Blue skies ahead for Sydney Airport?

Sydney Airport is Australia’s busiest airport. Its owner – Sydney Airport Holdings (ASX:SYD) – has profited from Australia’s growing attraction as a tourism destination, and the airport’s monopoly position. So what does the future hold for its key earnings drivers?

SYD has stable long-term returns leveraged to passenger traffic. It generates revenue in 4 primary ways:

- Aeronautical Services– the charge to airlines for use of terminal and airfield infrastructure on a per passenger basis. Charges are based on a commercial agreement with airlines, the largest of which is between the Board of Airline Representatives (BARA), which covers 32 member airlines including Qantas and Virgin. Large users like the latter also have separate agreements in place.

Aeronautical services represent approximately 50 per cent of total revenue. The aeronautical side is monitored by the ACCC under a ‘light-touch’ regulatory regime which is reviewed every 5 years by the Productivity Commission.

- Retail– SYD leases 244 stores and licenses advertising rights in and around its terminals, of which the International terminal T1 is accountable for more than 80 per cent of retail revenue. Lease agreements include a base rent component with revenue share post sales targets being met. Retail represents 23 per cent of total revenue.

- Property and car rental– SYD leases property sites and buildings spanning airport lounges, airline offices, freight facilities site hangars, hotels and car rental areas. The airport has over 650 operating leases with average occupancy of around 99 per cent. SYD also owns 2 hotels operating at the domestic airport (IBIS and Mantra). Property and car rental is 1 per cent of group revenue.

- Transportand Landside Operations– revenue generated from car-parking and fees charged to access landside areas. The airport has over 18,000 carparking bays with a roughly even split between international, domestic and at-distance. Transport and landside operations represents 11 per cent of total revenue.

Most of SYD’s commercial contracts and revenue is inflation-linked, which provides a natural hedge against rising interest rates (as higher interest rates are expected to be a function of higher inflation).

Simplistically speaking, the business can be split between a light-touch regulated infrastructure asset and a high-end shopping centre and commercial building / office space.

What is the outlook for SYD’s key earnings driver?

Now that we have established how the company generates revenue, it is important to understand the drivers of the revenue – for SYD, it is primarily growth in passenger numbers. Passenger growth is important given its direct linkage to aeronautical revenues and car-parking revenue, as well as increased demand for retail leases and property services.

SYD has previously disclosed international passengers generate approximately 3.5x the revenue of domestic passengers.

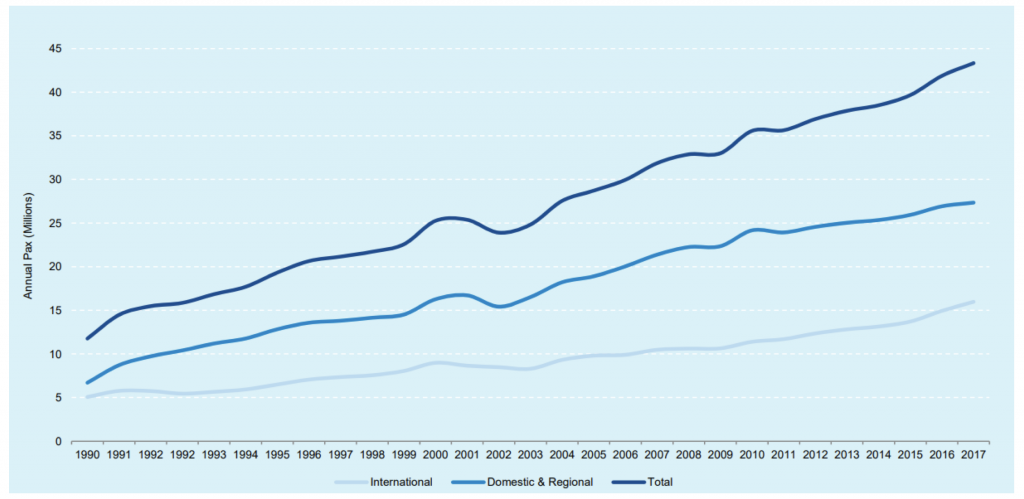

Sydney Airport Passenger Growth

Source: Company presentations

This chart was shown last week, which shows the longer-term trends in passenger numbers at Sydney Airport. The airport has benefited from strong structural tailwinds, which includes falling real airfares, growth in middle class incomes, increasing demand for international travel and Sydney’s increasing attractiveness as an international tourist destination – which augments overall population growth.

Domestic passenger numbers have also benefited from some of these structural trends but is more heavily influenced by local factors such as the economic outlook.

While passenger traffic is not immune to short-term fluctuations (such as the drop in 2001 due to the September 11 attacks), it would be safe to assume growth over the long-term given the above, as airlines continue to add services.

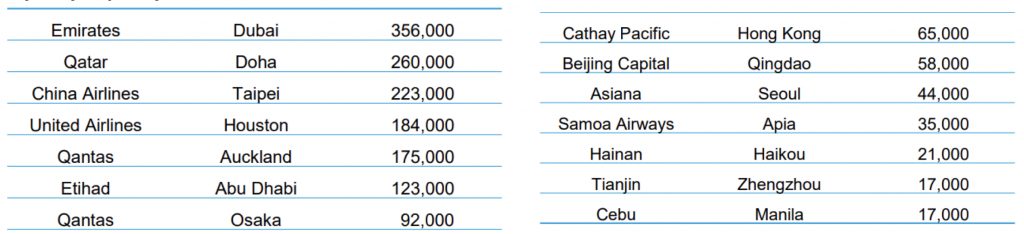

Sydney Capacity Additions in 2017-2018

Source: Company presentations, Montgomery

Capacity considerations

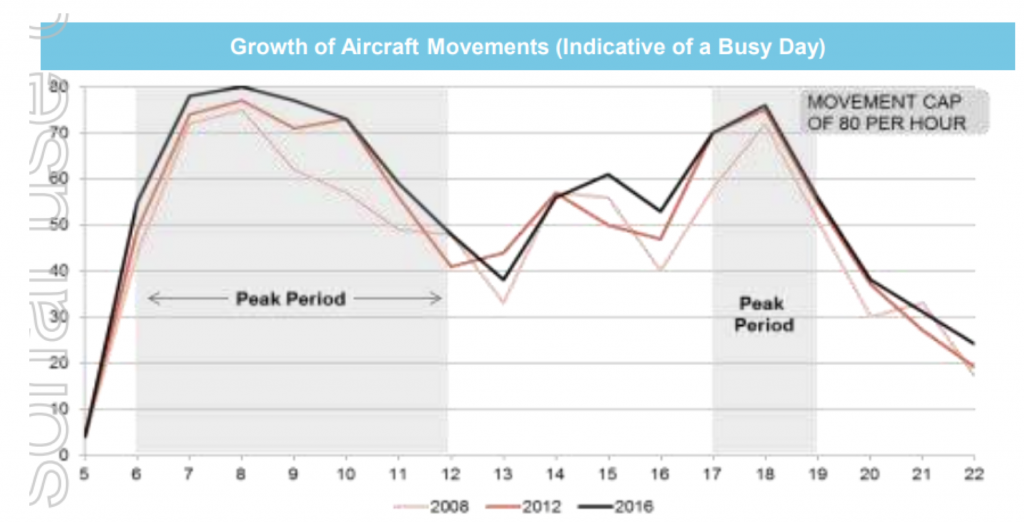

One aspect to consider when forming longer-term passenger estimates is the natural limit the airport has in terms of total Air Traffic Movements (ATM). Sydney Airport operates under legislated restrictions which restrict total passenger numbers including:

- Restriction in air traffic movements (ATM) to 80 per hour, or 20 per 15 minutes;

- A curfew operating between 11pm to 6am; and

- Regional ring-fencing whereby around 15-20 per cent of slots be available for regional flights.

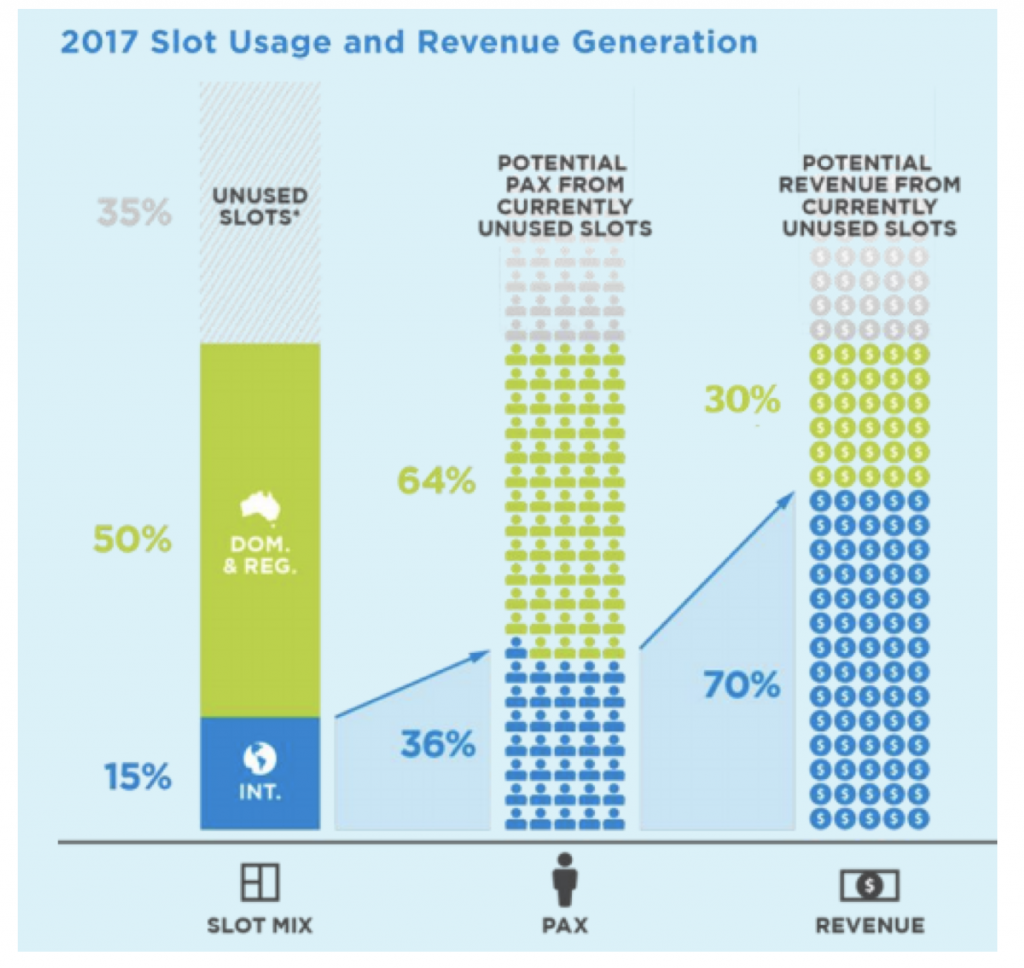

Source: Company presentations

Based on current ATMs, there remains significant headroom for additional flight movements and passenger growth, with Sydney’s estimated utilisation at 65 per cent. However, it is worth noting movements in peak hours are significantly higher and hit the regulated cap, so additional growth is more reliant on “up-gauging” (larger aircraft), “peak-spreading” (more movements in lower-peak hours) or an alleviation of movement restrictions.

Source: Company presentations

How will the introduction of a second airport impact Sydney?

In 2018, the Commonwealth Government approved the construction of Western Sydney Airport (WSA) at Badgerys Creek. Set to open in 2026, WSA will most likely divert some of Sydney Airport’s passenger traffic to WSA. As a new entrant to what has historically been a natural monopoly, Western Sydney Airport is posed as a potential longer-term risk for investors given the uncertain impact on Sydney Airport’s passenger growth.

While the overall impact is not immediately clear, studies of cities with multiple airports with separate owners has shown a level of increased competition in both pricing and attracting passengers. However, given the proximity of Sydney Airport to Sydney’s CBD vs WSA, it is unlikely there will be significant migration of premium international / domestic passengers to WSA. In fact, migration of lower yielding, low-cost carrier domestic passengers and an easing of Sydney’s regional slot requirement may improve profitability as Sydney Airport is close to capacity on peak slots already.

This blog is part of a multi-part analysis of SYD. For more of my analysis, watch my video here.

In the next part of my analysis, I will discuss Sydney’s regulatory regime and capital profile, and how this impacts Sydney’s earnings and dividend outlook. You can now find this part here.

This post was contributed by a representative of Montgomery Investment Management Pty Limited (AFSL No. 354564). The principal purpose of this post is to provide factual information and not provide financial product advice. Additionally, the information provided is not intended to provide any recommendation or opinion about any financial product. Any commentary and statements of opinion however may contain general advice only that is prepared without taking into account your personal objectives, financial circumstances or needs. Because of this, before acting on any of the information provided, you should always consider its appropriateness in light of your personal objectives, financial circumstances and needs and should consider seeking independent advice from a financial advisor if necessary before making any decisions. This post specifically excludes personal advice.

INVEST WITH MONTGOMERY