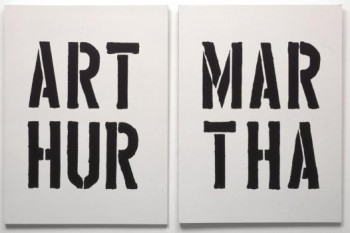

Arthur or Martha?

In my morning news trawl, I came across an interesting article on Bloomberg this morning. I have copied an excerpt below, and should you be so inclined, you can read the full article here.

The International Monetary Fund cut its outlook for global growth in 2015 and warned about the risks of rising geopolitical tensions and a financial-market correction as stocks reach “frothy” levels.

The world economy will grow 3.8 per cent next year, compared with a July forecast for 4 per cent, after a 3.3 per cent expansion this year, the Washington-based IMF said. US growth is helping lead a worldwide acceleration that’s weaker than the fund predicted two-and-a-half months ago as the outlooks for the euro area, Brazil, Russia and Japan deteriorate.

“In advanced economies, the legacies of the precrisis boom and the subsequent crisis, including high private and public debt, still cast a shadow on the recovery,” the IMF said in its latest World Economic Outlook. “Emerging markets are adjusting to rates of economic growth lower than those reached in the pre-crisis boom and the post-crisis recovery.”

According to the report, a sustained period of policy interest rates near zero in advanced economies has raised the risk that some financial markets may be overheating.

“Downside risks related to an equity price correction in 2014 have also risen, consistent with the notion that some valuations could be frothy,” the lender said without naming specific markets.

MORE BY RogerINVEST WITH MONTGOMERY

Roger Montgomery is the Founder and Chairman of Montgomery Investment Management. Roger has over three decades of experience in funds management and related activities, including equities analysis, equity and derivatives strategy, trading and stockbroking. Prior to establishing Montgomery, Roger held positions at Ord Minnett Jardine Fleming, BT (Australia) Limited and Merrill Lynch.

He is also author of best-selling investment guide-book for the stock market, Value.able – how to value the best stocks and buy them for less than they are worth.

Roger appears regularly on television and radio, and in the press, including ABC radio and TV, The Australian and Ausbiz. View upcoming media appearances.

This post was contributed by a representative of Montgomery Investment Management Pty Limited (AFSL No. 354564). The principal purpose of this post is to provide factual information and not provide financial product advice. Additionally, the information provided is not intended to provide any recommendation or opinion about any financial product. Any commentary and statements of opinion however may contain general advice only that is prepared without taking into account your personal objectives, financial circumstances or needs. Because of this, before acting on any of the information provided, you should always consider its appropriateness in light of your personal objectives, financial circumstances and needs and should consider seeking independent advice from a financial advisor if necessary before making any decisions. This post specifically excludes personal advice.

Hi Roger,

Thanks again for your valuable insights.

There certainly does seem to be a recurring theme in the financial media about clouds gathering around the macro outlook with the recurring theme of excess debt and the actions of central banks.

Without wanting to put you on the spot could I ask you that primarily as a value investor, how much weighting in your analysis is given to macro forecasting or top down investing. I note that you have long posted the downfall of iron ore and by default China which is certainly happening now.

I personally have a value oriented focus, however the current environment seems to have more risk than 2007 and for the what I believe will be the only time in my life seriously consider that gold actually has a place in an investment portfolio. This is not an investment, but simply as a hedge against the faith that has been placed in central banks over the last 6 years.

Whilst this goes against most value investors logic, I look at the current health of the balance sheets in the majors such Japan, Euro, US & China and then prevailing interest rates that the first 3 can borrow money at and it reinforces the view that nothing seems to be logical at the moment!

Cheers,

Peter

You might be more successful seeking advice from a personal professional adviser about shorting Italian and Spanish bonds or some index/ETF that tracks the price of ‘highyield (read Junk) bonds.