Altium continues its rapid expansion

Altium (ASX: ALU) is one of Australia’s most successful software businesses. Over the last five years, the company has grown rapidly, and its stock price has soared more than 10-fold. ALU’s FY2017 result shows a business going from strength to strength. But is it a tad expensive at these prices?

Here are some key take-outs from ALU’s FY17 result:

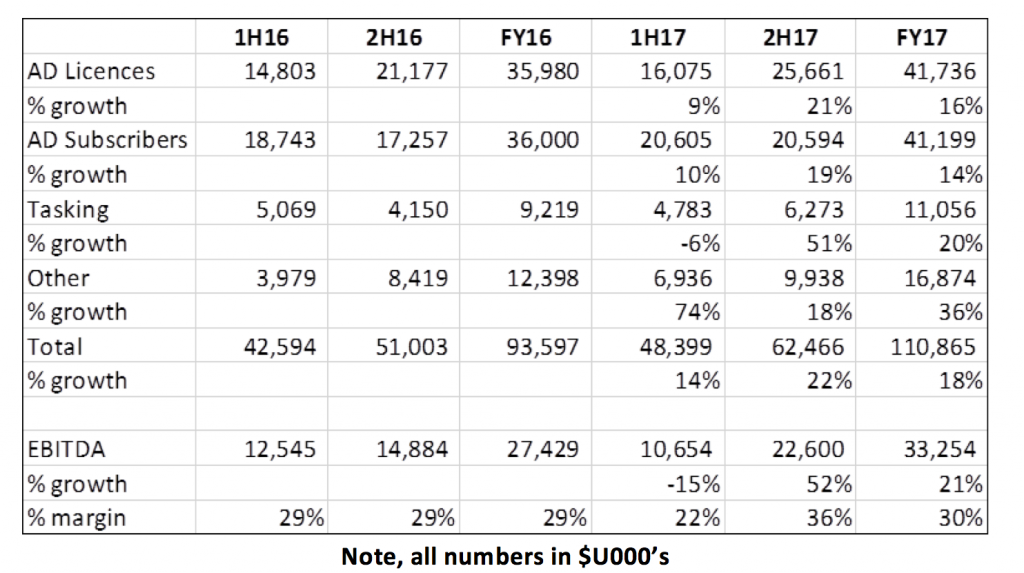

- Strong results across all segments.

- I wouldn’t extrapolate out the 2H result since there’s an element of seasonality – however the investment in the firm’s salesforce is clearly paying off.

- Further, Altium designer version 17 was launched.

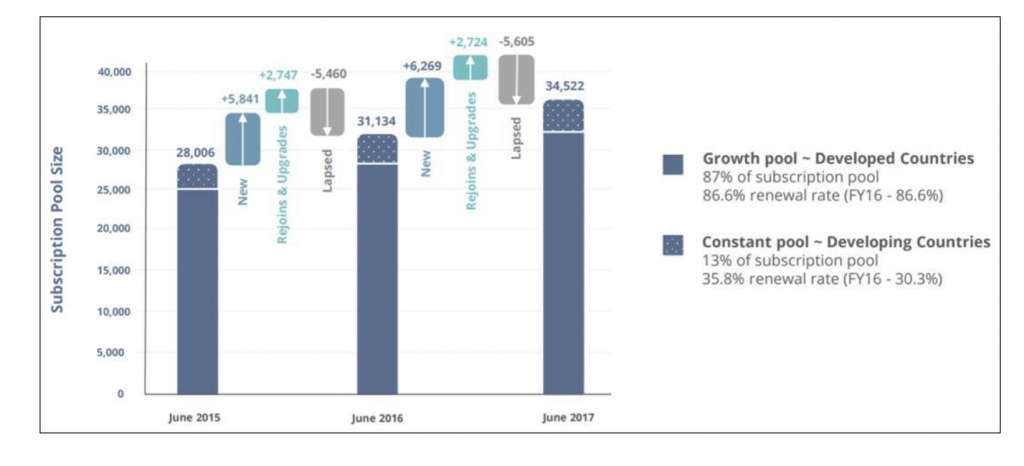

- AD licence sales volumes up 7 per cent year-on-year & subscriber base count up 11 per cent to 34.5 thousand.

- As per the below, subscriber churn down overall by 70 basis points. This was driven by better enforcement action out of China.

Note, all numbers in $U000’s

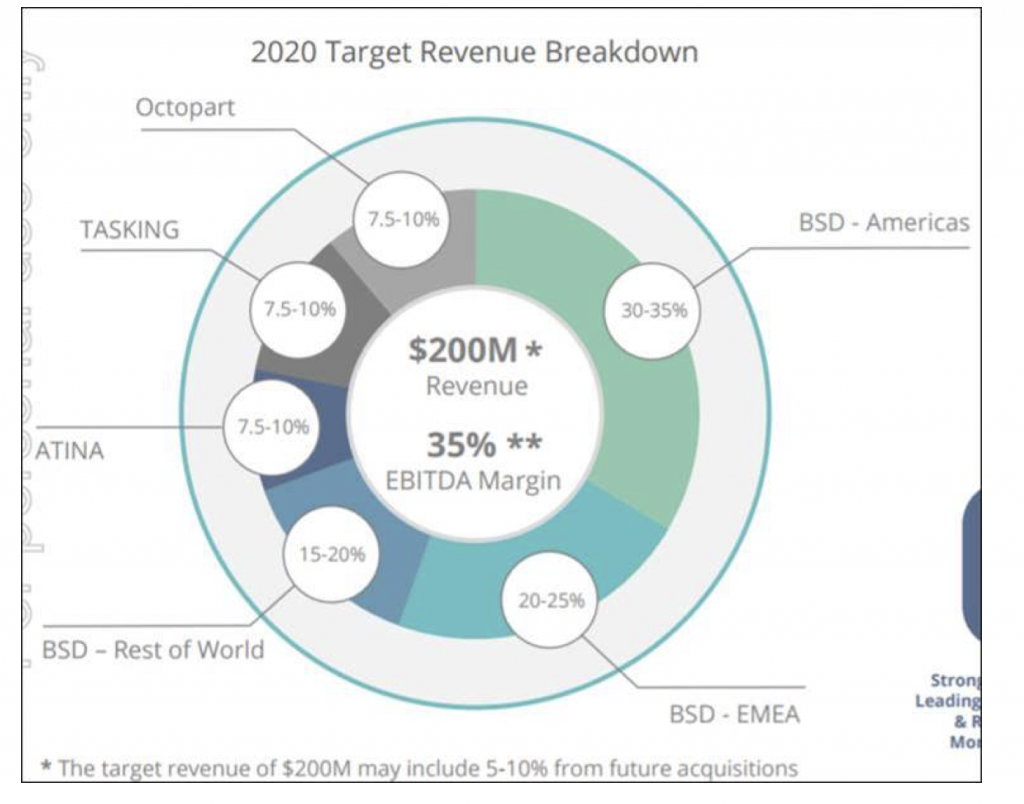

- Looking longer term, management updated guidance for 2020. It’s maintaining its $US200 million revenue target but adding a 35 per cent EBITDA margin target. Organic growth forecasts have been increased.

- Atina (high end software for extremely sophisticated printed circuit board (PBC) designs) anticipated to be launched by end 2017.

- We note a couple of key concerns that are worth acknowledging.

- Many of Altium’s customers are start-ups. It’s known that many start-ups fail and therefore some of the firm’s recurring maintenance revenue may face downward pressure.

- There’s an extent to the growth Altium can earn out of mainstream PCB electronic design services in the long term. Growth beyond this point will require Altium to expand/acquire its way into other parts of the PCB design chain and offer an all-encompassing PCB design solution (in the way Microsoft Office offers not just word processing in the form of Microsoft Word but also Outlook, Excel, Powerpoint, etc). This may be difficult.

Altium appears to be a quality company. However, given the price relative to our assessment of fair value, it’s difficult to justify holding a position in the firm. For clarity we had been selling around the $8.00 mark and no longer own Altium.

This post was contributed by a representative of Montgomery Investment Management Pty Limited (AFSL No. 354564). The principal purpose of this post is to provide factual information and not provide financial product advice. Additionally, the information provided is not intended to provide any recommendation or opinion about any financial product. Any commentary and statements of opinion however may contain general advice only that is prepared without taking into account your personal objectives, financial circumstances or needs. Because of this, before acting on any of the information provided, you should always consider its appropriateness in light of your personal objectives, financial circumstances and needs and should consider seeking independent advice from a financial advisor if necessary before making any decisions. This post specifically excludes personal advice.

INVEST WITH MONTGOMERY

Hi Roger,

Just wondering if you’re actually willing to admit that you got this one wrong, as the numbers would certainly suggest that is the case.

Cheers.

Hi Ned,

We sold it at a lower price when we thought it had become overvalued. That goes without saying!

Thats great Roger I can rest assured my funds are in good hands!

Hi Roger , has anyone from MIM revisted Altium since last sept, if your team thought it was over priced then ,it has subsequently flown! I have held it in my portfolio since 2015 and sold 30% earlier this year,

no regrets no one goes broke making a profit. A current view on where you see its value would be helpful.

As an aside you can go broke taking a profit, if your profits you take are smaller than your losses. That aside it’s not appearing on our screens as value.

Great call on ALU guys. I feel good because I have sold at a price which is above intrinsic value so statistically speaking I have made a decision of positive expected value.

Once again, thanks.

Yes. I am a holder of ALT and am so partly on the previous assssment by Mont, referred to by Pascal, that at around 9.00 the stock was still cheap. Something needs to have changed and it the general term “changing in Value” is not sufficient. I would normally only sell if something structural has changed in the Company or in it’s business model that indicates a deterioration in quality. I wonder what has been the change ?

Jeffrey, It’s important you don’t rely on this blog for stock tips. We have changed our valuation and outlook after further due diligence. You need to do your own research to establish whether your valuation and outlook has changed. You say you were “partly’ influenced by comments here. If you have not conducted comprehensive research before investing, it will be impossible for you to respond fully informed, if something changes.

Thank you very much Roger. I can assure you I do not reply on this Blog for my investment decisions. Also I do heaps of research on Companies so that my portfolio is as fine tuned as I can achieve. I go to Annual Meetings in the different capital cities and I phone companies and speak to directors. I am informed as much as is possible on a full time basis In an effort to have a Balanced Investment portfolio.. I will try to find out if anything has changed at ALT and make my decisions accordingly but it seems that nothing negative has changed in the Company but that your assessment of the same Company 12 mths ago has changed, rather than the Company changing.

TNE has always been expensive, every year. Again many thanks for your professional work.

Thank Jeffrey,

We have done further work on the components of the balance sheet and have arrived at our conclusion through a better understanding every asset and liability listed.

Sounds like Montgomery trying to talk ALU down to $8 to buy back in. Selling out at $8 was straight out dumb. I’ve previously heard Roger on TV talking this stock up big time.

Hi John, thanks for the comment but the above article is not in any way intended to ‘talk down’ or ‘talk up’ a stock.

On this blog, we provide commentary which we hope readers will find interesting and provide updates for investors on stocks in the portfolio but we’re always clear that these articles should not be used as a basis for investment decisions.

Hi John, yes you are right we did talk about the company in favourable terms. We started buying Altium at $2.86 and sold it mostly between $8 and just above $9. We think it was off-the-charts expensive at that point. If buying at $2.86 and selling at $8 to +$9 is dumb, there’s not a great deal we can do to change your view.

I agree with the article to an extent, one simple ratio I use to check with ALU was ‘deferred revenue/revenue”. Ratio has started to decline over time. ELO seems to have a much higher ratio providing earning certainty and better growth in deferred revenue. It is much cheaper on a P/S basis.

Hi Scott,

While on the subject of software companies, MIM being in the past a shareholder of Isentia

i wondered if you would enlighten us if you still hold the same past enthusiasm for the company.

Thanks.

Hi Garry, ISD is a rather small position now and whilst we think it’s trading at less than intrinsic value, it’s not as high quality as we believed it once to be.

Hi Scott

This was a great investment by the team, investing in early 2015 when the share price was around $3-4. Well done!

Sam

Thanks Sam, much appreciated!

Hi Scott,

I would like to question the assessment of Altium and its fair value and ‘new’ position that MIM seems to have taken on this company.

In your article you stated ‘……given the price relative to our assessment of fair value, it’s difficult to justify holding a position in the firm’.

However, a little over a year ago on 1, September 2016 in the article ‘faster-higher-stronger-its-time-to-watch-altium’, it was stated that ‘……In the case of Altium we believe while the share price has risen to circa $9.50, we believe the intrinsic value has risen to more than $12.00.’

So what has changed about Altium in the last year and why does there appear to be a change in MIMs position on this company?

More broadly, some of the commentary that has come out of MIM on so called ‘quality businesses’ has been questionable. For example Vita Group, Sirtex and Healthscope.

Its feels as though investors and followers of MIM really need to do their own homework.

Regards

Your question: “So what has changed about Altium in the last year and why does there appear to be a change in MIMs position on this company?”

What has changed, as mentioned in the post, was our assessment of value. After we started buying at $2.86, we subsequently sold out between $8.00 to above $9.00. Illiquidity meant that we couldn’t sell the entire position at a single price. With respect to your comment about quality assesments generally, we are bound to get a few wrong in a portfolio of 20-40 companies. Position sizing, as part of portfolio management, endeavours to limit the impact of any transgressions. If you expect us to get every call right, you have raised the bar too high for us to crest it. It is true however that in 2016 we had more than our fair share of misses. having undertaken a comprehensive review of these we have identified an ability within our own tool-set to, we believe, reduce the incidence of them in the future. We will not however avoid them completely and in the case of Sirtex, if faced with the same set of facts, we would probably make the same choice.

For clarity we purchased Sirtex at circa $15 and sold around $30 twice prior to our most recent investment in the company. Our third foray was based on a valuation dependent on the salvage setting dosage sales growth being maintained, not the outcome of a clinical trial. Of course if the trail results were favourable this would have increased the valuation by a multiple. Adverse trial results would have the valuation return to that we based on salvage-setting dosage sales, below which we had purchased. The CEO resignation, their share sale and the company downgrading its dosage sales forecasts are the grounds for a class action http://sirtexclassaction.com.au and http://www.smh.com.au/business/markets/deeply-troubling–sirtex-faces-class-action-20170731-gxm1m6.html

It’s also worth pointing out that several of our highly respect value & quality investing peers also own Healthscope.