Austal is a great story, but we are giving it a wide berth

Despite the impending closure of the Australian automotive manufacturing industry, not all is doom and gloom for local manufacturers. Take Austal (ASX: ASB), for example. This Perth-based shipbuilder has expanded significantly since starting in 1988, and today has operations in Perth, the US and the Philippines.

Austal specialises in manufacturing aluminium-hulled vessels, primarily for the military and commercial markets and is the leading manufacturer in its sector. The company has designed and constructed over 255 vessels for over 100 operators in 44 countries.

Montgomery does not have a position in Austal but we decided to take a closer look as it screens reasonably favourable on a couple of valuation and quant metrics.

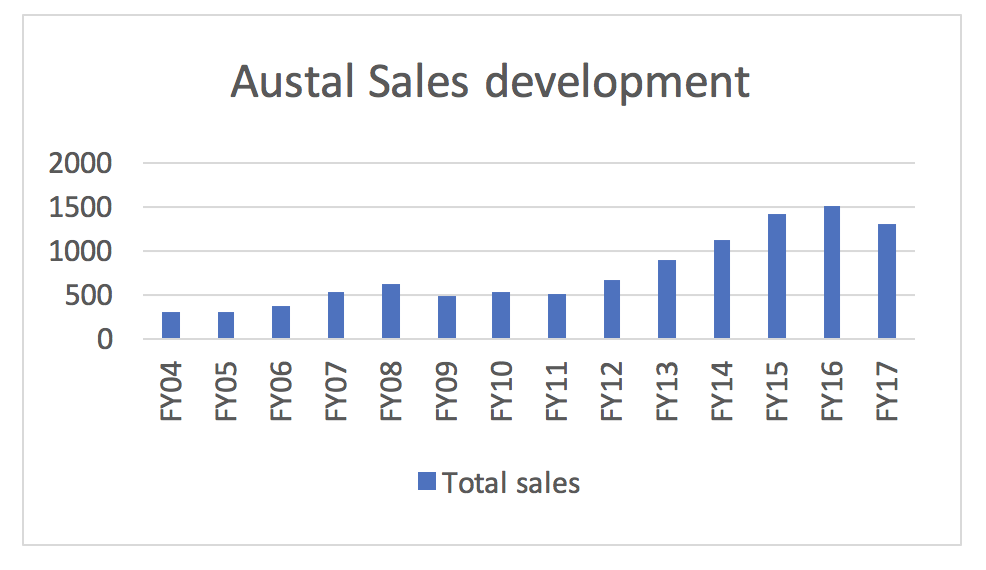

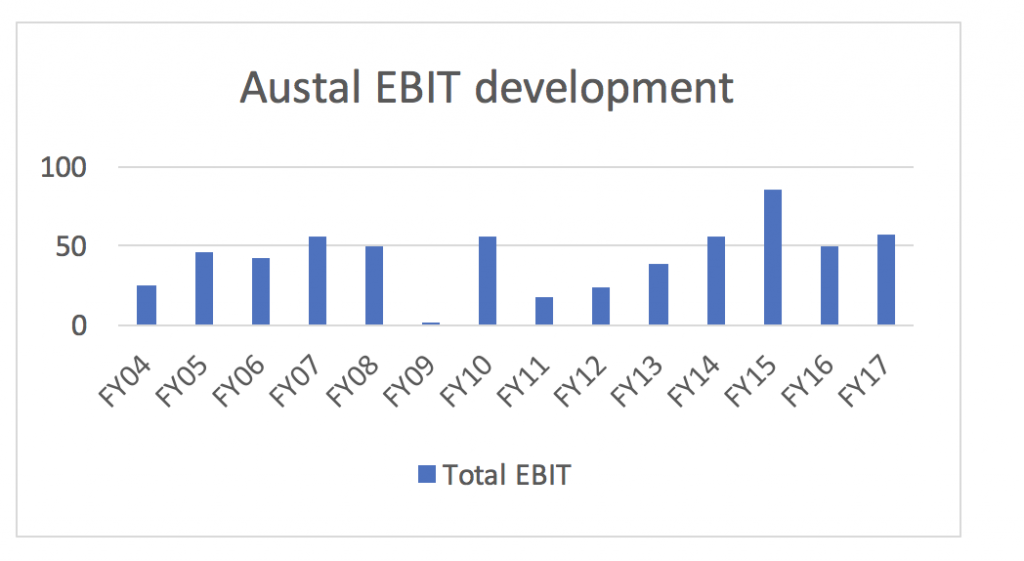

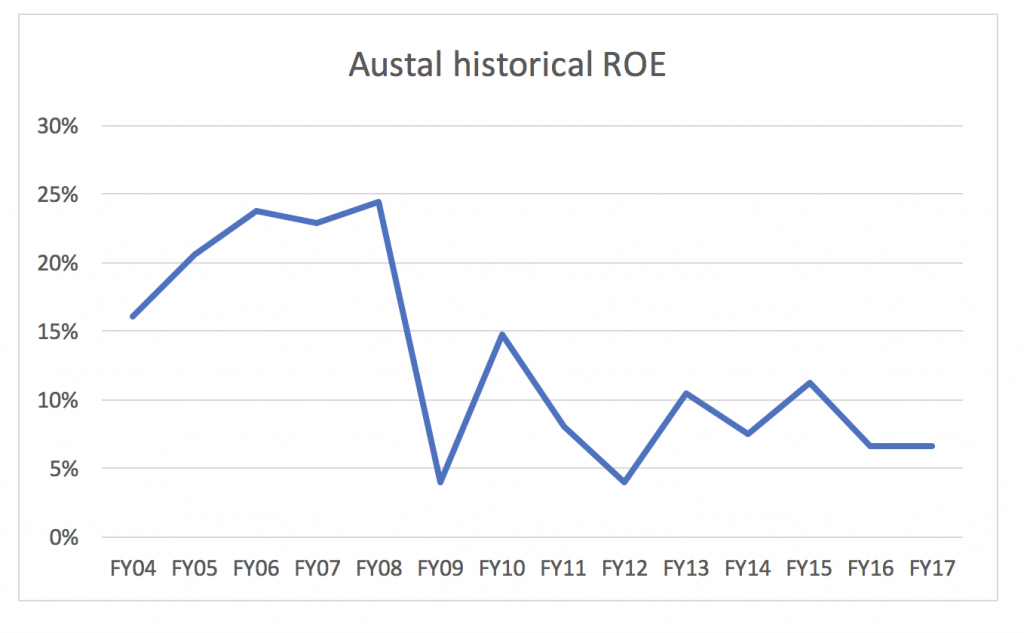

Sales, Earnings Before Interest and Tax (EBIT) and Return On Equity (ROE)

Since 2004, Austal has grown its sales by about 3x.

This has not translated into the same positive EBIT development, as FY2017 EBIT is roughly at the same level as in 2005, meaning that margins have been under significant pressure.

At the same time, the equity retained in the business has increased by 3x from $157 million to $460 million resulting in the ROE dropping significantly over the time period.

Why is this?

The reason behind the strong growth in sales is that Austal has secured two major programs with the US Navy where they are delivering both the Littoral Combat Ship and the Expeditionary Fast Transport ship out of their shipyard in Mobile, Alabama, US. This has contributed significant amounts of sales but, unfortunately, the US Navy is a hard negotiator and work on a cost plus arrangement meaning there is little opportunity to make very good profit out of such contracts (but with the positive of low potential downside as well).

What does the future look like?

Austal currently has an order book of about $3.0 billion ordered ships including quite a few from the above-mentioned programs (in addition to these programs, they have ~$300 million in orders from the Pacific Patrol Boat program and about $250 million from 6 commercial ferries).

$3.0 billion at the current margin of ~5 per cent is unfortunately not at all enough to justify the current market capitalisation of ~$600 million and even if we assume that they improve margins over time, it would require very ambitious margin improvement assumptions once we take tax and time value of money into account; so the market is clearly assuming that Austal will be able to add additional orders over time and hence values the company as a growing concern.

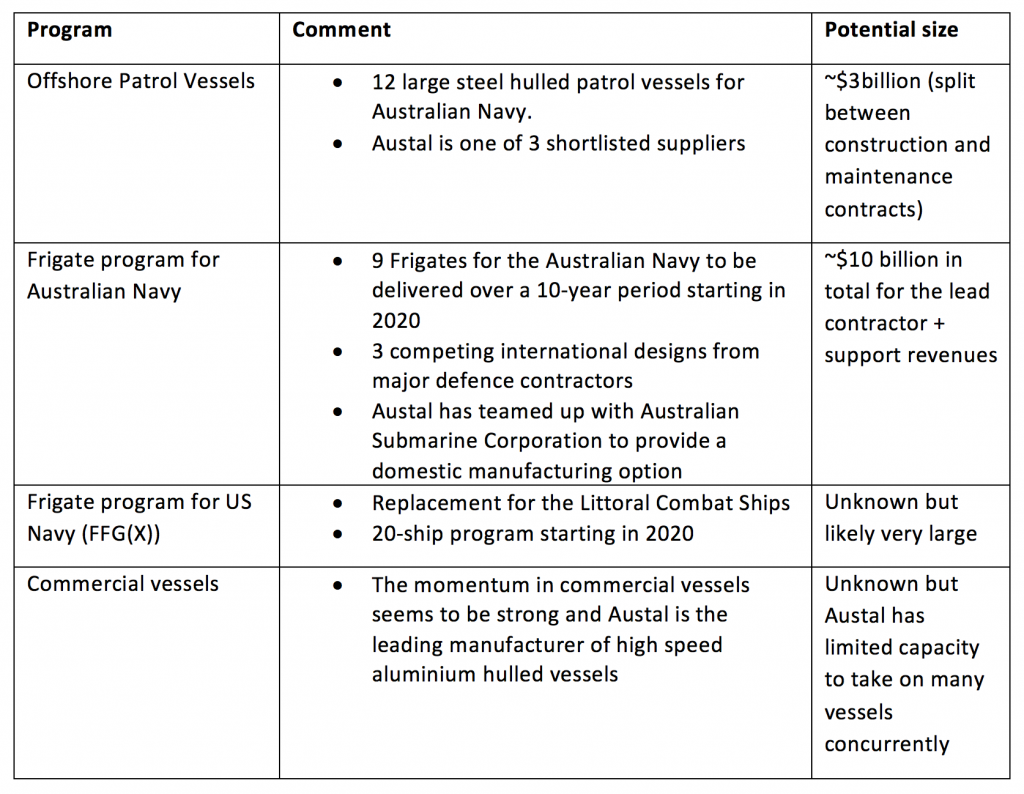

To evaluate what the potential future looks like for Austal, it is helpful to look at what potential programs there are that the company can generate business from. Below is a list of a number of programs that Austal could potentially win business from:

How to assess the potential?

As can be seen above, there are quite a few large programs that Austal can become involved in over the coming years. They are indeed likely to become involved in several of the major programs and we should most likely expect commercial vessel orders to continue to come through so constructing a positive forecast is quite easy.

Now, one of the most common pitfalls with forecasting is constructing a forecast based on uncertain information and giving your assessment of probabilities to high value. This can lead to very high assessments of value and lead to incorrect investments decisions.

For Austal, what you need to assess to construct a forecast are the following (to name a few):

- Which programs will they win? Although there are factors that point for Austal winning some contracts, there are significant uncertainties like for example the Australian Navy opposing mandating local manufacturing for the frigate program.

- What economics will the contracts deliver? Some contracts are likely to be “cost-plus” while other will have more of a fixed price nature.

- When will they start and how long will they take to execute? Especially with government programs, there is always the risk of changing goal-post and delays due to changing political situation.

- Will there be any cost variations? Ship building is a very hard business to get right, mainly because there is a long time before the signing of a contract and the delivery of a vessel. This means that a lot of projected cost items can change during the time in between and if you have a fixed price contract, you run the risk of having significant cost over-runs.

For us at Montgomery, trying to construct a forecast that we can put much faith in with this many “black-and-white” type variables, is not possible and instead we have chosen to look at what is needed to justify the current share price and then assess if we think this is reasonable or not.

Conclusion

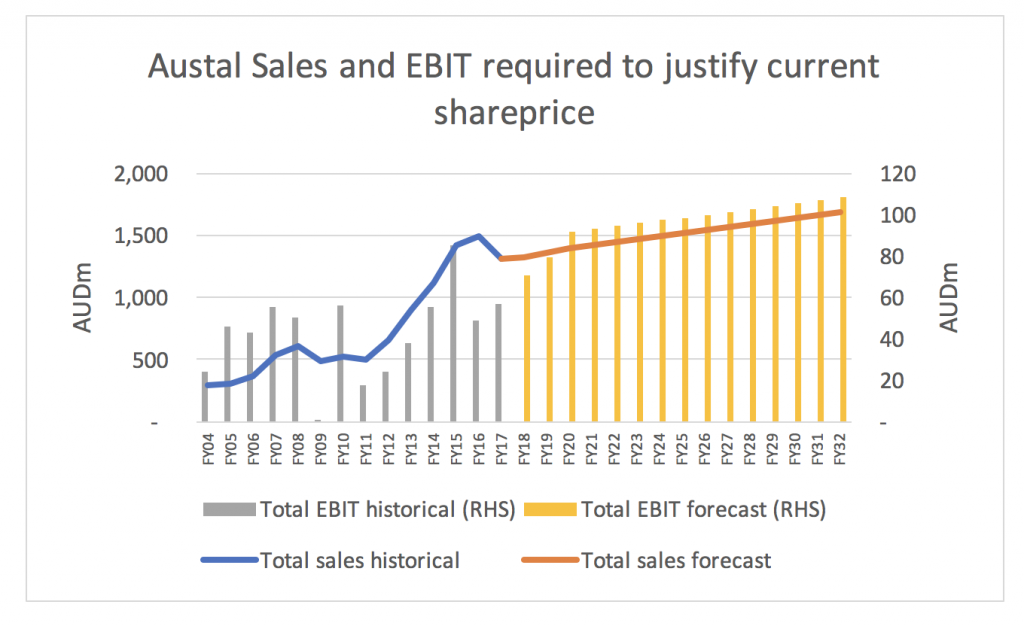

Using certain overcharging assumptions Weighted Average Cost of Capital (WACC) 10 per cent, terminal growth rate of 2.5 per cent and an explicit forecast period of 15 years, we back-solved what kind of sales, EBIT and investment would be needed to arrive at the current share price. The result can be seen in the following chart:

We basically need to see EBIT growing sharply over the coming 3 years and then at a reasonably decent pace until 2032 without any “down” years to arrive at the current share price.

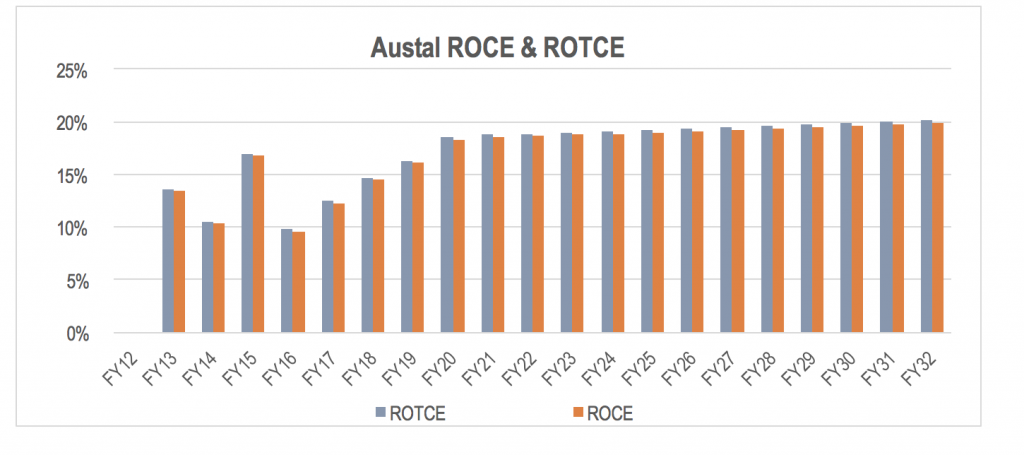

We also need to see Return On Capital Employed (ROCE) and Return On Tangible Common Equity (ROTCE) increase and keep at a level well above the recent history:

Constructing this scenario out of the potential contracts that Austal can win business from is not at all impossible and could probably even be described as relatively likely. The problem is that just winning the business is not enough. Austal also has to execute the contracts on time and without cost over-runs.

At Montgomery, we do not think that the risk/reward of this happening is attractive enough to justify an investment at the current share price given that we are looking for companies that we feel comfortable holding for a long time. If the share price were to come down to levels where we did not need to see such a sustained improvement in profits or if we could get more comfort in the economics of each contract, we might change our mind. But for now, we are not investing in Austal.

This post was contributed by a representative of Montgomery Investment Management Pty Limited (AFSL No. 354564). The principal purpose of this post is to provide factual information and not provide financial product advice. Additionally, the information provided is not intended to provide any recommendation or opinion about any financial product. Any commentary and statements of opinion however may contain general advice only that is prepared without taking into account your personal objectives, financial circumstances or needs. Because of this, before acting on any of the information provided, you should always consider its appropriateness in light of your personal objectives, financial circumstances and needs and should consider seeking independent advice from a financial advisor if necessary before making any decisions. This post specifically excludes personal advice.

INVEST WITH MONTGOMERY

Hi Andrew – great analysis on Austal, particularly, the inversion/Munger approach to assess the valuation. I came across your article after reading an article in today’s AFR on Austal proceeding to the next stage of US frigate program. The market cap has not changed much since you wrote this article. So I am assuming your view has not changed. Again, great analysis.