Australian loan growth continues to flatline

Reporting season is coming up for our major banks, and recent data provided by the Australian Government regulators shows that it may be a bumpy ride ahead.

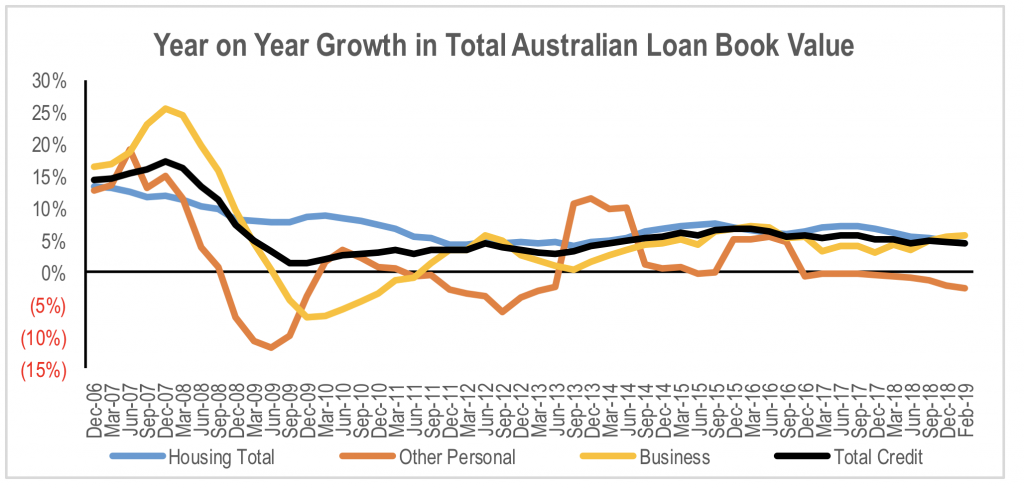

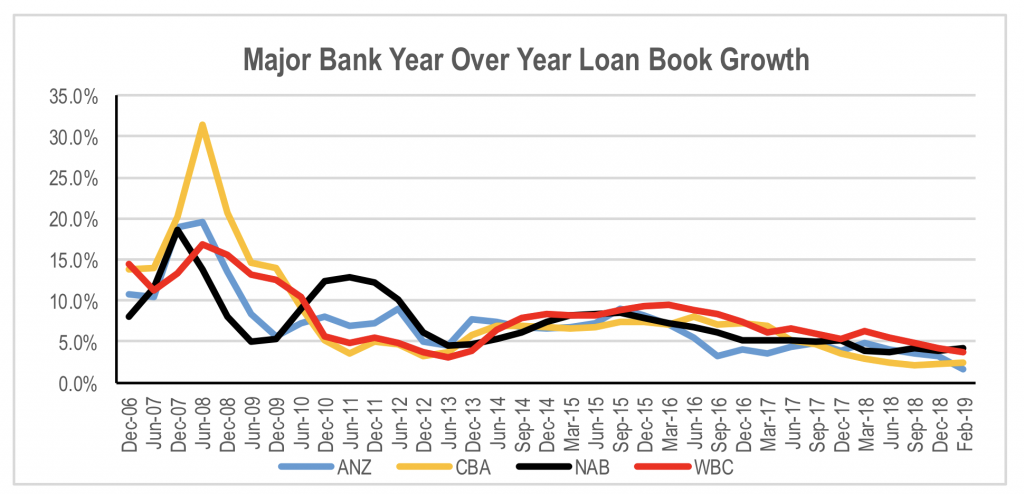

Overall market loan book growth has continued to gradually slow over the last 6 months according to RBA credit aggregates data as at the end of February. This is due to the tightening of credit approvals, weak residential property markets, weak wages growth and already stretched household balance sheets.

Source: RBA

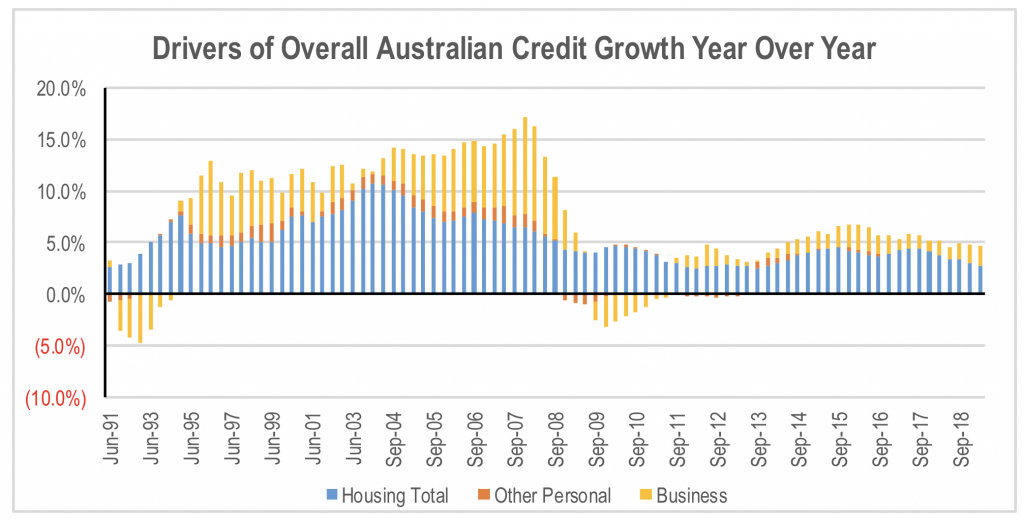

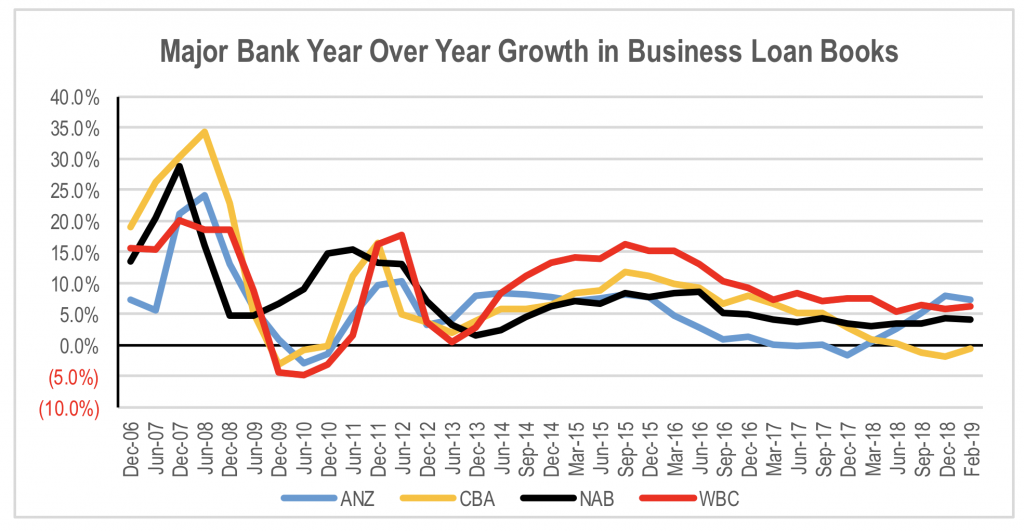

Business lending growth has held up better than mortgage loan book growth. In terms of the contribution to overall system loan book growth, mortgages have fallen, with an acceleration in business lending growth acting as a partial offset. This should favour National Australia Bank (ASX:NAB) and Australian and New Zealand Banking Corp (ASX:ANZ), given they are relatively more exposed to business lending than the Commonwealth Bank of Australia (ASX:CBA) and Westpac (ASX:WBC).

Source: RBA

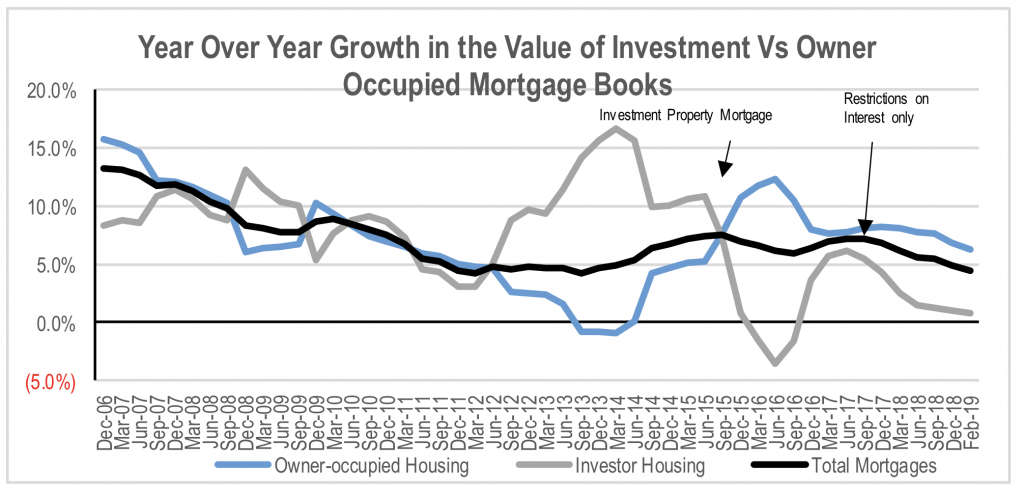

While the main source of mortgage book growth weakness had been lending on investment properties, the data is now showing a slowing of loan book growth for owner occupied mortgages.

Source: RBA

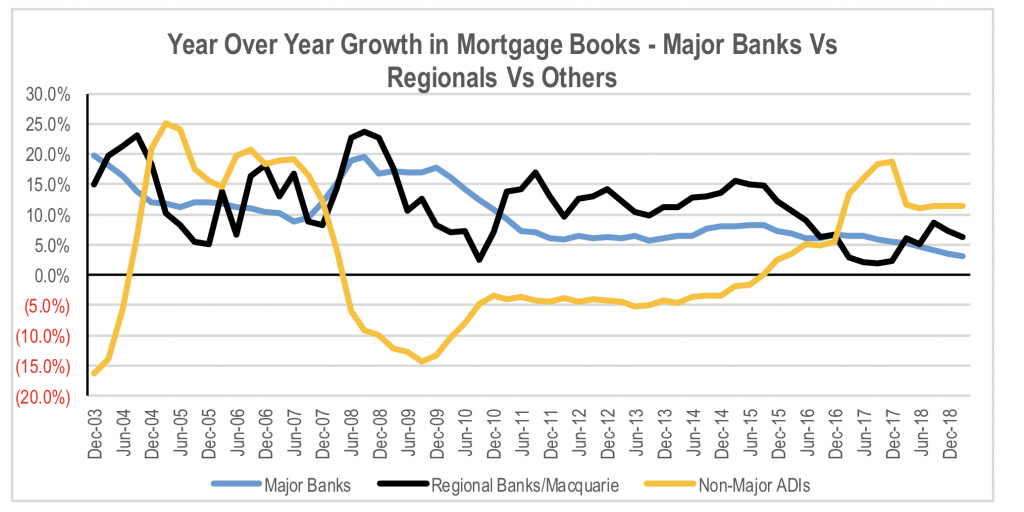

Within the mortgage market, the smaller lenders are continuing to gain share at the expense of the big 4, while the performance of the larger regionals and Macquarie has improved over the last two years. This is mainly due to strong growth for Macquarie, while two of the three large regions are seeing no mortgage book growth. Bendigo & Adelaide bank is growing its book above system rates.

Source: RBA, APRA

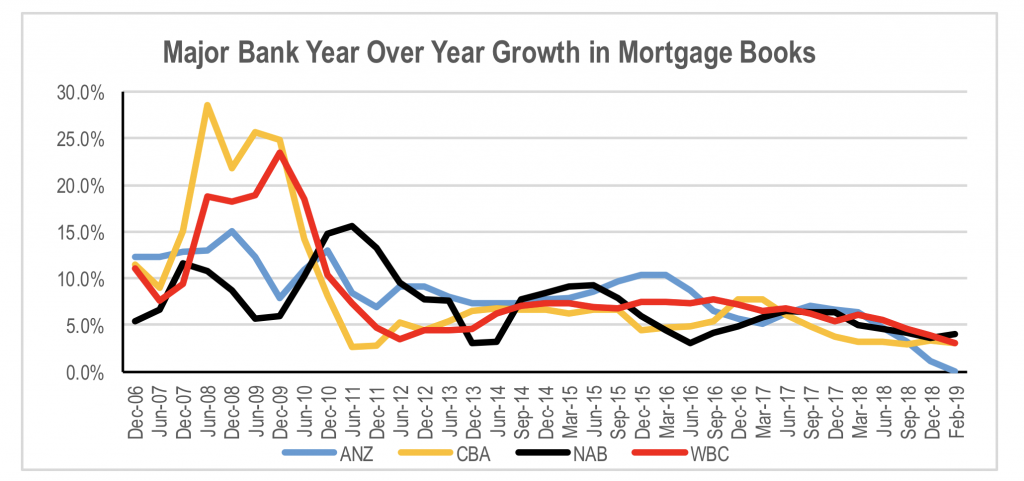

Among the major banks, ANZ has seen the most significant reduction in the growth of its mortgage book. Whether this is due to a conscious decision to reduce its exposure to residential mortgages due to perceived system risk, or if it is a consequence of its high reliance on mortgage brokers for originations relative to the other majors is unknown at this stage. But this will act as a drag on net interest revenue growth.

Source: APRA

Interestingly, ANZ is showing the strongest business loan book growth of the majors, while CBA’s growth is negligible. This would suggest that ANZ’s weak mortgage book growth is more likely to be a shift in risk preference toward business lending. For CBA, the weak growth in its overall business loan book is likely to be the result of a continued rationalisation of its institutional lending book. Given this is generally lower margin lending, the upcoming results could show a positive impact on net interest margin from mix, offsetting the soft loan book growth.

Source: APRA

When the data is combined, both CBA and ANZ are showing the greatest fall in loan book growth as at February relative to the same time last year.

Source: APRA

The Montgomery Funds own shares in Westpac and National Australia Bank. This article was prepared 16 April with the information we have today, and our view may change. It does not constitute formal advice or professional investment advice. If you wish to trade these companies you should seek financial advice.

This post was contributed by a representative of Montgomery Investment Management Pty Limited (AFSL No. 354564). The principal purpose of this post is to provide factual information and not provide financial product advice. Additionally, the information provided is not intended to provide any recommendation or opinion about any financial product. Any commentary and statements of opinion however may contain general advice only that is prepared without taking into account your personal objectives, financial circumstances or needs. Because of this, before acting on any of the information provided, you should always consider its appropriateness in light of your personal objectives, financial circumstances and needs and should consider seeking independent advice from a financial advisor if necessary before making any decisions. This post specifically excludes personal advice.

INVEST WITH MONTGOMERY

Any insights into the metrics of the business loans being written in comparison to mortgage lending? i.e could it be out of the frying pan and into the fire for banks should companies see recessionary pressures and/or interest rate shocks in the near term?

To my mind corporate debt be it in the form of rated bonds or straight lending seems to be one of the bigger risks on the horizon….

Hi Dane, Risks around credit losses are greater for business lending than mortgages and hence pose a greater risk for the banks in a recession. This is reflected in the higher risk weights applied by APRA in determining the amount equity capital required by a bank. Arguably, a recession is likely to see mortgage delinquencies and defaults rise more than in previous recessions given the concentration of risk and historically high level of household debt at present, whereas businesses are arguably less geared than households. However, in absolute terms, defaults would be higher as a percentage of business loan balances than mortgage balances. People generally prioritise repayments on their mortgages over other debts, and therefore this is the last thing they default on. The other area of risk is unsecured consumer lending, which tends to have relatively high default rates in recessions. Loan book balances in this area have been falling in recent years as consumers have moved toward newer products from non-banks like AfterPay. But when assessing these risks, we need to do it in the context of what the probability of recession is in the short to medium term. While we view the risk as being elevated at present, it is not a certainty.