Australia’s most successful resource service company

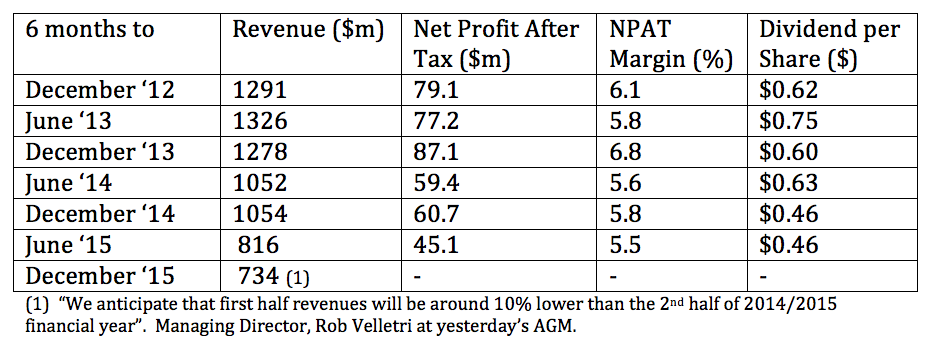

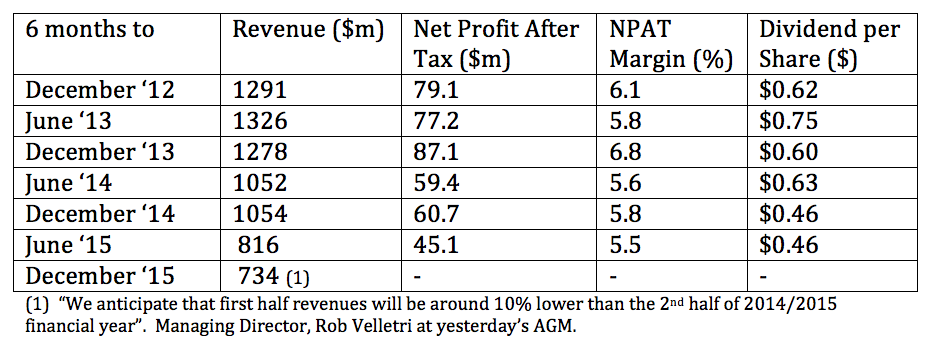

Australia’s most successful Resource service company, Monadelphous Group Limited (ASX: MND), has seen its share price decline by 75 per cent from $28.50 in February 2013 to the current $6.80.

At their Annual General Meeting yesterday, the Company described the outlook as “challenging” with surplus capacity and a focus by customers on operating costs and productivity of existing assets.

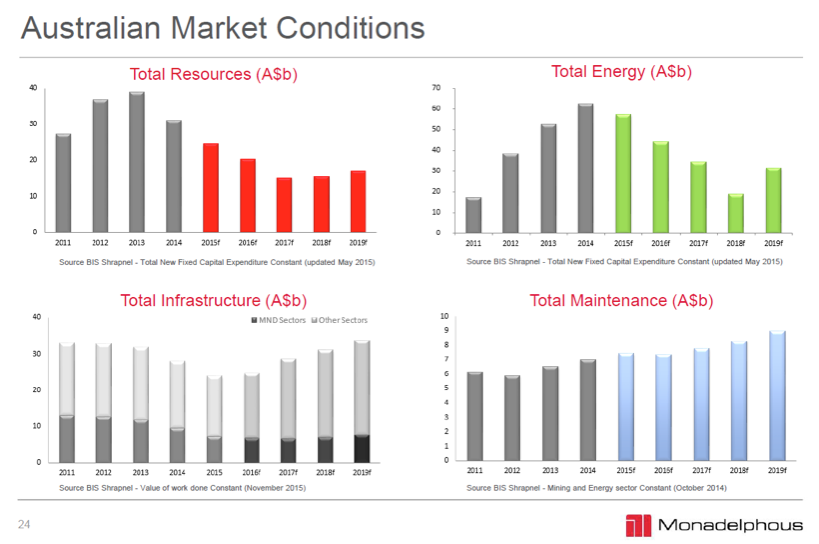

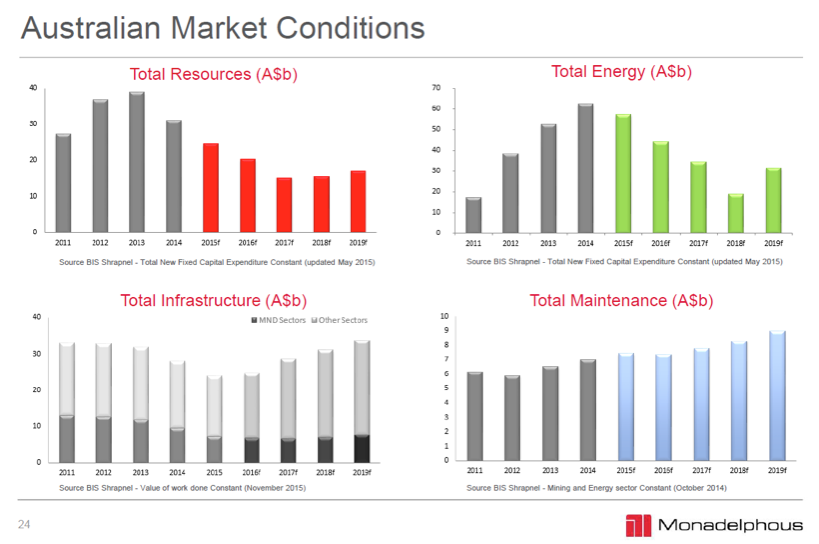

The graphs below paint a worrisome picture, with the Resource spend expected to decline over the next two years, and the Energy spend expected to decline over the next three years. While there are signs of life within Infrastructure (and Maintenance), if we aggregate the first three categories, then total spend is expected to decline from around $120 billion in 2014 to $105 billion in 2015 to $65 billion in 2018.

This is expected to manifest itself in Monadelphous paying significantly lower dividends over the foreseeable future; and a warning to investors to only pursue “yield plays” when a particular company’s underlying earnings are rising sustainably.

This is expected to manifest itself in Monadelphous paying significantly lower dividends over the foreseeable future; and a warning to investors to only pursue “yield plays” when a particular company’s underlying earnings are rising sustainably. To learn more about our domestic and global funds, please click here, or contact me, David Buckland, on 02 8046 5000 or at dbuckland@montinvest.com.

To learn more about our domestic and global funds, please click here, or contact me, David Buckland, on 02 8046 5000 or at dbuckland@montinvest.com.

MORE BY DavidINVEST WITH MONTGOMERY

Chief Executive Officer of Montgomery Investment Management, David Buckland has over 40 years of industry experience.

David is a deeply knowledgeable and highly experienced financial services executive. Prior to joining Montgomery in 2012, David was CEO and Executive Director of Hunter Hall for 11 years, as well as a Director at JP Morgan in Sydney and London for eight years.

This post was contributed by a representative of Montgomery Investment Management Pty Limited (AFSL No. 354564). The principal purpose of this post is to provide factual information and not provide financial product advice. Additionally, the information provided is not intended to provide any recommendation or opinion about any financial product. Any commentary and statements of opinion however may contain general advice only that is prepared without taking into account your personal objectives, financial circumstances or needs. Because of this, before acting on any of the information provided, you should always consider its appropriateness in light of your personal objectives, financial circumstances and needs and should consider seeking independent advice from a financial advisor if necessary before making any decisions. This post specifically excludes personal advice.

This is expected to manifest itself in Monadelphous paying significantly lower dividends over the foreseeable future; and a warning to investors to only pursue “yield plays” when a particular company’s underlying earnings are rising sustainably.

This is expected to manifest itself in Monadelphous paying significantly lower dividends over the foreseeable future; and a warning to investors to only pursue “yield plays” when a particular company’s underlying earnings are rising sustainably. To learn more about our domestic and global funds, please click here, or contact me, David Buckland, on 02 8046 5000 or at dbuckland@montinvest.com.

To learn more about our domestic and global funds, please click here, or contact me, David Buckland, on 02 8046 5000 or at dbuckland@montinvest.com.

Is that right David?

Does that actually mean ‘they’ are say DON’T invest in our company?