April Performance Aura High Yield SME Fund

Many readers will know Montgomery Investment Management has become the distribution partner for the Aura High Yield SME Fund. Launched in August 2017, the Fund has delivered a compound annual return of 9.72 per cent, after expenses, over the 57 months to April 2022 and 8.65 per cent for the twelve months to April 2022.

Monthly income distribution over the 57 months has varied between 0.93 per cent and 0.62 per cent, and the average distribution is 0.78 per cent per month.

Let us take the month of April 2022 as an example. The Fund commences with a unit price of $1.00, and over the month it receives a return of 0.64 per cent (after expenses). At month-end, the unit price grew to $1.0064 on a cum distribution basis. Once the income is distributed to the unit-holders bank account (or reinvested in more units in the Fund), the unit price falls back to $1.00.

Brett Craig is Portfolio Manager of the Fund, and he is assisted by James Chapman and Natalie Kolenda. The Fund is a wholesale offering, as defined by the Corporations Law, with a minimum initial investment of $100,000. Current ratings include “Very Strong” from Foresight Analytics and “Commended” by Evergreen Ratings.

The Aura High Yield SME Fund lends money via six platforms, with an average loan size approximating $100,000 and the largest loan is currently $1.1 million. The average duration of the loan book is four to six months, with a tiny portion of the loan book exceeding twenty-four months. The thesis is that the Fund’s underlying distributions should rise if the Reserve Bank of Australia increases its official cash rate – as it did on 4 May 2022 – for the first time since 2010.

The loan book is largely exposed to NSW, Victoria, and Queensland (46 per cent, 36 per cent and 14 per cent, respectively), and diversified across several industries with agriculture currently accounting for 40 per cent.

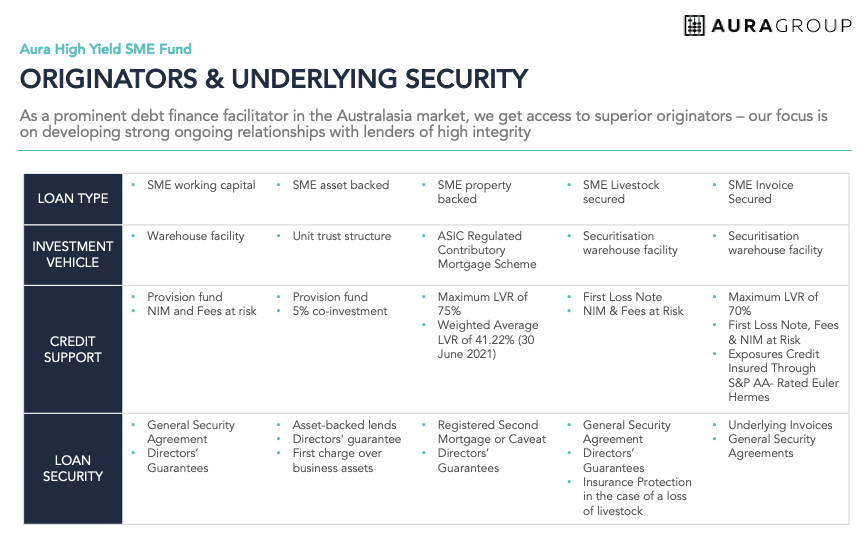

The table below details the types of loans for Small and Medium Enterprises (SMEs), the investment vehicle, the credit support, and the loan security.

For readers who are interested in the Aura SME High Yield Fund, Brett Craig will be presenting at a webinar on Tuesday 24 May 2022 at 6.30pm and you may wish to register here.

And for readers who are not wholesale investors, we intend launching the Aura Core Income Fund in the next few months, with a minimum initial investment of $25,000. Loans from this Fund will be higher up the collateral food-chain, and the return objective will be the RBA cash rate plus 3.5 per cent to 5.5 per cent per annum, after expenses.

A company associated with the author has an investment in the Aura High Yield SME Fund.

IMPORTANT INFORMATION

Disclaimer

Find out more about the Aura Private Credit Funds

You should read the relevant Product Disclosure Statement (PDS) or Information Memorandum (IM) before deciding to acquire any investment products.

Past performance is not an indicator of future performance. Returns are not guaranteed and so the value of an investment may rise or fall.

This information is provided by Montgomery Investment Management Pty Ltd (ACN 139 161 701 | AFSL 354564) (Montgomery) as authorised distributor of the Aura Core Income Fund (ARSN 658 462 652) (Fund). As authorised distributor, Montgomery is entitled to earn distribution fees paid by the investment manager and may be issued equity in the investment manager or entities associated with the investment manager.

The Aura Core Income Fund (ARSN 658 462 652)(Fund) is issued by One Managed Investment Funds Limited (ACN 117 400 987 | AFSL 297042) (OMIFL) as responsible entity for the Fund. Aura Credit Holdings Pty Ltd (ACN 656 261 200) (ACH) is the investment manager of the Fund and operates as a Corporate Authorised Representative (CAR 1297296) of Aura Capital Pty Ltd (ACN 143 700 887 | AFSL 366230).

You should obtain and carefully consider the Product Disclosure Statement (PDS) and Target Market Determination (TMD) for the Aura Core Income Fund before making any decision about whether to acquire or continue to hold an interest in the Fund. Applications for units in the Fund can only be made through the online application form. The PDS, TMD, continuous disclosure notices and relevant application form may be obtained from www.oneinvestment.com.au/auracoreincomefund or from Montgomery.

The Aura Private Credit Income Fund is an unregistered managed investment scheme for wholesale clients only and is issued under an Information Memorandum by Aura Funds Management Pty Ltd (ABN 96 607 158 814, Authorised Representative No. 1233893 of Aura Capital Pty Ltd AFSL No. 366 230, ABN 48 143 700 887).

Any financial product advice given is of a general nature only. The information has been provided without taking into account the investment objectives, financial situation or needs of any particular investor. Therefore, before acting on the information contained in this report you should seek professional advice and consider whether the information is appropriate in light of your objectives, financial situation and needs.

Montgomery, ACH and OMIFL do not guarantee the performance of the Fund, the repayment of any capital or any rate of return. Investing in any financial product is subject to investment risk including possible loss. Past performance is not a reliable indicator of future performance. Information in this report may be based on information provided by third parties that may not have been verified.