Are you a bull or a bear? Part 2: Reasons to be bullish

In my last blog, I set out the reasons for being pessimistic about equity markets.Now let’s look at the reasons to be bullish. I’ll let you decide which case is more compelling, and I’d love to get your comments. With many of the bear arguments centred around a bubble in technology stocks, it’s worth beginning the bull case with those same technology stocks.

Technology company stocks can be hard to value because a large portion of their value is future dated and therefore subject to greater uncertainty. Because future earnings power is hard to forecast, dependence is placed on a competitive advantage playing out and on management’s ability to deliver.

Just as you wouldn’t value a property development on the nil income it receives prior to construction, it makes sense to consider what a growth stock might earn in the future and value it on that basis with adjustments for the risks and time associated with success.

Technology stocks are often described as being over-hyped and over-valued. Investors in the space are also often dismissed for expecting too much. Tesla is often cited as the poster child for the excesses in technology stocks.

Markets tend to focus on what they can see. With structural growth stocks investors tend to under-estimate the future and ‘fade’ revenue and earnings growth in long term forecasts. Consequently, future winners look very expensive initially. But the optionality of market share takers is not captured by such analysis. So, while many of these stocks do not look cheap, the megatrends beneath them may render them good value.

As I articulated in my book Value.able in 2010, Warren Buffett described wonderful companies as simply having the following characteristics:

- Bright long-term prospects

- A high rate of return on equity driven by sustainable competitive advantages

- Solid cash flow

- Little or no debt

- First class management

Do the five companies currently dominating the US market satisfy the requirements of a wonderful company?

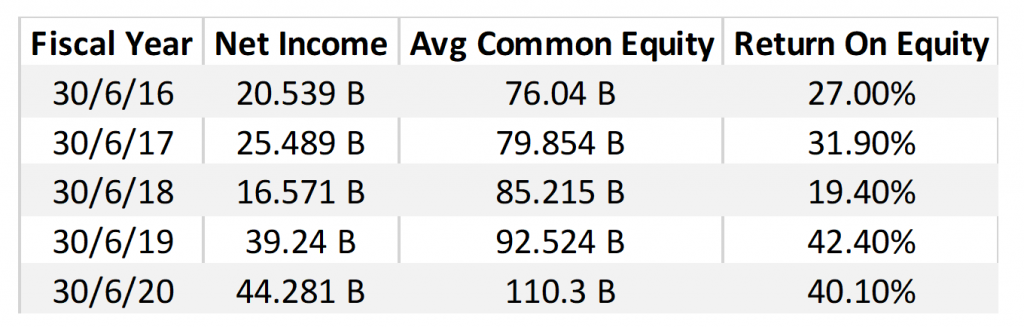

Table 1. reveals Microsoft’s Return on Equity over the prior five years.

Table 1. Microsoft Return on Equity

In anyone’s language this is an attractive return on equity. Exploring the profitability of the other four companies reveals a similar picture.

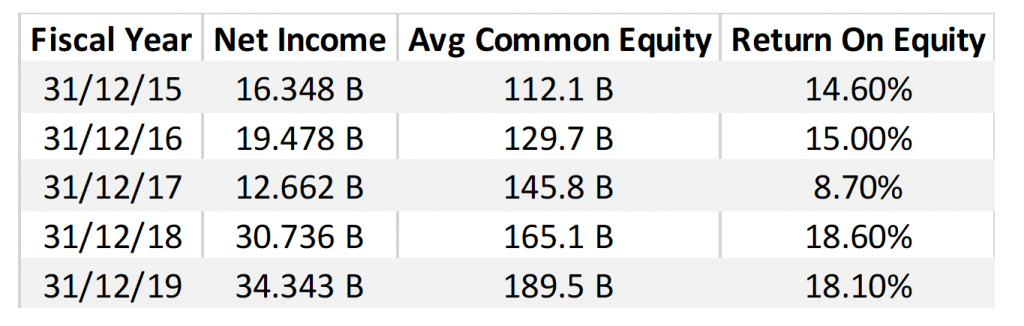

Table 2. Alphabet Return on Equity

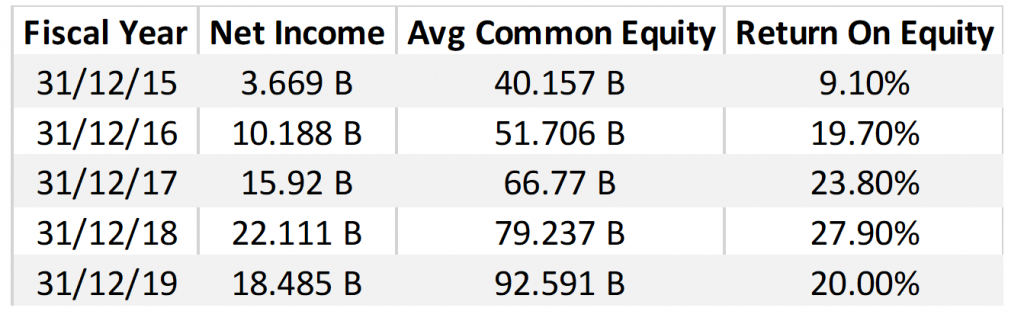

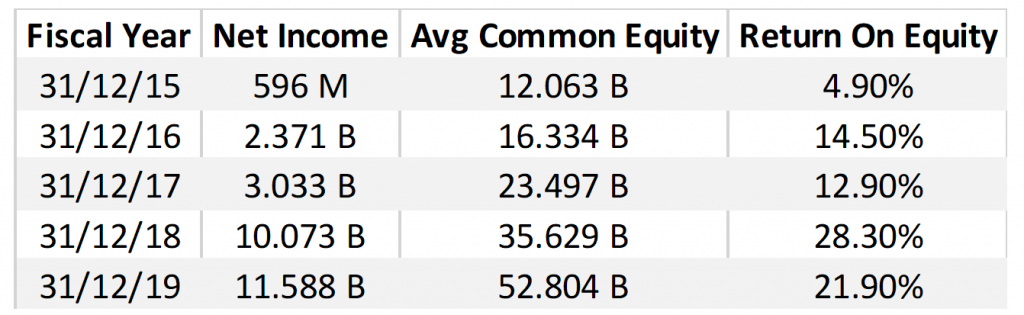

Table 3. Facebook Return on Equity

Table 3. Facebook Return on Equity

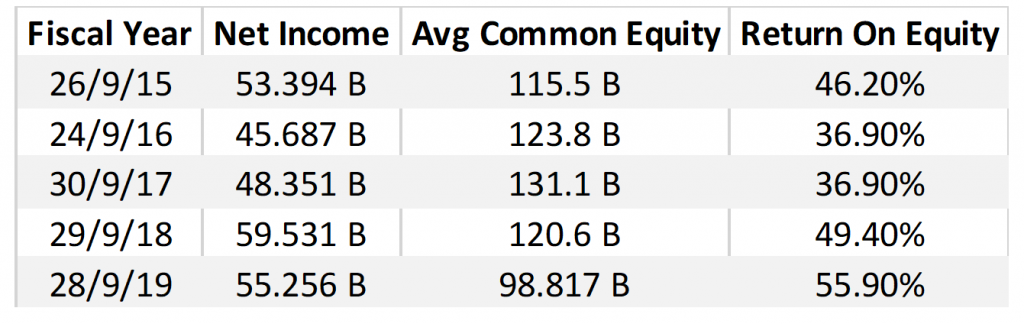

Table 4. Apple Inc return on Equity

Table 5. Amazon Return on Equity

Without exception these companies are generating attractive returns on equity and in most cases the trend is improving. In other words, as these companies grow, they become even more profitable. This is a highly desirable characteristic, especially when it is achieved on relatively modest amounts or no debt.

Google’s debt to equity ratio sits at just 7.8 per cent, Facebooks is 10 per cent, Microsoft’s ratio is 69.4 per cent while Amazon’s is 124 per cent and Apple’s is 169 per cent. Given their cash flows all of these companies have debt levels that are entirely manageable.

The driver of this impressive performance of course is the presence of competitive advantages, without which competitors would be able to chip away at their moats and bring profitability back to far less attractive levels. Very few companies can stay ahead because competitors copy their strategies.

And while ‘network effects’ and ‘flywheels’ are certainly part of the reason these companies stay ahead, it’s difficult to copy a company that uses its vast resources to adapt. Apple is first and foremost a computer company, but it has also pivoted to other areas such as the payment space, which has historically been controlled by banks.

Google was a search engine before building the mobile operating system Android and now dominates that space by market share. And don’t forget Google rendered traditional maps almost extinct by integrating GPS navigation and mapping into its product suite.

Over at Facebook, a sophisticated social networking site became the world’s leading provider of targeted direct advertising, while Jeff Bezos at Amazon turned a book selling site into the world’s largest online merchant platform, as well as one of its largest logistics players, data warehouse providers and media content creators.

There is no question that as these companies gain scale and entrench themselves in the daily habits of their customers, they become more powerful and therefore more profitable. There is therefore little doubt about the quality of these businesses.

These tech titans are not only growing at a rapid pace but as they grow, they are becoming more profitable. In addition to benefitting from the competitive advantage that is the network effect, they have become monopolies in which inheres the most valuable of all competitive advantages – the ability to raise prices without a detrimental impact to unit sales volume. In a world of declining real rates of return, such pricing power is scarce and highly prized by investors.

Legendary US value investor Howard Marks also pointed this out recently noting, “It certainly can be argued that the tech champions of today are smarter and stronger and enjoy bigger leads than the big companies of the past, and that they have created virtuous circles for themselves that will bring rapid growth for decades, justifying valuations well above past norms.”

And to the poor economic conditions, the bulls note that it is delivering very low interest rates, perhaps for years to come. Consequently, these companies are benefitting from the PE expansion that accompanies a sharp decline in both short- and long-term interest rates.

You can find Part 1 here: Are you a bull or a bear? Part 1: Reasons to be bearish

The Montgomery Global Funds and Montaka own shares in Microsoft, Alphabet, Facebook and Apple. This article was prepared 01 September with the information we have today, and our view may change. It does not constitute formal advice or professional investment advice. If you wish to trade Apple you should seek financial advice.

Microsoft, Alphabet, Facebook, Apple and Amazon are dominating the US market, are they expensive or are they generating attractive returns on equity? This table shows all five companies Return on Equity Share on X

Hi Roger, thank you for your insights. Crystal clear thinking as always. My observation is that this article focusses the FAAMG stocks, which are not the whole market. Your previous article was on the market as a whole. I would be grateful for your thoughts on the effects of passive ETF investing on the FAAMG stocks , and the potential effects of a tech sell-off that we have seen in the last couple of days.

Hey Jim,

Really great to hear from you. I didn’t address the ETF influence because that could be an entire blog post in its own right. As you know I have written about their influence in the past here on the blog. If their liquidity is higher than the liquidity of the stocks they buy, the sell offs will be accentuated. We may be seeing it play out right now.

Hi Roger

I think those five Companies have a great future ahead of them, but knowing how to value them is the difficult part. If 10 Analysts were given the task to value them, it’s likely they would use different assumptions and come up with 10 different valuations.

It would be interesting to know the current market capitalization of those five companies to work out how many times Average Common Equity they are currently trading at. Also, what would be a fair required rate of return over say the next 10 years assuming a lower for longer interest rate environment ?

The market caps are as follows in US$B: Facebook 862, Apple 2,250, Amazon 1,768, Microsoft 1,753, Google 1,170. The total is US$7.8 Trillion. You’ll have to look up their balance sheets to get the equity and calculate the equity multiple. I would not be suprised if investors are adopting six or 6.5 per cent as their required returns in this market. Even that is quite demanding considering 30 year US bond rates are 1.39 per cent and the equity risk premium might be just three or four per cent.