Aura Private Credit: Letter to investors 24 February 2023

Given this week’s quiet data release cycle, we thought we would explore some methods of funding that can be used by lenders we work with and to give context to where we participate in capital markets.

Over the past decade, the traditional banking landscape has been flipped on its head across the UK, Europe and North America with Fintech Lenders providing innovative and often tech-driven solutions to under or inefficiently serviced niches. Australia has also seen a significant number of entrants over recent years, with KMPG quoting a 8 per cent year-on-year increase in the number of Fintechs in its Australian Fintech Landscape 2022 release1.

One key differentiator between these businesses and the like of a typical bank is that they do not benefit from the Authorised Deposit Taking Institution (ADI) status of banks. This means they cannot issue term deposits to raise capital to finance their loan originations. Instead, these businesses will turn to private capital markets. The three capital options typically utilised by Fintech Lenders are:

- Venture Capital

- Venture Debt/Corporate Debt

- Asset-Backed Debt.

At Aura Funds Management in Australia, we have the ability and capital to offer all three options, discussed below, with Aura Private Credit focusing on Asset-Backed Debt. Before we dive in, let’s cover Venture Capital and Venture/Corporate Debt.

Venture Capital

Venture Capital financing is selling a percentage of ownership in your business to a Venture Capitalist in exchange for a sum of money.

Venture Capital, as opposed to Venture/Corporate Debt, is potentially less risky for fintech lenders, as it does not load the business with legally binding principal and interest repayment obligations that can lead to bankruptcy if not honoured. However, it is by no means free. Founders are giving up a degree of control and ownership in their business as well as signing an unspoken agreement to build the market capitalisation of the business as large as possible in the shortest period of time.

The Aura Private Credit investment team believes selling equity in exchange for capital can prove necessary for Fintech Lenders for three primary reasons:

- Extending runway prior to profitability;

- Financing loan originations prior to securing a debt facility, building out the lender’s performance record; and

- Funding the subordination/equity note requirements of an Asset-Backed Debt/Warehouse facility.

Venture/Corporate Debt

Venture or corporate debt is debt that is secured by the business’ balance sheet assets, which form the primary security in the case of bankruptcy. It will often come in the form of a term loan or line of credit. A line of credit may offer the flexibility to draw down in line with a lender’s loan originations, however, a term loan removes execution risk. While term loans are not as efficient as a line of credit, it provides lenders with the certainty and confidence required to fund loan originations as the cash is sitting in their bank account.

Pre-Asset-Backed/Warehouse Debt Facility

In most cases, a lender will be required to build a sufficient lending track record to show their processes and the characteristics of their client base. During this phase, lenders aim to collect as much data on their customers and the book performance as possible. This will aid discussions with an asset-backed/warehouse financier down the track. Increasing transparency over operations and performance to date may help to remove the “uncertainty premium” a financier may incorporate in the form of increased subordination/equity note requirement or heightened interest rate on the facility, or the case where financiers deem there to be insufficient information to warrant an investment.

When working with early-stage FinTech’s with less of a portfolio track record, the Aura Private Credit team will look for experienced management, strong systems, and tech-driven processes. Most importantly, the Fintech team must be open to consultation from the Aura Private Credit team to assist the Fintech in becoming investment worthy and market ready. We see this as a value add from the Aura Private Credit team – our experience and network is there to be leveraged for the benefit of both the Fintech lender and, of course, our investors.

Asset-Backed/Warehouse Debt Facility

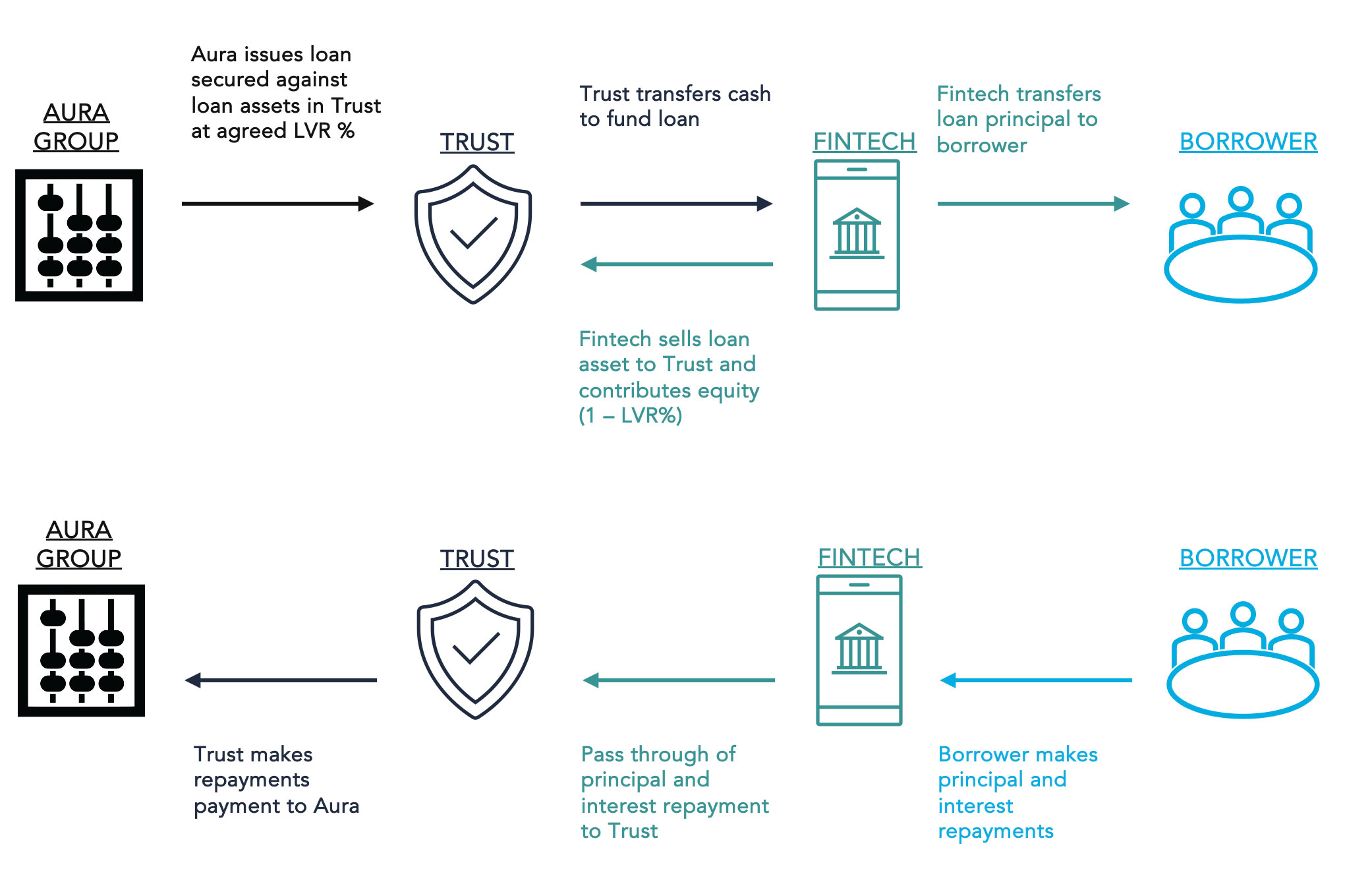

How does an asset-backed warehouse debt facility work?

First, it’s important to introduce a third party: a bankruptcy remote trust. This trust is what the financier is lending money to, not the Fintech’s corporate balance sheet. Investors, such as ourselves, find this attractive in the case a fintech lender goes bankrupt:

- The financed loans remain in place, supporting the financier’s investment – a stark difference to Venture Debt and Venture Capital;

- The pay down of principal and interest repayments, associated with the financed loans, continue to provide cash flow to service out the financier’s investment; and

- Net Interest Margin, the difference between the interest rate on the financed loans and the interest charged by the financier, continues to flow, retaining a source of funds to finance loan servicing/collections systems and personnel, either at the fintech or a third party, back-up servicer.

Hence the term “bankruptcy remote.”

Is it an unsecured loan?

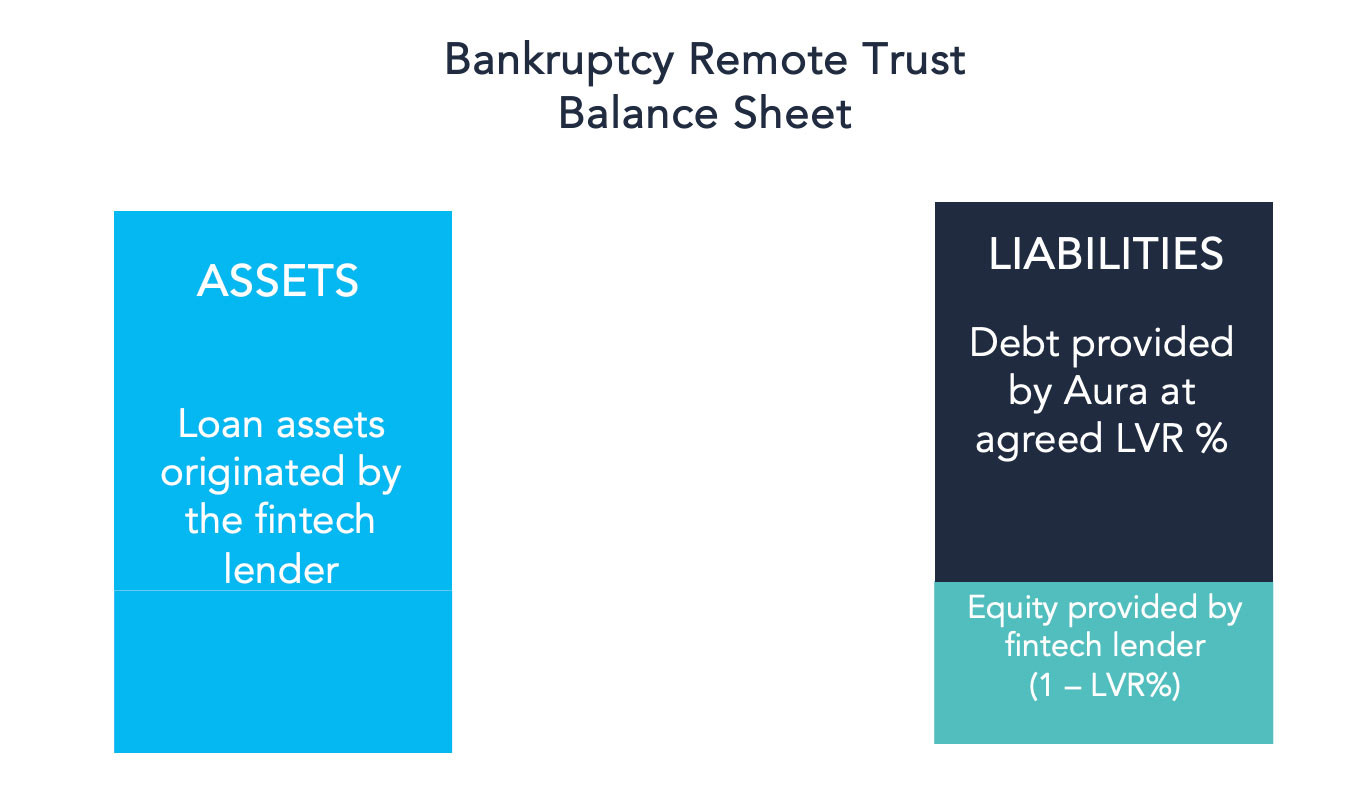

No, it is secured by the loan assets held in the bankruptcy remote trust. Additionally, the financier’s capital has priority over capital invested in the trust by the Fintech lending business and will also benefit from security at the underlying loan level.

The assets of the trust will be the loans originated by the Fintech lender that fall within a pre-agreed eligibility criteria. This is an important differentiator – the loan assets originated by the Fintech lender sit on the balance sheet of the trust, not the Fintech’s own balance sheet.

Does the Fintech need to invest their own capital into the trust, that ranks below the financier’s investment with respect to priority?

Yes. This is referred to as subordination or an equity note. The amount of subordination/equity note required will be determined by the “advance rate”. Think of the advance rate as an LVR (loan to value ratio) that the financier is comfortable lending to, measured against the principal value of the pool of loans on the balance sheet of the trust. Like the LVR requirements of a mortgage lender, measured against the value of a property. The percentage contribution of the fintech lender is 1 minus the advance rate percentage.

When repayments come through, the warehouse financiers claim on interest and principal is honoured in priority. Once honoured, the lender will have claim to all remaining capital, “net interest margin”, and may transfer it from the trust to its corporate body in the form of revenue, subject to the subordination/equity note requirements being satisfied.

Is there a cost advantage to a warehouse structure as opposed to Venture Capital and Venture Debt?

Yes. There is usually a lower cost of capital associated with warehouse finance. This is driven by the lower risk profile of the investment, due to both the later stage and bankruptcy remote nature of the investment. Additionally, as fintech lenders continue to build out their loan books, loan tapes and performance records, the market will typically reward the fintech via larger facility sizes and lower weighted average costs of debt capital.

The Private Credit team focus on warehouse financing which provides the optimal risk/return on investment in our view.