Big isn’t always beautiful

Index Fund investments are mirror images of the entire investing universe. For example, an Australian Shares Index Fund consists of about 200 or 300 investments in each of the largest companies on the ASX weighted by market capitalisation. People invest in Index Funds usually for two reasons. Firstly, simplicity. You do not have to choose particular investments as you own them all and secondly Index Funds, being passive investments, are inexpensive.

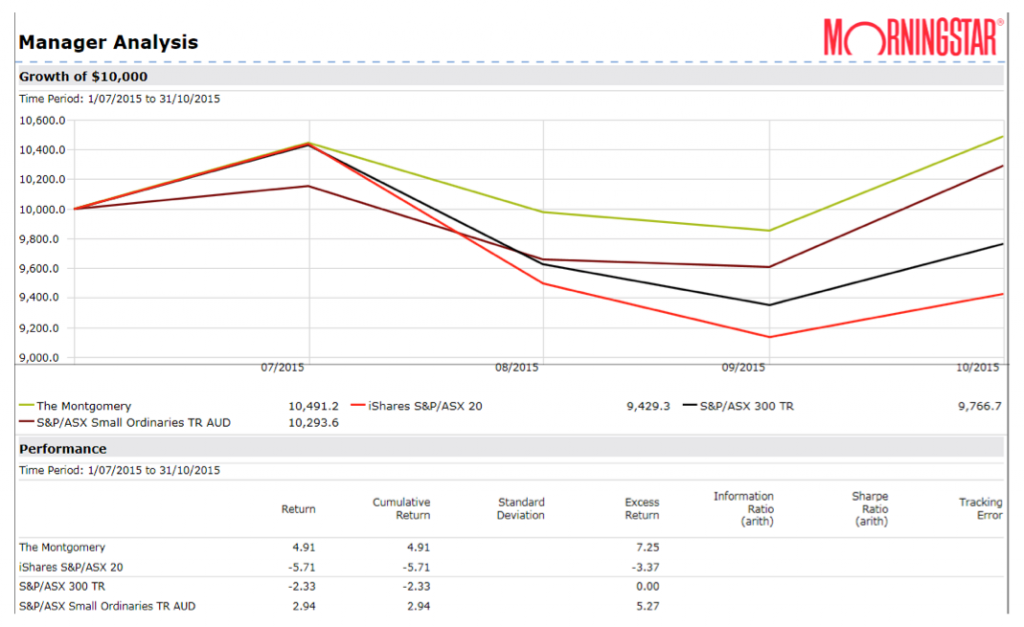

What has been interesting of late is the under-performance of the top 20 ASX listed companies (as represented by the iShares ETF S&P/ASX 20) relative to the broader market, being the S&P/ASX 300 TR Index. The top 20 companies on the ASX account for around 75 per cent to 80 per cent of the return of the index and since the 1st July 2015 to the end of October 2015 this part of the market has performed poorly, returning negative 5.71 per cent against the broader index of negative 2.33 per cent. This is probably not surprising given the large declines in some of the materials companies, some of the banks and the likes of Woolworths.

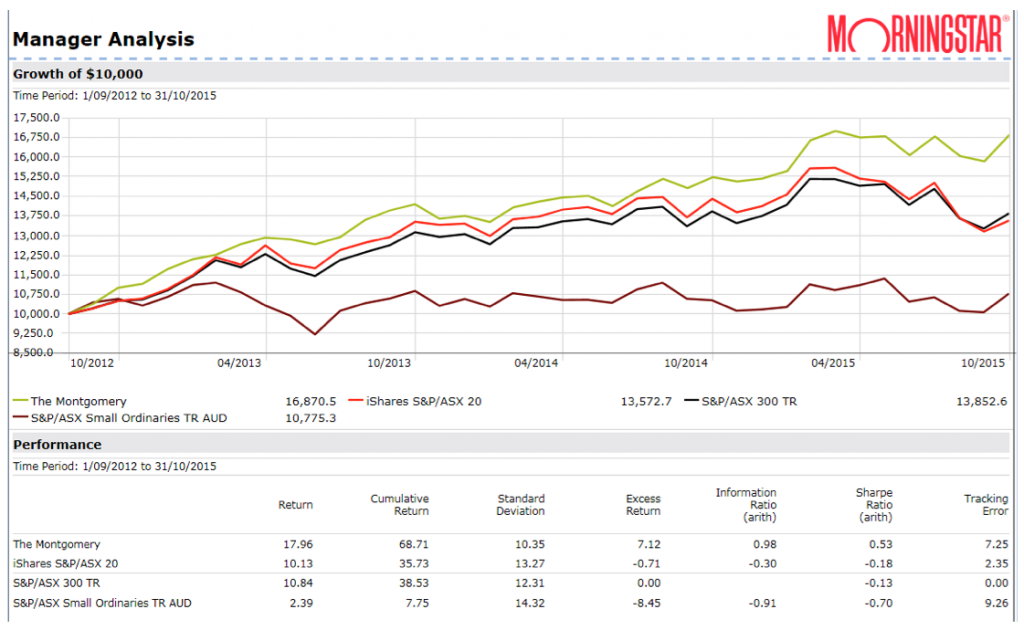

Montgomery does not consider many of the businesses that make up the top 20 as true “blue chips”. Why invest in companies just because they are big? Remember at Montgomery we only invest in businesses that are high quality, display bright prospects and where we can purchase them below our estimate of intrinsic value. Many of the companies in The Montgomery Fund (and the Montgomery [Private] Fund) are currently outside of the top 20 and the difference in performance can be seen more recently in Chart 1 and since inception (17/8/12) in Chart 2.

In summary, don’t be lulled into a false sense of security always thinking big is beautiful and please ensure every company held in your portfolio has an investment rationale. Don’t be afraid to look different to the pack.

Chart 2.

Scott Phillips is the Head of Distribution of Montgomery Investment Management. To invest with Montgomery domestically and globally, find out more.

Given the Montgomery team’s dislike of the banks in a number of videos, interviews and articles, I’m wondering how you reconcile that with your Australian Funds holding shares in a number of them?

There are three parts to the investment decision. Quality, Value and prospects. The valuation is based on quality and prospects. If something is cheap it is based on the other two factors having been considered.

Probably depends on your definition of ‘blue chip’. I would definitely include CBA and CSL (WBC? ANZ? MQG? TLS?) but probably not QBE.

Thanks Tim.

Sorry Roger scratch that comment please thought it was new fund..

Well done team glad i added to my investment. Hoping fund host will accept a emailed in form for Montaka if the original paperwork follows by a day

Hi Tony,

Feel free to give Fundhost a call and thanks for the encouraging words.

Hi Roger

Wouldn’t the Australian fund be a better comparison or example of how poorly the local market has performed

I find it interesting that an ASX 300 index fund comprises 47% in the financial sector with 5 of the top 10 holdings, this surely defies the intended purpose of an index fund being to diversify. For comparison a world ex-aus fund is under 20% financial sector.

Indeed Dan – we absolutely agree.

Interesting how winners and loses are supposedly picked eg what criteria are used to pick the future winners and losers?

And can that criteria be replicated?

I’d argue that disruption can make or break a business and there is no way to (accurately) forecast a disruptive event. This should be separate to fundamental business analysis.

Thanks for sharing your thoughts Roger.

Interested to know which of the ASX20 you do consider to be blue chips.

Hi Tim,

CSL, CBA, WBC, QBE. What are your thoughts?

Great points. Thinking about what is “blue chip” always reminds me of an article I read in an investor magazine around 2007 called something like “Investing Titans For Any Portfolio” that listed BHP, WOW, WOR, LEI, QBE and something else I can’t remember of hand. It was touting this lot as all weather performers that should be the core of any portfolio looking for good returns. I remember feeling pleased because I owned a couple of them. Fast forward to now and we know this mix has performed terribly for those unfortunate enough to have owned it since.

I laughed to open the paper from the same team on the weekend spruiking a new list of “Blue Chips” made up of highly priced infrastructure plays and healthcare companies. Mostly good businesses but certainly no bargains in there. Luckily I’ve learnt a few things since, but the herd mentality of the financial media rolls on unchanged, jumping on the bandwagon of the current hot stocks and extrapolating their returns into the future. I’ll look forward to reviewing their results again after the next crisis

Thanks for those comments Guy. It can be instructive to privately have a look at the track record of some of the big cap “all weather portfolio” suggestions. Thank your or the comment and taking the time to contribute.