Analysing Australia’s October CPI: Unexpected trends

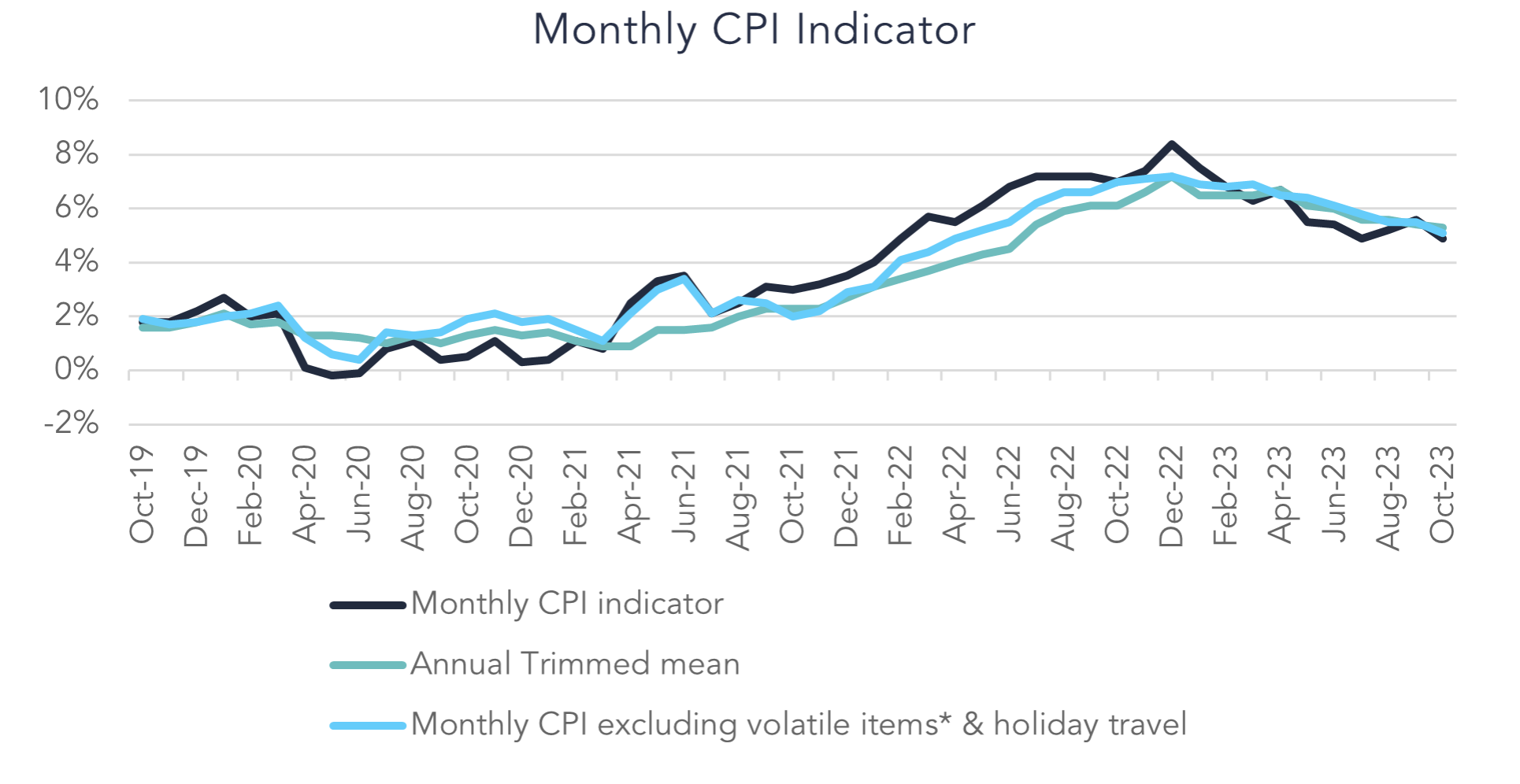

The latest monthly consumer price index (CPI) read released last week, came in unexpectedly lower than anticipated, at 4.9 per cent in the 12 months to October. This follows the previous read of 5.6 per cent in September. With the 8.4 per cent peak recorded in December, inflation is continuing to follow a downward trend off the back of the Reserve Bank of Australia’s (RBA) best efforts to raise interest rates in order to achieve a slowdown in inflation.

The most significant contributors to the CPI read in October were increases in housing (+6.1 per cent), food and non-alcoholic beverages (+5.3 per cent) and transport (+5.9 per cent). However, if we exclude the volatile items such as fuel, fruit and vegetables and holiday travel this provides a more accurate indication of the level of underlying inflation. For October CPI excluding volatile items came in at 5.1 per cent, a reduction from 5.5 per cent reported in September.

The Australian Bureau of Statistics (ABS) has advised that the falling level of inflation was impacted by a reduction in consumer demand as pricing pressures for consumer goods moderate in line with the reduced level of demand.

This data point will be heavily considered at the RBA’s monetary policy decision meeting, being held tomorrow. The likelihood of another rate rise is slim. The RBA is juggling the need to return inflation to target within a reasonable time frame, whilst also trying to maintain the gains that have been made in the labour market. They intend to maintain the stability in the unemployment rate and strength within the labour market, whilst also ensuring they pull the right levers to bring inflation back in line.

The challenge the RBA now faces is time, the RBA needs to ensure that inflation is not maintained at a high level for too long, as there is the risk that the normalised level of inflation will be revised and increased. This could cause wider economic damage. Future rate rises have not yet been ruled out.