AGL faces the perfect storm

In what’s been a terrible year for the energy sector, AGL is the latest company to disappoint. Its full-year results included a steep drop in profits and signalled that there’s worse to come next year. While AGL intends to maintain its attractive flow of dividends, I’m not convinced this will be enough to tempt many investors given the negative outlook.

As I previously worked in the energy industry, I normally take a good look at the results of the large integrated utility companies AGL and Origin when they report. AGL, previously known as The Australian Gas Light Company, is one of oldest surviving companies in Australia founded in 1837 and being the second company to list on the Sydney Stock Exchange in 1871. AGL is the largest retailer of electricity and gas to Australian households and businesses and is a household name to many people.

Today, I am going to take a look at the full-year results announced on 13 August as it seems like AGL and the wider industry is currently facing some severe headwinds.

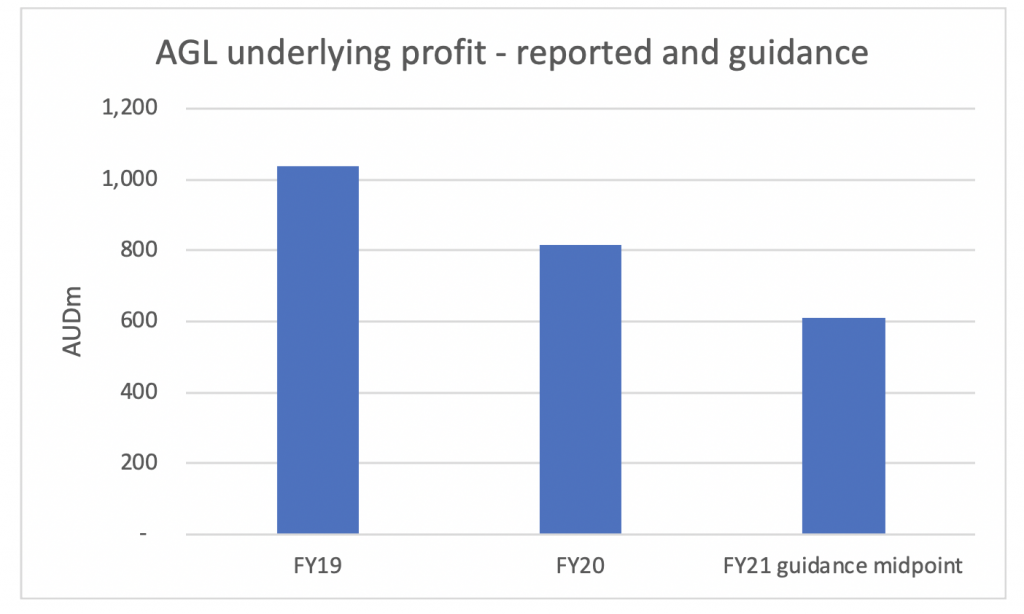

If we look at the underlying profit in FY20, from the chart below we can see that it is down by 22 per cent from FY19. Of concern is the company’s guidance for FY21 has indicated a further 25 per cent reduction in profits:

Source: AGL

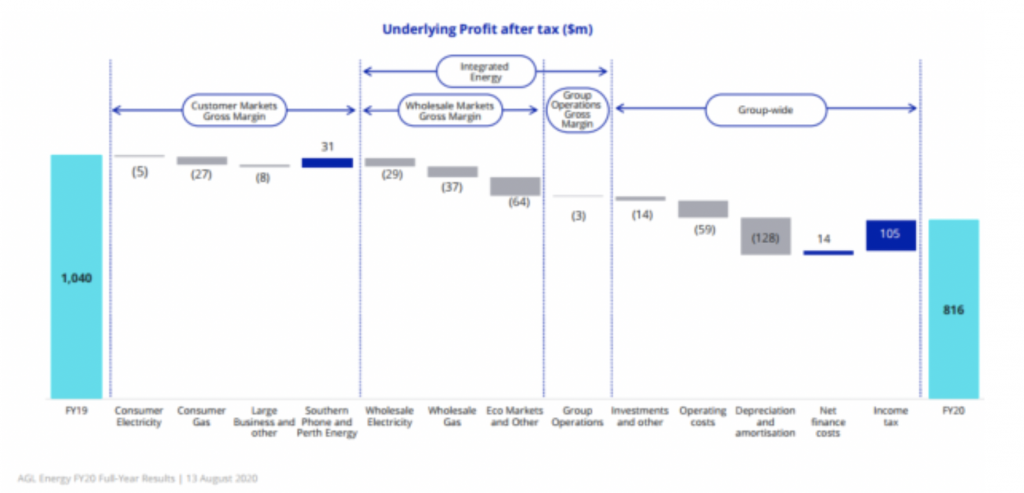

These are not pretty numbers to see, especially from a company that many would assume should be quite stable and defensive by the nature of the products it sells, so let’s have a look at what is going on. AGL helpfully provides this chart that explains the difference between FY19 and FY20 profits:

Source: AGL

Before getting into the numbers, we should note that AGL splits its business into Customer Markets, which is the retailing part of the business, and Wholesale Markets, which is where they produce or source electricity and gas.

If we start from the left, we can see they saw a $27 million drop from Consumer Gas. This is due to both lower gas prices which has intensified competition while AGL has already locked in the cost of the gas and to lower volumes as businesses have used less gas during the COVID lockdown. We can also see that acquisitions of Southern Phone and Perth Energy contributed positive $31 million.

The biggest fall in profits came in the wholesale part of the business. Wholesale Electricity declined by $29 million, Wholesale Gas by $37 million and Eco Markets and others by $64 million. To understand why this is happening, the following charts are helpful:

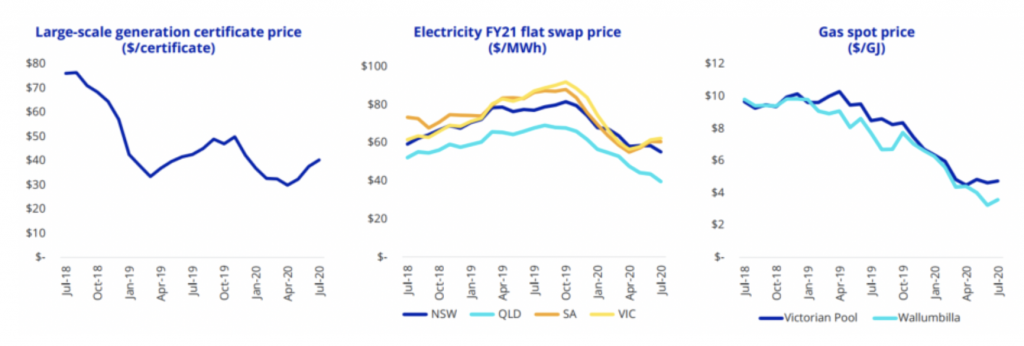

Source: AGL

Starting from the left, we can see that the prices of Large Scale Generation Certificates (LGC) have come down significantly. AGL generates LGC from renewable energy generation and as the total amount of renewable energy generation has increased rapidly over the last couple of years, the prices have come down significantly and the revenue generated from selling the LGCs has declined.

The middle chart shows electricity prices have come down since the beginning of the COVID crisis as demand has declined due to reduced economic activity and increased supply from renewable energy sources. AGL is long generation capacity as it produces more electricity than it has contracted to sell and the extra generation has to be sold into the spot market at lower prices.

The chart to the right shows the gas spot prices, which have more than halved in the last 12 months due to both reduced export demand as LNG prices have cratered due to global oversupply and lower domestic demand due to the crisis. AGL does not have its own gas production but purchases gas from other suppliers on long-term contracts on a take-or-pay basis and then resells this gas to end users but not on a take-or-pay basis which is the cause of the drop in profits from Wholesale Gas shown above.

Looking further to the right in the profit chart above, we can see that operating costs have increased by $59 million out of which $38 million is due to COVID-19 related costs (increased health and safety costs and higher credit losses from customers not being able to pay their bills).

There is also a $128 million increase in depreciation due to high capital spending in the previous years.

Overall, the drivers for the decline in profits are quite clear and understood by the market and the actual results came in roughly in line with expectations.

What disappointed the market though, and has driven down the share price by about 10 per cent as of the time of writing, was the outlook statement indicating a further decline in profits, which is significantly (about 20 per cent) lower than consensus expectations. The drivers underlying this dire outlook are:

- Wholesale Gas margin is expected to be about $150 million lower than in FY20 as even though gas spot prices are very low, longer term gas contract prices have not fallen as much and, as AGL has maturing old gas contracts at very low prices, they will have to source new gas at higher prices than before.

- Wholesale Electricity margin (including LGCs) is expected to be about $150 million lower than in FY20 as falling prices for both electricity and LGCs result in lower revenues.

- An estimated doubling of consumer hardship costs to about $40 million (an increase of approximately $20 million) as government stimulus packages tail off and unemployment increases, resulting in more customers not being able to pay their bills. This is of course very dependent on what will happen to the overall economy and I see potential for this to be quite a bit higher if lockdowns like we are seeing in Victoria continue.

Overall, it is clear that things are not going that well for AGL at the moment. Despite the share price fall, which we can see in the chart below, the implied P/E from the guidance is about 17x – so not much of a discount to the overall market which I would like to see before considering investing given the negative outlook.

AGL share price

AGL’s underlying profit in FY20 is down 22% and concerningly, the company’s guidance for FY21 indicated a further 25% reduction in profits. Is this one company to steer clear from? Share on XThis post was contributed by a representative of Montgomery Investment Management Pty Limited (AFSL No. 354564). The principal purpose of this post is to provide factual information and not provide financial product advice. Additionally, the information provided is not intended to provide any recommendation or opinion about any financial product. Any commentary and statements of opinion however may contain general advice only that is prepared without taking into account your personal objectives, financial circumstances or needs. Because of this, before acting on any of the information provided, you should always consider its appropriateness in light of your personal objectives, financial circumstances and needs and should consider seeking independent advice from a financial advisor if necessary before making any decisions. This post specifically excludes personal advice.

INVEST WITH MONTGOMERY