BHP’s shale adventure – the reinvestment challenge of big resources

Recent press reports have suggested BHP (ASX:BHP) has been offered over US$10 billion for its US Onshore Oil and Gas assets from BP. For those who have followed the US onshore journey, you will already know it has not been a pretty one for the Big Australian.

A quick history lesson – BHP acquired its US Onshore assets – the Fayetteville gas acreage and Petrohawk’s oil and gas acreage for a combined US$20 billion in two transactions in 2011. Since then, it has also committed US$18 billion of capital to grow production, while generating US$9 billion EBITDA, a proxy for operating cash-flow. It has also led to $US10 billion of “non-cash” impairments, which excludes US$3 billion of goodwill from the acquisitions remaining on the balance sheet. Should a sale materialise at ~US$11 billion, BHP will have crystallised US$18 billion of losses over 7 years, more than the market capitalisation of every ASX-listed company outside of the top 15.

I view this acquisition as a great example of the challenge that a resources company may face during the cycle. Given the long lead-times associated with uncertain exploration outcomes, acquiring a development or producing asset remains the quickest and surest way to deploy “super” profits to replenish project portfolios and address finite resources (as we may have just seen with South 32’s proposed acquisition of Arizona Mining). It also tends to promote pro-cyclical behaviour – which leads to paying too much for assets, and in almost all cases without a potential cost synergy offset to soften the blow.

Consider in 2011, BHP generated US$30 billion in operating cash-flows, with surplus cash of US$14 billion. BHP was looking for a way to grow earnings, but with a limited number of attractive, large-scale opportunities in its undeveloped project portfolio, had difficulty in re-deploying large amounts of capital that would generate an acceptable return.

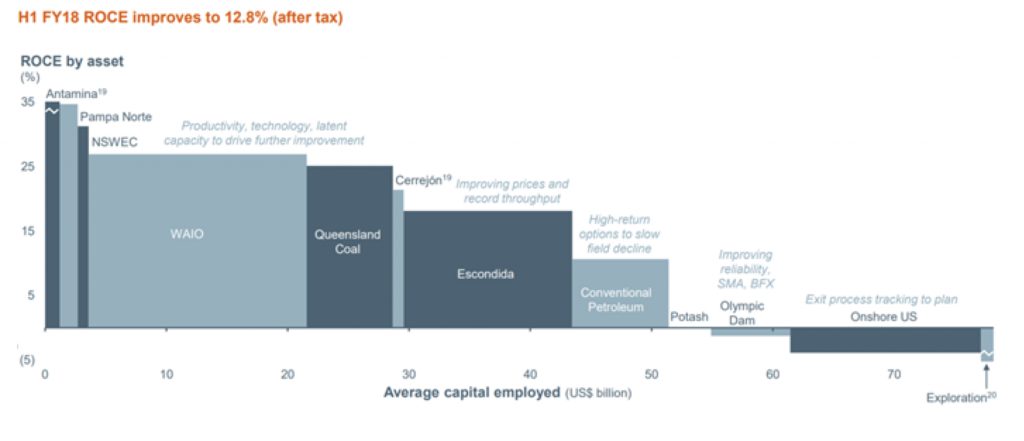

BHP Return on Capital Employed

The lack of suitable growth options is demonstrated by the fact that 7 years after the acquisition, BHP is still heavily reliant on its 3 core asset basins (Pilbara iron ore, Queensland coking coal, Escondida Copper) – assets that have been in production for over 25 years – to generate ~90 per cent of its returns on an EBIT basis (also noteworthy is Olympic Dam’s negative drag on this chart, which was acquired after a takeover battle with Xstrata in 2005).

US Onshore provided a perfect sink for capital given the assets’ unique ability to scale up development quickly provided there were enough drilling opportunities, without a discernible impact on its end market. Seven years – and a collapse in oil price later – has led to the development of a Capital Allocation framework to avoid the mistakes of the past.

A successful sale will likely be cheered by investors given the significant capital and time investment these assets have demanded over the past 8 years. Not only will it free over US$10 billion of invested capital from the balance sheet, it will also reduce future capital requirements of the group. BHP will be projected to be in a net cash position, while also improving its financial metrics including PE ratio, EV / EBITDA multiple and return on capital employed.

What I will be watching with interest is what BHP elects to do with the cash. The challenge in terms of a relatively bare project portfolio – especially in energy – has yet to be addressed by BHP. Management however have indicated the cash will go back to shareholders. How this cash is distributed – either in the form of a special dividend or a share buy-back – may provide some insight into the Board’s view of where we are in the current cycle and the relative value of BHP shares vs its other investment opportunities.

This post was contributed by a representative of Montgomery Investment Management Pty Limited (AFSL No. 354564). The principal purpose of this post is to provide factual information and not provide financial product advice. Additionally, the information provided is not intended to provide any recommendation or opinion about any financial product. Any commentary and statements of opinion however may contain general advice only that is prepared without taking into account your personal objectives, financial circumstances or needs. Because of this, before acting on any of the information provided, you should always consider its appropriateness in light of your personal objectives, financial circumstances and needs and should consider seeking independent advice from a financial advisor if necessary before making any decisions. This post specifically excludes personal advice.

INVEST WITH MONTGOMERY

peter s

:

Nice first post Joseph. From my layman view you’ve taken a somewhat complex story and distilled it down to make your point clear.

The scenario you’ve layed out above is seemingly repeated very often. The Alcan aquisition by RIO comes to mind as another example. How on earth does this keep happening though? We are so often told how these CEO’s talent is worth the exorbitant salaries yet their careers are so often replete with failures, and obvious ones at that. Along with these aquisitions at the top of the market so many companies are always taking on too much debt. A story that is repeated again and again.

The only example to the contrary would seem to be Peter Coleman at Woodside who had the discipline to maintain low debt and avoid expensive projects at the peak of the market.

Joseph Kim

:

Hi Peter,

Unfortunately this does seem to happen over and over again – a lot of the time it’s usually down to the incentives of management not being properly aligned to long-term shareholder outcomes. Sometimes they feel pressure from the shareholders of the day to act, like with activist shareholder Elliot’s recent proposal to BHP to conduct rolling buybacks with no regard for where we are in the cycle.

Personally I feel Peter Coleman may have paid more than necessary for the acquisition of Wheatstone 3 years ago, but clearly this purchase was of much smaller relative scale compared to BHP onshore or Rio’s Alcan buy.