Hospital check-up

The private hospital diagnosis this results season was as unpleasant as this year’s flu season. Since result day, Healthscope (ASX: HSO) has plummeted 25 per cent down to $1.68 and Ramsay Health Care (ASX: RHC) 19 per cent to $63.84. Roger Montgomery previously discussed some of the risks we had identified into the results in this June blog. Into the results we felt that both hospital operators were trading at stretched valuations and as a result reduced our positions. Following the share-price correction, we remain comfortable with our remaining holdings.

To begin we wish to make clear that we view both Ramsay and Healthscope as strong quality companies with competitive advantages and exposure to well supported growth dynamics. Private hospitals play a critical role in Australia – they make up 33 per cent of Australian hospital care by beds, 40 per cent by number of patients, 59 per cent of surgeries, and 70 per cent of rehab.

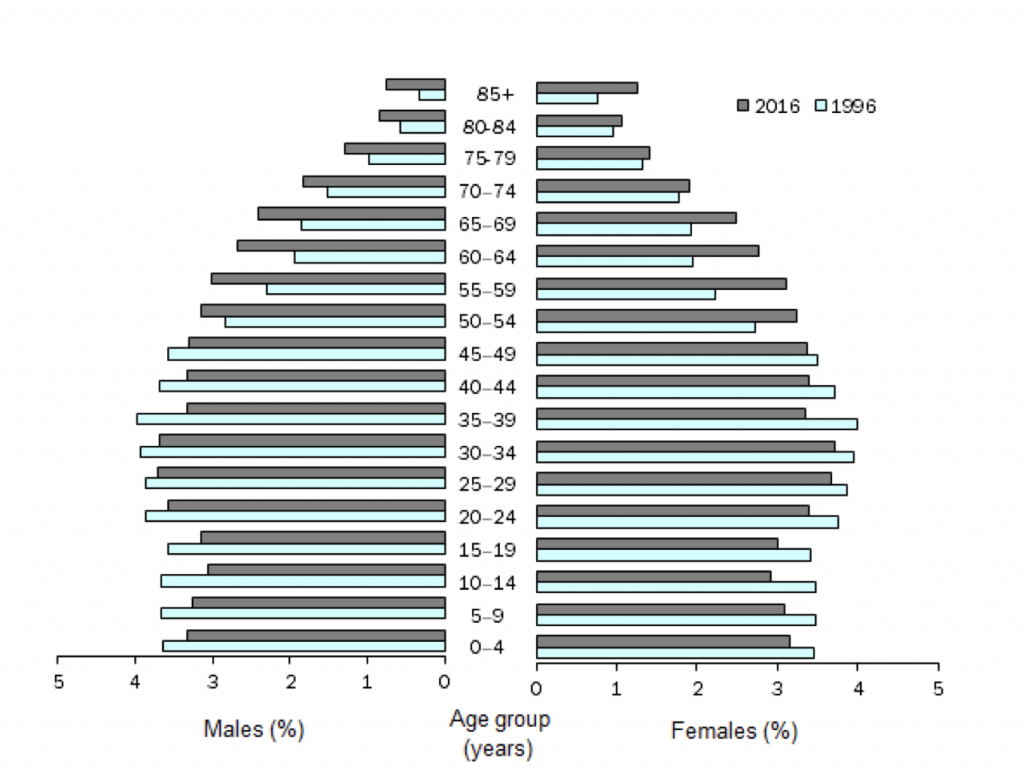

The prescription for these services increases with an aging population – and Australia has one heavily supported by the baby boomers. We note the proportion of people aged over 65 years old has increased to 15.3 per cent (from 12 per cent) in the last decade and only the first 5 years of baby boomers have reached this maturity.

Source: ABS

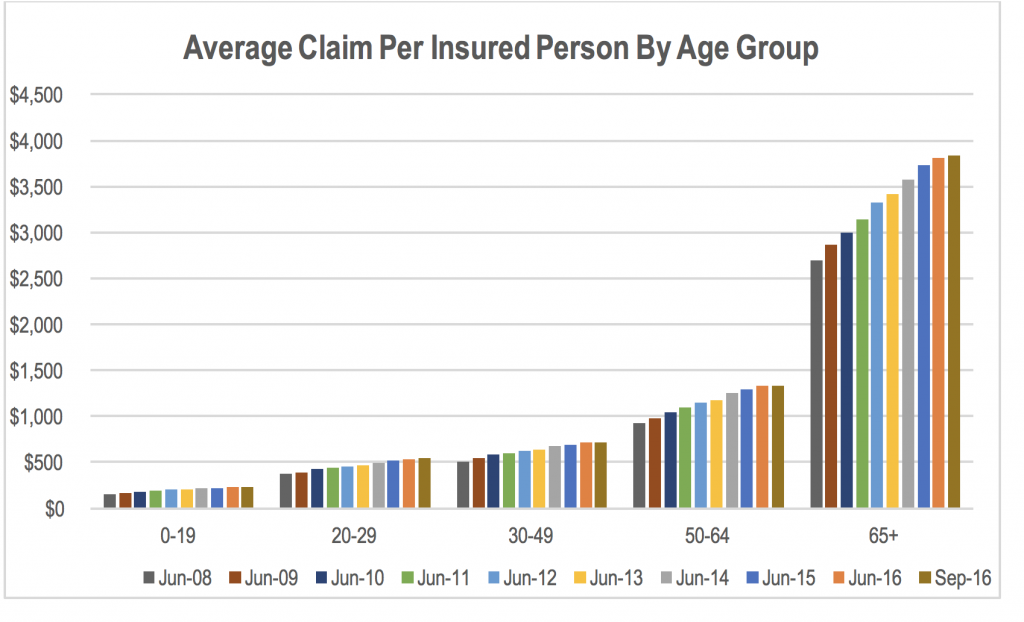

It is this 65+ age group that accounts for the lion’s share of medical claims:

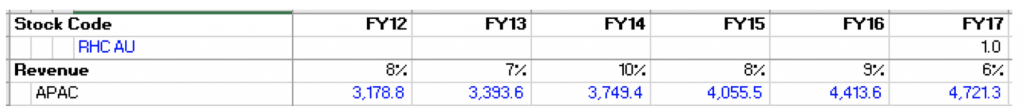

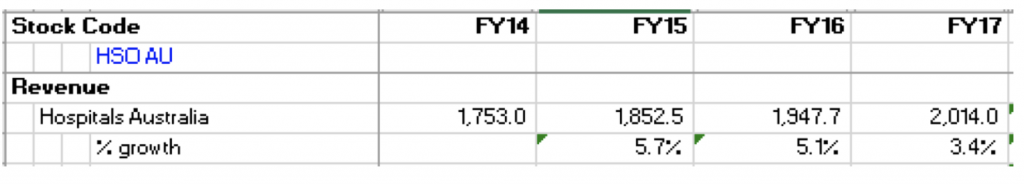

It is for this reason that we have seen increased hospital demand which in turn has driven strong top-line growth for both RHC and HSO. In fact – this (together with high healthcare inflation and a positive mix shift) has led to consistent high single digit top-line growth for both RHC and HSO:

But what went wrong? Why was growth stunted this year? What’s changed?

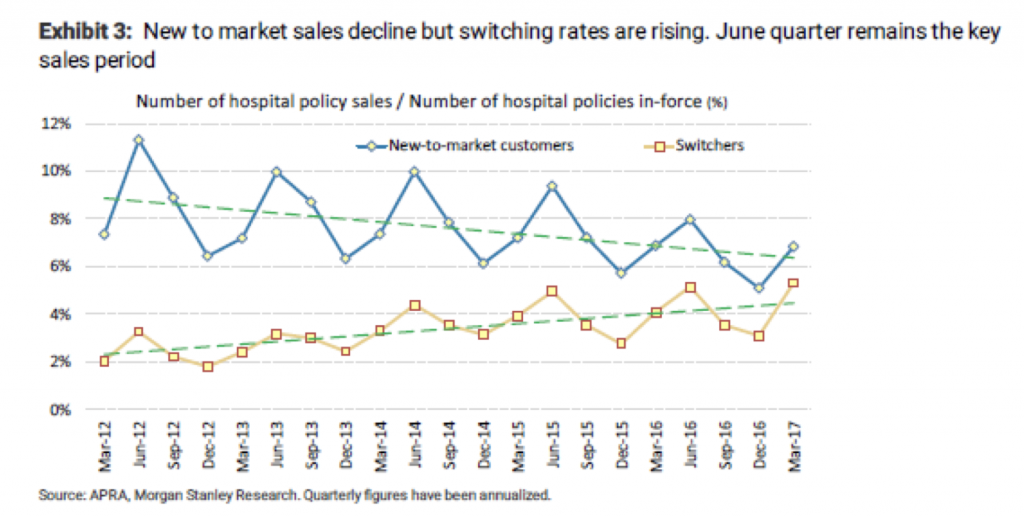

To answer this question we need to consider where the profits come from – ie. Who is actually paying. 70 per cent of private hospital funding comes from health insurers (the remainder includes Government, Department of Veteran Affairs and Medicare payments). This relies on private health insurance take-up, which has experienced consistent decline. Providers find themselves competing more for switching patients than those that are new-to-market:

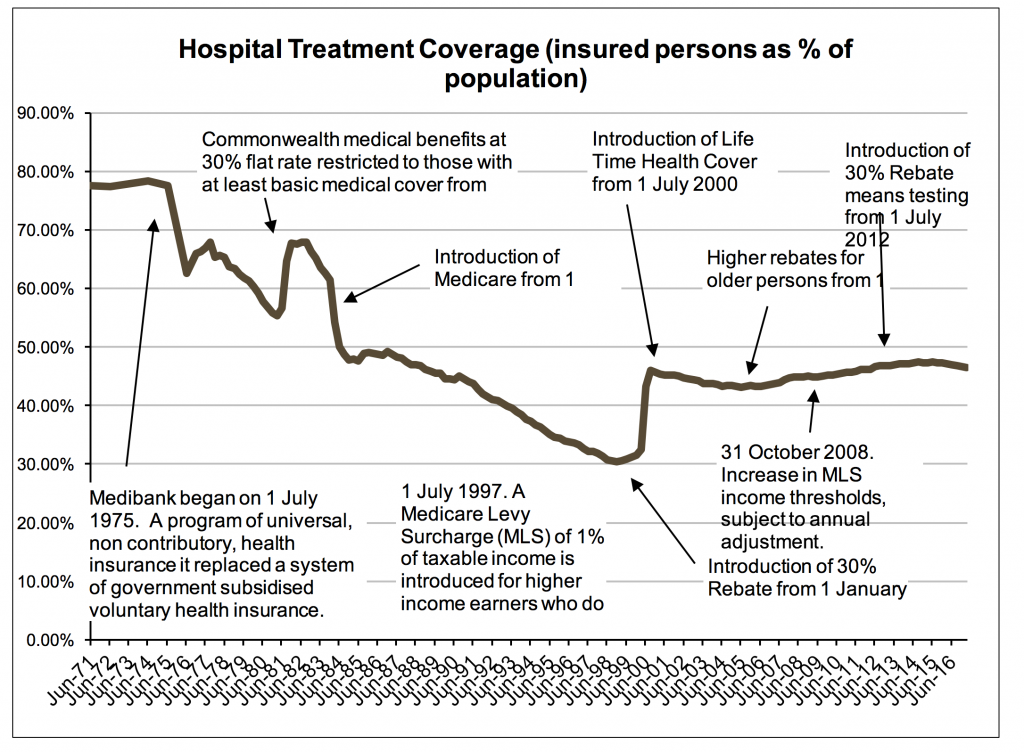

Whilst on the positive side, hospital treatment coverage appears to have stabilised at around the 47 per cent mark;

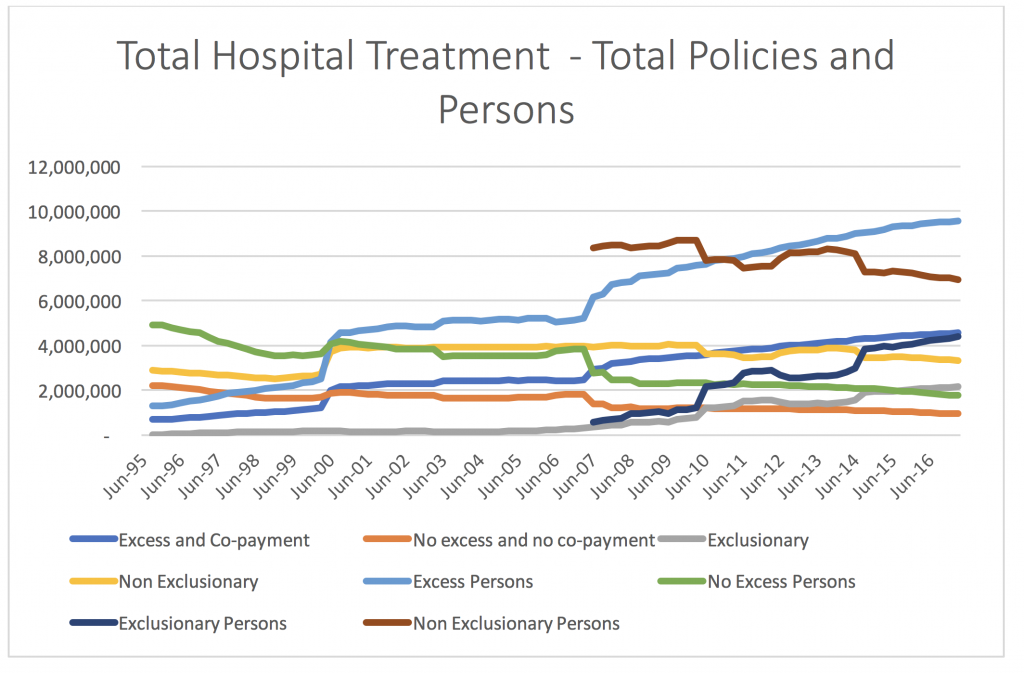

This misdiagnoses the truth because more people are moving to policies with higher excess and exclusionary policies. This leads to higher out-of-pockets from using the Private health system – unpleasant on top of your already steepening private health insurance fees.

Now whilst this trend has been going on for a while, in 2017 it began to come through more in the data. We saw more private patients in public hospitals (avoiding gap payments), and this volume leakage was exacerbated with some seasonally lower healthcare volume. A dire prognosis for a highly fixed cost business such as a hospital. Even worse for one which had recently expanded its capacity significantly (HSO has had a more recent pipeline of both greenfield and brownfield projects).

We could see weak volumes from lower usage of private hospitals, and a cyclically lower use of health services this year. This pressured the top-line – particularly for the newer hospitals that HSO had recently opened, and further compressed margins from fixed costs. Whilst we trimmed our position for these risks, the result surprised the market and we saw a significant share-price correction.

Now at less stretched valuations, we see a more favourable diagnosis for the private hospitals. We continue to see strong demographical support for health services. Whilst we continue to see signs of private patients in public hospitals – there is a tipping point at which waiting lists become too long and the government must inevitably intervene to lower pressure on the stretched public system. In terms of lower surgical volumes experienced in 2017, we see this as cyclical and that it is unlikely patients put off procedures ad infinitum. We remain happy long term owners of both companies.

The Montgomery Fund and the Montgomery Private Fund own shares in both Ramsay Healthcare and Healthscope.

This post was contributed by a representative of Montgomery Investment Management Pty Limited (AFSL No. 354564). The principal purpose of this post is to provide factual information and not provide financial product advice. Additionally, the information provided is not intended to provide any recommendation or opinion about any financial product. Any commentary and statements of opinion however may contain general advice only that is prepared without taking into account your personal objectives, financial circumstances or needs. Because of this, before acting on any of the information provided, you should always consider its appropriateness in light of your personal objectives, financial circumstances and needs and should consider seeking independent advice from a financial advisor if necessary before making any decisions. This post specifically excludes personal advice.

INVEST WITH MONTGOMERY

Robert Warren

:

I have been considering buying Healthscope for some time and holding for a long term investment but the noise of a takeover is putting me off is the Montgomery fund going to hold their shares or sell them would love to know your thoughts on this

Roger Montgomery

:

We currently have a position in HSO.

william-garbett

:

This is on top of the looming change in prosthetic pricing. Price changes that could dent those weakened profits and force HSO into raising more equity.

When will the market begin to see some blue sky?

Lisa Fedorenko

:

Hi William,

Yes indeed, there has been a significant amount of press lately about a potential cut in prosthetic pricing, similarly to what we saw last year. At this point, we feel that this information is well understood by the market and the current price incorporates some risk due to this.

HSO is well within its debt covenants, and is less impacted by changes to the prosthetic pricing than RHC would be. For this reason, whilst we are cautious on depressed volumes pressuring margins, we are less worried about the need for equity.

Changes to prosthetic prices are not the only thing on the agenda, and indeed there is scope for positive news too – for example a tiered health insurance system (bronze, silver, gold).

Hope that helps answer your question.

Lisa

Sam

:

Excellent article Lisa and great call by the team to reduce the weightings to HSO and RHC given the recent pullback in share prices.

Sam

Lisa Fedorenko

:

Thank you Sam

Anthony

:

Great article, the key is to not listen to noise of the short term and focus on the fundamentals of the long term! I’m a happy shareholder of HSO and wish I had more cash to buy in the dip!

Lisa Fedorenko

:

Thank you Anthony

greg

:

Hi lisa i am curious as to what intrinsic valuation you have come to as for both present and future i get alot lower result to the price for HSO going off Valueable tables/formula