Australia – on the precipice? (part two)

Part two of a two part series on the demise of Australia

Last week, we began our ‘Australia on the Precipice’ series and argued that our nation’s future looked bleaker than many were currently anticipating. Since then the stock market has slumped as has the Australian dollar and the RBA capitulated to growing economic headwinds and lowered Australia’s benchmark rate to 2.75%—an all-time low. Keep in mind all of this can turn around in an instant, rendering us completely wrong!

Since the IMF announced that it would begin reporting foreign reserves of the Australian dollar a month ago, the currency has collapsed by circa 8%—trading below parity for the first time in ten months. With government tax receipts falling well short of expectations, Australia now faces years of budget deficits and more pressure on its current account—heaping additional pressure on the domestic currency that has weakened as expectations for Chinese growth have waned.

The government and media focus on this year’s budget disturbed me. Once again the short term, job securing, finger pointing and point scoring highlighted the entrenched lack of long-term planning this country has endured, and from which it will soon suffer even more.

JFK once quipped, “a rising tide lifts all boats”. When it comes to investing, the quote implies that we shouldn’t mistake a rising market for investing genius.

The implication is the same when it comes to Australia’s economic management and the credentials of our governing politicians.

Australia’s economy experienced a ‘rising tide’ following the GFC, as a boom in Chinese infrastructure construction (subsequently debt-funded) fuelled demand for steel at such an unprecedented rate that the price of iron ore, which had languished between US$10/mt and US$20/mt for twenty years or more until 2004, rallied to over US$180/mt by 2011.

Sir John Templeton famously observed that the four most dangerous words in investing are “this time is different”.

It is human to suffer from what cognitive psychologists call ‘representativeness’ – the tendency to assume that the future will forever resemble the recent past. And our politicians are no different. They are no better at picking turning points than anyone else, and in their wildly optimistic budgets and forecasting they did indeed believe that this time was different.

Claims of superior economic management inevitably followed but often any federal budget surplus was not materially more than the combined annual tax receipts of our big mining companies in that year. ‘Sound economic management’ – or a ‘rising tide’?

Tides eventually recede, and populations can awaken to find that king tides have left a wave of destruction. The resource boom was a king tide that many believed would endure. It has now come to a crashing end. And that brings us to Warren Buffett’s well-known quote, “It’s only when the tide goes out that we see who was swimming naked”.

Economic mismanagement, including tacit permission for monopolies and duopolies to form in our grocery sector; stupid, blind and technocratic adoption of economic theories like ‘level playing fields’ in our agriculture, textiles and other manufacturing sectors; the blind faith in the benefits of lower consumer prices; and the defense of high salaries, will now come home to roost on our shores.

With the mining boom over – something that we have been warning investors about frequently for almost two years – Australia sits on the precipice.

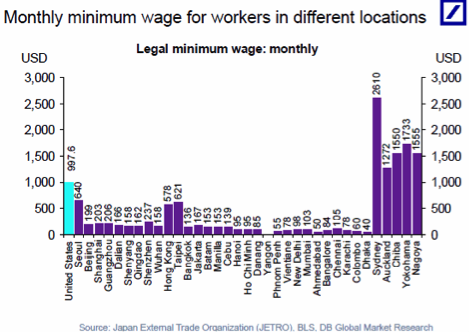

Take a look at the following chart produced by Deutsche Bank, which reveals the legal monthly minimum wages for cities around the world. Yes, the very large spike is Sydney.

If this is the minimum you can be sure the average is even higher. Wages in Australia are unjustifiably higher than the rest of the world. What special skills do we have that nobody else in the world has? What unique benefits do we bring that warrant salaries so much higher than the rest of the world? And what special skills do our politicians have that make them believe that this imbalance can be sustained, while keeping Australia competitive in a post-resource-boom world? No wonder foreign hedge funds are shorting the Australian dollar.

Notwithstanding the obvious fact that we can’t keep requiring our businesses to deliver ever-lower prices to consumers, while simultaneously paying the world’s highest salaries, and expect them to survive, it is essential that the government starts looking at ways to encourage the economy and the markets to identify new industries that can support millions of employees. Once discovered, the tax reins need to be let go to ensure sufficient scale can be built.

The government doesn’t have such a great track record at picking winners so their role should be broad tax and policy reforms that encourage the market and economy to identify successful new industries.

In an increasingly competitive world, our high salaries are a chain around the ankle of business, preventing scale and the employment of more people. The longer it takes for our businesses to develop scale, brand recognition, share of mind and competitive advantages, the bigger the head-start we give global competitors.

Add the internet to the mix, and if we cannot deliver superior products and services, or competitive prices, there’s someone not that far away that will. Rising levels of the permanently unemployed will ensue and increasing numbers of Australians will have no choice but to purchase products and services from cheaper overseas suppliers, with Woolies and Coles happily clipping the ticket and paying overseas-returning execs millions of dollars in gratitude.

To find out more about Montgomery Investment Management and its two investment funds, please click here.

Kelvin Ng

:

Hi Roger, PIMCO is confirming everything you’re saying:

http://www.pimco.com/EN/Insights/Pages/Filling-the-Hole-We-Have-Dug.aspx

Kind regards,

Kelvin

Rajnay Padarath

:

I was interested to read your comments regarding George Soros and reported shorting of the Australian dollar. Does Montgomery Investment Management short currency in it’s funds, either directly or through ETF’s matched against major currencies such as the US Dollar (for example, Betashares: USD)?

Roger Montgomery

:

Hi Rajnay,

I’d be interested in your thoughts about it. What would you think if we didn’t and would you think if we did?

Rajnay Padarath

:

Hi Roger,

I would guess that indirect exposure through an ETF wouldn’t make sense since you’d be a fund manager paying a fund manager.

Direct investment through holding the currency I believe would be a valid way of acting on your teams overall thematic views that are expressed in this two part series, in that you eliminate one stage of a screening process that requires identifying a quality business trading at a discount that benefits from a falling AUD and instead simply invest in the more ‘pure’ currency theme.

However, from a fairly basic understanding of financial markets foreign exchange is obviously inherently risky and I confess to not being aware of your funds specific investment rules.

Andrew Legget

:

I think what you have been mentioning are the specific symptoms of the major problem. As a country, we do not know where we want to be in the future. We have attached ourselves to resources and agriculture and held on for dear life. Unfortunatley that bandwagon is about to hit the brick wall and come to a stop.

Only once we know where we want to be can we try and do what we need to to get there and i still don’t think we know the final decision. In fact i get the feeling that certain politicians believe this will still be mining.

If you were to ask me what type of skills a person will need to be attractive to employers in the australian of tomorrow i couldn’t tell you.

This is a leadership issue happening at a time where there is little leadership.

We need to work out what type of businesses we want to attract to our shores to help sustain growth (technology would be at the top of my list) and what we can do to set up an environment that is attractive for these companies (tax breaks, special business zones etc).

I have other thoughts on some issues that i have with the Australian economy and the incentives at play that are influencing business decisions but i might have to research this a bit further before sharing.

Peter Silbert

:

Roger

A great set of articles that should make us think where we put our investment dollar. With the Aussie likely to devalue by another 10-15% over the next few years, overseas investments look attractive, either directly or presumably with careful selection of companies that earn a significant amount of their income either directly or indirectly from overseas (in areas other than iron ore !)

Miguel Schmiddy

:

I would please like to see the graph modified to include more cities that would provide a more realistic comparison of minimum monthly wages. Additionally, the other piece of information missing is the %’age of people actually on that minimum wage. Neither myself, nor any of my friends are on minimum wage, so I wonder how useful that chart actually is… This script has so many plot holes, you can drive a bus through them…

Roger Montgomery

:

The wonderful thing about investing and markets is that buses regularly come through, crashing slow motion train wrecks too. I think we don’t need to argue whether Australia is number 1 or 2 or 3 or 4, the point is self evident. Australia is uncompetitive, just ask Ford – who will not be making cars in Australia, or buses for that matter.

xiao fang xu

:

http://www.youtube.com/watch?v=sA0WDoTtTT8#!

watch this first.

JasonLWalsh

:

How does Montgomery Investment expect to make good returns into the next decade if the future is as bleak as this? Jason.

Roger Montgomery

:

Hi Jason,

There are businesses in health care and telecommunications, for example, that may be less affected. Keep in mind a sustained lower Australian dollar could really help.

Globalpao

:

Great to see the discussion on long term need for Australia, and realization of current crux. MSM too often avoids the topic and the rise of the popularity of both your refreshing commentary and the folks over at macrobusiness (who have been calling this for some time) is evident of the void.

I would argue however that high wages need to be discussed within the context of other huge irregularities with the ROW. Wages cannot be attacked when coffee is $5 a cup and a FHB needs over $100k deposit (to avoid LMI) for a 1960’s red brick walk-up unit still 1hr from the CBD (I am from Sydney). See Deutsche’s own Big Mac Index, The Economist ranking of overvalued housing markets etc…

Originally from a property background, I am biased in viewing these irregularities through that lens, I cannot help but see that Mr/Mrs Coffee shop owner charges $5 because the rent is so elevated and locked into 4% annual increases for the next 5 years. This rent being so high, due to the demand for return from the large capital outlay of the investor. Sure if wages were lower then two staff could be hired for $10/hour each instead of $20/hr for one. However, how are these two staff members ever going to pursue their own entrepreneurial ambitions without adequate surplus?

I guess my point is that both sides of the coin need to be viewed, elevated asset prices are just as crucial to competitiveness, and form major barriers to entry. Shelter is a basic human right, and when affordability is so stretched at present for the next generation of entrepreneurs (looking at a longer time frame than saying affordability is the best in e.g. 5 years), that provides a massive barrier to risk-taking.

The political risk of creating affordability (if wages are already elevated, only option being lower house prices through increased supply) is so high that no one dares. While we talk of the need for the next generation of nation builders to accept lower wages moving forward, perhaps a little sacrifice from those who have benefited from the massive boom in asset prices over the past 30 years and large scale greater fool theatrics will be in order too.

Roger Montgomery

:

These are excellent points. The idea that inflating asset prices is a net positive due to the “wealth effect” should indeed be questioned.

Tim S

:

I agree with you on this. The question of why everything in Australia is so expensive vs the rest of the world generally ignores our over-priced real estate (commercial and residential).

Despite the high prices, I don’t see our discretionary retailers making huge profits. Our retail centres are owned by a handful of owners, and they are able to charge dearly for space at their malls. In the next few years, rents will need to come down.

Separately, in order to be able to afford to live in such expensive residential real estate, minimum wages need to be high (or is the cause and effect reversed?).

Either way: high cost labour + high cost rents = expensive goods

Roger Montgomery

:

Spot on Tim!

Jason

:

I’ve been saying something similar for a while now. With the rise of globalisation and the internet the incomes will become much closer around the world. Sadly that means Australia’s wages will have to decrease to be competitive with the global market. As you said, high wages and low consumer prices will not be sustainable.

Steve Baron

:

To me the warning signs were the price of fish n chips. $40 worth in Australia and here in NZ I could get the same for $20 and much better quality in NZ!

The big question is will good stocks like FLT hold their value or be sucked out to sea when the plug is pulled right out of the bath? How big will the drop be and for how long? As Roger always says, timing the market is always difficult.

Roger Montgomery

:

I like the idea of a fish’n’chip index. Sadly not as universally useable as the Big M’ index.

Paul Audcent

:

Before I retired eight years ago I was working for a number of manufacturers in OZ and NZ. What a sad state of affairs we find ourselves in now. What on earth has OZ got that the world at large needs. Sometime ago I invested in Lynas lets hope it rare earth they need!

james.benjamin3

:

Sifting through the noise that has surrounded global economic activity in general and the financial response to the GFC in particular, it is clear that the path to global solvency is through the real value of debt declining (or to put it another way, lower global currencies – the ‘reflation trade’). This is made problematic due to the extremely high levels of sovereign debt that have been issued keeping the expansion going since the severe recessions of the 1980s. The A$ is the least ugly of the lot and the unlikely beneficiary of a monetary crisis that has no comparison since the collapse of Bretton Woods in the 1970s. Throw in demographic headwinds and it seems clear that the problems identified above are not unique to Australia, but indeed portend a catastrophic crisis in our financial system.

Roger!! Typo…”nation’s future”.

Roger Montgomery

:

Thanks James…for the heads-up too.