ARB and the long game

ARB Corporation (ASX:ARB) – the Australian-based global manufacturer and distributor of aftermarket 4WD parts and accessories – has been a stellar performer since listing on the ASX in 1987. It’s a quality business, with sustainable and valuable competitive advantages that enjoys attractive long-term economics. ARB’s share price soared during the lockdowns, but has dropped over 42 per cent in the past year.

I have often written about REA Group as a signature high-quality listed Australian company. The ability to charge a higher price without a detrimental impact on unit sales volume is the most valuable competitive advantage any company can foster. And because so many analysts and investors mistakenly believe the company’s revenues and profits are correlated with house prices, its shares can, reasonably frequently, be purchased at attractive prices.

Albeit more cyclically exposed, ARB is another company that enjoys attractive long-term economics and frequent share price contractions.

To investors without an interest in ‘offroading’, the company might not immediately seem to possess the traits required for a sound long-term investment, but a brief examination of the economics of the business reveals a company in which inheres sustainable and valuable competitive advantages.

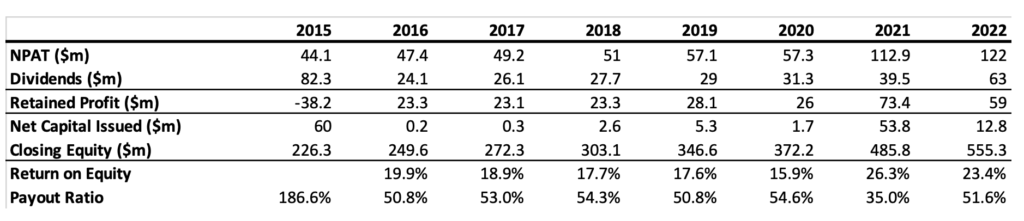

Table 1. ARB economics

Prior to the COVID-19 pandemic ARB was generating returns on average equity of between 17.6 and 19.9 per cent, and earnings growth of circa seven per cent, with no interest-bearing debt. It’s nothing to be sneezed at but the pandemic changed all that. Earnings surged 97 per cent in 2021 and grew another eight per cent on top of that, in 2022, as consumers, unable to travel overseas, kitted out their 4WDs to tour Australia’s outback.

Including the earnings generated in 2020 and 2021, return on all the incremental capital retained and contributed since 2015 has been 22.4 per cent. There’s no question that is an attractive number, especially as it was achieved with little or no debt.

But there’s a potential chink in the armour of this company and it relates to the above-trend rate of growth in retail sales experienced during the pandemic years.

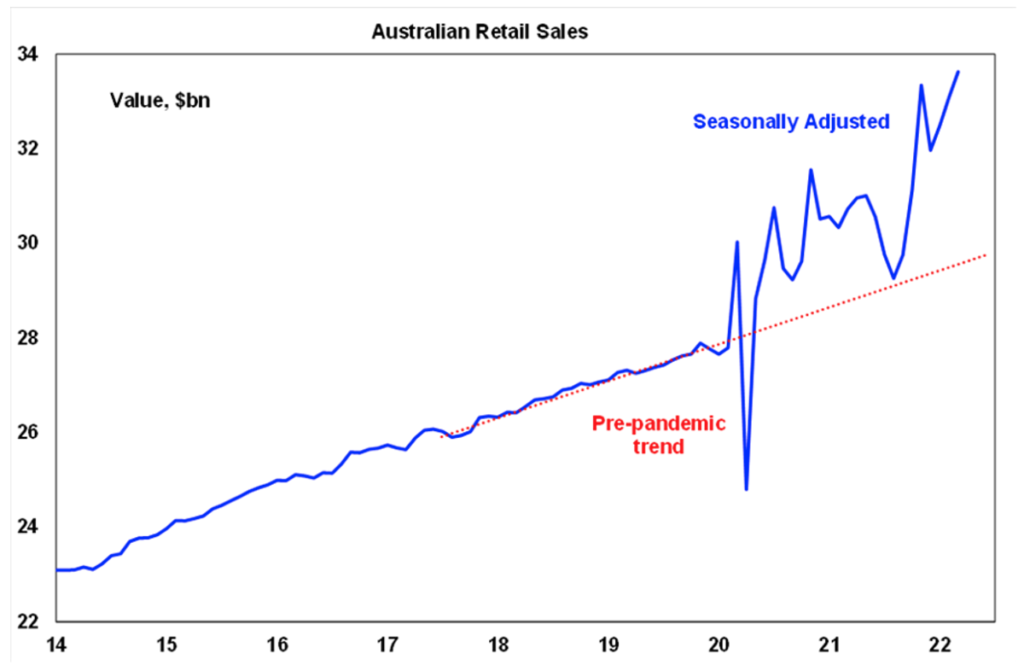

The chart in Figure 1. has been bandied about a bit since the beginning of the year and it shows the massive, and obviously unsustainable, rates of growth in Australian retail sales experienced since the pandemic took hold.

Figure 1. Australian seasonally adjusted retail sales

Source: ABS

On the back of this chart many believe consumption has been ‘pulled forward’ by consumers. I agree with that idea and have previously referred to the Economics of Enough™ a period after a surge in consumption when consumers need to ‘digest’ their purchases, and in response slow or stop purchasing.

It must be remembered however that Figure 1. is measured in billions of contemporaneous dollars and therefore includes the impact of inflation.

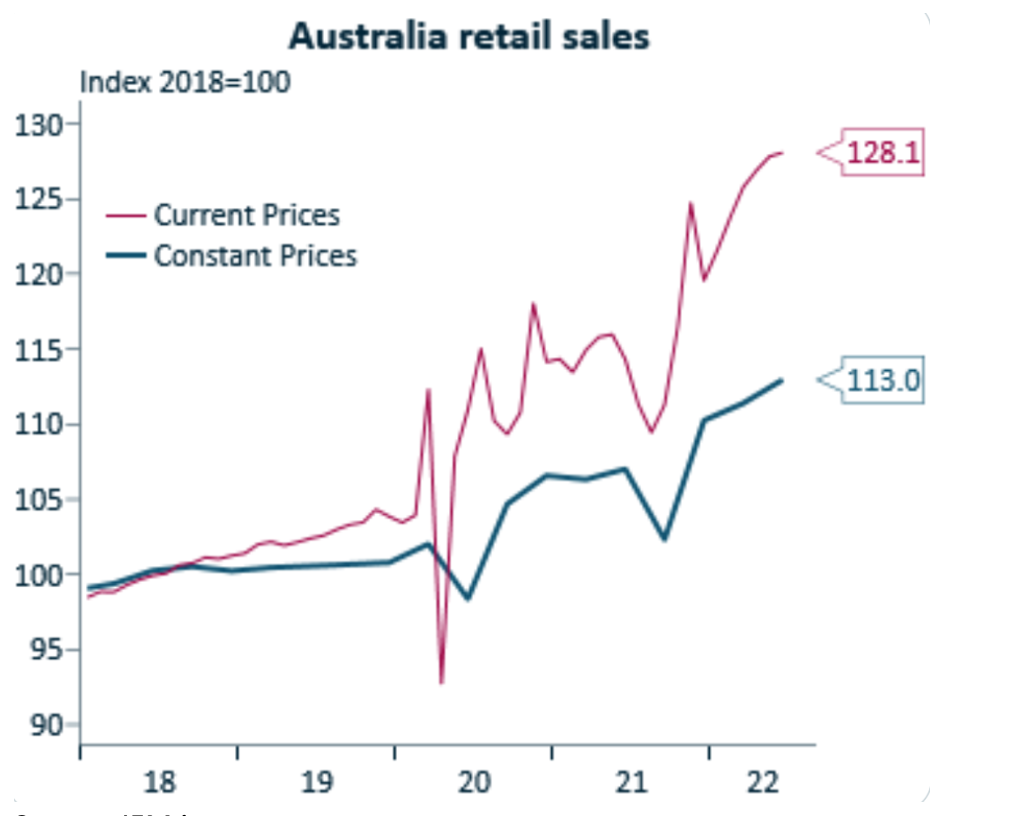

Adjusting for inflation, or stripping out the inflation, as the economists at IFM investors have done, provides a little more insight into the changes in volume. Figure 2. reveals a still discernible spike in Australia’s retail sales trend.

Figure 2. Australian retail sales adjusted for inflation

Source: IFM investors

The ‘read-through’ for ARB is that consumers have brought forward their purchases. If so, the change in slope of retail sales doesn’t represent a new steeper trend. Indeed, a switch from spending on goods, to spending on services, especially as international travel becomes easier and more affordable, will likely accelerate a return to trend. And a return to trend would however produce some sharply declining consecutive growth numbers for retail sales and possibly for any company that experienced a steep jump in sales during the COVID-19 period.

It is that concern (along with withdrawal of liquidity by global central banks) causing the share price of ARB to fall 45 per cent from a high of $54.53, in January this year, to $29.26 today.

The question is whether the fears are delivering an attractive price at which investors can be confident of an attractive long-term return.

What about the company’s outlook?

Several sell-side analysts believe the strength of the company’s balance sheet and margins should enable it to survive Original Equipment Manufacturer (OEM) – think Toyota Hilux and Ford Ranger –supply chain disruptions, the consequent lack of vehicles being delivered to consumers and input cost inflation.

With respect to a lack of vehicles, ARB reported OEM sales were 32.1 per cent lower in the second half of FY22 thanks to the outbreak of war in Ukraine. These events, and the emergence of Omicron in January 2022, also impacted export sales in the second half of the financial year, which were 5.1 per cent lower than the previous half.

Obviously, such events are temporary in nature and while the timing can never be known, a resumption of normal supply chains is inevitable along with an eventual reduction in inflation (you can read more about our thoughts on these subjects here at the blog).

Importantly, the shifts in export and OEM sales highlight ARB is more than just a seller of 4WD parts and accessories to Aussie DIY off-roaders. In fact, export sales represent 38.7 per cent of total sales. In FY22 export sales grew by 17.4 per cent. In the US, where a third Distribution Centre will open in October, ARB called out an agreed commercial relationship with Toyota.

In Australia the company will continue to roll out stores, but it is the leveraging overseas of its reputation here (built over decades) that will eventually dominate the company’s narrative. The company lists its strengths as strong brands around the world, loyal customers, capable senior management and staff, a strong balance sheet and clearly articulated growth strategies. That will all happen over the next decade but by then investors may not have the opportunity to acquire shares sold down amid local investors worried about slowing domestic sales.

An investor buying shares today, is acquiring $6.81 of equity per share. During COVID-19 the company was earning a 25 per cent return on that equity. Prior to COVID-19, return on equity averaged 18.5 per cent. If we conservatively expect a sustainable rate of return on equity equivalent to the pre-pandemic number, and adopt a continuing 50 per cent pay-out ratio, and an eight per cent discount rate, we arrive at a valuation of about $23.50.

As an aside, if one assumes the pandemic period return on equity is sustainable, the valuation jumps to $36.80. That seems optimistic at this juncture. The lower valuation band offers long-term investors a potential landmark, to compare prices against, should other investors become myopic about the prospects for the company’s above-trend domestic sales, or bearish about the market, interest rates, liquidity, and the economy generally.