Ansell Update

The Montgomery funds took a position in glove manufacturer, Ansell (ASX: ANN), after its first half result for the 2015 financial year exceeded our expectations. Six months on the company has announced its full year report, and while the results did not exceed the market’s expectations, our investment thesis remains intact.

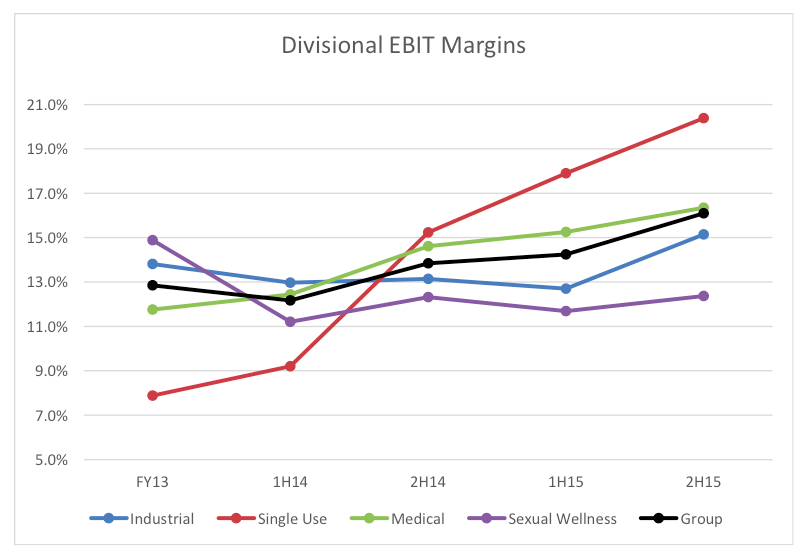

The Montgomery funds invested in Ansell on expectations that the underlying profitability of the business would improve following several years of major acquisitions. It was pleasing to see margins increase across all business lines in the second half of 2015, as it demonstrates that Ansell is slowly but surely unlocking scale benefits.

We have also remained aware of Ansell’s currency exposure. Given how strongly the US dollar appreciated against the Euro we considered that consensus revenue estimates for the 2015 financial year were overly bullish. We determined that Ansell was likely to meet full year guidance for 2015 due to lower commodity prices and the strength of the US dollar against South East Asian currencies, so it was pleasing to see an outcome that aligned with this work.

The market was caught off-guard by management expecting earnings to fall by 2 to 14 per cent next year. While it is prudent for management to provide such wide earnings guidance given the considerable volatility of global currencies, we are optimistic that next year’s earnings will finish towards the favourable end of that range (barring any further invasions by key countries of course…)

What disappointed us though was the underlying organic revenue growth of 0.6 per cent, which was below management’s target for mid-single growth each year. While it was pleasing to see Core Brand growth of 3.7 per cent for FY15, the Russian and Brazilian markets detracted 1.6 per cent from revenue, and ongoing rationalisation of brands reduced growth by a further 1.5 per cent.

Rationalisation, which describes the removal of duplicate or legacy products, is an ongoing requirement for a company like Ansell that relies heavily on acquisitions. Management has allocated considerable time and resources in “cleaning up” the product portfolio, so there should be fewer lower-quality brands remaining to restrain revenue growth. We’re watching this closely.

All in all, our thesis for Ansell remains unchanged after this result. Ansell is a dominant player which is capable of strong acquisitive growth and margin expansion. However, as the full-year result has demonstrated, it is a company with many moving parts, and earnings can be materially affected by currency movements. If the US dollar continues to appreciate strongly against the Euro (in isolation) then our investment may need to be assessed, but for now we are comfortable maintaining the position in both funds.

Ben MacNevin is an Analyst with Montgomery Investment Management. To invest with Montgomery domestically and globally, find out more.

This post was contributed by a representative of Montgomery Investment Management Pty Limited (AFSL No. 354564). The principal purpose of this post is to provide factual information and not provide financial product advice. Additionally, the information provided is not intended to provide any recommendation or opinion about any financial product. Any commentary and statements of opinion however may contain general advice only that is prepared without taking into account your personal objectives, financial circumstances or needs. Because of this, before acting on any of the information provided, you should always consider its appropriateness in light of your personal objectives, financial circumstances and needs and should consider seeking independent advice from a financial advisor if necessary before making any decisions. This post specifically excludes personal advice.

INVEST WITH MONTGOMERY

Good comments on Ansell. If the USD appreciates against both the AUD and the Euro, won’t these two currency movements largely cancel each other out, i.e. earnings in USD may fall, but when the USD earnings are re-patriated in AUD there will be a benefit?

Thanks.

Thanks for the question Shane. Ben is away for a few days and will respond in the next couple of weeks. Stay tuned.

It’s up against stiff competition.

Hi Ben,

Thanks for the ANN update. I haven’t done any analysis on them.

But (and sorry if this is a silly question), why does the declining euro cause them issues? It’s not like the euro is declining much faster than the AUD against the USD.? Is it because they export to the euro zone from the US making their products more expensive and hence they lose market share/revenue?

Hi John,

Ansell’s latest presentation revealed 25% of revenues and 13% of costs are derived in Euros, which means that it doesn’t provide a natural hedge. If the US dollar continues to increase against the Euro, the translated earnings will fall. The reason we say “in isolation” is because the US dollar has been appreciating strongly against most global currencies, including the Malaysian Ringgit and the Thai Baht, which helps offset the weakness in the Euro.

Love your work Ben! (and the RM team), keep up the good work.

“If the US dollar continues to appreciate strongly against the Euro (in isolation) then our investment may need to be assessed, but for now we are comfortable maintaining the position in both funds.”

Does this mean the team does not expect further QE in Europe, or the US to raise rates in the near term, or a combination of the two? Just curious as to your underlying thoughts here.

Hi Simon, predicting currencies can be just as hard (if not harder) than predicting share price movements. The US dollar may very well continue to strengthen against the Euro, which will have unfavourable short-term effects on earnings. But we consider that over the long run these forces will balance out and the fundamentals of the business will be the primary driver of value.

I hope you guys are right. Ansell has been a huge disappointment this year.

We take a portfolio approach Carlos. We won’t get every call right and we don’t need to and can still produce decent overall returns.

I would have thort that it would have been obvious to management that currency movements would have a large impact on earnings and therefore made preparations for this .Also it would be reasonable to think that analysis of

The company done by professionals would have revealed this risk which is evermore relevant in the currency manipulating world of today