Are these the best value stocks right now?

With reporting season over, and armed with the Value.able mantra, how are you uncovering the very best stocks worthy of your attention?

With reporting season over, and armed with the Value.able mantra, how are you uncovering the very best stocks worthy of your attention?

Lifebuoy soap was once marketed as Floating Above the Rest. Are there any companies post reporting season doing the same?

While many of my peers believe 2012 could be a very difficult year for investors, there are currently a selection of companies that appear to be both high quality and trading at prices offering a rational safety margin compared to our estimates of their intrinsic value.

Each reporting season we present a short-list of companies worthy of careful analysis. This reporting season is no different. As always, the list is not exhaustive. You are free to agree, disagree or append the list. Indeed, I encourage you to do so. For debate often brings A1 ideas.

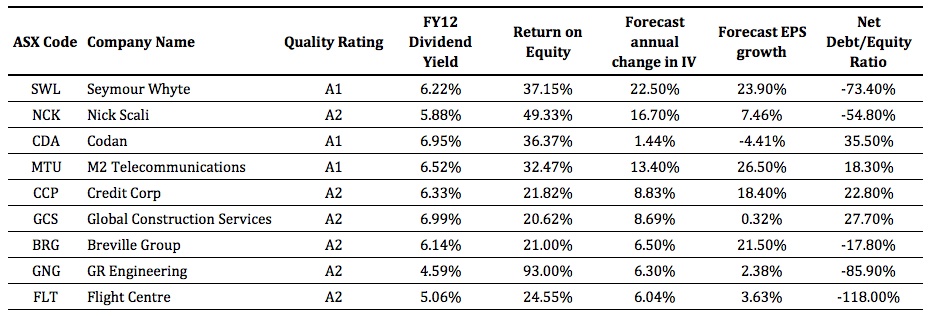

I decided to look for Large Caps, Mid Caps, Small Caps, Micro Caps and Nano Caps with an A1 or A2 Quality Score across all sectors and industry groups.

I’m also interested in companies for which there are analyst forecasts for at least one year ahead and whose current market price offers a safety margin of more than 10 per cent.

From over 2080 listed companies, 17 meet the criteria.

An attractive and sustainable Return on Equity is also important, so let’s seek out companies whose ROE is greater than 20 per cent in the most recent financial year, have a forecast dividend yield of more than four per cent and whose intrinsic value that is forecast to rise at least six per cent per annum.

The result?

Nine companies trading at a discount to intrinsic value that may be worthy of your attention.

Here they are: Seymour Whyte (ASX:SWL), Nick Scali (NCK), Codan (CDA), M2 Telecommunications (MTU), Credit Corp (CCP), Global Construction Services (GCS), Breville Group (BBG), GR Engineering (GNG) and Flight Centre (FLT).

If we were in a bull market, I suspect a stampede to get ‘set’ may ensue, without proper research. With the luxury of a market where the tide may still be going out, you may just have the indulgence of time to conduct plenty of research. Regardless, independent research is essential. As is seeking personal, professional financial advice.

So, what have you been researching? Go ahead and list your “Top 5”. We’ll put together a worthy riposte.

Alternatively, put forward your A1 suggestions and we’ll compile a list of intrinsic valuations and Skaffold® Quality Ratings for the next blog post.

Finally, keep in mind that I cannot predict where the share prices for these companies are headed. They could all halve, or worse. And remember, seek and take personal professional advice.

Posted by Roger Montgomery and his A1 team, fund managers and creators of the next-generation A1 stock market service, 8 September 2011.

guys! retail is finished! get away!

–> ORL

There is not much for me to refute in this post, but i have to say i disagree. There will always be a market for retail and especially a retailer who is innovative in their approach.

Retails not dead, only those retailers who can’t innovate. Not all retail companies are created equal, some still have product offerings and competitive advantages that mean they still are relevant and have a market.

Well said Andrew,

and this was shown buy ORL’s excellent results

Cheers

I do think that was the original point that ben was making….

Just had a quick glance at Orotons yearly results, and it has come in above what i was expecting. Seems to be an ok result. The ROE dropped as i predicted so i am not too worried here, Oroton can only generate ROE of 80%+ for so long. Profit growth of 7.9% which is a bit lower than the 18% for the previous year which could mean that the growth is slowing and the company becoming more mature. This is something worth investigating, my gut says it is. positive Like for Like profit growth leads me to believe that this profit didn’t just simply come from new stores as was the case with Jb Hi-Fi.

Inventory jumped a fair bit but the stock turns was pretty flat, oroton introduced new product lines and 8 new stores (ORL and RL combined). So this does not raise too many concerns with me.

Debt went up, but interest cover of around 33x means that it is still completley manageable.

According to the preso, the Oroton online store no makes up greater than 6% of company sales and online sales grew by about 180% apparently against the previous year.

Apparently the first 7 weeks of this current financial year (2012) exceed their expectations (wish i knew what they were expecting so i could make a better judgement as to how good this statement is).

I am a big fan of this company and i have a sneaking suspicion that after i get into the valuation nitty gritty it might be at a good margin of safety.

I think it is still the best listed retailer on the ASX.

My quick valuation for the 2011 figures just announced comes to about $9.79. I will come up with my forecast values for the upcoming periods after some further digging. At the moment and due to my forecast calculator being a very conservative one it is sitting at just over $7.00 for 2012 and just under $8.00 for 2013, but as i said my method for future IV’s is very conservative.

Hi Roger,

Your thoughts on ORL’s results (released today)?

Good result. ROE boosted by hedging loss but otherwise very, very clean result – no abnormal items.

ORL reported NPAT of $24.789m, up 7.9% • LFL sales were up 7% (Oroton LFL +4% with ‘controlled discounting’, Ralph Lauren +10%,

online sales growth of 180% – now 6% of total sales) • NPAT margins of 15.1% were down slightly from 15.7% • COGS were stable, the margin pressure came in additional warehouse / distribution,

marketing and selling expenses. • – no abnormal items. Large -ve movement in reserves of -$4.2m was due to a cash flow hedge.

Inventory was up $6.7m – a 28% increase – note: aged inventory declined, Opened 9 stores

in total. Also distorted by RL stock purchases in line with Northern Hemisphere.

OCF $24m was in-line with NPAT • Investment totalled $6.9m – this was down last on last year’s given their refurbishment

program is mostly complete. • FCF – $17.1m • Dividends paid $19.6m.

Opened 8 new Oroton stores – 4 in Aust / NZ, 4 in Asia (KL and Singapore). Refurbished 11. • Opened 1 new RL store @ Birkenhead Point. Refurbished 3. • 50,000 facebook fans

Will open 5 New Oroton – 4 of these in Asia. • Will open 4 new RL concession stores. • Stronger start to the year than expected for the first 7 weeks of FY12 trading. • Management believe that the overal Australian retail market is undergoing a restructure

creating opportunities for those who are innovative. This last point reflects Sally’s passion on the subject of innovation – something ‘old skool’ retailers at big electrical chains and supermarkets haven’t worked out.

ORL stockturns last year 1.99, this year 1.57. With such poor numbers there is no way they don’t have a lot of aged stock. Of course as they always do, ORL have got a bit creative with the calculations in their presentation. (For example, they have reinvented the ROA and the ROCE calculation to suit, and have stated their stockturns to be 1.8 instead of 1.57.)

The lack of information on sales/profit for the Asian stores is also an alarm bell.

Peter

Hi Peter ,

Think Roger has refered to this re seasonality of northern hemisphere stock..

Think this was excellent in the current enviroment……..Much better than DJ’s or Myer.

Cheers

Hi All,

I would like mention IDE. This company has been doing well for about 3 years now and has reasonable prospects for the near future. I am an owner of shares in this company.

Thanks Phil.

Hi Roger and Grads

Here are my top 5 , After reading value – able i made a mistake and brought a couple of companies at not a big enough discount to I.V. Not a lot invested and happy still to hold them, though the most vaulable thing is patience, so next time around im looking for the best at the best discount. And due to the current climate im also looking for companies for the longer term.

l also continue to drip feed the market and targets at different levels.

WOW looking for 22.00

IRE Getting more attractive ??

COH Want a bigger discount 43.00

CSL watching the dollar $$ 23.00 9.00 How long till we get an interest rate drop??

Could it be just like buying a car if you cant get that CV8 Z for the right price

there might just be another one come up tomorrow.

Also intersted in

CTD,CCP,GEM.

TRS: SHOULD BE AFTER CSL

Thanks Jefferey

Hi all,

My 5 most watched list are

SMX

OZL

CDA

SWL

CBA

I would post some reasons why but am on Holidays at Thredbo so I have higher priorities this week :)

Graeme

Hope the snow stuck around for a few days.

First of all I would like to say thank you to Roger and the team also all of you Value Investors for all you have contributed to this forum.

These are the 4 companies to look at:

1.GNG – GR Engineering

2.ANZ – ANZ bank

3.FGE – Forge

4.MTU – M2Telco

Roger

If i can have the liberty to stretch the list to a top 6. ROE > 25 %, nett debt to equity 30%.

NOE

MCE

BHP

FGE

TSM

IFM

Nigel

If i can have the liberty to stretch the list to a top 6. ROE > 25 %, nett debt to equity 30%.

NOE

MCE

BHP

FGE

TSM

IFM

Nigel

Roger,

If i can have the liberty to stretch the list to a top 6. ROE > 25 %, nett debt to equity 30%.

NOE

MCE

BHP

FGE

TSM

IFM

Nigel

My current best five picks are:

MGX, DRA, DCG, IFM and CWP though I feel more inclined to sit on the sidelines until I can get an injection of confidence. Perhaps a win in the Rugby would help?

Roger G

Thanks Roger, I am very keen to have re-affirmed the IV’s for 5 stocks and their Skaffold quality ratings. All 5 of these I currently hold and am considering adding to my holdings.

BHP

TSM

VOC

IVC

ARP

All the best

Scott T

VOC

NFK

SLR

CDA

FLT

Apart from perennial star performer ARP, I believe FWD was a stand out performer in FY11.

I’m impressed with this company’s vision and strategy. They made a clever acquisition during FY11 (BRB Modular) which gives then a lauching platform for their manufactured accomodation in the eastern states.

The company has demonstrated it has the processes and skills to build and operate accommodation facilities for the large mining companies (Sea Ripple in Karratha WA). FWD is expecting further large scale contracts of this nature in FY2012.

FWD continues to invest in their business. They continue to invest in the design and process technology of their products (like ARP). This is where I believe their competitive advantage lies. They are also adding new production lines to meet demand, and sourcing more materials from the Asian region.

This all adds up to a competently managed company, which knows what it does well, and continues to build on those strengths. I can’t help but be impressed, and a glance at average ROE shows that it is rising while keeping net debt very low.

Hi Roger,

Going with five, I have these. Recognising value as not necessarily being the greatest MOS, COH a good example of this.

COH

GNG

MTU

RMS

ZGL

Hey, I got into RMS at about 40c and there’s no way I’m selling in the current environment.

Some say gold is in a bubble atm. No way, currencies will continue to be rerated.

Cheers

Rob

Most of the usual suspects appear in my top 5 –

JBH

MCE

UOS

FPS

TWD

UOS I’ve only seen mentioned once here, but it passed through my screens. I’d be interested in comments on that one.

Similarly, another one on my list, VRL, isn’t anywhere near being in the buying zone yet, but passed through my screens – nevertheless, I’m not comfortable about it; there seems to be too much “financial restructuring” going on. Comments?

As for VRL, i think it is in a very tough kind of market and any owner in this business should expect it to be very similar to riding one of the roller coasters in there theme park.. Looking at some estimates of ROE over ten years appears to back this up. I can see a lot of external pressures on the companys earnigns that they have no control over

I am interested in an american company (at the right price of course) that is a similar type of business but i wouldn’t be to keen on VRL. Even thie american company has some issues with it which leaves me to wonder whether it is a wonderful riverboat worth climbing aboard on or whether they are pirates who will make me work off the plank into the waters of the Carribean.

These types of businesses especially theme parks can be quite capital intensive. Designing, installing, running and maintaining theme park rides can be incredibly expensive.

The cinemas are only as successful as the movies that are released during the year and you cannot be sure how successful a movie will be when released. The rear view mirror would not really tell you much in regards to this company. Internet priacy is a huge risk to this units earnings.

Theme parks tend to be a bit more stable and have better scope to raise prices in line with inflation/costs etc. But it is dependent on the area where the parks are located continuing to be a tourism drawcard and need to ensure they keep investment up to stay relevant, they are also very seasonal businesses especially the Wet and Wild parks.

As i said, it is a hard company to value and i can see exactly why you are not comfortable with it. These types of businesses can be hard to predict, the rear view mirror shows varied results. If you are like me and place an emphasis on strength and stability in companys than i don’t think you could pull the trigger on it. If you must value it than i would use a large required return and would need a MOS of giant drop proportions.

This question is off-topic, but it has puzzled me for a while. Delete if too irrelevant. Roger, you’ve said a number of times that it’s very hard for an Australian company to establish a competitive advantage because Australia is so small. I live in Finland presently, a country of 5 million. Some of the major companies here include Wärtsilä, Orion (manufacturing for ACR, by the way), ABB (formerly Strömberg), Ponsse, Kone, and Fiskars, all of which appear to have done very well for many years, and presumably have some kind of continuing competitive edge. I leave Stora Enso, UPM Kymmene, and Nokia out of this for obvious reasons, but they have been in this class in the past and may be again. What does Finland do right that Australia, four times larger, cannot do? Is it purely a fact of geography? Or it is just a question of perspective? Please note that I have not researched the companies I’ve mentioned apart from reading the papers, etc.

Hi Rod,

What I have said is that its hard to sustain the most valuable competitive advantage and I have usually (but not always) been referring to retailers. Kone is a successful international business. if a company has been in the class in the past but isn’t now, thats the point I was making. Keep well.

Hi everyone, had a phone conversation with Mr Paul Wright from Matrix on Thursday. I do hold Matrix shares. The gist of the conversation confirms what other bloggers have already posted (Ron shamgar I think) but thought I would share it here anyway.

Paul Wright is the CFO and was the CEO before Aaron Begley.

* there will be be statements to the market in a couple of weeks to “clarify” the order book.

* 2012 will be “solid” but not “brilliant”. A year of consolidation.

* growth expected 2013/14.

* riser buoy business expected to contribute 57% of revenue over next 2-3 years, down from current 80%. the engineering business currently contributes $30 million revenue and this is expected to grow. This diversification is seen by the company as a positive.

* it is a lumpy business

* the strong growth in the last 24 months was due to a lack of supply of new drilling ships, but this supply deficit has now been corrected.

* the world drill ship market currently stands at 200. In the next 5 years the new drill ship market is expected to grow to 300 ships. There should be strong demand for matrix products here.

* the other positive is that the MCE riser buoy products have a 10 year life cycle, so the replacement fleet market in the next 5 years is expected to exceed Henderson plant capacity.

* further equity raisings are not on the agenda, but couldn’t be ruled out 3-4 years down the track.

* the main purpose of the equity raising this year was to make the balance sheet bulletproof. The raising should have been done closer to $7 rather than $8:50.

* the current price is an overreaction.

Hope this is useful or interesting to somebody. I continue to hold shares and am looking forward to touring the henderson plant in the next couple of months.

Cheers,

Brett A

Hi Brett,

This is very useful and a wonderful contribution. Thank you for taking the time to post.

Question; Do you think that; “there will be be statements to the market in a couple of weeks to “clarify” the order book” and ““solid” but not “brilliant”” could mean 1) “downgrade” or 2) upgrade or 3)reaffirm current guidance?

Never listen to a newly listed company’s opinion about what the current market reaction is or is not.

Thanks for the post, Brett. Certainly ‘solid but not brilliant’ doesn’t sound like an upgrade to me – my guess is that there will be a drop on the numbers from only a month ago. ‘Consolidation’ in this instance is code for ‘Not as much work as we would like’. Would they prefer ‘consolidation’ over ‘running Henderson flat-knacker to satisfy demand’?

Growth in 2-3 years time? Hmm. What have their predictions been like recently?

It raises another question for me – if demand is expect to exceed Henderson capacity at times over the next 5 years, why might there need to be another capital raising in 3-4 years?

On the other hand, of interest regarding the MCE order book is this excerpt from the most recent Austock research report:

“Not all the work MCE does needs to be covered by the order book. ~20% of MCE revenue is short lead time, short turnaround orders that regularly come in. Taking this into account, we estimate that MCE needs to win $66m to support our FY’12 revenue forecasts. Given each drill string is equivalent to ~$14m, this is only 5 drill strings. In our opinion, this risk is not that high. The outlook for deep sea rig build (see below) is positive, but MCE is now in the position that it needs to converts quotes to orders to turn around its fortunes. The announcement last Tuesday that National Oilwell Varco (NOV) had won the contract to supply the drilling equipment to the first seven Petrobras drill rigs was positive, NOV is MCE’s largest customer.”

Thanks Brett.

in my opinion it will be a downgrade. but i thought it was already priced into the shares of Matrix anyway. So maybe Mr market’s schizophrenic mood will push the shares up??

As a patient investor i am willing to hold this one for now, as in the next 2-3 years, MCE should have at least ONE stellar year!

From current share price levels, that should provide an adequate return on investment. lets wait and see.

cheers.

How to reconcile this to the detail (c.f. Macondo driven drilling standards upgrades etc) of what was said in the Switzer interview with the CEO posted on 4 March 2011 a short six months ago ?

Goal posts and timing seem to move very rapidly in this business despite the long term investment horizon of its clients – not very confidence inspiring in the reconciliation.

Beware the hockey stick shaped demand projection, so loved by business leaders and analysts.

Direct link to the thread with the video:

http://rogermontgomery.com/peter-switzer-interviews-matrix-ceo-aaron-begley/#comments

The problem we have here is management. They haven’t been transparent enough with their share holders and now have a good track record of over promising and under delivering. I have spoken to them as well and have been very excited about this company in the past. The problem I have is if management have under delivered and over promised in the past, which is the opposite to what Aaron Begley said his mantra was when interviewed on Switzer, what now should give us confidence that they won’t do the same in the future? If they announce a downgrade shortly, this will be further evidence of this and in my opinion makes life very difficult for their investors. I still own some MCE and will continue to but right now Management are not making me feel as confident as I did in the past. There would be no need to announce confirmation of what they have just told us and it is unlikely by the language used that it will be an upgrade, so it looks to me that the chances are that there will be a downgrade. That all said they will more than likely have a great 2013 but the short term looks very uncertain. Now investors are fearful about MCE and as value investors we need to work out whether the companies MOAT and bright prospects are bright enough to take advantage of this.

Hi Brett,

Thanks for the report. It certainly looks solid from a long term perspective. One question… When Paul talked about riser buoy contribution going from 80% to 50%, did he mean that revenue contribution (orders) would go down, or was he referring to the growrh in engineering outbalancing the growth in riser buoys? By your comment that the replacement demand for riser buoys exceeding Henderson capacity I assume the later (which would be fantastic), but thought I should check..

Thanks

Emily

Doesn’t sound like the same company discussed here six months ago. This has been a bit of a case study in mass hysteria really.

David

Thanks Brett,

Great post. Regarding the upcoming announcement, I wonder if this is a change in the way investor relations are handled, or just a one off?

Mr Wright resigned today for health reasons.

Hi David,

Think it was Mr Kenyon,

Which everyone probably new about because Brett refers to Mr Wright as the CFO when he spoke to him the other day

Late inclusion – my top 5 prospects at good value:

TGA

FGE

MCE

GNG

SWL

Cheers,

John P

Thanks John and everyone who has been posting their famous five. We are now collating the data and the ten most popular will get a run on the next blog post.

Thank you Brett – very much appreciated

I read somewhere a long time ago that riser bouyancy normally has a 20 year life span. I don’t recall specifically where it was I read it but this is interesting to hear from MCE it is 10. I wonder if that is comparable with other manufacturers.

If replacements exceed Henderson plant capacity in the next 5 years then buyers of MCE today may look very smart (assuming margins etc are maintained). If correct, this may provide a much more stable order book than the current one.

If the replacement market gets going MCE will enter a stable phase. It is then I would like to hope that MCE has a durable competitive advantage that it can build upon. It is now that it can build that. If there are any MCE execs reading this – a durable competitive advantage is what you need to focus on. Don’t worry about today’s, tomorrow’s, or June’s prices.

>25% ROE; solid long term growth prospects, able, driven and straight up mgt, sustainable competetive advantage; trading at 2.5x book = I write out a cheque

MCE’s spin master is reported to have said ” the current price is an overreaction. ”

Now at what price did they vend this company into the IPO two years ago and what does that tell you about the MCE leaderships’ comprehension of value, as opposed to price?

Then ask yourself, how does this assessment flow to your assessment of the risks associated with substantial capital investments made subsequent to the IPO and what is the realistically sustainable ROE of the business subsequent to that investment?

Still an ‘overreaction’?

Hmmmmm! Not so clear is it?

My top 5 looking like good value:

FGE

BHP

MCE

CCP

TGA

I was looking at Mortgage Choice (MOC) and it seems like quite a good company, high levels of ROE, no debt etc etc. While management did not give any guidance, I couldn’t find anything bad that they have flagged for next year. Why then, do analysts predict EPS of around 15-16 cents for 2012 when last year, EPS was almost 23 cents?

Using 23 cents, I get a ridiculously high 2012 valuation (more than double current share price) and even dropping EPS to 15 cents, it still looks cheap.

Could somebody clear up what is going on here?

Thanks,

Chris

if im not mistaken Chris, their trailing commission gets reduced from next year. cheers.

Hi Chris,

You need to look carefully at the accounts and not just the headline profits. Profits this year were abnormally inflated as they made an adjustment to future trailing commissions. What you want to look at is the cash flow for a real indication of profits. If you take out the abnormal one off profit (which is really an accounting profit) then EPS was closer to 13.4c. Therefore, assuming there won’t be this abnormal profit in 2012, EPS will be closer to 15c. With a RR of 13%, my valuation is $1.15 in 2012 and $1.23 in 2013. I hold the stock for it’s high FF yield of over 11% but not because it is undervalued. I hold it instead of holding cash but would sell it and invest better opportunities as the market improves. The danger is that MOC would fall with the market but I don’t expect that it’s dividend would fall and the dividend yield should cushion any fall in the price.

The investor with a portfolio of sound stocks should expect their prices to fluctuate and should neither be concerned by sizable declines nor become excited by sizable advances. He should always remember that market quotations are there for his convenience, either to be taken advantage of or to be ignored.

– The Intelligent Investor, Third Edition, 1959

Nice reset of the compass for everyone Peter.

HI Roger,

My apologies, I wasn’t sure were to post this, but it seems that COH is being discussed a bit here.

I was wondering how yesterdays news that Sonova (which owns one of Cochlear’s main rivals, Advanced Bionics) has announced the immediate re-entry of AB’s HiRes 90K implant into the US, after having received approval from the FDA has affected your valuations?

UBS have adjusted their forecast of earnings-per-share for fiscal period 2012 and 2013 by 11 percent.

Cheers,

Trent

These announcements are timed to remind clinics they have a choice. Thats all. There has been a 10 month gap since their own recall (one of many recalls mind you) and I believe the fault of one of Cochlear’s competitor’s product caused electric shocks to the user. WHat does affect my near term valuations is the scenarios I have mentione here; Whats the worst case scenario of 2012 – a $400 million revenue hole (50% of rev this product) and no fill from Freedom range (so NPAT of $30-$70 million and down from $180mio). OK then that would be a shock and the stock could fall to $8.00 – $19.00 (on a P/E of 15). How many month/years before their R&D gets it back on the shelf or produces a new and superior product? (they spent $109 million on R&D last year – a not insignificant barrier to immitation). AB returned to market after 10 months. In the meantime how much market share can a competitor take take back when they have not only had their own recalls but their products have caused electric shocks to patients? As Chalrie Munger noted, he’s a better investor because his “guesses” are better than most.

Thanks Roger. This is such a great company and this market over-reaction has certainly produced an excellent buying opportunity. Its nice to finally be holding this one.

Cheers,

Trent

Price could halve Trent. I just don’t know and it will depend on the financial impact, which remains unknown although rapid distribution of previous model seems to be stemming any permanent significant adverse impact. Only time will tell.

” although rapid distribution of previous model seems to be stemming any permanent significant adverse impact.”

You’d think so. Indeed, it would be naive to think that COH hadn’t prepared for this pre announcement of the recall. I imagine they would have had Freedom units bagged up and dropped off at the courier destined for every place that uses COH implants on the morning of the announcement. It may have come as a surprise to the market, but the company would not have waited until making the announcement to start thinking about what they were going to do to minimise their financial impact.

exactly.

Another 5 to look at.

VMG

NOE

BSA

FSA

VTG

Thanks Tim.

Roger,

In putting together this list of businesses, have you taken into account their competitive advantages and future prospects beyond the predicated growth in intrinsic value? In my opinion, the predicted growth in intrinsic value is only one piece of the puzzle when assessing the future prospects of a business. A classic example is MTU. Although it is an A1 and has solid predicted growth in IV, as you said on Switzer, no one really knows what affect the NBN will have on MTU. So even though it is an A1, if we can’t accurately predict its future prospects because of some signifcant variables, can we really class it as investment grade?

I myself am not yet convined of the future prospects of MTU. I don’t like that it relies on scale and a couple of key relationships in such a dynamic industry. In a few years time, I don’t think this competitive advantage will compare to that of companies in this industry that are currently snapping up their own dark fibre (most notably another blog favourite).

Thanks for continuing to provide such high quality posts.

Michael

Michael,

The post is about encouraging investors to do exactly the sort of investigating that you describe. Regarding MTU, I am comfortable its qualities are better than many, many others in the wasteland of profitless prosperity referred to as the ‘market’.

Roger,

What are your current thoughts on TSM?

I know there are strong Australian dollar concerns with their British expansion but it appears Eurozone fears are spooking investors and bringing this business down heavily. I can see no other justification for a 10% drop in the last week (aside from Mr Market being irrational).

So my 5 at the moment would be:

FGE

COH

CBA

JBH

*TSM

*pending further information than above.

Hi MattB,

will be sure to cover it in a near term post.

An apt description by Robert Gottliebsen in articles he wrote

“This is a market dominated by computer traders who are driven by charts and by coordinated shorting or buying. The days of value stocks have, for the time being, been pigeon holed. Value investing will return, but for the moment computers run the games – hence the enormous fluctuations.”

I found this a useful opinion as a relatively amateur investor with too much enthusiasm and probably too much money in the market. Though i have learnt that its a lot harder to be comfortable with decisions you have made during periods of turmoil which has taught me that completing adequate due diligence and understanding the business is as important as buying with a MOS when it comes to peave of mind.

For the record my current favourites

– BHP

– DCG (though the market is testing me)

– FGE

– DTL

– TSM (especially if the AUD continues to fall)

Volatility is a useful partner in your value investing journey.

Remember Ryan that “during periods of turmoil” its the Value investor that quietly limbs over the parapet and walks across no mans land picking up parcels of beaten down/discarded stocks- sometimes 30% cheaper than they were just days earlier. Think MCE and more recently COH. If it wasn’t for charts, day traders and CFDs then we would have to wait longer and longer for the next period of Mr Market mania.

Hi All,

Regarding FLT.. I came across this: http://www.google.com/flights/ this morning. Seems Google have at least begun to enter the travel industry.

RobF

Not sure Google have killed every industry player, simply by entering a sector.

and certainly will take a while for google to impact FLT if this continues… “Sorry, locations outside the U.S. are currently not supported.”

The android market when it first launched had a fairly limited list of countries, this was only in early 09 and has expanded a fair bit since then. This will change and when you own the web-site where ppl type in “book flight to X” and can place your service at the very top, that’s very important.

Just in my home country in South East Asia, almost 5% of new born babies suffer from hearing loss. And more and more people can afford to treat their babies by implant technique. Local hospital can now master the process. Also, because of the huge social benefit of restore (or recreate) hearing, people has been proposing the process to be covered by public medical insurance (like medicare).Turn on your ethical filter and this would be on top of the list.

It’s just like one step back so we can step in.

Hi roger and bloggers

i would be interested in the ‘skaffold’ QR view on

MIN

FPS

kind regards,

Ok Seb. Thanks.

Hi Roger,

Two stocks that I would like to recomend that both have increasing cashflow and discount to intrinsic value

1) FML

2) LYL

Thanks John f.

Hi Roger,

My top 5 are:

COH (just got into this one yesterday)

BHP

DML

SEK

MAQ

I got into DML on a George Soros investment tip and very happy with its performance to date. IMO its still a bargain at todays price.

Cheers,

Trent

P.S I am very, very excited about Skaffold, thank you so much for the invite!

Thanks for the feedback and for the suggestion to look at DML.

From memory (so don’t quote me) George Soros is reported to have bought DML when the stock was trading less than 60 cents. It is now $1.40. The company has not made a cent, although I have read all about it and agree that it does look promising, although it is certainly not for me in this messy, more than usual unpredictable market.

I understand this is a stock that gets spruiked a fair bit.

Take care,

Chris B

Hi Chris,

You are correct, George Soros did get onboard with DML quite early on and bought in at an enviable amount. I am not usually one to buy into a company that is yet to start generating revenue, in fact this is my first. However I think this particular company is something a little bit special. They are hitting all of their targets and they are on schedule to begin producing in the first half of 2012. I agree that this was spruiked a bit in the months following the Soros buy in but I think that this one has been off the mainstream radar for sometime now. IMO the foundations are solid but I understand that this would not be everyones cup of tea. Having said that, this company has been the strongest performer in my portfolio in the last few months. This is definitely one to watch.

Cheers,

Trent

Great list Roger! I do value dividend yield and it plays a part in my stock selection process, as the primary purpose of my particular portfolio is income. If good stocks drop in price, but continue to pay healthy dividends, that doesn’t bother me, because I don’t need to sell them. Since buying and reading your book, I’ve certainly changed the way I approach investing, but I still have an eye on yield. There are plenty of other people who rely on their investments for steady income but also invest for capital growth, so thank you for including yield as a filter for this particular list of yours.

My top 5 are:

FWD

ARP

MND

MIN

HSN

Monadelphous isn’t so cheap now, but I bought it a couple of years ago at $14.49, and it’s a great company. The other four are still reasonably priced though.

From your list Roger, I also own some CDA, MTU & BRG, so very pleased to see them make your list.

Thanks John for being the voice of a vast majority of Australian investors.

I had lunch with a financial planner yesterday. They have their clients asset allocated: 75% cash, TD’s / 25% equities.

They said they won’t be increasing their asset allocation to shares until the all ords is back to 5000 – 5500 and can demonstrate it can stay there – markets too uncertain / risky at present etc….

So, they think it’s less risky to buy after a +20% rise.

This thinking is not uncommon.

Hi Brad,

If the index goes to 5000 and then a month later is at 7000, has it demonstrated its ability to stay there? What are your thoughts on the requirement for hindsight to satisfy this criteria?

Hi Roger,

This kind of thinking, from a market profession, is a contemporary example of the kind of behavour Buffett describes in his 1979 Forbes artice “you pay a very high price in the stock market for a cherry consensus”.

I had to train my mind to go against the crowd, but to be certain one is right, you need an anchor.

Waiting for prices to rise 20% to buy is stupid.

Brad

A well known Eureka Report writer (not Roger) wrote the same thing. Wait until All ords goes up at least 30% and demonstrates that it stays there for at least 3 months. I listened to him. The problem was All Ords kept going up and and up until it went up by 50% and then stabilized there. I was hoping it would somethow stabilize at some point, but certainly I did not expect that it would go up by 50%. This recommendation came almost at the very bottom of GFC (around March that year). I see similar sentiment these days. I cannot tell what happens. But that sort of strategy doeas not work certainly. I see the same person in the same newsletter making similar recommendations these days along the line of going to low levels of cash. You have to have a sense and make a decision at some point. Individual stokcs can move in different directions to All Ords.

Cheers

Yavuz

Reminded of Irving Fisher who just prior to the Wall Street Crash of 1929, claimed that the stock market had reached “a permanently high plateau.”

Interesting that if you applied the same logic to property, no one would ever buy houses. How many people say “ooh, I think I’ll wait until it goes 10% higher before I buy a house”; they don’t.

The property market is perhaps slightly less volatile, but that impression is also underlined by the fact that there is no ready intraday market for property (except REITs). If there was, you may be very surprised about what your house or investment property really was worth !

When the median price of houses goes up, those without one and renters usually complain. People don’t do the same when sharemarkets go up and stay there, saying “boo hoo, shares are too expensive”.

In 2007, it was getting stupid and every man and his dog were making easy money by picking any old resource company, and taking out margin loans to do so. I actually thought “it’s like the secret is out and everyone knows about the sharemarket. This is not fun anymore”; the same feeling as when everyone latches on to the secret and it’s not secret anymore.

“What we need is a really good crash to get rid of all the newbies” I thought, and hey presto, we did. The sad thing is though, some of those people will walk away, hating shares and saying “the sharemarket is a casino controlled by rich people” because that’s what they unconciously viewed it as – a ‘get rich quick’ game, and that property is ‘safer’ or ‘better’.

When bananas (a soft commodity) went up to $12, $15, $20 and stayed there, what happened ? People either didn’t buy or went and bought something else because the intrinsic value – the experience and taste of eating the banana – was not there to justify paying that price.

It was the same in Rich Dad, Poor Dad when Rich Dad offered Mike and Robert (as kids) to clean his store and earn an amount of money that eventually, got ridiculous. The metaphorical fun balloon then popped.

If you are like me, you buy when you have the money, and when you can, what you can. Example – I invested all the way through November 2008 to March 2009, picking up some great companies, but it is useless me saying “ooh, I should have thrown more money in, I should have bought that or this” because what’s done is done. Any fool can borrow or throw more money into the market – where does it end ?

At that moment in time, it was the ‘right’ thing to buy and at the ‘right’ price for me. Needless to say, I expect to get proved right in my selections over the next 5-10 years.

Take your swing at that one, big, fat pitch and live with it.

I had the same discussion with a supposed value investor in 2008/9 who said that he was waiting for the ASX to rise to 4000 and then he would invest.

This thinking is not uncommon but it sure is irrational. If they think it will go to 5000, then shouldn’t they invest wisely now and collect the upside? If they think it will decline then they can wait and buy great companies when they come into value or they can go all into cash.

I feel sorry for the people who entrust their money to fund mangers who maintain these thoughts.

regards

Steve

You are right brad, this thinking is not uncommon, and just plain lazy. After the All Ords is up to 5000 and sits there for 6 months, they will pile their clients back into “Blue Chips” like Qantas, Amcor, Onesteel, Fosters, Westfield.

6 months later their clients will be calling asking why they haven’t made any money, even thought they are now 80% invested in the market.

That’s what makes a market I guess.

All the best

Scott T

“That’s what makes the market I guess” or “That’s what makes the market a guess”?

If you wait for the Robbins, spring may be over

Hi Roger

My top 5 ROE > 20%, high dividend yield are

JBH

MMS

HSN

MTU

MIN

Other favourites are FGE, MND & DCG.

Thanks for all of your quality insights. I have learned a lot from you.

Evelyn

Thanks for the compliment Evelyn.

Hi Roger,

My 5

BHP

ANZ

CSL

WOW

BKW

Cheers,

Tim

Ok, so here we go. My best 5 discounts (for today!)

TRS

DWS

LYL

ANG

RIO

Thanks to previous posters for sharing. Always cool to widen the net a little.

Thanks Brenton for posting.

I know people here love their gold stocks yet no one mentions sandfire resources (it’s a copper play ad well). 4 brokers have dcf valuations of $8-11. High quality reserves. Anyone else have views on this. Currently trading at $6.80.

I have a few professional investing peers who own it but I haven’t come up to that valuation …yet.

You forgot to mention – never made a profit. You might as well take your money to the casino.

Peter

I thought i’d post the stocks that i’d be looking into buying if I was constructing a portfolio and had the funds to do so. The score column is just something i’ve included within my spreadsheet to score the value investing nature of the stock. For comparison purposes i recently scored Qantas a 15.10 (Out of 100).

Stock MOS SCORE IV

FGE 39% 92.98 $7.12

ACR 14% 50.35 $4.15

PTM 17% 77.49 $4.31

IRE 16% 68.51 $8.64

MML 11% 75.36 $9.70

HSN 56% 85.18 $1.35

ARP 12% 64.90 $9.10

RIO 60% 77.43 $110.10

I think it gives a good mix of mining services, Info Tech, Gold mining, Diversified Mining, Financials, Financial services (IRE) and Bio-tech. Only others I might think of adding is a bank (ANZ) and some consumer stocks (WOW, JBH or maybe DMP).

Interested in the thoughts of others.

Hi Josh – curious to know where you get $1.35 for HSN. I’ve owned it for some time now and came up with a figure of between $.91 – $1.00 based on most recent results – ROE of around 25%. You might use a lower RR than me – i am using 12%.

Regards

DAvid

Hi David,

I use a slightly diff valuation technique so that may be for starters what is driving the different valuation. I also used ROE of 25% and a RR of 12.5% but then that doesn’t mean a whole lot when our equations are different.

Looking at HSN’s past i think its the kind of company I want to own for the very long term. Continues to pay dividends at a healthy yield while earnings have also continued to expand over the last 4 years. Plenty of opportunity for the world-wide as energy consumption is and will be a huge factor going forward.

I just like the way they have a pretty steady cashflow from contracted customers and can easily add to that as they approach or market to others.

Regards

Josh

Well said – i also reckon its a gem and with the need world wide to better monitor and ration energy, the market for their technology will become larger.

THere is also a very close corellation between its operating cash flow and profit – with no debt. Not a bad space!

Regards David

Roger, some people want to join Skaffold but dont want to buy your book.

Why force them?

Cheers

Zoran

Hi Zoran,

Thanks for your rather frank post. Coincidently, I asked my team that very question today. They responded they would like to give their ‘frequent flyers’ something special. A way of saying thanks. That’s all. I couldn’t argue with that. If you can make a convincing argument in the absence of one from me, go right ahead and drop the team a message at my email address roger@rogermontgomery.com. Put “Team Skaffold” in the subject line and they’ll get it.

I play the card game of Bridge. First I took lessons. Now I can read articles on bridge play and know what they are talking about. Similarly, I’m glad I studied Value.able before I went on to avoid Cochlear, a great company that interests me, but way over intrinsic value. I didn’t buy it (at $75), and am I glad!

My advice: tell your pals to buy the book and read it before they go any further. It’s brilliant, illuminating, and necessary. And 50 lousy clams.There’s your answer Zoran.

P S I’m going to make my first investment in Cochlear now. Without Roger’s value.able information, I’d have bought much earlier, and been somewhat disappointed. I believe investment in this nervous market justifies great care in the selection of only the very highest quality companies, preferably at very big margins of safety. I will do as I have done with MCE, FGE, MIN, ACR, TGA, ORL :buy about twice what I plan to hold, sell half (or with some of the above, all of them) when the price approaches or exceeds IV, and sit peacefully with the balance of my holdings. With a little more courage, I’d buy MCE again now, but I’m uneasy about this one, as I suspect are others of my peers.All credit goes to Roger for teaching me to understand what I am doing.

Hey David,

I note some here at the blog have lower valuations than even the current price.

Hi Zoran and Roger

I can see Zoran’s point of view but I look at it from a different perspective.

It may not strictly be the case, but speaking generally the success of the book has contributed significantly to the success of this blog, with it’s many learned and learning contributors giving a vast array of insights into our good & not so good listed companies.

Many of the questions asked on the blog have been along the lines of “What is your MQR for this?” and “What is your IV for that?” So rather than continue to answer bits & pieces here & there, Roger has very generously poured his IP into this exciting new product so that all of our ratings/IV questions can be answered. Obviously we still have to do the research part but at least we can save some time by choosing to trust his ratings/IV’s.

Why wouldn’t he want to reward the people who have significantly helped to create the market for Skaffold?

In any case I don’t think Roger has said Skaffold is limited to those who purchased his book – it’s just that the initial opportunity to join as a founding member (with the accompanying benefits) is limited to his loyal band of Graduates. Which I think is fair enough.

Thanks again Roger for the past, present & future services!

Hi Scott,

I thank you for sharing your sentiments. I can’t wait to share it with you and look forward to your feedback. With the help of the community we will keep it beyond the leading edge and well out of reach of anything else.

Roger, will skaffold have a free or nominal fee trial version. Most software products offer this.

Cheers

Unlikely. In fact I can say no. The information Skaffold offers has a value that is very high and so it will only be accessible to its members. We won’t be offering it freely to anyone else.

The Insights blog will be here and I won’t ever charge for access to the Insights Blog despite the value it too offers to those seeking a good source of ideas to research.

Blimey, it’s 50 bucks for a book! Might I most respectfully suggest that those who can’t bring themselves to stump up the money for this book (which is outrageously underpriced) probably should not be in the value investing game.

The fact of the matter is that it’s Roger’s book, Roger’s business, Roger’s valuation service, Roger’s funds management operation so Roger’s rules apply. I might further suggest that Roger may wish to be selective about who has access to his services and that it might be appreciated if people are prepared to demonstrate an interest and at least some committment to his approach, rather than just wanting to make a dollar out of it alone.

BTW Roger, Gustav says hello.

Thanks for that Greg. Delighted he’s communicating again!

HI GREG /DAVID KING

Its not about 50 bucks,its about not being able to buy beer unless you buy tube of toothpaste first.

By reading book, you David avoided COH,did you avoid MCE by reading the same book?

I am proud owner of signed copy of Valuable but I would rather have thousands of Scaffold members pushing certain share than fewer(only those that have abook).

When Scaffold comes out we will need as many members as we can get to have an impact.

Cheers

Zoran

Those sentiments (“pushing stocks”) are not shared by me Zoran. Indeed I wouldn’t be the only one to take offence to the implication. Always “do your own research”. Always “seek and take personal professional advice”. They aren’t empty words here at the insights blog. When I say I am under no obligation to keep you informed of any change to my view or opinion, it is nothing less than a Warning! that you cannot rely on the last thing an invited guest says on TV or Radio for your investing strategy.

Skaffold will be appealing to anyone who upon reading about value investing has had the ‘lightbulb moment’ (remember there is nothing in Value.able that hasn’t already been said by greater investors and thinkers – “standing on the shoulders of giants” etc etc).

It won’t be for everyone and thats fantastic by me. Indeed we should be discouraging the pursuit of value investing and instead encourage tea-leaf reading…

I think Zoran missed a note by me that I had owned MCE, and in fact I sold it at just under its peak. I would have had no knowledge of this company were it not for Roger’s original inputs, and those of others in this place. If it is the company I thought it was when I first bought, I dare say there will be some happy investors down the road who buy at around this week’s levels. I could be sorry I didn’t join them, but until they announcel some new business, it’s too speculative for me.

Zoran, then do without.

Seriously, this is why most Aussies have no money, because they spend it on other stuff. If you are on the poverty line, fair enough, but if you spend money wisely, you will make money off that investment.

I have books that cost me $100 that have repaid their cover price in full many, many times over.

Anyone heard the story of the car park man “Earl Crawley” and how he did it ? Maybe find out !

I like it that only reader’s of Value.Able will have access to Skaffold initially. I hope it remains that way.

Sorry, would just like to clarify that comment – I hope that Skaffold will refocus bloggers (including my) focus toward thoughts & discussion of the sources of competitive advantage rather than what is this MQR, what is that IV etc

It will free you up to do all the right things in terms of thought.

“Go figure”…Common Roger. You know it is more complicated than that. We all new COH was expensive. Way above anyones IV calculation. It remained one of the few stocks on our market that was largely left untouched by the recent market correction over the last couple of years. Of course it was going to be savaged by ANY negative news…no matter how slight. This announcement simply made people question this businesses inherent risks, by focusing their attention on “what could go wrong”…instead of…”what a wonderful successful Australian business story”. Well it sure woke them up. Because guess what. Implanting electrical devices into people is a risky thing to do, electronics will fail, and if they are in people, and they have to be removed (and it still remains unclear if this has to happen), the company will inevitably have to pay something from their bottom line towards this failure. So where was the provision for this “event” in company forecasts? As you are well aware, people need to really understand a business. And in this case it also involves medical risk as well as financial risk. People simply chose to ignore this. But now they have to factor it in. That is why the stock was punished. It is all about reputation.

All good ponts and reflective of a view. I believe we humans have a tendency to make things more complicated than they need to be. In the quest for more information we become more confused. In the quest for funds to do what we are really passionate aboute , we forget the thing we were passionate about and the quest becomes the passion. Curiously the more obfuscating a thing is, the more it is valued and the more simple verion seen as a quaint anachronism.

We both agree that Cochlear was expensive but not so sure I agree with “Of course it was going to be savaged by ANY negative news”. Not sure thats any more complicating either. Nevertheless from an investing perspective I am glad that it was savaged and we purchased some shares on the day. It may continue to decline, I am no great forecaster of prices, but I cannot think of twenty superior companies listed on our market. One ‘fitting centre’ rep I spoke to today after hearing them chat on the radio about the issue has fitted over 2000 devices and over 520 of the model that is being recalled and they have had just two faulty examples since 2009. That is a very big deal for those two people however it appears the proactive decision by the company is being well received and the recall and subsequent R&D may just save them money and push the competitive advantage and market share even further ahead in years to come. That, I guess is the ‘other’ view and what makes a market.

COH hitting $55 today, unbelievable value in a fantastic company. COH’s price during the last 3 days of trading shows Graham’s Mr Market analogy at it’s best. Typical irrational behaviour by uneducated investors who panic and sell instead of realising the impact of the product recall to the long-term prospects of the company will be minimal at best.

I,m not surprised at the panic sell but a little surprised at ppl buying. At $50-55 its only about where it should be. Wirh no guidance but some estimates of 20% loss in revenue, thie iv isn,t pretty. Just my thoughts

Keep an eye on the range of possible revenue and profit outcomes from the recall – not known by anyone at the moment, not even Roberts. Will have an effect on the ROE in the short term but not long term. nevertheless the short term impact will mean slower growth in equity/bookvalue and so push out by years what we had for intrinsic value only a few weeks ago.

Yes, treating what is temporary as though it will be permanent. The timing of Cochlear’s announcement followed by that of its competitor could be the perfect scenario for the investor to buy COH – provided it is a temporary hitch. Inverting the situation is helpful here I think, rather than thinking about what factors would cause it to be temporary, try to work out how it could be a permanent setback. A voluntary recall, no-one injured, small % of units affected, and an easy alternative for replacement – it is hard to see how this will have a long term effect.

While I am not a hearing specialist, my observation of my fellow health care professionals is that they tend to be fairly ‘sticky’ with their preferred providers and suppliers. My view is that those who are familiar and trust the COH product would be unlikely to be put off by the current issue. It could be argued that if a competitor could produce a unit that is demonstrably superior to anything in the COH range then it could have an impact that would be somewhat greater at the moment than it might normally be. I also think though that a voluntary recall by a smaller manufacturer would impact it more than a similar event by the dominant player.

The issue of course is incumbent shareholders’ prior belief that the company was bullet-proof. Before worrying too much about the competition, keep in mind they too have had recalls.

Roger my 6 our:

MIN

BHP

ANZ

WOW

FGE

RMS

Thanks for your list Manny.

Hi, I have 4 candidates that each have greater than 20% ROE. low debt to

equity ratio, growth prospects and forecast dividend yield >4% (if it’s

considered important. Keener on Consolidated Media (CMJ) if Alan Jones is

not excommunicated, and Carsales (CRZ) forward thinking management. Less

keen on Hansen Technology (HSN) and RCG Group (RCG). Cheers ColinW

Thanks and kind regards

Colin

Thanks Colin. Great list and good comment on the yield inclusion.

From the reporting season I was attracted by the following three.

Wellcomm[which has been a favourite of mine for some time] came out with a solid result that re inforced my IV of 2.85 with the prospect of Asian growth providing a “blue sky” impetus.

Laserbond [LBL] is a small company,tightly held with a large management holding,that specialises in”reclamation and surface engineering of industrial components operating in severe environments” ie: mining equipment.EPS of 2cents on Equity of 10cents;a 25% payout ratio and a positive outlook gives a conservative IV of 23cents.

Infomedia [IFM] is ignored as forecasts for next year are lower due to an increase in amortisation.Cash Flow is higher than reported profit of 3.3cents on Equity of 11.6cents giving an IV of 38cents on a dividend of 2.4cents fully franked.Not only a sound business but a fantastic yield exceeding 12%.

Regards Doug.

Thanks for the list Doug. Nice work. Wellcomm and Zicom are gettinga few mentions here at the blog.

I am starting to feel that the companies that roger believes we should invest in are extinct or have reached maturity. We have a market full of ordinary businesses (take your pick) mature models

lacking growth prospects (JBH/wow)and overpriced business eg voc.

Innovation is scare & banks are looking for credit growth.

Miners are the only ones- commodities – seems the only industry.

Hi Dino,

….and then along comes a +20% decline in one day in the worlds biggest manaufacturer/marketer of Cochlear Impants with unit volumes still growing at 17% per annum. Go figure!

Did someone just say something? Sorry getting a bit hard of hearing. Did someone just say a wonderful hearing aid company is on special?

Thank you Luke. Perhaps not exactly what we want to hear.

I’ve been waiting for COH to fall below $60 since Sep 2009! Two years of patience and I finally now have bought back into this wonderful business. I’m sure I’m not the only Value.able Investor that bagged a bargain yesterday.

I’ll take a quality mature company any day of the week. I am not too fussed whether they are more on the mature side or not as long as they are still a qualtiy company. They are out there and as we saw with COH yesterday, every now and again something will happen where you can buy these companys at decent prices. It is just a game of patience. Roger himself is mostly in cash.

Patience and calm temperment is the key to a value investor, if we wait, the opportunities will rpesent themselves.

They always do. And “you know value when you see it”.

When the share price falls out of the sky, it is best not to buy a full position at that time. Check what happened to TRS, LEI & BBG. Big falls, then falls to new lows, and significantly lower. A fall of 20% in one day shakes the confidence of investors, and it is rare for a stock to get off the canvas quickly from such a fall. Buying in about a months time is likely to be the better way to go, as we will likely see prices continue to migrate lower.

I think there may be merit in this approach. Would be good for someone to test it though. Decisions should be made on facts as much as a possible.

I agree. So many examples of shock drops and the shares have continued to slide like TRS ORL LEI of recent memory. Marcus Padley wrote a piece (RM Note: in the Sydney Morning Herald/The Age?) on this phenominan called shock drop stocks. One reason for the continual slide he suggests is that big instos and holders have to slowly sell out their positions without completely flooding the market. Makes sense and 9/10 I’ve seen big 10-20% drops continue to make new lows during the next few weeks and months.

Roger,

I read it on Yahoo7 Finance. Here is the link: http://au.pfinance.yahoo.com/our-experts/marcus-padley/article/-/9218189/shock-drop-stocks/

Generally not a fan of Marcus, probably due to his very pessimistic style of writing, but nevertheless this article was very enlightening for me. Perhaps even a good shorting strategy if after a big ‘shock drop’ of 10-20% the share price is still well above IV…food for thought.

So how do we deal with this situation, if we have seen a big fall, but are expecting the stock to go lower? While we can be reasonably confident the stock price will be much higher in 10 years time, the lower the price we pay, the higher the expected return. This is a dilemma that I have faced even when stocks are significantly below estimates of intrinsic value.

Vishal

You have to follow your own approach. You need a process that explains how you build your position. Is it over time, is it the result of certain margins of safety being triggered. What is your process? Only then will the consternation you display in your various questions be mitigated. Hope that helps even if only a little.

Yes it does, in highlighting the need for a more systematic approach on my part. thanks Roger.

Regards, Vishal

Hi Roger and keen followers,

I finally got the courage to re-read Value.able and sat through 10 hours of trying to put my brain through it’s paces and I have created an Excel spreadsheet to calculate IV based on pages 183 – 190.

DTL using current Financial Report 10%RR and using 55% ROE but I am uncertain about Equity Per Share as EPS seems to be interchangeable on this Blog as Equity Per Share as per your book Value.able Ed 1.page 188 Step A. and Earnings per Share and this is confusing for first timers.

I came up with $15.99 and in 12 mths est $17.34.

Will someone pls advise if this is close?

Thanks, Will

Hi Will be sure to read and digest the references to implied growth rates…

Sorry to hijack to conversation, but how would one go about finding and accessing reliable analyst forecasts? After searching around on Google, it seems the big international banks only allow account holders access to their research reports. I do get a select number of reports through my broker, Bell Direct. However it is a limited selection. In Value.Able, Roger suggests just Googling a company to find a free report. However, in practice, I have found it very difficult to uncover any free research reports and I’m a very experienced Googler. Any advice on the matter would be greatly appreciated. Thanks.

There’s a mountain of core info (EPS, DPS forecasts) available through the major data vendors via the large online brokers. Interested to find out what everyone else has been using. Many smaller companies put the analyst research of their company up on their own websites too.

Hi Guys,

Not sure what Bell direct provide but etrade and comsec have analyst consensus forecasts for the analysts that subscribe to the Morningstar thingy. This is not all forecasts though.

As Roger says the company Websites often have analyst coverage.

Yahoo Finance also has EPS estimates.

I have found not very many companies that I can’t get at least something for from these 3 sources

Hi Roger and fellow graduates

I was reading Marus Padbury’s article in the SMH on Saturday and was wondering what your thoughts on his article were.

He is basically in cash 100 percent as he feels that a GFC2 is on the cards.

I would be interested in what everyone thinks about this .

Hi Mark,

I know and like Marcus a lot. I have always thought the Holy Grail was a stop loss that stopped you out before a major catastrophe but kept you in during the smaller declines that ultimately reversed. A consistent ability to identify which type of decline they would transpire to be would be handy. We agree that 2012 could be a shocker for investors in teh stock market. We are still over 62% cash in our fund and haven’t bought anything for a few weeks now – with the exception of a certain CI manufacturer very very recently.

Mmmmm.

CI Manufacturer,

Wonder what that was,

A Classic case of Graham’s Mr Market,

Looks like he is serving you will Roger?

Hi Mark. I subscribe to Marcus’ newsletter and have watched his income and medium term growth portfolios all hit their stop-losses until he had nothing left except FGL in the income portfolio (and that won’t last long with the current market volatility). I find Marcus’ insights and humour quite educational and entertaining, but I don’t employ stop-losses myself, and remain almost fully invested in Australian listed shares. Marcus could well be right about GFC2 (although he has commented that he regards this current volatility as GFC1 still playing out), and he’s not alone in his predictions.

An alternate view however would be that shares in Australian companies with limited (or preferably no) exposure to the USA and Europe that are profitable, have healthy cashflows, and pay good dividends, would be a better option than cash, because you’re exposed to the upside risk of possible share price increase, without sacrificing much income (as opposed to a bank term deposit for instance), especially if you take advantage of market volatility to buy quality stocks at healthy discounts to their intrinsic value.

It depends on your individual appetite for (and tolerance of) risk. I personally am OK with a portfolio of high yielding quality Australian stocks (and even a couple of low yielding ones like ZGL who are very undervalued in my opinion) and I’m not too concerned with a full blown GFC2. If a number of European banks collapse or have to be nationalised or otherwise recapitalised (for instance), it’s going to be a wild ride, but it won’t cause my portfolio to be worth nothing, or my dividend income to reduce to zero. It’s scary, but not fatal. My opinion only. Marcus Padley prefers to be in cash right now. I don’t. Roger’s about 60/40, I think (or thereabouts). Your call.

Hi John and everyone,

I think it was Munger (or Buffett) who said, “Unless you can watch your stock holding decline by 50% without becoming panic stricken, you should not be in the stock market.”

My own take is that there is lots of cash on the sidelines.

Sooner or later that cash will slowly start flowing back into the market. ( if interest rates are cut a few times then this will happen quicker).

It still may take a year or two.

So if you have good businesses in your portfolio and are prepared to sit it out then sooner or later that money on the sidelines will find its way back into the market and all things being equal those good businesses should increase in value.

Good thinking.. Has been effective in the past. Will be again.

Hi Roger,

While this list is not my top 5, these are the stocks that I’m currently spending a bit more time on.

4 gold stocks

DRA – Dragon Mining

KCN – Kingsgate

RMS – Ramelius

SAR – Saracen

and these three

LYL – Lycopodium

BKL – Blackmores

BKW – Brickworks

Cheers

Mike

Thanks Mike.

I am puzzled why value investors would buy gold stocks when the gold price is at all time highs. Seems like the opposite reaction to what should be done. Rest assured, the bubble will pop, and it may not be too far away.

Good to hear a contrary opinion Michael. Thank you. You could be right. While Soros is long gold stocks, Jim Rogers is too but he says even a 40% correction is normal in a bull market for gold. You could all be right at the same time! We have a little exposure to gold but in entities that appear to be very cheap even at much lower gold prices than currently being seen.

Entities! Plural! That will get the gold bugs revved up.

I just can’t get excited about gold, it just doesn’t float my boat as an asset class. Maybe there’s something wrong with me.

Nothing wrong with that at all.

Just on the gold stocks I mentioned above. Normally I wouldn’t touch resources or gold stocks.

However, they serve two purposes in my portfolio.

1. They appear cheap compared to their current prices, have high ROE, very little or no debt, and even if the gold price collapses, they will still make decent profits, because their cash cost of producing gold is way below the current price. Even if gold fell to $1000 an ounce, they’d still be making a profit.

2. They are a hedge against the markets suffering a major collapse.

Many gold producers also hedge or partly hedge their expected production, so they aren’t receiving $1700 or $1800 for gold for gold they sell. This means they are still making decent profits despite receiving $1200 per ounce of gold (as an example).

Cheers

Mike

Mike, re cash costs and gold. I read an interesting piece from my broker the other day indicating when the mining costs for deferred waste is included (and it is a cost) then the cost can be significantly higher. On the stock they covered in the report it was, on average, 23% higher. Quite Illuminating!

Cochlear down 20% this morning on a product recall….

Thanks MattB. Good spotting.

Hi Roger

Is late but COH still seems expensive

Equity 503.3

Shares 56.7

BV 8.87

ROE 35.7

PR 73%

IV $46.81 using a 10% for a safe stock?

Maybe i should check my figures tomorrow

Thanks Tony C. Keep an eye on the range of possible impacts from the recall. Will have an effect on the ROE in the short term but not long term. nevertheless the short term impact will mean slower growth in equity/bookvalue and so push out by years what we had for intrinsic value only a few weeks ago.

Top 5 with my 2012 IV Estimate

DCG $2.60

FGE $6.80

SWL $2.35

ARP $7.96

COH $62.44 – Big fall on the recall notice. Possibly an overreaction but if it falls below $50 I’m in.

Few arguments against that list Scotty although a few here have posted contrary opinions of SWL.

My top 5, I have held these for awhile now..Getting a little nervous about WOW and ANZ though recently. WOW because of there growth prospects (hardware) and ANZ because of the cloud hanging over the global financial sector in general. These stocks have been like the tortoise in the hare and the tortoise fabal, they just keep plodding along.

WOW

CSL

SMX

COH

ANZ

Thanks Garry. Smart looking list.

Typical, something i have been waiting for for a long long time happens when i have no money to get into the market.

re: COH dropping around 27% (or $57) today where i have a 2011 value of $58.00 and 2012 of $60+

I know that this event will of course flow through to the resutls by a decrease in forecast profits due to the recall and cause a lower IV but nothing really changes in my opinion in the long term so i think the $60+ one will be accurate at some point in the future.

Saying all this and taking my value investing hat off and my human hat on, i hope these faulty items that are being recalled don’t do anyone any physical damage.

We are agreed Andrew. There is no impact on health & Safety I am told. The device shuts down. reputationally may be a positive to recall when failure rate is less than 1% but increasing. Market share will be way above competitors for a long time so conversely, reputationally a recall has a bigger impact.

reading more about it today, i think it is possible for COH to actually “spin” (for lack of a better word) into a positive for them. It could potentially say a lot when a company decides to recall a bunch of their products due to a 1% failure rate. Makes a big statement about their focus on their products quality. Also, the decision to recall at a hit to their short term profits shows that management are ensuring that any reputational damage to the brand is minimal in the long term. Long term thinking by a companys management is a great thing from this value investors point of view.

Still wish i had the funds but bought up as many as i can on a newspaper linked online trading game. Although the time frame of this competition is one which places the value investor making this sort of move at a disadvantage from those buying and rapidly selling speculative exploration companys. But i am a value investor so that is what i will do even in a short term trading game.

Hello Gang 1st time…Flight Centre is A2 …on a recent trip to Honolulu l stayed at Turtle bay and cruised on the Pride of America…FLT price quote’s were appox plus $100 for Turtle Bay and plus $1200 for the boat….from online direct prices to the venue’s….makes you wonder how they do it ?? Lets know if you have any presentions in Melb..would like to meet you…Teddy

Will do Teddy. Their competitive advantage may not be ‘the lowball provider’.

Teddy,

My wife and I have just returned from a 2 week trip around Vietnam and Cambodia, which was organised by Flight Centre. Not one hitch; stayed at 5 star hotels; met at the airport and transported to the hotel; a personal guide at most locations; internal flight tickets delivered to the hotel; etc. We were most impressed. I am not trying to ‘sell’ Flight Centre, I am commenting on what a professional organisation does. Consequently, their shares are now on my watchlist.

PeterB

Thanks PeterB. Nothing like coal face scuttlebutt.

COH down 19% today on the back of a voluntary product recall.

Irrational mister market at work again?

Interesting article from Wall Street Journal:

The Age of ‘Macro’ Investing

________________________________

Sept. 11 Ushered in an Era of Geopolitical Turmoil That Continues to This Day. Here’s How Investors Can Protect Themselves

Couple of extracts:

“Two generations ago, the U.S. endured a global conflict that cost 50 million lives,” Mr. Bernstein says. “The next generation faced down the Soviet Union and its 20,000 nuclear warheads. If you had told Americans then that the U.S. should someday be even more afraid of a handful of jihadis from countries that couldn’t even make their own bicycles, they’d have keeled over laughing.”

Put Fears in Perspective

So how should investors respond in a world where macro events seem more common—and threatening—than in the past?

First, put the fears in perspective, taking a cue from the great investor Warren Buffett.

“We will continue to ignore political and economic forecasts, which are an expensive distraction for many investors and businessmen,” wrote Mr. Buffett in his 1994 letter to shareholders of Berkshire Hathaway Inc. “Thirty years ago, no one could have foreseen the huge expansion of the Vietnam War, wage and price controls, two oil shocks, the resignation of a president, the dissolution of the Soviet Union, a one-day drop in the Dow of 508 points or Treasury bill yields fluctuating between 2.8% and 17.4%.”

Added Mr. Buffett: “We have usually made our best purchases when apprehensions about some macro event were at a peak.…A different set of major shocks is sure to occur in the next 30 years. We will neither try to predict these nor to profit from them. If we can identify businesses similar to those we have purchased in the past, external surprises will have little effect on our long-term results.”

We are similarly ambivalent towards economic forecasters. Someone yesterday quoted this; “if you lined up all the economists end to end, they still wouldn’t reach a conclusion”.

Another 5 Roger…

min/mtu/dtl/ilu/lyc……rob.

Hi Roger

Mine are a bit different and would love your opinion – I am prepared for the hit my pride will take if you declare them all dogs :)

NFK (Good ROI and no net debt. MND owns a portion which has to be a decent sign doesn’t it?)

BSA (Not great ROE but good cashflow and cash positive for first time)