After its price plunge, is McMillan Shakespeare a bargain?

Since hitting a high of around $15 in mid-2016, McMillan Shakespeare (ASX: MMS) has fallen to around $11. At this price, and with a demonstrated ability to consistently earn high returns on equity, it seemed like a good candidate for inclusion in our portfolios. So we conducted some due diligence. The outcome is a must-read for all would-be investors.

The buy thesis was fairly straightforward: in MMS you could buy a quality business for circa 10x its earnings (almost implying no growth forever) that had good long term prospects and included a free option on earnings growth from the United Kingdom and parallel segments such as consumer finance.

Wonderful… but what’s the catch?

Let’s start by reviewing the business. MMS is the market leader in salary packaging and novated leasing services in Australia.

Salary packaging is a method of restructuring taxable income by taking advantage of a number of legislated Fringe Benefit Tax (FBT) exemptions or concessions whilst novated leasing is a finance lease arrangement (typically for a car) between a financier, an employer and an employee. Novated leasing allows employees to pay for a car with income on a pre-tax basis, thereby making the employee better off. These services are shown in the firm’s financial statements under the ‘Group Remuneration Services’ (GRS) heading.

Clients pay for salary packaging services upfront, but novated leasing revenues are largely comprised of commissions from many different parties. For example, the client may pay a fee upfront for MMS to arrange the lease, but the financier will also pay a commission, as will the car dealer, the insurance provider, the mechanic who adds on aftermarket products and so on. MMS earns roughly $5k-$6k in fees for each lease it provides through this arrangement.

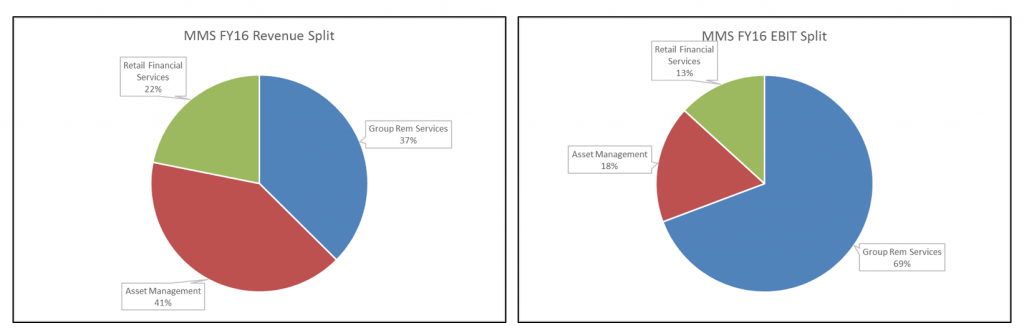

MMS also provides asset management (fleet) and retail financial services (on commission) although this combined contributes a minority of earnings and much less in terms of the firm’s value (asset management in particular is highly capital intensive).

The below tables show the firm’s revenue and earnings split by segment. It’s worth noting that the majority of earnings before interest and tax (EBIT) is sourced from the GRS segment. From a valuation perspective, north of 80 per cent of the firm’s value is also in this segment.

Now let’s think about how the salary packaging and novated leasing industry has evolved over time. If we go back some years, MMS dominated the industry and, whilst it had competition, it was limited.

Many clients would not even consider entrusting their salary packaging contracts to anyone but MMS due to its sound track record. In addition, MMS’s dominance of the market and its asset management business allowed it to generate many novated leasing contracts, earning substantial returns on invested equity.

Note: Returns on equity had been falling due to investment in more capital intensive businesses but were overall still high.

Note: Returns on equity had been falling due to investment in more capital intensive businesses but were overall still high.

In short, MMS enjoyed excessively high levels of demand for its services and competitors had difficultly stealing away customers.

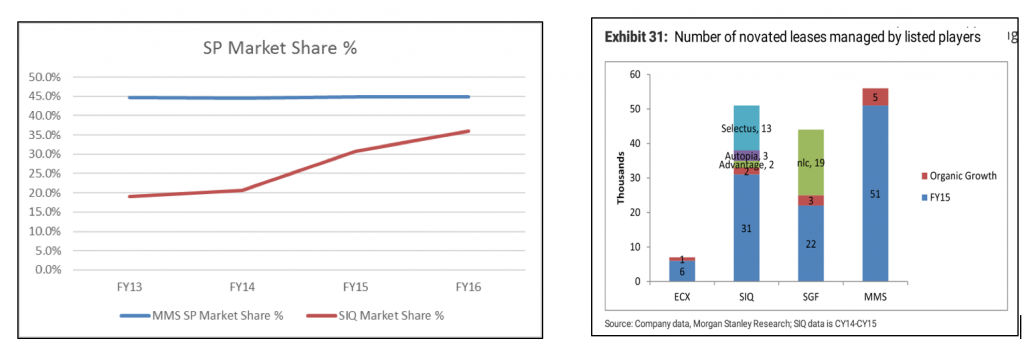

Over time, however, competitors slowly grew and developed a track record of their own. Acquisitions were made by competitors in order to achieve more scale and obtain a foothold into specific customer industry segments. SG Fleet (SGF) bought NLC and Smartgroup (SIQ) acquired Advantage Salary Packaging in December of 2015, and then Selectus in July 2016.

Essentially, the industry moved from having one dominant player (MMS) to having large competitors.

So what does all this mean? Let’s first consider the salary packaging market. Notably, each salary packaging client paid circa $300 back in 2000 for this service on an annual basis. By 2015, this figure had fallen roughly to $200 per client per annum simply due to the increased level of competition between MMS, SIQ and other smaller players. As prior, the barrier to entry for the salary packaging segment is having a track record so as to give clients the confidence that their salary packaging will be handled appropriately, but this barrier has clearly been hurdled by SIQ and further discounting is expected.

If the issue were limited to this it would be fine. It makes sense to discount say $10-$20 on a salary packaging fee in order to maintain or generate more leases at $5k-$6k per pop. However, what if the situation has changed in the novated leasing market such that discounting becomes prevalent here too? Let’s look at an example.

Historically, MMS was a sole provider to the QLD government for novated leasing contracts. Clients could source leasing from other sources. However, due to MMS’s preferred position, it was able to source a substantial amount of volume.

In 2016, MMS made an announcement to the market that it had rebid for this contract; however, its generous terms had now changed – MMS would now be competing within a panel of 8 providers. In order to defend its market share, the firm quickly reduced its take of fees. This led to a revision of MMS’s FY17 revenue and earnings and a sharp drop in the share price.

Throughout the market, it’s not uncommon for clients to have leasing panels with several providers. We also note that post consolidation there are now 3 novated leasing players of considerable scale, offering a product that is relatively commoditised (and with many substitutes). Each player now also has relatively equal access to customers in the market.

Microeconomics 101 would suggest that these firms are likely to compete (i.e. discount) in order to win market share off the others and grow earnings. But how will this play out?

The model used to describe this particular dynamic is often referred to as the Prisoners Dilemma – it goes something like this – two suspects are being interrogated in separate rooms by the police (each suspect cannot communicate with the other). They are each offered the chance to confess for which, in exchange, they’ll receive a light sentence. If one refuses to cooperate whilst the other confesses, he’ll receive a harsh sentence. However, if both suspects remain quiet, the police won’t have enough evidence to convict either of them and they’ll walk. If both confess, they’ll each receive a fair sentence with neither gaining a benefit for cooperating.

It’s clearly tempting for each suspect to confess since each knows that the worst outcome then is a fair sentence and even if this is less optimal than walking free, it’s better than not cooperating and receiving a harsh sentence if their partner confesses.

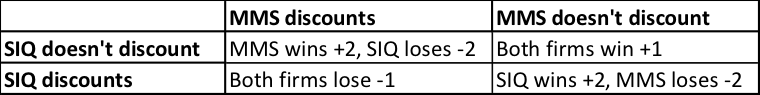

Let’s now apply this to the MMS situation keeping in mind that, like the suspects in the Prisoners Dilemma, the competitors cannot collude on their responses (I’d note that the ACCC is highly adverse to companies engaging in collusive practices……and rightly so).

The ideal situation from a profitability standpoint would be to not offer discounts (again, arriving at this decision without collusion) and receive volumes in line with their size. All players of scale in this scenario would earn returns on capital well in excess of cost and generate immense value for shareholders over the longer term. Since each player is taking a slice of the pie in line with its size, no player would feel that it is getting an unfair share either.

However, if we were to add in some worldly realism, each player will most likely seek to maximise market share by enticing customers away from competitors via discounting. Whether this is perceived to be fair or not by others is not up for consideration.

The below table summarises the actions each player might take (I’ve used MMS & SIQ for this example). We assume that if both firms weren’t to discount, each player can grow its earnings by some increment (summarised as +1). If both were to discount, each firm would lose -1 as a result of each holding its volume levels yet losing on price. If one firm were to discount whilst the other doesn’t, it would gain a large share of the market which more than offsets the price decline.

It’s true that this scenario is hypothetical, but it’s largely for illustrative purposes. We’re more concerned with the outcomes.

Since each player knows the others will likely discount (since the incentive is there to do so), they’ll likely discount themselves as a protective act since the worst they’ll get here is a -1 but the most is a +2, whereas without discounting, the worst they’d do is a -2 but the best they would get is a +1.

Because of this, in the absence of a coordinated approach between the competitors, it’s very likely that each party will begin to discount its take of leasing fees in order to protect its market share.

Now let’s backtrack. The buy thesis was fairly straightforward in that you could buy a quality business for circa 10x it’s earnings (almost implying no growth forever) that had good long term prospects and included a free option of earnings growth from the United Kingdom and parallel segments such as consumer finance.”

What this misses is that that 10x p/e ratio might actually not be so. If discounting becomes the norm in the segment, it might very quickly become 15x and 20x with little prospect of actually generating the level of growth that those multiples imply.

Notably we believe that none of this is due to the fault of management. We’ve met/spoken with management of both firms and rate them highly. Our view is that the issue is structural in that no firm in this industry segment has a substantive competitive advantage over the other such that it can hope to avoid discounting/volume loss in the face of intensifying competition. The only outcome (as we see it) is reduced returns on capital and substantive downside risk.

If the above analysis is wrong, we’d estimate that MMS has somewhere in the order of 40-50 per cent upside. However, if it’s correct, the question then becomes one of ‘well…how bad does it get?’ And that’s hard to answer.

The theoretical answer is that competing firms will gradually lower each other’s returns in an iterative process towards the cost of capital (i.e. the minimum level of profit the firm’s shareholders requires it to earn on invested capital in the business), however novated leasing businesses typically have very low levels of invested capital, so this theoretically minimum threshold (i.e. near 0) is not useful for our analysis.

The only downside analysis we can perform at this point is to ask ourselves: what is the value of MMS if discounts were to be in the order of 25 per cent relative to today? Or 50 per cent? Whilst we’d prefer not to disclose these valuations, they do suggest to us that if we were to punt on that 40-50 per cent upside, we’d be taking a whole lot of downside risk. We’d further not regard the downside risk as just ‘tail risk’ – it actually appears quite likely as per our analysis via the Prisoners Dilemma.

And we haven’t even gotten onto disruption risk. See here and here for an overview of what Carsales.com (ASX: CAR) has planned for the sector.

As for when these scenarios play out – it’s difficult to say. In our view there’s no immediate catalyst to drive up competitive pressures in the near term. However, if prospects for earnings growth derived from organic sources were to deteriorate for any reason, perhaps that will be the pin-drop that sets off an avalanche.

This post was contributed by a representative of Montgomery Investment Management Pty Limited (AFSL No. 354564). The principal purpose of this post is to provide factual information and not provide financial product advice. Additionally, the information provided is not intended to provide any recommendation or opinion about any financial product. Any commentary and statements of opinion however may contain general advice only that is prepared without taking into account your personal objectives, financial circumstances or needs. Because of this, before acting on any of the information provided, you should always consider its appropriateness in light of your personal objectives, financial circumstances and needs and should consider seeking independent advice from a financial advisor if necessary before making any decisions. This post specifically excludes personal advice.

INVEST WITH MONTGOMERY

Hi Scott,

Thanks for your response but I can’t help thinking in this example of MMS it’s maybe a bit more complex than that, albeit your analysis is very thorough.

But what jumped out at me and hit me was the fact that If superior returns like gravity, must inevitably revert downwards to a lower return, so then is it not true that lower return players must inevitably move up?

So, does that mean you buy mainly low return companies because gravity pulls them up over time and they are cheap now? Of course not ! I think we might agree that’s not the case ! Maybe you would agree however that management and luck plays a role. But in this case I gather you think all the players are trapped into am industry which will can only yield continually reduced prices. Undoubtedly that is what the market thinks and possibly the main reason for the falling price.

But as you would know amongst a sector there will be vastly different outcomes and if you do some research on companies with good remuneration practices, you find they have a better track record, amongst other things, because that is just one other important factor.

Game theory might make for some interesting reading but may I suggest some good managers don’t need to play the same games as their lesser competitors. To say an industry is in such structural over supply or competitive position that all players must suffer similarly suggests to me we must therefore ignore management influence altogether. A view, I suggest, you would not entertain. Even so, if we accept industry returns are in a state of steady decline, might not that present rationalisation possibilities for the better player, from which enhanced value can emerge? Lets see what the next report yields ?

Having said all of that, these are the aspects that make investing both interesting and at times frustrating because it soften hard to get a handle on what going on at the coal face.

Best wishes

Hi Linsday

No it’s not true that low returns via the law of gravity must inevitably revert upwards. Returns on capital are a function of competition in the industry hence as competition increases, returns tend to fall and vice versa. So with respect to this industry, we can see that competition is increasing right in the segment where the incumbent firms make the majority of it’s earnings.

Critically, we can’t see a competitive advantage strong enough within any of the firms to counter this issue.

You’re correct that management focus can deliver improved outcomes however this improvement is not normally enough to counter structural changes in the competitive landscape. As noted in the article, we rate the management of the firms in this segment highly.

I can’t say however when we will see the entirety of this thesis play out. Anecdotally, industry contact have said that competition is indeed increasing now and is expected to hit novated leasing revenues the hardest. But the magnitude of this impact of FY17 revenues, FY18 revenues, FY19 revenues etc etc is very hard to predict. Hence, looking through only the next report may not be enough.

Hi Scott,

Good article. A few years ago the salary packaging market changed overnight with an announcement from the then Treasurer Chris Bowen. I recall at the time TMF had a position in MMS, and there was an article posted on rogermontgomery.com analysing the decision making to either sell, hold or increase the position. I’d be interested to see how that played out for the TMF in the end ?

At the time the government had announced to change the legislation – however this never eventuated.

Thanks

Steve

Hi Steven

That was a little before my time at Montgomery, however from memory the team ended up buying a larger position at the lower prices and made a substantial capital gain as the share price recovered.

All the best.

Hi Scott, nice article. Will you be able to review and write something similar on the Company Slater and Gordon? Very interested to see your thoughts from a different angle.

Unfortunately not Jack. It takes a great deal of time to understand a business at this level and it’s difficult to justifying putting an effort like that into Slater & Gordon.

Thanks however for reading!

All the best,

Scott

Hi Scot,

Thanks for a very well written and insightful piece of research into MMS. In relation to your salient point “However, if we were to add in some worldly realism, each player will most likely seek to maximize market share by enticing customers away from competitors via discounting. Whether this is perceived to be fair or not by others is not up for consideration.”

The point I would make, having worked in senior positions in very large service organizations, is that one can only hold on to a hope current MMS management are far better players at this game than that !! That is to say they will, if necessary, sacrifice market share or new business or renewals to the extent they impact adversely on earnings. One hopes that the option of reducing costs in lieu, to even accept a fall in market share can be entertained, accompanied by conceivably better outcomes, even if earnings were to level out as a consequence. There is no point in profitless prosperity.

Whilst I agree the services are now commoditized to some degree, one expects a former market leader to invest in better systems that might enable it to carve out seriously superior returns to that of its more recent rivals, who paid premium prices for acquisitions and who have weaker Balance Sheets. Might I suggest what is of crucial importance, is the way any bonus pool is employed which needs to focus more at the EPS level and or return on equity to ensure behaviors reflect what is in the best interests of shareholders. My cursory view of the latest remuneration incentives for MMS lead me to be mildly satisfied but I would be interested in your more in-depth view. Given I hold the stock and have not decided to sell as yet would be most interested in your response.

Best wishes

Hi Lindsay, thanks for your message.

Almost as if they’re subject to the laws of gravity, high returns over time get competed down towards lower returns/returns approximating the cost of capital. Unfortunately, this rarely changes even if compensation plans are well written.

Unless we can see supply advantages or high switching costs – perhaps coupled with economies of scale, it’s hard to see why the above won’t occur.

Nice article.

Hi Scott,

Nice article applying game theory to value investing, however, I feel another very serious consideration for investing in MMS is the fact that the businesses core function is built on a piece of federal legislation. If I recall correctly, not long ago this legislation was looked at and could have been changed should have an electoral outcome been different.

Is this reasonable thinking?

Cheers,

Ed

Hi Ed,

Yes it’s very reasonable and was something we reviewed in our research.

It is however a well known risk for all players in this industry and many before me have provided their thoughts – Hence I decided not to comment since there was nothing of additional value that could be added.

Great article thanks Scott and well reasoned.