Are we “wrong” on property?

Before we begin, thank you all sincerely for your engaging comments and your feedback here on the blog. And the thanks even extend to those whose disagreement is so vitriolic that their comments cannot be published. Fortunately, as investors we are used to disagreement; every time we buy a share, the seller has the completely opposite view. So, keep the comments coming – we may not publish your expletives but we always enjoy the process of investigating and understanding the divergent views.

If you are one of the tens of thousands of investors who have been reading our blog since the beginning, you’ll know that we are value investors. And one of the downsides of value investing is selling ‘early’. It is inevitable that we will think prices are ridiculous long before others do. This was indeed the case when we called, in 2010, an end to the iron ore boom.

On March 4, 2010 we wrote;

“In China today there is, presently under construction and in addition to the buildings that already exist, 30 billion square feet of residential and commercial space. That is the equivalent of 23 square feet for every single man, woman and child in China. This construction activity has been a key driver of Chinese capital spending and resource consumption.

About two years ago if you looked at all the buildings, the roads the office towers and apartments under construction the only thought to pop into your head would be to consider how much energy would be required to light and heat all those spaces.

But that won’t be necessary if they all remain empty. In the commercial sector, the vacancy rate stands at 20% and construction industry continues to build a bank of space that is more than required for a very, very long time.

Because of this I am more than a little concerned about any Australian company that sells the bulk of its output to the Chinese, to be used in construction. That means steel and iron ore, aluminium, glass, bricks, fibre cement … you name it.”

At that time iron ore was trading at $140/t and by April of that year it had hit $184.80/t.

Had you been prompted by our post and sought advice before selling out of iron ore in March 2010, you’d have missed the run up to $184/t and you could say we made the wrong call by being early.

But iron ore has since fallen to a low of $37/t.

So would you now conclude we were right?

Before answering that, it should be noted the iron ore price has bounced again, and as recently as a few days ago, traded at $95/t.

So were we right or are we wrong?

This is the problem with prices – they move around a lot. They move around a lot more than the underlying fundamentals justify.

Warren Buffett once advised to never take your cue from prices. Despite that sage pronouncement from one of the world’s most successful investors, most people pay no attention to it and decide whether their calls are right based entirely on prices; If the price goes up, then no matter what their reasoning was for buying – they must be right. If the price goes down after buying, then no matter what the reasoning for buying – they’re wrong.

Value investing however cares much more about values than it does about prices. And because we are dealing with fundamentals, which move much more slowly than prices, it is inevitable that value investors will look very wrong from time to time.

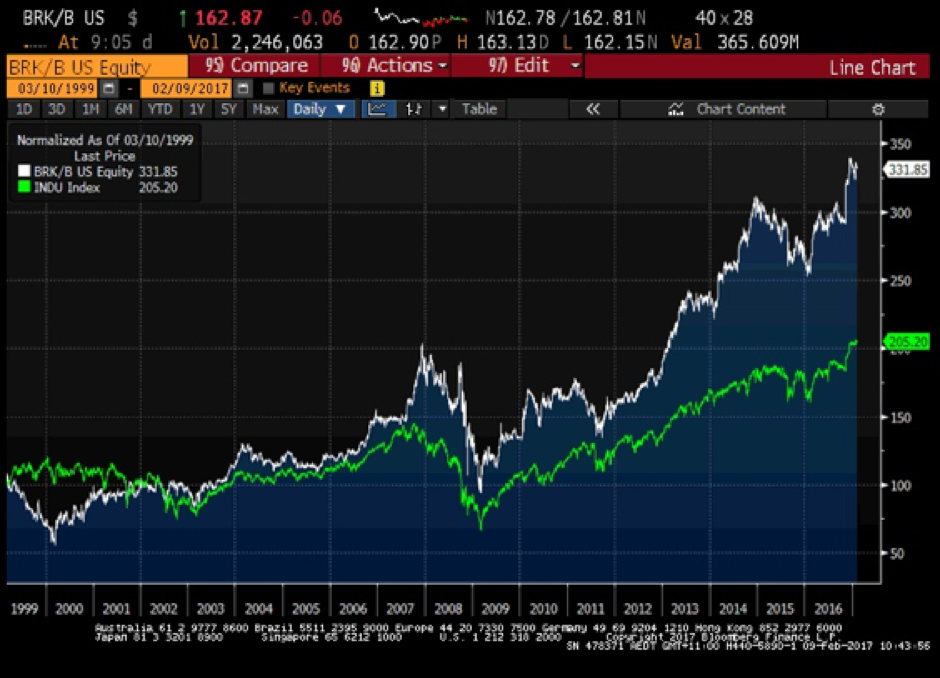

Take a look at the following chart of Berkshire Hathaway’s share price for the nine months prior to the tech wreck, in 2000. You can see that Buffett’s company’s share price underperformed the Dow Jones by a massive 41% in the nine months to January 2000. So was Buffett wrong to stand aside from the tech bubble? You could have made a lot of money buying tech stocks with no revenue. At the time several commentator’s said Warren Buffett was ‘washed up’, that he was ‘too old’, that he should retire because he didn’t ‘understand’ the then ‘new paradigm’.

Chart 1. BKR.B shares versus Dow Jones 9months to Jan 2000

The second chart however reveals the subsequent performance, and you can see the period of underperformance in the first chart as a small blip on the left hand side.

What I think is hilarious, if it wasn’t so worrying, is that in 1999 Buffett was a washed up investor who knew nothing about the new paradigm. However, two years later at the end of 2001, he was a ‘genius’. And yet between those two ‘labels’ he didn’t change a thing.

As value investors we will continue to serve the same menu no matter what others are serving. If you come to our restaurant the menu will never change and you will know what you are getting. We won’t be chopping and changing the offer or the recipes to meet the fickle demands of a population of diners obsessed with fads and prices.

Back to property and we have been warning about the emergence and growth of a bubble in house prices since 2013 and, once again, we have been early. If you only look at prices, you’d argue we have been wrong. But the fundamentals we discussed in those early warnings such as burgeoning household debt to income and GDP and oversupply have only deteriorated further since we first started arguing the makings of a bubble were emerging.

My good friend Hamish Douglass once observed, “It’s better to be six months early than six minutes late.”

Importantly, our warnings are now being echoed by the likes of Greg Medcraft from ASIC who is quoted in today’s The Australian Financial Review as saying; “I have been saying for a while I thought it was a bubble and other people are catching up now.”

Yesterday Rob Simeon, a real estate agent with Richardson & Wrench in Mosman, Sydney noted: “It was only a matter of time before some property punters would cash in simply because property data is now pointing to a significant price correction. The latest Reserve Bank of Australia (RBA) data has inflation adjusted wage growth sitting most uncomfortably around zero which spells disaster for households carrying excessively large mortgages. Time to cool the heels-cash in, and lock oneself into a lease for twenty-four months or so and watch what happens as there are some worrying signs out there, although some areas will see minimal change and others massive.”

…and that’s from a real estate agent!

Most worryingly Scott Morrison is making off like Pontius Pilate and washing his hands of the whole property bubble/bust affair, by telling the banks they shouldn’t raise interest rates, but knowing full well he has no command of global bonds rates and the banks’ cost of funds.

As value investors focused on businesses rather than stocks and values rather than prices, we will look out of kilter from time to time. Our job here at the blog, and as stewards of our investors’ funds, is to protect capital or at least alert you to the issues that may be detrimental to your wealth. If we are a few years early, and look silly in the interim, so be it.

The problem with property, as a class of financial asset, is that it is nothing like any other class of financial asset. The most fundamental valuation of a financial asset is the NPV of the sum of cashflows. Technically, land is eternal (at least until the sun expands in 5 billion years or so), so the NPV of an near infinite set of cashflows is nearly infinite. But try telling that to people in Detroit.

The issue here is that cashflows from property are entirely dependent on (a) monopoly access to one or more economic resources and (b) income to service mortgages and/or rents. While monopoly access to location is controlled by zoning, transport infrastructure and development approvals, and monopoly access to credit is controlled by central banks, REAL incomes are a function of productivity, which generally goes to shit when your entire economy is based on commodity exports and financial speculation.

What we have in Australia is not a property bubble, but an income bubble, created through the temporary aberration of China becoming an industrial economy, with less success than Japan for political reasons. Investment as a percentage of GDP in China is now 42% and falling. Expect that to halve in the next few years, taking down Australian export earnings and the exchange rate with it. Real incomes will fall, the consumer economy will falter, bringing down the FIRE industry with it.

Succinct arguments Jon and some rare insights from an obviously experienced investor/owner. Thanks. I’d also add that for many Australians your proposed ‘income bubble’ has been masked by historically low interest rates (=income recession) and suggests the REAL/underling picture is far worse. I would say that the NPV of an infinite series of cash flows still does depend on the discount rate/growth rate relationship.

Hard working people paying tax via TFN are paying for Range Rovers. it’s a sad saga.

No Action from Austrac.

No Action from ASIC. Medcraft started speaking as his term is finishing without any action till now.

APRA is joke.

Any one who takes action will loose in the next election.

We have a housing shortage that’s why we allow foreigners to own 25% of new homes “officially”

One does wonder how that sits with the 85,000 empty apartments in Melbourne. Sounds like a dent in the ‘shortage’ could be made rather quickly.

I don’t believe the markets have turned their minds to the French presidential elections that are a week away. The past 3 elections pollsters have, on each occasion, over/under estimated major parties by 2-3%. If this is true again, any party within 5% of second place could make it to the run off second round.

If Le Pen (front runner for most of the election although todays polls show half a percent behind) and Melchon (currently 3% behind the leaders but risen 4% in the last 10 days as Socialist party voters switch) finish first and second then both candidates in the run off will be in favour of a “Frexit”.

If either is elected they would still need to get over several hurdles but could impact European markest and have flow on effects to interest rates and who knows where.

I find it interesting that people call a bubble to something that I have seen 4 times now , and that’s a normal market cycle . Fair value is a willing but not overanxious buyer matched to a willing but not over anxious seller . By definition the markets of Sydney and Melbourne are above the fair value line and will revert . By definition Perth is below the line .

Prices have fallen in Perth and some areas have rusted , being worth the same today as 10 years ago.

Sydney and Melb will correct and or rust and you will have 3-6 months to act once the signs are there if you have an open mind . The great thing about this article is to keep the mind open and be prepared to act . You will need to act to preserve outperformance .

Markets will always go in cycles , watch for volumes coming off and for anxiety and denial .

Thanks Roger , we are always learning .

When the crunch finally happens what will happen to all those good small/medium businesses that you invest in if people won’t have any money (very little) to spend?? After the GFC in 2007 I witnessed a number of small/medium well run and long established businesses close shop.

I find it odd that property has risen and RBA/Govt/APRA et al are expected to bring in measure to slow or pop the bubble – when the share market tears higher 50% does anyone complain? No – yet this is primarily benefitting the wealthy and adding to housing unaffordability. Additionally measure which affect the whole nation but are for 2 cities only.

With property I think the transaction costs sometimes prevent people from selling – additionally if negative gearing was scrapped investors won’t want to sell grandfathered properties. Will a CGT Discount reduction be grandfathered too?

Also read some literature last week that net debt to equity ratios of the nation are around 25% on property. Also saw some interesting graphs on Sky Business YMYC last night showing that while Sydney has boomed it has not always been the case – on the ground I don’t see excessive speculation from investors – just demand and latent demand at that for housing close to the CBD’s of 2 major global cities. That won’t go away anytime soon!

I have to agree with you Roger but prices for property have risen so much in Sydney and Melbourne that even if prices were to fall by 50% most people would still not be able to afford to buy its crazy

Joseph,

You are right, WA residents were the same – it will never happen here, when was the last recession in WA, We have Ore, China will grow forever, when did property last materially fall in WA or Australia? The Australian gov had models that Ore would go over $220/t and as we all know it peaked at $180. Some suburbs in Perth increased by 8 fold. Most countries argument is that it hasn’t happened here before or atleast not in their lifetimes. Phillips Soos has a great book – Bubbleeconomics where it details property prices in Australia and it shows we have had 3 property bubbles in 1840, 1890, 1930 but they were long enough ago – not in our lifetimes. 1880s was a big one where Melbourne prices became the 2nd highest property prices in all of the British Empire behind only London helped by the Gold rush. This ended in tears around 1890 and we had a 10 year depression…

Hi, currently, this time is different. In NSW, a significant under investment in housing stock for many years is manifesting itself into potentially a 10 year bull run on property. Unemployment won’t change and the only thing that will slow it down are rate rises. People are moving to the major centres for opportunities and the population continues to grow.

The populations of Nevada and Florida were both growing at over 4% per annum, as was Ireland’s just before they bust. Suggests this is more an issue of credit availability.

Hi Andre,

I think you may be ignoring the fact that the Australian economy doesn’t exist in isolation and that changes in foreign markets can have a significant impact on what happens here. The obvious example is the out-of-cycle interest rate increases that will continue if the US Federal Reserve continues to increase rates. The RBA can hold rates down for as long as they like, but banks get their funds from overseas lenders too and if funding costs for the banks increase, Australian banks will be forced to adjust rates higher. We have seen this already with NAB, Westpac and CBA all raising rates. Roger has written about this at length.

Given Trump’s poor performance, Fed is less likely to hike again, or at least the hike would be much slower. On the other hand, China has been printing money exponentially while selling it’s foreign reserve to prop up CNY’s exchange rate. Therefore, the unleashed 4 trillion foreign reserve plus the leverages from local banks in doomed countries like Australia, Canada, UK, etc. will unquestionably lift the assests price around the world, until China exhausted its foreign reserve. That would be when the global economy will be hit hard, and the recession would bring us back to stone age.

Hi Roger, I have to point out that you are most likely wrong on this topic. The world economy has long been divorced from fundamentals, ever since the Great Depression. We are in the middle of a century long money printing bonanza. The central banks will keep printing ever more money. Therefore, there will be ever more lendings created to support the housing market. The haves will keep the value of their money against hyperinflation, and will live a cossy job free life sponsored by the de facto helicopter money tunneled to them through their property. And the have nots will become slave renters and works for the haves.

You may be right, I’m yet to meet or read anyone who can tell me why this money printing madness can’t continue ad infinitum. How does it stop? Is it the elites deciding enough is enough, offloading prior to crashing markets, torching the aspirational middle classes and picking up the cheap assets before reigniting the next bubble?

I agree with Greedy about the ease of State banks creating more paper money and these days with no backing. In the old days it was different. But Rogers comments on property are so true, sadly its a picture of basic greed thoughout the world. Who would’nt want to get the most from their property because they then have to buy a home at a higher price and on it goes in a ever ascending spiral. Until one day SNAP.

Hi Roger. Thanks again for excellent insight and thorough due diligence. Australia feels like one big property cheerleader at the moment. There are many headwinds for property especially the slow unwinding in manufacturing and construction so it will be interesting to see what unfolds. Given the ludicrous valuations for cardboard boxes out there how would you play the current situation as a first home buyer/owner occupier? Rent and wait things out until 2019-2020? Logic seems to indicate that people in general are as about as stretched as they can get in terms of borrowing at the moment.

G’day Roger,

Those who argue against the bubble’s existence will often say ‘This time it’s different because of … ‘

In WA at the height of the mining boom when Perth property was in the midst of the bubble what was the main argument that the bubble denialists fell back on to argue against the bubble’s existence?

Was it ‘…because China will continue to grow and they’ll always need our iron – ore’?

I’m keen to know what that one key argument was because it would be handy to compare and contrast it against other arguments used when discussing the current SYD/MEL bubble.

Thanks Roger.

I think it’s high time we admitted that our economic theory is busted, and endless money printing is not a good idea it’s very obvious that our system of money creation is out of control and nobody has any clue how to fix it .i find it amusing that the EU prints money to lend to bankrupt member nations as a bail out and then expect more spending control and discipline from the troubled nations in order to pay back the money they just created with a wave of a wand. It’s all completely insane,And if we were to let things crash and burn in 2008 like we should have ,things would be rosey by now ,but this new world where nothing is allowed to fail is going to cause far more pain than ever before when the chicken finally come home to roost .and we will only have the do gooders to blame as usual.I don’t think it was at all wise to outlaw the business cycle as we shall see I fear.

Hi Roger, Let’s all wait and see.

Hope you’re having fun Tim.

I’m originally from Brisbane and live in Melb now but when I went back to Brisbane in September last year and again in Xmas I couldn’t believe the amount of building going on in and around the CBD in areas like Wollongabba, Coorparoo and throughout the Valley and the city. In 2015 there was a lot of building but by late 2016 it just looked like a Chinese SOE had come in and built away…

My grandparents said at xmas that a friend had bought 2 units in Moorooka and his financial planner told him to sell because of the oversupply. He bought them 2 years earlier apparently and is trying to offload them at break even. See how he goes…

Keep us in the loop Laurent. Goes to show that median house price increases over the last two years in Brisbane are meaningless to the individual investor.

Thanks Roger,

having said all that (ranting?) in my above comments I still think it madness that people are borrowing $700 $800, $900 k or more to buy a derelict house or brand new 1bed unit in Sydney.

I have a friend who bought a 1 bed unit for $850k in Vaucluse because it had a view of the opera house. I told him he could’ve bought a large waterfront renovated mansion on the gold coast.

I am a firm believer of spreading risk to say 25% cash, 25% property 25% shares and 25% gold/silver because everything moves in cycles at different times. Now its easy if you are a multi-millionaire but this type of diversification for the average person can be achieved by-

1. 25% of funds into a Montgomery fund (I do like Rogers thinking) as I have no doubt its better to pay a professional money manager to invest vs investing oneself- its fraught with danger and stress eg. see share price falls of BKL, ACX, VOC etc …or just keep paying into your ‘balanced’ superfund.

2. 25% into property is much harder to achieve but that could be the ‘rentvest’ deposit combined with a parent or co-investor or both in a ‘normal, safer ‘ housing market such as brisbane -but buy a house on a large block of land somewhere near the CBD for around $600k (do not buy a unit)

3. 25% cash could be difficult to achieve along with the other investments -it comes down to saving money and leading a frugal life- no $20 smashed avacado breakfasts or $6 lattes

4. 25% gold /silver – not sure 25% but I think even as little as 10% in some liquid asset like gold or silver coins kept in a safe for a ‘just in case’ scenario !

One last thing -Bernard Salt has a great article in today’s Australian newspaper (23march) explaining the population growth in Australian capital cities over the next 30yrs will be the biggest percentage population growth in the world so even if you get the property market timing wrong in the next 5 yrs, as long as you buy well in Brisbane, Sydney, Melb or even high growth like Gold Coast (where i live) and hold for 30 years (which is what should be done anyway) you will make money from the higher than everage population growth..

To add to the debate. Particular for Brisbane.

I’m in management rights and know a number of others that are too.

My developer is currently renting (trying to rent) all vacant apartments and selling (trying to sell) with a tenant in place.

Associate’s developer is offering free storage spaces/cages and free extra car parks to get his last 4 over the line.

Rents are dropping, low open attendances and applications falling over (current rentals making offers to keep tenants from leaving).

From where I sit all the signs were increasing in severity from late last year. I backed my gut feel of ‘get out’ and sold out of 2/3 of my business. Like your comment above I might be early, but someone will be left holding the ‘hot potato’, same as in 2008. It just won’t be me.

Thanks for sharing Simon.

Hi Roger,

I wondered your thoughts on this.. I’ve read some interesting articles where they say that central banks don’t have control over rates and at best influence them. QE programmes aside, the yearly amount of bonds a central bank such as the RBA buys in its open market operations is a drop in the pond to the total corporate/gov bonds flowing through the Aussie system and they might influence the short end of the curve but barely nudge the long end. Is the RBA to blame for these crazy low rates that spurred the property bubble, or were they caught in the global bond bull market where rates went negative in Europe and Japan and to all time lows in America? Surely if the RBA raised rates while Europe was going negative, mortgage rates would have gone up some cause of rising savings rates but bonds would be so cheap and rmbs could be raised at low interest rates?

relative rates (global comparisons) play a huge part Laurent.

The reserve bank and our politicians have done a wonderfull job of transitioning our economy from mining to construction. I wonder what will happen once the cranes start coming down and put into storage or redeployed overseas. Once the rivers of stamp duty money used to fund the current infrastructure projects turns back into a trickle and the confidence dwindles.

I think we have been living in gold rush times over on the east coast. It’s not normal to have that many cranes and projects underway. We will break the world record for the longest run without a recession on the 1st of April but I suspect there’s not much left in the tank. Good luck to Malcolm Turnbull he may well have the unenviable legacy Paul Keating had of copping the blame for a recession.

Looks like our kids will see what happens when the money runs out, a city with unfinished projects and holes in the ground.

Hope the pain isn’t to bad for the battlers.

This is one of the reasons you were so attractive to invest with, the menu doesn’t change with the wind or market.

Looking forward to seeing the long term results!

I sold our investment property in 2012 and I mentioned it on this blog around that time. Being that early is indistinguishable from being wrong.

My excuse is that I didn’t think interest rates would keep falling, which then takes us to today. Now that I’ve been proven wrong, should I now jump in?

I say that interest rates need to keep falling for that to work, but those on the other side of the argument point out how I already got it wrong, and that it may keep going up as it is a strong market.

We shall see.

Great analysis and I was most pleased to see the prior piece in the Weekend Australian.

I came across this piece of research today which if true is quite hard to believe:

http://www.lfeconomics.com/wp-content/uploads/2017/03/APH-Consumer-Protection-Submission.pdf

Wow! “There is the strong probability that widespread fraud is taking place in the mortgage market;

(2) There are already sufficient laws and regulations to defend consumers, borrowers and investors from fraud;

(3) The government, regulators and other relevant public organisations have been unwilling to investigate and prosecute lenders, and

(4) Under these circumstances, changing and/or adding to the regulatory framework will do little to protect consumers from the predations of lenders.”

Keep up the great work Roger.

We need more people like you .

The media in this country as in most other countries is a total joke.

Who ever believes the propagandistic media and not persons such as yourself that tell it the way it is. I wish them all the best when the hard crash is realised.

And it most certainly will happen.

Have got to be pretty ignorant to not see it coming very soon

Hi Roger , once again a great article , you’re sticking to you’re fundamentals and that’s what you’re about , I love reading the comments , the diversity of opinion

The valuations on property are insane and no doubt about it, but the big outstanding question is government support. It seems whether its first home buyers grants, shared equity schemes or dipping into super, Australian governments will only act to support the prices and push them higher.

To me this is the great moral hazard that has been created by our government policy. People buy investment properties with the expectation of government support everytime some weakness is observed in the market, and everytime they go up they buy more. We can borrow to buy investment property with our super (but not shares). Now governments know they risk destroying these people’s investments and superannuation and the costs to the country down the line so they have more incentive to act to support prices. The too big to fail property bubble.

Another great article on the property market. Why do we not have more financial professionals calling this? I feel like it is pretty much you, Steve Keen, ABC, Lindsay & Phillip who are watching the oversupply and mortgage debt pretty much at 100% of GDP (Higher than America’s Mortgage debt/car loan debt/credit card debt before the GFC) and commentating on this.

Loved your comment that Scott M knows full well he can’t influence bond yields and cost of funds for banks. This is what so many people I speak to everyday don’t get as they have said rates will never go up. Interest rates/bond yields heavily impact what your mortgage rate is and they are very hard to predict. If every prop investor was so good at picking the bond market direction, they should start a bond fund, charge 2 and 20 and become billionaires (Obviously they don’t have that expertise). But rates keep changing and it’s naive to just say “rates will never go up”.

The rules of home affordability:

You should put at least 20 percent down when buying a home

Your maximum mortgage payment (rule of 28): The golden rule in determining how much home you can afford is that your monthly mortgage payment should not exceed 28 percent of your gross monthly income (your income before taxes are taken out).

Your maximum total housing payment (rule of 32): The next rule stipulates that your total housing payments (including the mortgage, homeowner’s insurance, and private mortgage insurance [PMI], association fees, and property taxes) should not exceed 32 percent of your gross monthly income.

Your maximum monthly debt payments (rule of 40): Finally, your total debt payments, including your housing payment, your auto loan or student loan payments, and minimum credit card payments should not exceed 40 percent of your gross monthly income.

Don’t buy a house that costs more than three years’ worth of your gross annual income.

The One Percent Rule This is a general rule of thumb that people use when evaluating a rental property. If the gross monthly rent (the rent before expenses) equals at least one percent of the purchase price

Formula #2: The Cap Rate

If a house passes the One Percent Test, I look at a measure called the capitalization rate, or “cap rate.”

The cap rate measures your cash flow, relative to property value. Cap rate equals annual net operating income divided by the acquisition price

Hi Roger

Everything you say makes for perfect logic and common sense, but so did the reasons for buying Isentia and Healthscope and REA.com. No I am not having a go at you or Montgomery funds because other ‘TV advisors’ on Switzer had talked about other growth stocks ( I had also bought (then sold) Hansen, Blackmores, Aconex, TPG) and then watched about 30 other ‘fantastic growth stocks’ that were paraded on TV, all fall 30-50% and are yet to recover more than 10%.

So my point is you are constantly warning about a housing bubble /crash scenario, why don’t you ever warn about a share market crash?

I just think the same warnings (stocks have the potential to fall 50% in 1 day ) should be brought out for investing in shares as we have already seen it happen to growth stocks

(but not yet in property)

PS. I saw the XJO and shares fall 70% in the GFC, vs property prices fall 10-20% in my area, so im sorry but the only things Ive seen that regularly ‘crash’ in the last 30 years are shares…

Plenty of blog posts here discussing asset bubbles in everything from bonds to low digit number plates. The sell off in mid cap growth stocks was the work of the big index hugging funds having to sell to get cash to fund an increase from underweight positions in BhP CBA RIO et al. The pendulum will swing back…eventually. Our opinion only of course!

Being a bear on the Australian property market flies in the face of an entire generation completely wrapped up in hubris, believing that they’re all financial geniuses and the ticket to wealth is jumping on the property ladder regardless of price or yield. Unfortunately for some there will soon be no one left to throw the hot potato to and people are going to get burnt.

What I find most disturbing however is the desire of regulators, and state and federal governments, to keep the whole charade going whatever the risk. History will show the dangerous combination of negative gearing, CGT and stamp duty concessions, FHB grants, irresponsible lending practices and excessively accommodative monetary policy have inflated valuations far beyond what can be reasonably justified. I can only hope the rest of the economy is doing well when the party stops.

A study of all past financial crises reveals regulators always and without exception want the boom to run a little longer. They don’t want a crash on their watch.

Hey Roger. Loved the passion in this post.

How do you see the correction playing out? When interest rates rise?

What is your advice to mom and pop investors during this time.

Timing and magnitude are something we’re typically poor at. For personal advice be sure to consult with someone who’s intimately aware of you personal financial circumstances and needs

I am a cautious person by nature so when property values started escalating, especially over the last few years, I believe they were and are overvalued considerably.

Since subscribing to your blog you outline in a logical manor, removed from emotion, the facts and I like your approach.

Please keep up the good work we need more people having intelligent conversation on real issues not smoke and mirror tactics.

I recently attended a seminar where Craig James , Commsec Chief economist, did a talk in Brisbane. I asked him about the supply of units coming online over the next year (in particular Brisbane) and his comment was that it will cause some “indigestion” for the economy but CBA don’t see it as a major concern.

CBA are the largest residential mortgage lending. Don’t ask the barber whether you need a haircut.

That’s a beautiful quote Roger , it made me laugh , but so so right

I, for one, do not have a problem with your analysis, Roger. I applaud your bravado in calling out your concerns for the developing property situation in this country and I think you’re even more gutsy to double-down on those ‘calls’ in the face of some emotional and brutal differences of opinion on the subject. Sometimes people just don’t see it until it stares them in the face! Will it be doom or just a little bit of gloom. Nobody will really know until it happens but either way there will still be many people finding themselves in very stretched financial positions as the property pricing situation unwinds itself (in my opinion). So please, keep calling it as you see it. That is only just one of many reasons why I am comfortably happy being a long-term member of the Montgomery Funds.

Thank ypou for those encouraging words Charles. We’ll do exactly that.

Thank you once again. The question is would you buy an undervalued asset, fairly valued asset or overvalued asset whatever that may be. People who bought in the last 5 years went for the latter, buying something that is overvalued when looking at the return is a financial suicide and many will finally experience it on their own skin.

Thanks Dario, I have removed the hyperlink because I don’t know anything about its author.