Baby got back

I recently discussed the fantasy world that some seem to be living in believing that a recovery will be easy and quick rather than slow and halting. We are in a recession and recessions rarely last six months, and finally, employment prospects in hospitality, retail and construction have deteriorated to such an extent that there will be fewer jobs for people to come back to when their jobseeker payments return to ‘normal’ and Jobkeeper payments cease later this year.

For all these reasons the V-shape being carved out in the expectations of investors is becoming increasingly difficult to believe.

One hope being pointed to by the ‘V-shapers’ is that the US Federal Reserve has their back. The announcement by the US Fed that it would, for the first time, buy corporate bonds – and junk bonds at that – certainly moved the goal posts. A quick history lesson is warranted here.

Cast your mind back twelve or so years and you might remember CDO’s. They were structured credit products, purchased by local councils and university endowments, offering higher yields than available elsewhere. Even though they were full of dodgy subprime mortgages, many were given AAA ratings. Remember those? They basically brought down the entire world financial system.

Following the GFC, ultra-low interest rates, QE and the trend for stock buybacks, resulted in a massive issuance of what are known as leveraged loans. A leveraged loan is a loan that is extended to companies that already have considerable amounts of debt or a poor credit history. Hmmm tasty. Heck, why not? Let’s go for it, don’t you think?

No, you don’t think!

The GFC was all about dodgy mortgages of US$700,000 being extended to Mexican strawberry pickers who were earnings US$14,00 per year. Leveraged loans are similar, they are all about billions being extended to companies that earn zero dollars per year. Nice! How long do you reckon that will last?

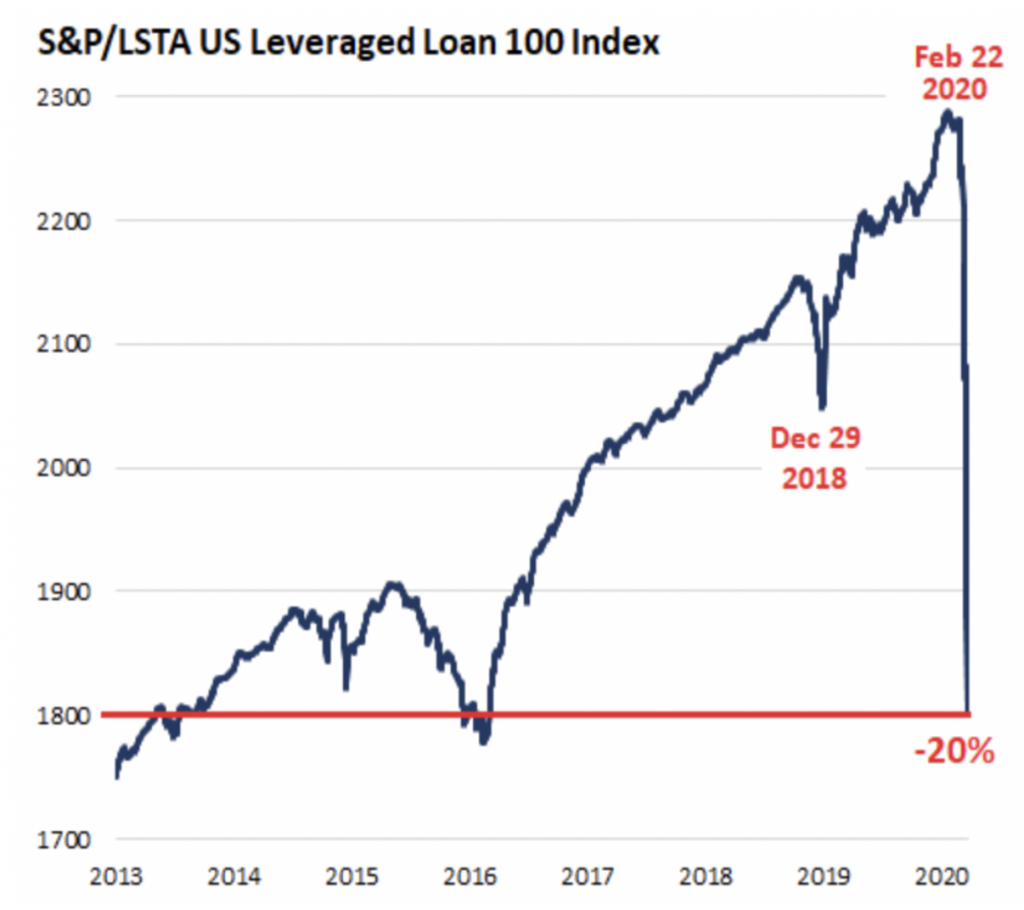

It lasted more than a decade. But it collapsed on March 23. See Figure 1.

Figure 1. The market for people buying highly leveraged loans

According to some estimates, the biggest “owner” of these leveraged loans are CLOs. A Collateralised Loan Obligation is a securitised pool of debt. The debts are Leveraged Loans – corporate loans that have a low credit rating or leveraged buyouts made by a private equity firms to take a controlling interest in an existing company.

According to some analysts at March more than a ¼ of the loans within CLOs had been downgraded and more than an additional 1000 tranches of loans within CLOs were under review for a potential downgrading.

Eventually and inevitably the market went into meltdown but a cascading domino infection or contagion back down the risk curve towards AAA rated securities was, at least temporarily, avoided when the Fed stepped in to offer to buy this rubbish.

Yeay!

Now the market can get on with taking risk again because the Fed will buy it from you if you end up getting what you deserve.

The thing that investors have forgotten again is that when the Federal Reserve buys junk bonds, it is making the debt cheaper for already weak companies but it isn’t putting revenue in their bank accounts. It isn’t bringing customers to them and it isn’t bringing the unemployed out of unemployment because those low-grade, high risk companies are unlikely to employ more people. Indeed, the headlines reveal they are sacking people by the thousands. Think Uber, WeWork and others.

Buying these bonds does not save the businesses from bankruptcy if revenue declines. It only gives them cheap debt. The Fed may have your back but the support is spineless.

Roger this article is really concerning and shows that you are really thinking deeply about the big picture at the moment. When the letters ‘CLO’ is used its does resonate with the term ‘CDO’ and hence sets off an alarm bell. I think it would be good for you to voice your concerns and the mechanisms involved using some concrete examples – like the Mexican strawberry pickers in the case of CDOs as this explanation is fairly abstract at the moment. I, for one, would also be interested in how you have come to this position. What you are arguing does some a little different than what Michael Burry has of late been arguing with his concerns about the proliferation of ETFs though maybe there is a link here?

Hey John we have previously written about ETF dangers here quite a bit (just type ETF into teh search bar on the home page). Here’s a quick summary from tonight’s webinar for The Montgomery Fund investors at 6pm:

1) Post GFC we had ultra-low interest rates and massive central bank liquidity. Combined with a trend for stock buybacks, it resulted in massive issuance of leveraged loans (leverage loans are simply loans to companies that have really poor credit).

2) The biggest “owner” (60%) of leveraged loans is CLOs (like CDO’s in the mortgage market = another form of structured credit, collateralised loan obligations)

3) As at March more than a ¼ of the loans within CLOs had been downgraded and more than 1000 tranches of loans within CLOs were under review for a potential downgrading

4) A meltdown in US leveraged loans and junk bonds occurred on March 23rd (the S&P/LSTA Leveraged Loan 100 Index fell from 2300 index points to 1800, wiping out all the gains since the year 2013).

5) A contagion/domino-like disaster in the financial system was averted when the Fed saw the collapse and announced it would buy corporate bonds and even sub investment grade corporate bonds.

6) Yay. happy days. We are saved. Nothing to see here.