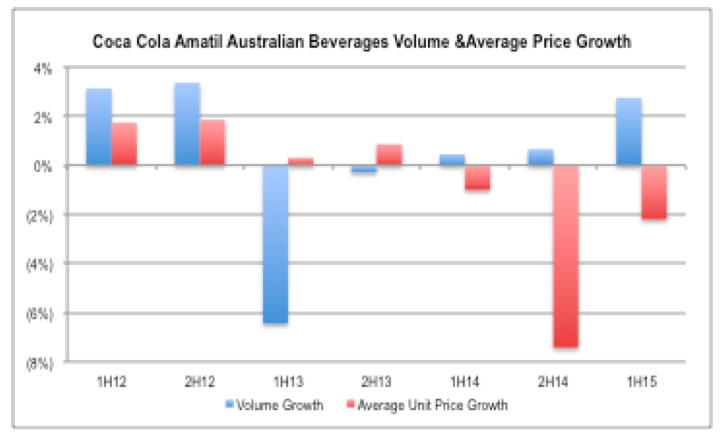

After many years of diverging strategic priorities between Amatil and TCCC, the relationship had deteriorated such that TCCC’s support and investment in Amatil’s markets had been eroded. This resulted in a downscaling of marketing and new product in Amatil’s core markets. To offset this, Amatil has become more aggressive in using pricing growth to boost margins and earnings. As was shown by the beer companies in the later part of last decade, aggressively raising prices while underinvesting in brand equity is a recipe for disaster.

With a change in leadership, Amatil is now trying to redress the underinvestment of recent years. It is rebuilding its relationship with TCCC, resulting in increased marketing support and new product launches. It has reduced prices across most channels, making it more competitive. The first half result showed the company’s first reasonable volume growth in Australia for 2 years. However this largely came at the expense of price realisation.

As previously noted, Amatil is predominantly a distributor and manufacturer of beverages. While changes to the customer landscape in non-supermarket channels over the last 10 years has been a negative for the company, it still enjoys the advantage of far greater consumer access than its competitors.

As previously noted, Amatil is predominantly a distributor and manufacturer of beverages. While changes to the customer landscape in non-supermarket channels over the last 10 years has been a negative for the company, it still enjoys the advantage of far greater consumer access than its competitors.

The question is whether it can leverage this asset to deliver a better suite of products that matches consumer demand. This has been happening, albeit slowly for a long time, with non-carbonated (ie still) beverages making up an increasingly significant proportion of the company’s volumes. The difficulty for Amatil is that its ability to drive portfolio change is limited by its reliance on TCCC for new product innovation and marketing support.

One backstop for shareholders is that even if the new management team is unsuccessful in stabilising then growing the business, Amatil’s core distributor asset could be more valuable in the hands of another company.

On the plus side, the company’s capital expenditure requirements have fallen sharply after many years of heavy investment. As those that read our article in The Australian on the weekend will recognise, this means an improving outlook for marginal returns and therefore the quality of earnings relative to recent years.

Stuart Jackson is a Senior Analyst with Montgomery Investment Management. To invest with Montgomery domestically and globally, find out more.

This post was contributed by a representative of Montgomery Investment Management Pty Limited (AFSL No. 354564). The principal purpose of this post is to provide factual information and not provide financial product advice. Additionally, the information provided is not intended to provide any recommendation or opinion about any financial product. Any commentary and statements of opinion however may contain general advice only that is prepared without taking into account your personal objectives, financial circumstances or needs. Because of this, before acting on any of the information provided, you should always consider its appropriateness in light of your personal objectives, financial circumstances and needs and should consider seeking independent advice from a financial advisor if necessary before making any decisions. This post specifically excludes personal advice.

INVEST WITH MONTGOMERY