Anatomy of the Australian Small Cap Market – a focus on Growth

In reference to Monday’s blog Gary Rollo, Portfolio Manager for the Montgomery Small Companies Fund, makes some very interesting points regarding the anatomy of the Australian small cap market with respect to the “Growth” sector.

These include:

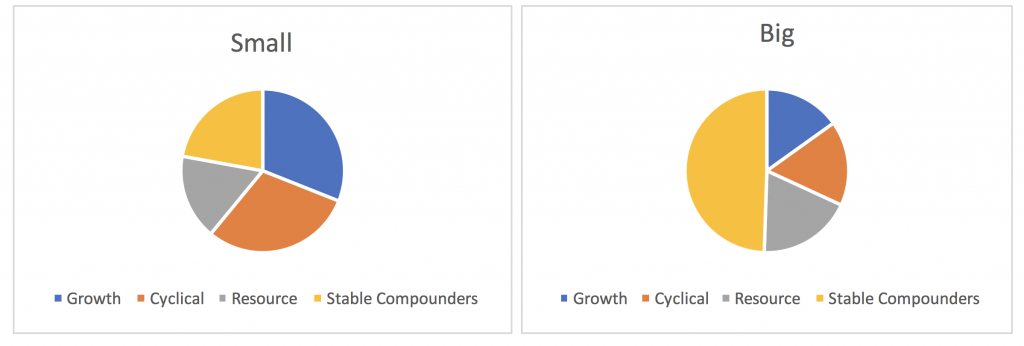

- The “Growth” segment accounts for 30 per cent for those companies ranked 101 to 295 in S&P’s size ranking system, in comparison to 15 per cent for those companies ranked in the top 100;

- “Rockstars” (two-year EBITDA growth exceeding an annualised 25 per cent) and “Next Best” (two-year EBITDA growth exceeding an annualised 12 per cent) account for 40 per cent and 30 per cent, respectively, of the “Growth” segment;

- This means over 20 per cent (or 30 per cent times 70 per cent) of the Australian Small Cap audience of stocks are growing their two-year EBITDA at a multiple of the broad market;

- This leads us to conclude that while the ASX 100 is recording marginal growth of its EPS, the Small Cap stocks are growing their EPS by around 13 per cent. This growth differential means the prospective PE for the ASX 100 is 18.8X whilst the prospective PE for the Small Cap stocks is 17.0X;

- While Gary Rollo and Dominic Rose, Portfolio Managers of the Montgomery Small Companies Fund, have targeted 57 companies in the Small Cap Index classified as “Growth”, they are also tracking a further 64 companies they classify as “Growth”, outside the ASX 100 which may also become “tomorrow’s leaders”;

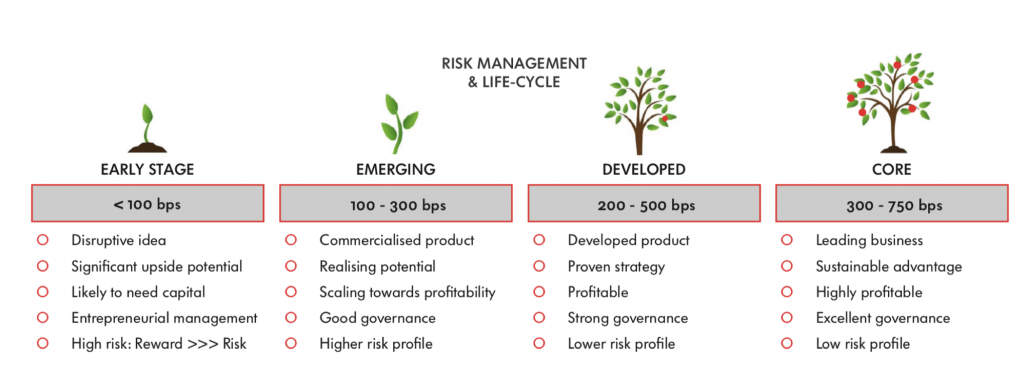

- The Montgomery Lucent lifestyle investing approach means The Fund will gain access to a select group of earlier stage growth companies, whilst strictly managing risk. To re-cap, an “Early Stage” company accounts for less than 1.0 per cent of the Fund, an “Emerging” company accounts for between 1.0 per cent and 3.0 per cent of the Fund, a “Developed” company accounts for between 2.0 per cent and 5.0 per cent of the Fund, and a “Core” company accounts for between 3.0 per cent and 7.5 per cent of the Fund; and

- The relevant weightings demand a strong focus on risks, including liquidity, earnings expectations, stock correlations and capital structures.

You can view Gary Rollo’s blog here.

If you would like to invest in our new fund at inception, Friday 20 September 2019, please download the Product Disclosure Statement for the Montgomery Small Companies Fund, here.