Aura High Yield SME Fund: Low dispersion of returns and no negative months (to date)

The standard deviation, or measure of the amount of variation, of the S&P/ASX 300 Accumulation Index over the period between 1 August 2017 and 31 October 2023 was 15.2 per cent. One standard deviation (or plus or minus 15.2 per cent) means the dispersion around the average occurs 68 per cent of the time, whilst two standard deviations (or plus or minus 30.4 per cent) means the dispersion around the average occurs 95 per cent of the time.

Whilst this Index delivered investors a compound average annual return of just under 7.0 per cent over this 75-month period under review, turning $100,000 into $152,343, one standard deviation implied a range of returns of negative 8.2 per cent to positive 22.2 per cent, whilst two standard deviations implied a range of returns of negative 23.4 per cent to positive 37.4 per cent.

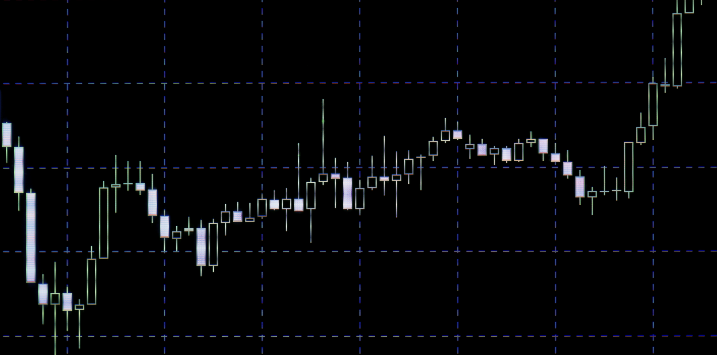

The S&P/ASX 300 Accumulation Index, over the 75 months to October 2023, delivered an average return of 0.66 per cent per month, with 26 negative months (35 per cent) and 49 positive months (65 per cent). The worst month was the COVID-19 scare in March 2020 which was negative 20.8 per cent and the best month November 2020, which was positive 10.2 per cent.

I contrast this with the Aura High Yield SME Fund (for wholesale investors), run by Brett Craig and his team at Aura Credit Holdings. Over the same 75-month period, the Fund has produced a compound annual average return of 9.6 per cent, turning $100,000 into $177,479. The average monthly return was 0.77 per cent, the worst month was 0.60 per cent and the best month was 0.93 per cent.

The major observations include:

- Relative to the S&P/ASX 300 Accumulation Index, the Aura High Yield SME Fund outperformed by an annualised 2.64 per cent (9.81 per cent versus 6.97 per cent) or $25,136 per $100,000 invested over the period 1 August 2017 to 31 October 2023.

- The dispersion of months returns from the Aura High Yield SME Fund were exceptionally low, whereas for the S&P/ASX 300 Accumulation Index they were exceptionally high.

- The Aura High Yield SME Fund did not produce a month of negative returns. The S&P/ASX Accumulation Index produced 29 months (35 per cent of the period under review) of negative returns.

- For wholesale investors, looking to invest in a Fund which has, to date, paid monthly income and with monthly liquidity, the Aura High Yield SME Fund may be worth consideration.

*Returns to 31 October 2023. The Aura High Yield SME Fund returns assume reinvestment of all distributions. Past performance is not a reliable indication of future performance.

Disclaimer

Find out more about the Aura Private Credit Funds

You should read the relevant Product Disclosure Statement (PDS) or Information Memorandum (IM) before deciding to acquire any investment products.

Past performance is not an indicator of future performance. Returns are not guaranteed and so the value of an investment may rise or fall.

This information is provided by Montgomery Investment Management Pty Ltd (ACN 139 161 701 | AFSL 354564) (Montgomery) as authorised distributor of the Aura High Yield SME Fund (Fund). As authorised distributor, Montgomery is entitled to earn distribution fees paid by the investment manager and, subject to certain conditions being met, may be issued equity in the investment manager or entities associated with the investment manager.

Aura Credit Holdings Pty Ltd (ACN 656 261 200) (ACH) is the investment manager of the Fund and operates as a Corporate Authorised Representative (CAR 1297296) of Aura Capital Pty Ltd (ACN 143 700 887 | AFSL 366230).

The Aura High Yield SME Fund is an unregistered managed investment scheme for wholesale clients only and is issued under an Information Memorandum by Aura Funds Management Pty Ltd (ABN 96 607 158 814, Authorised Representative No. 1233893 of Aura Capital Pty Ltd AFSL No. 366 230, ABN 48 143 700 887).

Any financial product advice given is of a general nature only. The information has been provided without taking into account the investment objectives, financial situation or needs of any particular investor. Therefore, before acting on the information contained in this report you should seek professional advice and consider whether the information is appropriate in light of your objectives, financial situation and needs.

Montgomery and Aura Group do not guarantee the performance of the Fund, the repayment of any capital or any rate of return. Investing in any financial product is subject to investment risk including possible loss. Past performance is not a reliable indicator of future performance. Information in this report may be based on information provided by third parties that may not have been verified.

My main confusion comes from the comparison to the s&p 300 index. I’m a fan of you Roger but im confused as to why your comparing the s&p 300 index (which is made up of individual companies) to lending? Isnt lending and its returns completely different to a singular corporation? Not to mention the companies competitive advantage and the general market that they are selling in, I hope your able to make sense of this for me

Totally different. You are right. But we still compare asset classes all the time: see Asset Class Returns Index returns are typically adopted to do this. The Private Credit may still be a bit young to have such and index created.

I apologise for my ignorance (I’m still learning) but I wasn’t aware any of the Montgomery funds were offering lending services? My understanding was the available investing funds were just for that investing in the markets?

Hi Tom, Montgomery now provides access to Private Credit.

There’s a comparison to the s&p asx/300 accumulation index?

Does this help Tom: Fund Performance

Does warren Buffett use these standard deviation measurements? Sounds crazy to me, and after reading rogers book these evaluations seem to go against what he portrays in the book.

Hi Tom, This is private credit not equities. Different measures are appropriate and, in this case, are used simply to provide context to those analysing the profile of returns. I hope that makes sense.