Apartment price pressure mounting

Further to our recent warnings about the risks to residential property prices, additional insight has been provided by the release of March quarter results from Genworth (ASX: GMA). Genworth is the largest (dominant) provider of mortgage insurance in Australia.

The results showed an accelerating trend of falling gross written premiums, indicating that the tightening of lending standards by the banks, and the reducing willingness of lend at high LVRs in particular, is increasing sequentially.

Second, the number and value of new claims remains pretty flat. However, there are increasing delinquencies coming from WA, QLD and SA. This is not surprising.

Given the typical profile of delinquencies and mortgage age, it’s not surprising that delinquencies remain subdued as the primary mortgages at risk at the moment are those entered into during 2013. Anyone that bought property in 2013 is likely to be sitting on a reasonably large equity buffer at present. The risk will ratchet up as mortgages from property purchases at the peak of the cycle in 2015 start to hit the peak of delinquency risk in FY18. This risk is likely to be exacerbated by downward pressure on high density property prices in Sydney, Melbourne and SE QLD given the significant increase settlements that are supposed to occur in the second half of 2016 and first half of 2017.

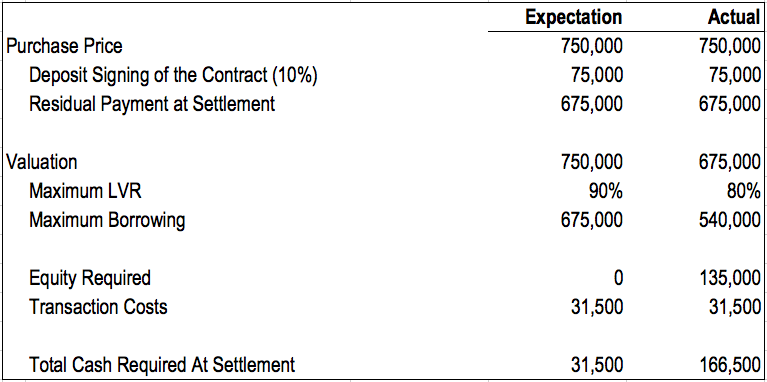

Changes to lending standards since the off the plan sale occurred mean that buyers will need to stump up a lot more cash at settlement than they previously expected for 3 reasons. First, banks are less willing to lend on LVRs above 90 per cent, particularly for investment properties. Second is the restrictions being imposed on foreign borrowers. And lastly, reports indicates that inner city apartment valuations are coming in 8-11 per cent below the purchase price. With the borrowing capacity struck off the valuation rather than the purchase price, the buyer will need to put in a lot more equity than they expected. I have shown an example below. This could lead to forced selling and further downward pressure on inner city apartment prices.

This could lead to forced selling and further downward pressure on inner city apartment prices.

Stuart Jackson is a Senior Analyst with Montgomery Investment Management. To invest with Montgomery domestically and globally, find out more.

This post was contributed by a representative of Montgomery Investment Management Pty Limited (AFSL No. 354564). The principal purpose of this post is to provide factual information and not provide financial product advice. Additionally, the information provided is not intended to provide any recommendation or opinion about any financial product. Any commentary and statements of opinion however may contain general advice only that is prepared without taking into account your personal objectives, financial circumstances or needs. Because of this, before acting on any of the information provided, you should always consider its appropriateness in light of your personal objectives, financial circumstances and needs and should consider seeking independent advice from a financial advisor if necessary before making any decisions. This post specifically excludes personal advice.

INVEST WITH MONTGOMERY