Buckle up, it could get bumpy

For over a year we have been warning that the property market in Australia might experience a set back. To summarise, the following steps sets out the thesis:

- Background: Based on ABS household formation (demand) and approval and construction (supply) data, Australia is producing dwellings at a run rate of 50 per cent more than is required. There is potentially an oversupply equivalent to a year’s worth of demand.

- Developers of apartments who are coming out of the ground now will find they will be selling completed projects into an oversupplied market.

- They will be unable to meet their loan obligations to the banks and others without discounting the unsold inventory.

- Apartment prices will decline.

- When this occurs and by how much is open to debate but suggest within the next 24 months.

- Property is priced ‘relatively’. A family looking for a three bedroom dwelling who observes that apartments have fallen 10, 20 or 30 per cent will eschew attending the auction for a similar sized house if the vendor hasn’t also dropped the price.

- That means less people attending auctions for houses and so vendors for houses will have to also lower their expectations.

Adding fuel to the thesis is an article published this afternoon in the AFR, Westpac calls time on lending to foreign residential property buyers.

Westpac and related banks including St George, Bank of Melbourne and BankSA have ceased lending to all foreign property buyers.

As Neo was warned in the movie The Matrix; “Buckle up Dorothy because Kansas is going Bye Bye”

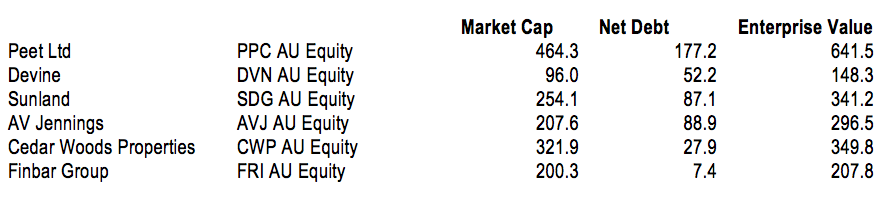

You might like to also consider carefully (and seek and take personal professional financial advice) your investments in property developers such as the following:

As well as the bigger operators such as Mirvac, Lend Lease and Stockland.

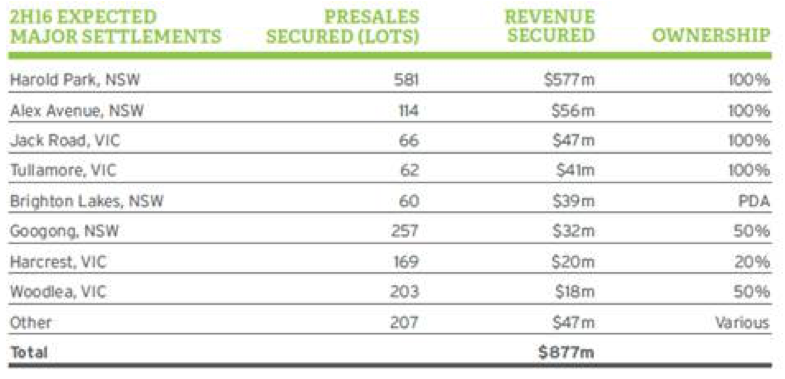

There are a lot of high density residential capacity due to be completed in the second half of 2016 and first half of 2017. Mirvac for example, has the Harold Park Precinct 3, 4 and 6 projects to be completed over the next 6 months. The company noted that it has A$877m of residential pre sales to settle in the second half of 2016 (2H16).

It also sold 1,960 lots in 2H15 and expects to settle 2,900 residential lots in FY16. The company expects to settle 14,000 lots between FY16 and FY20. Major projects are expected to generated 70 per cent of target EBIT over these years. The pipeline is made up of 37 per cent of future revenue from NSW, 35 per cent from VIC, 22 per cent from QLD, and 6 per cent from WA. The company currently has A$2.6bn of pre sales to get full settlement, 30 per cent of which is from overseas buyers and 20 per cent is mainland Chinese.

Roger Montgomery is the founder and Chief Investment Officer of Montgomery Investment Management. To invest with Montgomery domestically and globally, find out more.

Thanks Rodger, guess I’ll just trust in your judgment which has been my best strategy to date regarding investing. I just hope that train wreck doesn’t put to many dents in our portfolio when it derails.

Regards Andrew ronan

Of course there can be no guarantees Andrew.

Hi Rodger ,it seems very obvious that we are in bubble territory with the insane property market here and it’s very well documented now in the media everywhere including your own comments ,I watched on the abc last nite yet another article outlining this phenomenon ,it was also mentioned that international hedge funds were actively shorting major aussie banks which are very exposed to a downturn .I find it very hard to understand why we are long the banks ,and even if they are a1 companies won’t they be far better value when the crash comes?

Regards andrew ronan

Hi Andrew, Our bank exposure is significantly lower than the market and peers. Predicting share prices is not our thing and we focus instead on business performance. We are carefully watching for changes in NIM and provisions as well as funding costs.

As a developer myself, I do believe there is an oversupply of apartments. I am struggling to find a catalyst though that is going to cause the property market to collapse. There has been a cooling off in the market, but will it just level off from here? It won’t be interest rates, will it be China? I see the banks have tightened lending to foreign investors as they are realising they are highly exposed to this so called property bubble. Will it be unemployment?

I just can’t seem to put my finger on it.

I am always interested in the idea that there needs to be a catalyst. To this day investors and academics debate the catalyst for the GFC and the 1987 crash.

let me guess Roger

you are yet another hedge fund short the banks and property developers?

Incorrect Simon. Having recently purchased, we currently own CBA and WBC.

The properties you mention in the article have been no-go zones for savvy investors for 18+ months (high density apartments in the CBD). A lot of people in the industry have seen this coming for this particular type of property for a long time, so it is not fair to tar the entire Australian property market with the same brush.

I think you are making the mistake of classing property in Australia as one single market. I would class these apartments you mention as the “Qantas” or “ABC Learning” of the property market. You would need rocks in your head to invest in these assets.

This is in contrast to your 3-bedroom home within 2-10km of the CBD in a good suburb with owner-occupier appeal, which is more like the CSLs or REAs you would prefer to invest in.

Shelter will always be a basic need and with 70% of the market being owner-occupiers, population increasing at a touch under 100k per annum in Sydney/Melbourne and inner-middle ring suburbs almost fully built out, I still see property as one of the safest bets for the average punter over the next few decades.

Lets keep in touch David and keep an eye on whether a train wreck transpires. I am less sanguine than you.

Great article Roger.

I remember the country thinking your Wesfarmers valuation of sub $20 just couldn’t be possible or happen back in 2008. Wesfarmers had been around $44 from memory and your call was at $38 ish (can’t quite recall the price exactly). A few months later they were not only under $20 but sat around $15 with the company offering shares in a capital raising at $13.50.

You were spot on then and spot on now. I wouldn’t be buying any property in Australia as an investment.

Thanks for remembering Dean. The more I consider the facts, the more confident I am that we will see a train wreck with few immune.

Firstly I’d like to say that I’m no expert, just a typical person who doesn’t understand how people think the residential property market can go up much more if at all than wages over the long term.

In fact Duane, property has only been rising in line with wages since the 1970’s (and it has obviously decoupled from that recently!). prior to the 1970’s property has tracked inflation for hundreds of years.

Hi Roger

Thanks for the article, regarding the calculation of the 50% run rate on ABS data could you point me in the specific direction of the data you used and how the calculation was performed as I went through my own calculation of the ABS website and based my calculation of data from 2011 to 2015 of number of total market sector (Australia wide) dwelling approvals vs the average of all three forecasts of housing formations for the corresponding period and noted that there has still been a healthy excess of formations above dwelling approvals is there something that I am missing?

Thanks in advance

The difference is due to only the start date for the calculation. That’s all. We can debate that until the proverbial cows come home. Not much point in debating in though. Time will reveal whose thesis is correct. Let’s just wait and I can get back to work.

It strikes me that if the RBA does drop rates by 25bps (and again after the election?) then those existing property investors are less likely to feel the pressure to sell and those potential property investors are less likely to baulk. It also highlights that we are a long way off any substantial lift in interest rates, which perhaps steady’s the nerves of highly leveraged property investors. Also if the government is reducing the attraction of super (by increasing taxes and reducing limits) – there may well be more money sitting outside super to invest – perhaps into property. Thanks again Roger for stimulating my grey cells…..

Hi Paul, we’ve written extensively here about the basis of your understanding of price dynamics. You’ll also find I discuss it with Ticky and Ros on the ABC if you select the Media and In The Press tabs. It’s very common to believe that prices can only fall if owners are ‘forced’ to sell. Prices can also fall if buyers simply reduce their bids. Bit happens every day in the stockmarket and at art and livestock auctions so it can and does happen in the property market. You also need to remember that even if regular investors aren’t forced to sell, developers with debt and unsold inventory on their hands will be.

When you say that “a family looking for a three bedroom dwelling who observes that apartments have fallen 10, 20 or 30 per cent will eschew attending the auction for a similar sized house if the vendor hasn’t also dropped the price, that means less people attending auctions for houses and so vendors for houses will have to also lower their expectations.”, I don’t agree.

Comparing apartments with houses is wrong, because assuming that the size and location is identical, the house (by definition) HAS to have more land attached to it as a function of footprint and a greater percentage of the price will therefore be “land value”. I would sooner have a house than an apartment or a unit any day because of this reason.

Land appreciates, buildings depreciate, so therefore an apartment can only ever have a partial share of the appreciating land component (which is why they make lousy investments but nice lifestyle choices, because capital growth is limited). Also, there is a massive supply of apartments coming on-stream in Melbourne, not to mention those already present which are, by now, looking tired and dated; there’s not a massive supply of houses in the same area (so you cannot compare the two properly).

Therefore, I find it hard to believe that house prices would have to be curtailed by the same, if any amount, purely because of the thing (land) which goes up in value and there being such a huge difference in the amount that the two types of dwelling have.

We understand this principal well and have written about it elsewhere. Your thesis however does presume a rational market and rational investors at all times. Fortunately we can (and you will) take advantage of irrational pricing periods. Even though you may find it hard to believe, your own comments recognise it when you note that apartments make lousy investments (presuming their capital gains are lower than houses with land), and yet apartments in harbour-front developments in Sydney have recently sold for 100% above their off-the-plan prices.

The whole overpriced housing dynamic is really starting to play out. As part of the generation that is currently priced out of the market, it is comforting that you can genuinely start to see evidence of how prices will either stagnate or fall. However, the problem is that its likely the economy will come under stress if prices fall to more affordable levels in areas where there was clearly an oversupply. If falls are relative, then the whole market also corrects. Thus, unemployment rises with a poor economic outlook – banks would probably be more reluctant to lend to my generation. LVR demands go up and you need a larger deposit to be able to buy. The transfer process should occur (selling from offshore and negatively geared investors who no longer see future price appreciation) to those buyers (our generation and the people that actually want and need to live in a particular suburb). The gap between a sellers price and a what buyer would be able to pay could be quite large. All in all it isn’t great for the for economy. As much as I would like to see lower and more affordable prices, I know that what comes with that will not be great for the country. Its a double-edged sword.

Sounds like some good shorting opportunities with these property developer shares

Hi Roger

what happens when the RBA cut rates (after that fake CPI number) on may 3rd?

property still falls?

I dont think so

Remember what RBA Governor Glenn Stevens said about the elasticity of demand when rates are cut from already low interest rates. There is also the Economics of Enough to contend with. Do you really think there is an army of buyers that have been holding off buying a property until interest rates drop to 1.75% from 2%? Rates have been low enough for long enough, and banks have been accommodating enough, that anyone who was going to buy in this cycle has. Finally, The Reserve Bank of Australia has devoted an entire chapter to ‘Chinese demand for Australian property’ in its quarterly stability review. That in itself requires one to pause and reflect.